Do You Pay Social Security Taxes If You Are Self Employed Self employed people must report their earnings and pay their taxes directly to the IRS You re self employed if you operate a trade business or profession either by yourself or as a

How do you file and pay Social Security taxes if you are self employed You file Schedule SE through Form 1040 or 1040 SR For sole proprietors or independent contractors the form to use is Schedule C Self employed individuals generally must pay self employment SE tax as well as income tax SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves It is

Do You Pay Social Security Taxes If You Are Self Employed

Do You Pay Social Security Taxes If You Are Self Employed

https://global-uploads.webflow.com/604ba8386f3113259dae5f99/63176ae0a2103c253460a614_iStock-1408922975.jpg

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

Do You Have To Pay Tax On Your Social Security Benefits YouTube

https://i.ytimg.com/vi/yVRdBCJXqAU/maxresdefault.jpg

Yes You pay in the form of Self Employment Contributions Act SECA taxes reported on your federal tax return You file a Schedule C If you re self employed you still have to pay Social Security taxes Find out how much you ll need to pay how to file and how to claim benefits too

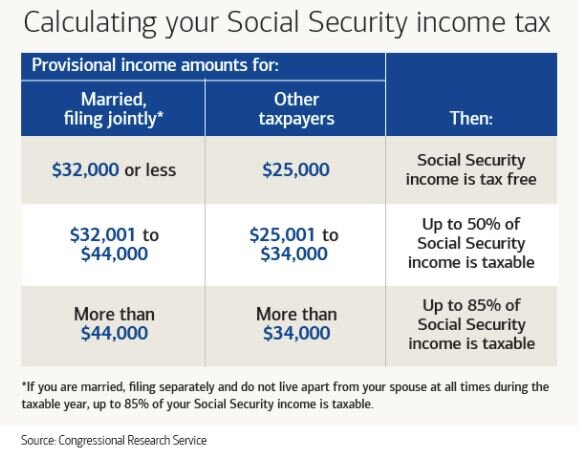

Self employment tax is 15 3 covering Social Security and Medicare Use IRS Schedule SE to figure out how much tax you owe You can deduct half of your self employment tax when filing your income tax If you Even if you don t owe any income tax you must complete Form 1040 and Schedule SE to pay self employment Social Security tax This is true even if you already get Social Security

More picture related to Do You Pay Social Security Taxes If You Are Self Employed

Social Security s Never Beneficiaries Social Security Intelligence

https://www.socialsecurityintelligence.com/wp-content/uploads/2020/07/Depositphotos_11106029_s-2019.jpg

How To Pay Your Taxes YouTube

https://i.ytimg.com/vi/bZjTIHPyY94/maxresdefault.jpg

How Much Income Do You Pay Social Security Tax On YouTube

https://i.ytimg.com/vi/Xo5k1_Tdbo8/maxresdefault.jpg

Yes self employed workers with more than 400 in annual net earnings from their business must pay Social Security taxes This also applies to self employed workers who earned more than 108 28 Self employed people must report their earnings and pay their taxes directly to the Internal Revenue Service More Information Before self employed people can earn Social

If you re self employed you ll need to file taxes throughout the year typically via quarterly payments The self employment tax is 15 3 a combination of Social Security and Medicare taxes If you earned enough self employment income you must pay self employment tax regardless of your age even if you re a minor dependent or are retired and already receive Social Security

Can You Get Social Security Benefits Without Being A US Citizen YouTube

https://i.ytimg.com/vi/Zg61UAsdBDk/maxresdefault.jpg

Do You Pay Social Security On Capital Gains CountyOffice YouTube

https://i.ytimg.com/vi/NYX90Wqi1RU/maxresdefault.jpg

https://www.ssa.gov › pubs

Self employed people must report their earnings and pay their taxes directly to the IRS You re self employed if you operate a trade business or profession either by yourself or as a

https://glassnercarltonfinancial.com › ...

How do you file and pay Social Security taxes if you are self employed You file Schedule SE through Form 1040 or 1040 SR For sole proprietors or independent contractors the form to use is Schedule C

The Basics Of Social Security Tax When You Are Self employed AFE

Can You Get Social Security Benefits Without Being A US Citizen YouTube

Do You Have To Pay Tax On Your Social Security Benefits Greenbush

What You Must Know About Self Employed Social Security Tax

Do You Pay Social Security Tax On Capital Gains CountyOffice

Cash Out Refinancing On Paid Off Home Credible

Cash Out Refinancing On Paid Off Home Credible

Self Employed Taxes

Filing Taxes After Selling Items On E Commerce Websites Wcnc

Home Equity Line Of Credit HELOC For Self Employed Borrowers

Do You Pay Social Security Taxes If You Are Self Employed - When you work as an employee your employer withholds Social Security taxes from your paycheck and contributes an equal amount to Social Security However as a self