Are Taxes Considered An Expense When it comes to accounting for taxes in your business expenses the answer is yes taxes are considered an expense in business This means that they reduce your taxable

Federal Income taxes are not an expense but cost of doing business Depends on your tax type of business as to were the entry will go too If Sch C will end up as Owners What Taxes Are Considered Business Expenses In some cases your business taxes can be deductible as business expenses Your business is likely a pass through entity

Are Taxes Considered An Expense

Are Taxes Considered An Expense

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

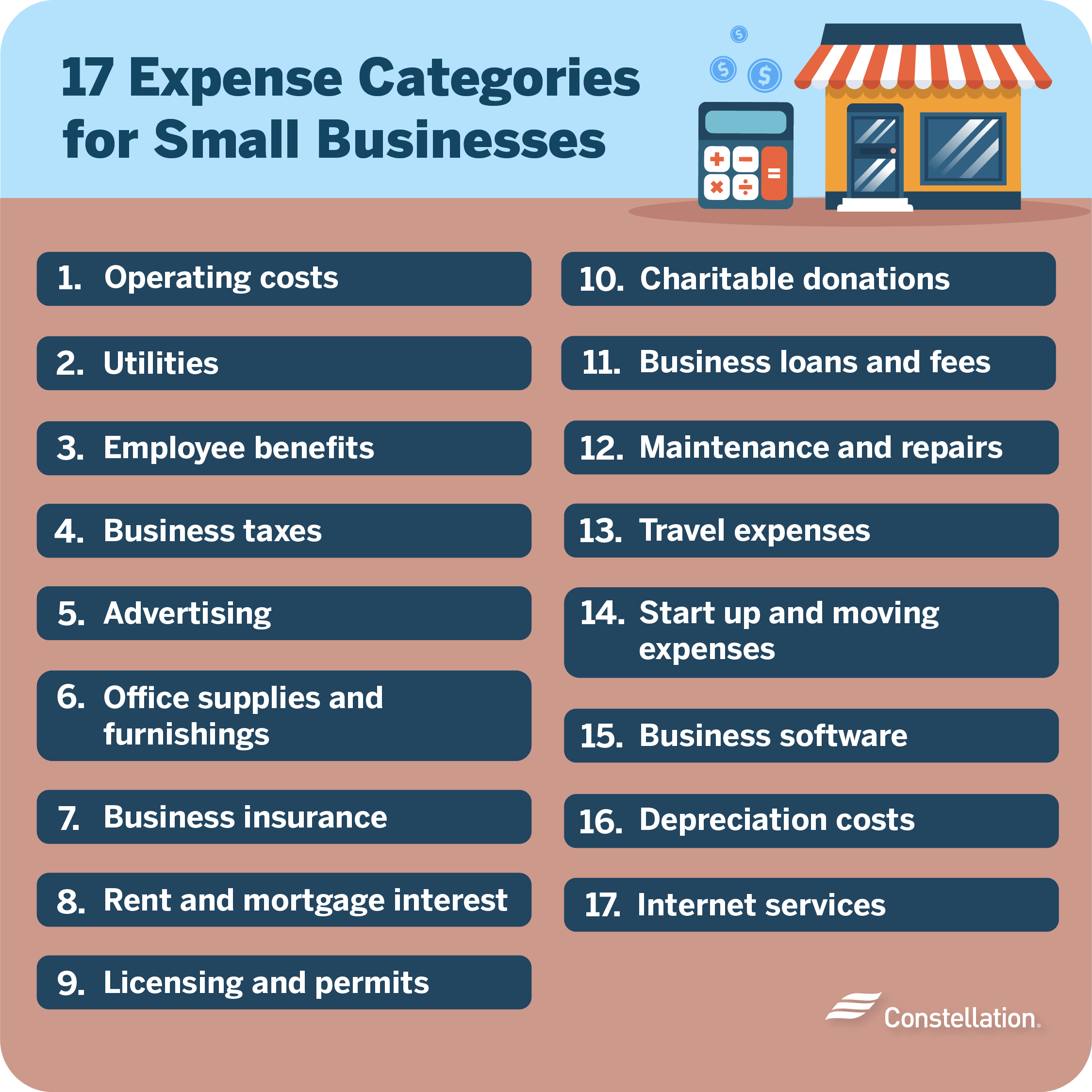

Small Business Expense Categories To Write Off Constellation

https://blog.constellation.com/wp-content/uploads/2023/08/business-tax-expense-categories.png

What Are Taxes And Why Are They Important For The Economy

https://www.befiler.com/wordpress/wp-content/uploads/2022/10/What-are-Taxes.jpg

Tax expenses are the total amount of taxes owed by an individual corporation or other entity to a taxing authority Income tax expense is calculated by The answer to this question is yes taxes are considered an expense In fact taxes are a significant expense for most businesses governments and individuals

Income tax is considered an expense for the business or individual because there is an outflow of cash due to tax payout After the taxable income is determined the business A tax expense is the amount an individual or commercial entity owes in taxes to the government The tax rate determines the actual amount the owing party must pay and there

More picture related to Are Taxes Considered An Expense

Prepaid Expenses Definition Journal Entry And Examples

https://global-uploads.webflow.com/628cb4acdaf9087cd633cc6b/648c8148f5403c2c20593f99_Screenshot 2023-06-16 at 15.23.58.webp

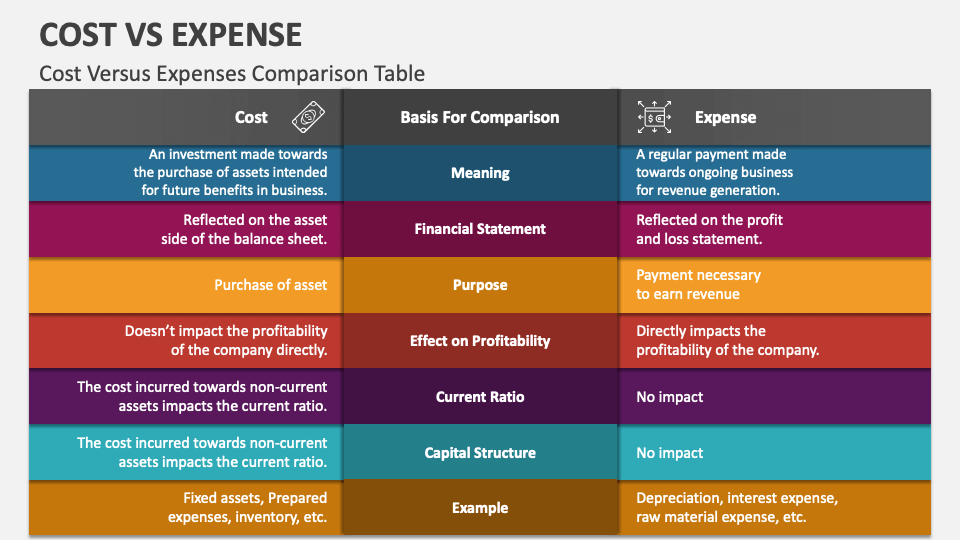

Cost Vs Expense PowerPoint And Google Slides Template PPT Slides

https://www.collidu.com/media/catalog/product/img/b/7/b7b7a12cedb88ded0c930523110155f252a8e9252836263efa78ef040d10c63d/cost-vs-expense-slide1.png

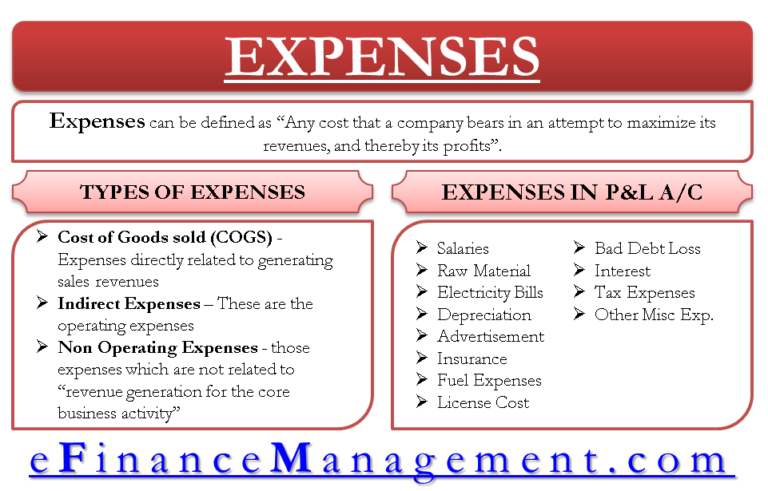

What Is Expense Definition And Meaning

https://efinancemanagement.com/wp-content/uploads/2014/11/Expenses-768x491.png

Income tax is considered as an expense for the business or individual because there is an outflow of cash due to tax payout Is income tax an asset or expense Income taxes include all Income tax expense is what you ve calculated that our company owes in taxes based on standard business accounting rules You report this expense on the income statement

[desc-10] [desc-11]

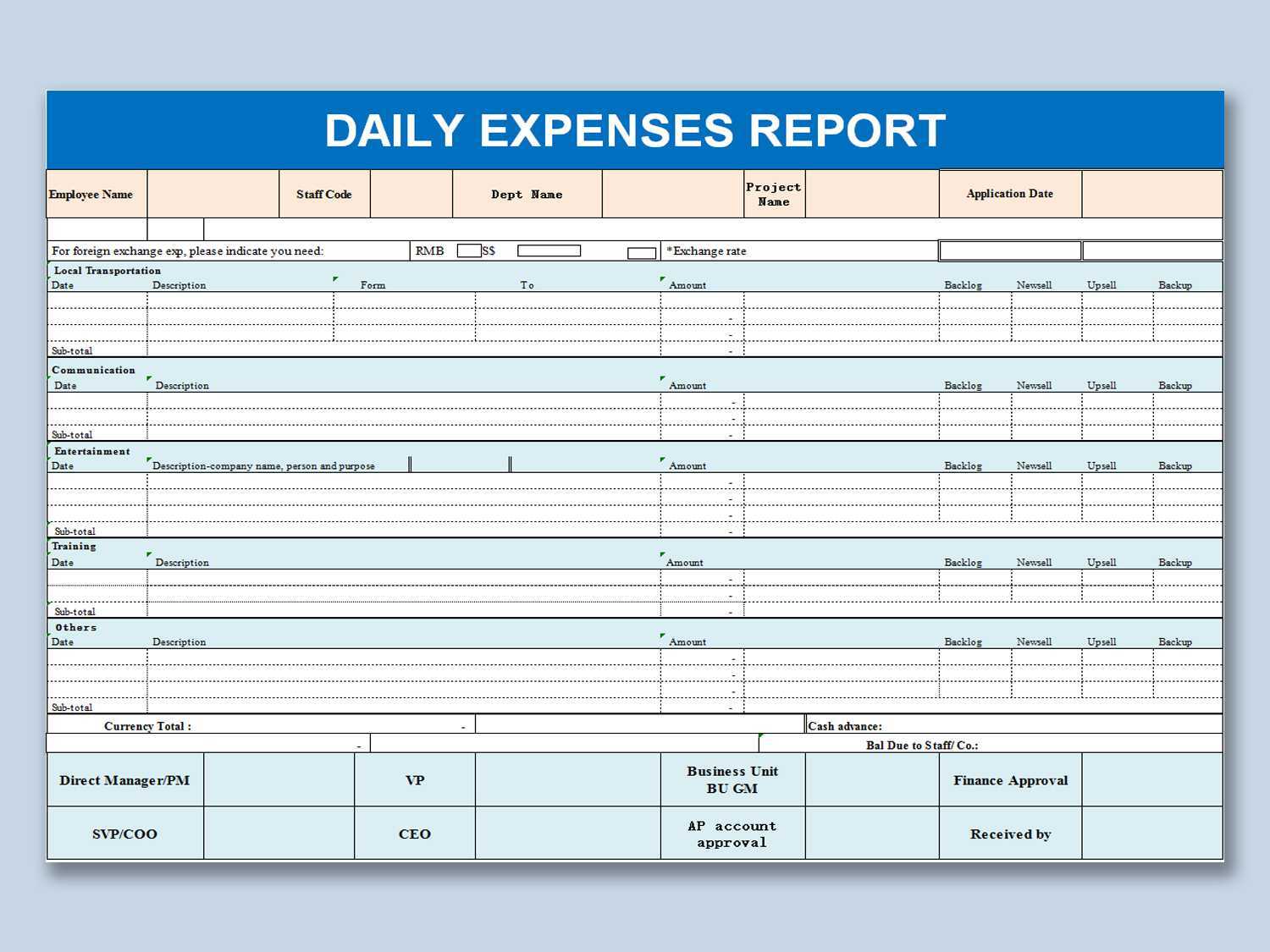

Expense Report

https://d4y70tum9c2ak.cloudfront.net/contentImage/ZFDeQkBcE4vU0ngrpSw30uep7jxMa8AFnB51JVlcrgE/resized.png

What Is Expense to Sales Ratio Formula And Ways To Improve Expense

https://uploads-ssl.webflow.com/5fcdef3cc7cf1d1e14b4ba0c/63b42d165771f52b80baed9a_Expense-to-Sales Ratio.jpg

https://oboloo.com › are-taxes-considered-an-expense-in-business

When it comes to accounting for taxes in your business expenses the answer is yes taxes are considered an expense in business This means that they reduce your taxable

https://quickbooks.intuit.com › learn-support › en-us › ...

Federal Income taxes are not an expense but cost of doing business Depends on your tax type of business as to were the entry will go too If Sch C will end up as Owners

:max_bytes(150000):strip_icc()/expenseratio-Final-0ec56abb4fde4c30a850007d090f24d0.jpg)

Are Expenses An Asset Leia Aqui Are Expenses Considered Liabilities

Expense Report

What Is The Difference Between Salaries Payable And Salaries Expense

EXCEL Of Daily Expenses Report

Expense Accounts FundsNet

Fun to Know Facts About Income Tax RISMedia

Fun to Know Facts About Income Tax RISMedia

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

General Ledger Expense Types Printable Form Templates And Letter

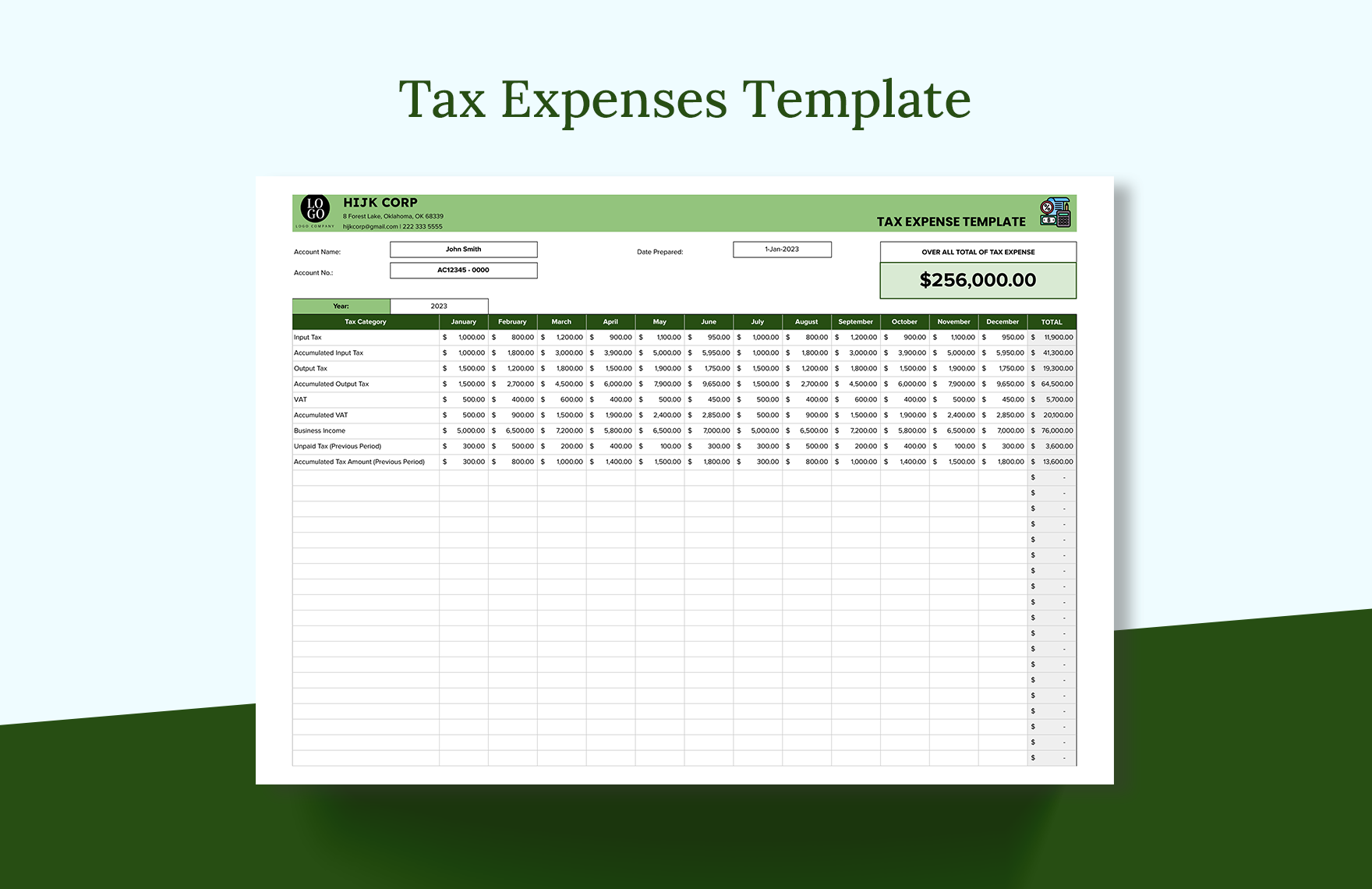

Tax Expenses Template Excel Google Sheets Template

Are Taxes Considered An Expense - Tax expenses are the total amount of taxes owed by an individual corporation or other entity to a taxing authority Income tax expense is calculated by