Definition Of Assessment Year Under Income Tax Act 1961 Article discusses about Meaning of assessment Scope Procedure Time limit of Assessment under section 143 1 section 143 3 section 144 section 147 Every taxpayer has to furnish the details of his

As per S 2 9 of the Income Tax Act 1961 unless the context otherwise requires the term assessment year means the period of twelve months commencing on the 1st day of April every year What is assessment under the income tax act 1961 and How many types of it are there Every taxpayer has to furnish the details of his income to the Income tax Department These details are to be furnished by filing up

Definition Of Assessment Year Under Income Tax Act 1961

Definition Of Assessment Year Under Income Tax Act 1961

https://taxaide.com.ng/wp-content/uploads/2022/09/methods-for-determining-personal-income-tax_0709135752.png

Important Amendments In Income Tax Act 1961 Relating To MSMEs Taxwink

https://www.taxwink.com/uploads/1682395540.png

Section 11 Of Income Tax Act 1961 Exemption For Trusts

https://vakilsearch.com/blog/wp-content/uploads/2022/08/Section-11-Income-Tax-Act.png

UNDER INCOME TAX ACT 1961 1 DEFINITION OF ASSESSMENT AND REGULAR ASSESSMENT Section 2 8 2 40 Section 2 8 assessment includes reassessment As per Section 2 9 of the Income Tax Act 1961 states that assessment year means the 12 month period beginning on the 1st day of April every year The assessee is required to file the income tax return of the

Assessment Year in Income Tax Act 1961 hereinafter referred to as the Act has been defined in Section 2 9 It is a period of twelve months starting from April 1 of every year And such period shall end on March 31 of next year In this article we will delve into some of the most important definitions under the Income Tax Act 1961 Assessment Year AY and Previous Year PY The Assessment Year is the year in which your income is

More picture related to Definition Of Assessment Year Under Income Tax Act 1961

No Limitation Under Income Tax Act For Filing Application For

https://www.taxscan.in/wp-content/uploads/2022/11/Income-Tax-Act-application-condonation-Kerala-HC-TAXSCAN.jpg

Penalty Chart Under Income Tax Act 1961 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/02/Penalty-chart-under-Income-Tax-Act-1961.jpg

Medical Expenses Deduction Under Income Tax Act 2023 Update

https://instafiling.com/wp-content/uploads/2023/01/Medical-Expenses-Deduction-Under-Income-Tax-Act-1080x675.png

Income tax is a tax on the total income of a person called the assesses of the previous year relevant to the assessment year at the rates prescribed in the relevant Finance Act Some of the important definitions The Assessment Year is the period immediately following the Previous Year in which the income earned during the Previous Year is assessed and taxed The concept of the

Income Tax law defines Previous Year as defined in section 3 of Income Tax Act 1961 hereinafter referred to as IT Act The Previous Year is the Financial Year immediately preceding the Assessment Year The Assessment Year AY defined in Section 2 9 of the Income Tax Act is the 12 month period from April 1 to March 31 in which the income of the previous year is

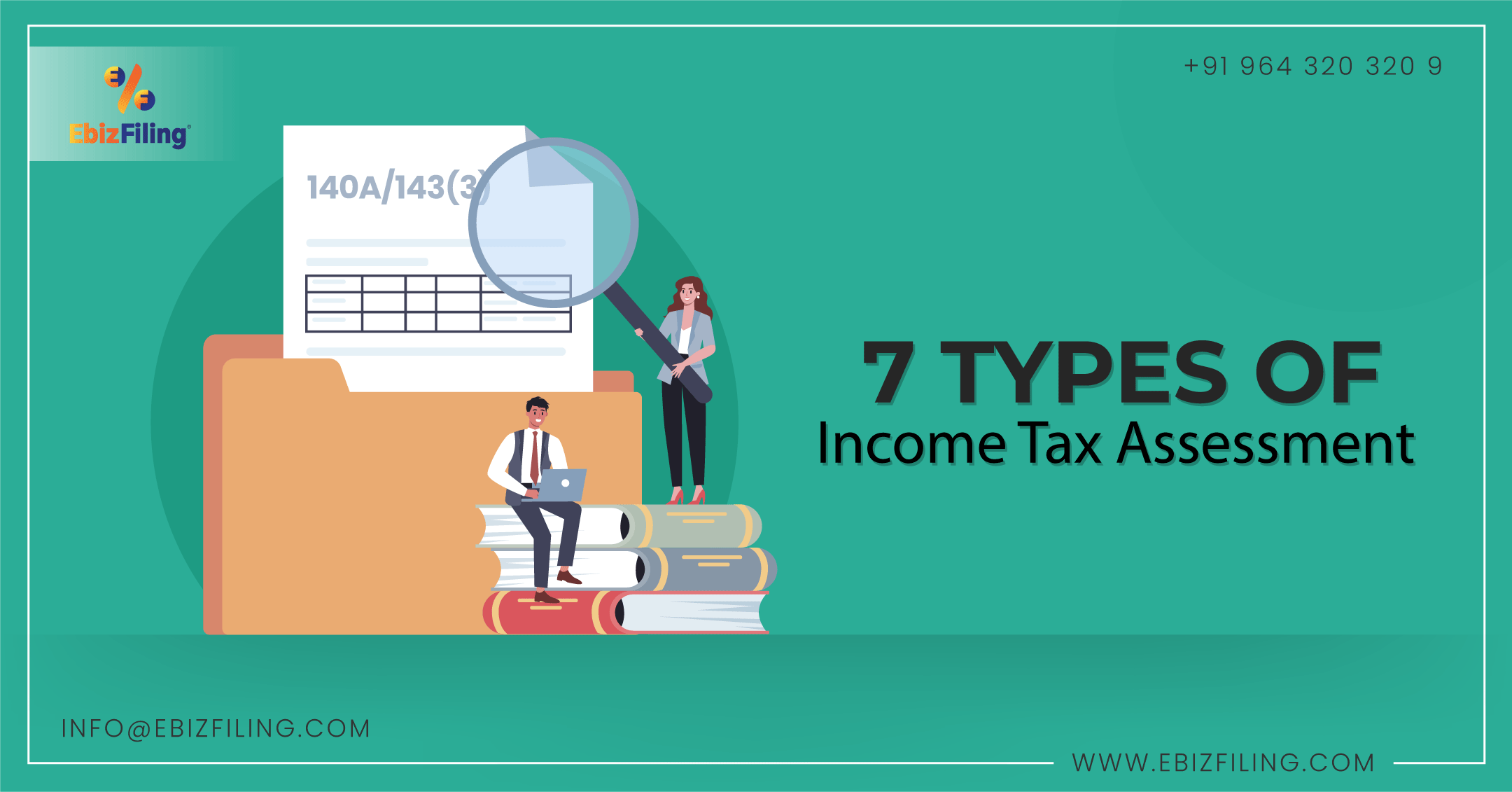

Different Types Of Assessment In Income Tax Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/01/7-types-of-Income-Tax-Assessment-1.png

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1e6ed41ab1579da043d5061a9e55bffc/thumb_1200_1553.png

https://taxguru.in › income-tax › faqs-asse…

Article discusses about Meaning of assessment Scope Procedure Time limit of Assessment under section 143 1 section 143 3 section 144 section 147 Every taxpayer has to furnish the details of his

https://fintaxblog.com › meaning-of-assess…

As per S 2 9 of the Income Tax Act 1961 unless the context otherwise requires the term assessment year means the period of twelve months commencing on the 1st day of April every year

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Different Types Of Assessment In Income Tax Ebizfiling

TDS Provisions Under Income Tax Act 1961 Taxguru in TDS PROVISIONS

A Comprehensive Guide To Section 43B Of The Income Tax Act Ebizfiling

Income Tax Audit Services In Bangalore Auditor And Tax Consultants In

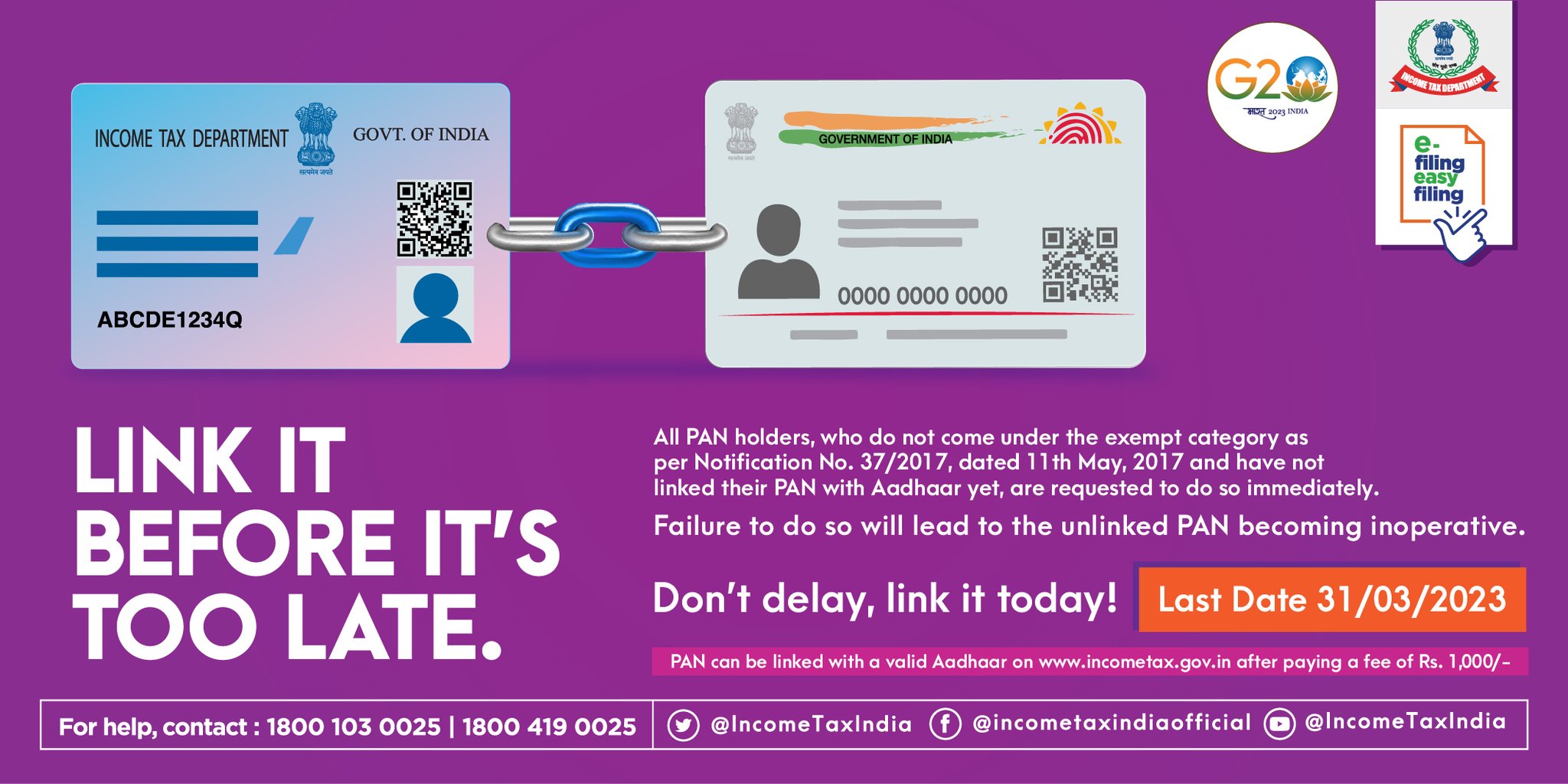

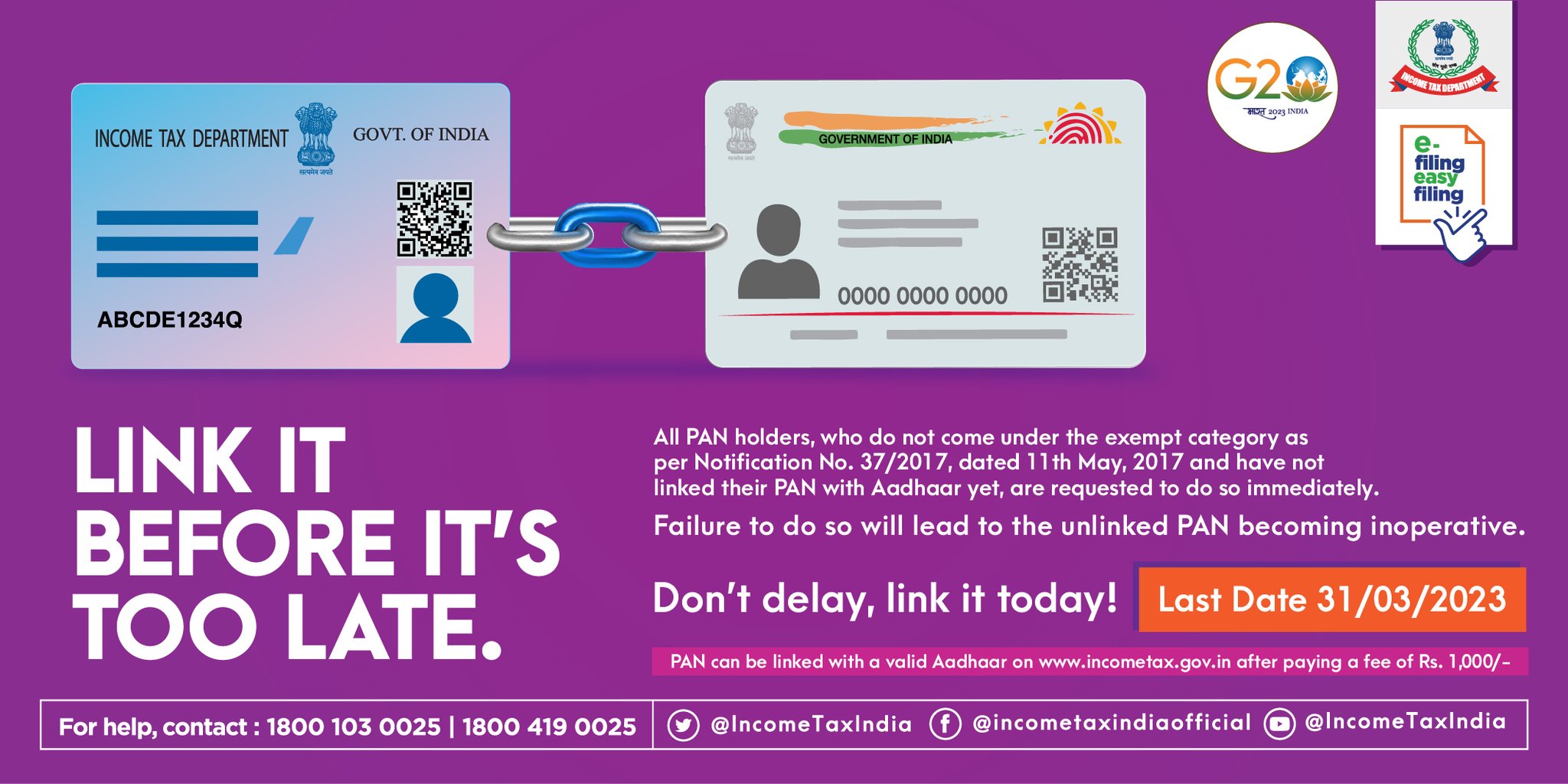

Income Tax India On Twitter As Per Income tax Act 1961 It Is

Income Tax India On Twitter As Per Income tax Act 1961 It Is

Assessment Procedure Of Income Tax

Income Tax High Value Cash Transactions That Can Attract Income Tax Notice

Income TAX ACT 1961 ADV PRAJITHA R INCOME TAX ACT 1961 Charge Is

Definition Of Assessment Year Under Income Tax Act 1961 - As per Section 2 9 of the Income Tax Act 1961 states that assessment year means the 12 month period beginning on the 1st day of April every year The assessee is required to file the income tax return of the