Claiming Meals As Business Expense To claim a video using the Manual Claiming Tool On the Manual claiming page click a video s row to expand it and get more info about the video Click SELECT ASSET A pop up window

The Manual Claiming tool is used by copyright owners who demonstrate a need for the tool and have advanced knowledge of Content ID The tool gives copyright owners a way to manually Claiming partner uploaded content allows for monetization options Content ID matching and reporting Partner uploaded Shorts are subject to Content ID scanning which may result in a

Claiming Meals As Business Expense

Claiming Meals As Business Expense

https://exceldownloads.com/wp-content/uploads/2022/06/expenses-Reimbursement-form-template-in-Excel-feature-image.png

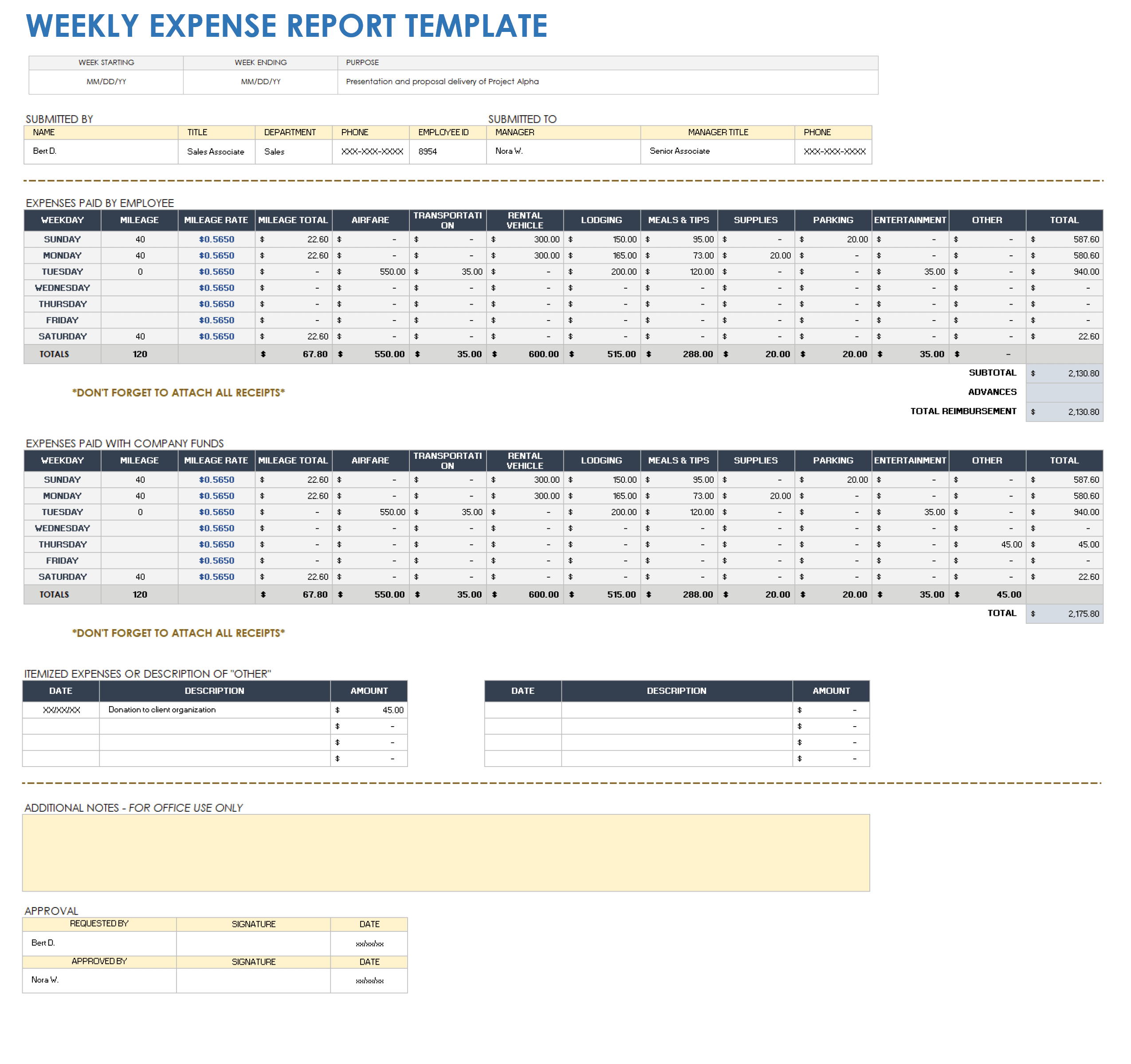

This Expense Claim Form Is Perfect For Employees Requesting

https://i.pinimg.com/736x/78/b1/bf/78b1bf6f21d67800becaeaea2ffd74fd.jpg

Should We Start Claiming Medical Expenses As Business Expense By

https://miro.medium.com/v2/resize:fit:875/0*wctvUzN78XJ27aTm

Official Google Business Profile Help Center where you can find tips and tutorials on using Google Business Profile and other answers to frequently asked questions If you don t have one create a Google Account Go to Google Search Search for yourself or the entity you represent and find your knowledge panel

By focusing on providing the best user experience possible Google has earned a trusted brand name Unfortunately unscrupulous people sometimes try to use the Google brand to scam Troubleshooting Claiming Your Business Profile To make sure your business is eligible to show up on Google verify your Business Profile If you have more questions about profile

More picture related to Claiming Meals As Business Expense

4 Tips For Drafting A Spreadsheet For Business Expenses Online Logo

https://www.onlinelogomaker.com/blog/wp-content/uploads/2023/02/ce630ab93ec043bbfc67b856a3d092f5.jpg

Expense Report Form expense Report Template expense Report small

https://i.etsystatic.com/22031907/r/il/6710f8/4677923693/il_fullxfull.4677923693_lp7o.jpg

Claiming Food Expenses In A Limited Company AccountingFirms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/10/claiming-food-expenses-in-a-limited-company-2.png

Edit a Business Profile You can edit your Business Profile directly on Google Search or Maps Certain features to manage your profile may differ between Search and Maps and your Official Knowledge Panel Help Center where you can find tips and tutorials on using Knowledge Panel and other answers to frequently asked questions

[desc-10] [desc-11]

How To Reduce Tax By Claiming Meals And Entertainment Expenses YouTube

https://i.ytimg.com/vi/o4YIfNsDFCk/maxresdefault.jpg

Annual Expense Report Form Business Company Personal Expense Form

https://i.etsystatic.com/40992497/r/il/3dfc53/4907920837/il_fullxfull.4907920837_4t3r.jpg

https://support.google.com › youtube › answer

To claim a video using the Manual Claiming Tool On the Manual claiming page click a video s row to expand it and get more info about the video Click SELECT ASSET A pop up window

https://support.google.com › youtube › answer

The Manual Claiming tool is used by copyright owners who demonstrate a need for the tool and have advanced knowledge of Content ID The tool gives copyright owners a way to manually

The Importance Of Managing Meeting Expenses A Procurement Perspective

How To Reduce Tax By Claiming Meals And Entertainment Expenses YouTube

Travel Expense Excel Template

Sample Small Business Expense Report Template Venngage

Employee Expense Report Expense Reimbursement Set Streamline How You

Claiming Lunch As A Business Expense What You Need To Know More Than

Claiming Lunch As A Business Expense What You Need To Know More Than

Excel Templates For Expenses

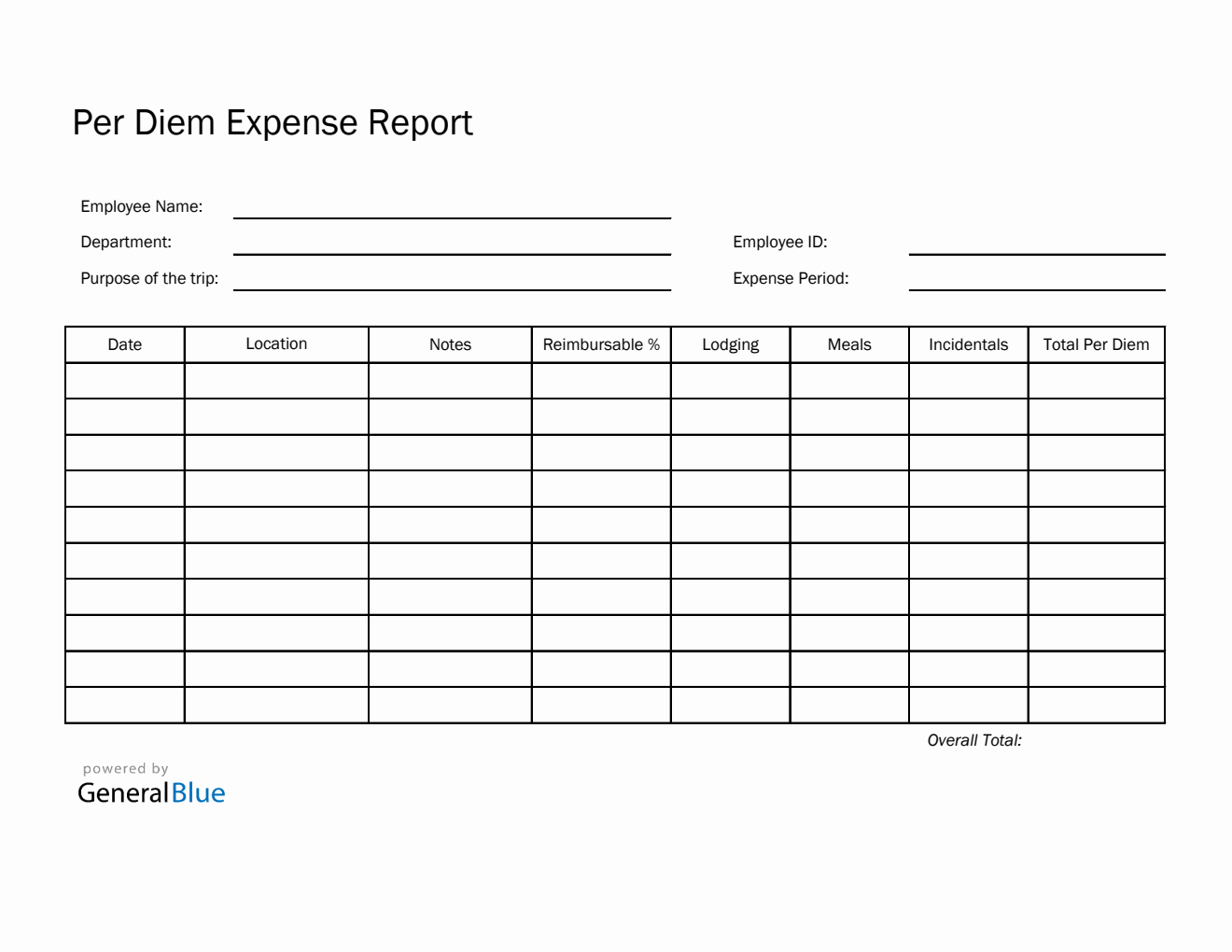

Per Diem Expense Report Template In Excel Printable

Claiming Lunch As A Business Expense What You Need To Know More Than

Claiming Meals As Business Expense - Official Google Business Profile Help Center where you can find tips and tutorials on using Google Business Profile and other answers to frequently asked questions