Are Self Employed Required To Pay Into Social Security Explore the implications of not paying Social Security as a self employed individual including penalties exemptions and common misconceptions

Self employed people are required to file Social Security taxes Since they are their own employers they have to pay the employer s portion of As a self employed individual you re required to pay Social Security taxes on your earnings These taxes are essential as they fund your future Social Security benefits It s

Are Self Employed Required To Pay Into Social Security

Are Self Employed Required To Pay Into Social Security

https://i.ytimg.com/vi/utireMufhIY/maxresdefault.jpg

How Do I Pay Into Social Security If I Am Self employed

https://glassnercarltonfinancial.com/wp-content/uploads/2020/08/TAXES-FOR-THE-SELF-EMPLOYED-_-HOW-BUSINESS-OWNERS-FILE-SOCIAL-SECURITY-ON-YOUR-TAX-RETURN-THUMBNAIL-768x432.jpg

Secure Online Payments With Capitec Pay Capitec Bank

https://www.capitecbank.co.za/globalassets/approved-images/transact/capitec-pay-header-image.png

Yes You pay in the form of Self Employment Contributions Act SECA taxes reported on your federal tax return You file a Schedule C Form 1040 to report profit or Self employed people are required to pay into Social Security but their obligations differ from those of traditional employees If you were a traditional employee you d contribute 6 2 of your earnings to Social Security Your

If you are self employed you earn Social Security credits the same way employees do 1 credit for each 1 810 in net earnings but no more than 4 credits per year Special rules apply if you Self employed individuals must pay a self employment tax of 15 3 on their net earnings up to a certain threshold This tax comprises two components 12 4 for Social

More picture related to Are Self Employed Required To Pay Into Social Security

Does Congress Pay Into Social Security

https://cdn.aarp.net/content/dam/aarp/retirement/social-security/2021/12/1140-ssa-about-card.imgcache.revcfeea7705cf5f930b79c9b9e17aabbbb.jpg

How To Pay Into Social Security For W 2 1099 Or Self Employment YouTube

https://i.ytimg.com/vi/m9CF9UKXtnU/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYEyBQKH8wDw==&rs=AOn4CLAwPXkllCWcHUu1IKxlwusicG_nqQ

How To Pay Into Social Security For W 2 1099 And Self Employment YouTube

https://i.ytimg.com/vi/KjMBTMlMd2M/maxresdefault.jpg

You must have worked and paid Social Security taxes for a certain length of time to get Social Security benefits The amount of time you need to work depends on your date of birth but no one needs more than 10 years of Self employed people must report their earnings and pay their taxes directly to the Internal Revenue Service More Information Before self employed people can earn Social

If you are self employed you are still required to pay both Social Security and Medicare taxes Self employed people are responsible for paying the entire 12 4 Social All self employed workers must pay Social Security taxes just like individuals who work for an employer Those who work for an employer split their Social Security tax burden

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA Social Security And Medicare Taxes

https://www.thebalancemoney.com/thmb/apcFotrcGmN0DxX56zUvIVjKusQ=/1500x1000/filters:fill(auto,1)/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png

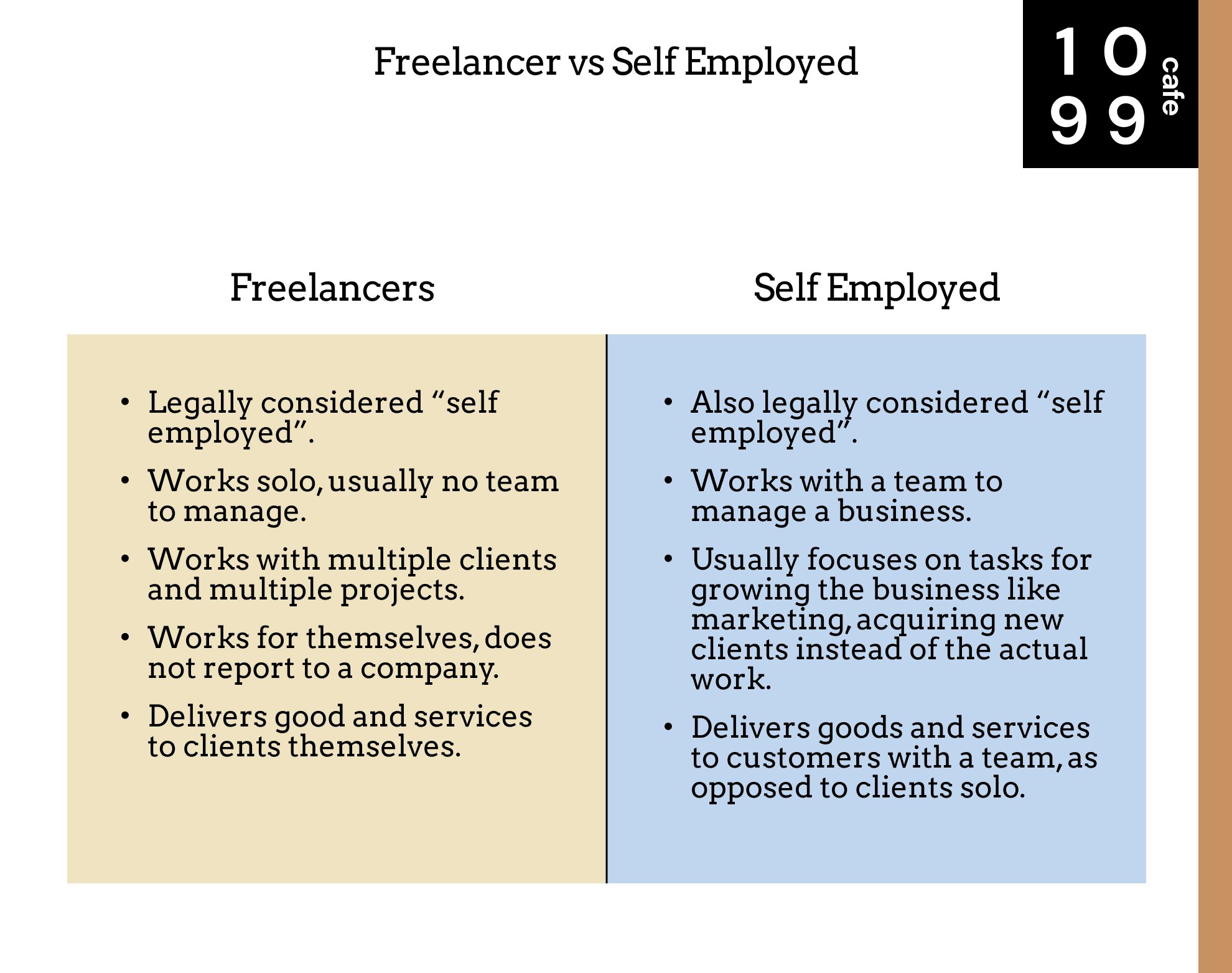

Freelancer Vs Self Employed Main Differences 1099 Cafe

https://images.squarespace-cdn.com/content/v1/62bf512694446a492e067bbe/e9062d09-fc8d-4825-8fc2-d3c7845a0211/freelancer+vs+self+employed.jpg

https://accountinginsights.org › self-employed-not...

Explore the implications of not paying Social Security as a self employed individual including penalties exemptions and common misconceptions

https://www.thebalancemoney.com

Self employed people are required to file Social Security taxes Since they are their own employers they have to pay the employer s portion of

Significant Increase In Social Security Contributions For The Self

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA Social Security And Medicare Taxes

Social Security 8 Types Of People Not Eligible To Receive Benefits

What You Must Know About Self Employed Social Security Tax

The Basics Of Social Security Tax When You Are Self employed AFE

How Many Workers Pay The Benefits Of Each Social Security Retiree

How Many Workers Pay The Benefits Of Each Social Security Retiree

Got A Job At Age 70 Do I Pay Into Social Security Again

Are Social Security Benefits Subject To Income Tax

Elc Self Employment Business Expense Form Employment Form

Are Self Employed Required To Pay Into Social Security - Yes You pay in the form of Self Employment Contributions Act SECA taxes reported on your federal tax return You file a Schedule C Form 1040 to report profit or