Floating Exchange Rate Definition A pegged exchange rate fixes one country s currency to another country s currency In order to maintain a pegged exchange rate a central bank must maintain a high level of currency reserves The rate is beneficial in that it facilitates trade and investment between two countries with the pegged currencies It can be especially advantageous

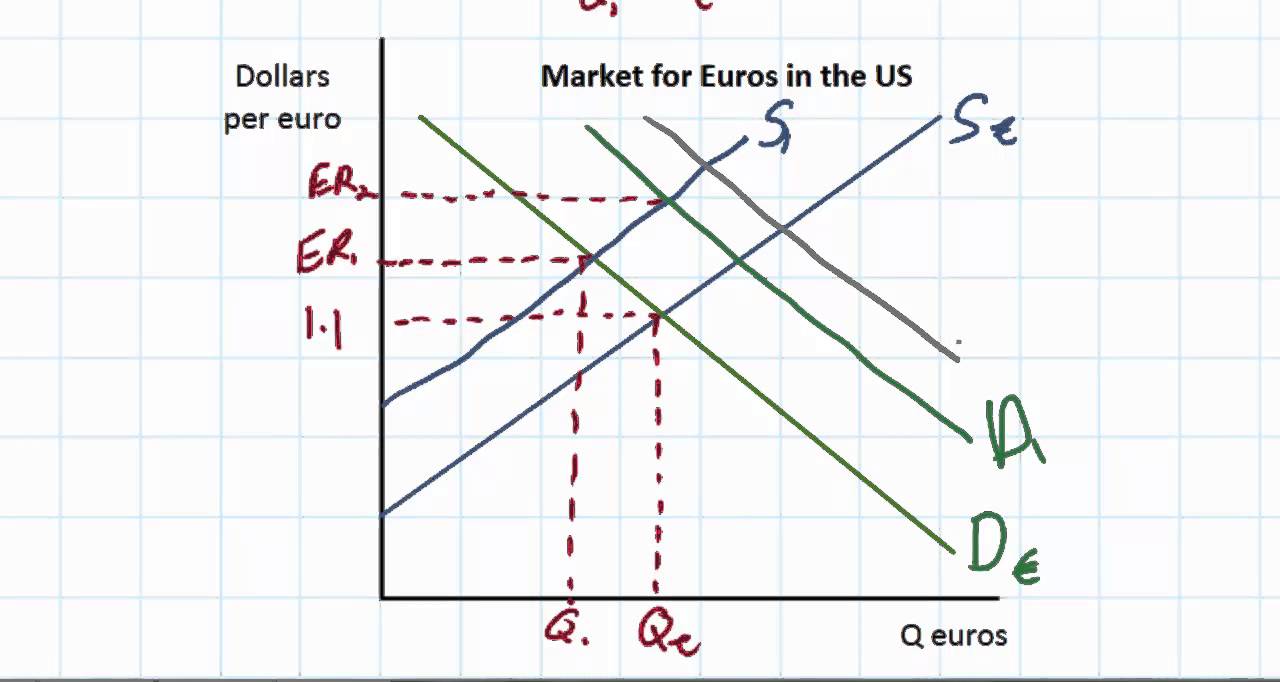

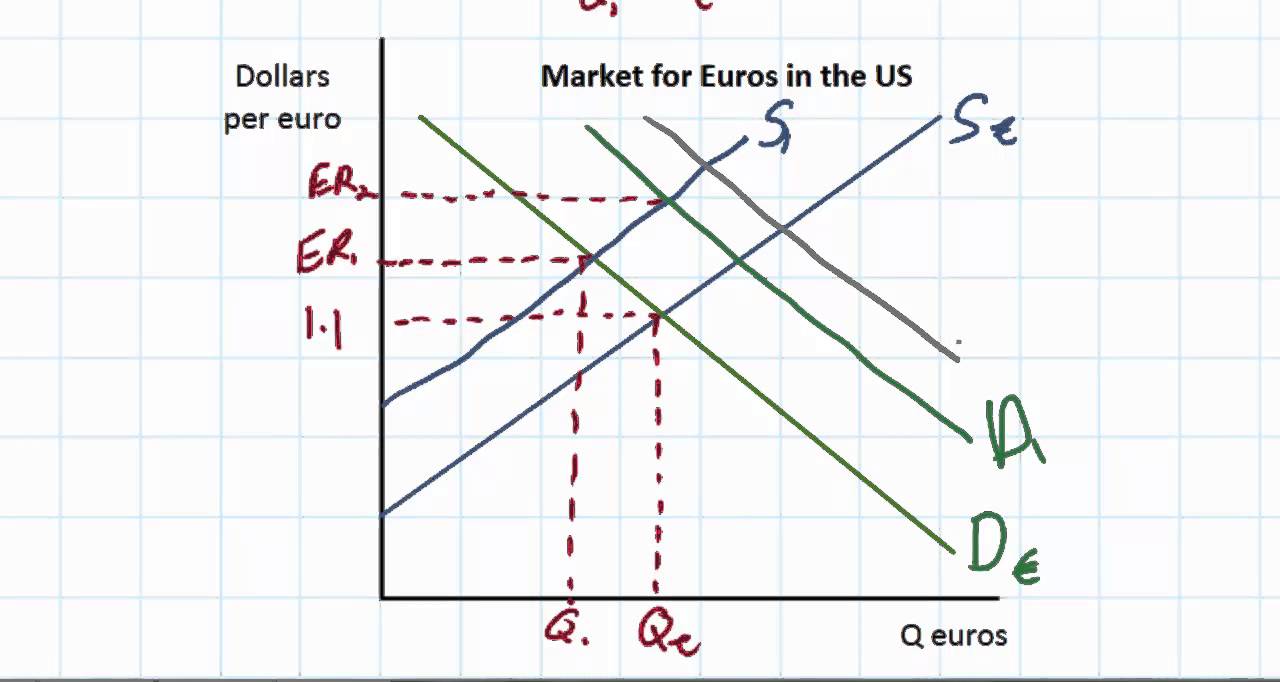

Exchange Rate Example Let s say the current exchange rate between the dollar and the euro is 1 23 This means that to obtain one euro you would need 1 23 dollars Conversely if you were about to take a vacation to Europe you could take 1 000 to the bank and receive 813 01 Exchange rates can be fixed or floating This is considered a basis swap For this interest rate swap example Company ABC has a loan with a floating interest rate indexed to the 1 month LIBOR but it wants its rate indexed to the 6 month LIBOR Instead of exchanging a fixed rate for a floating one it exchanges one type of floating rate for another

Floating Exchange Rate Definition

Floating Exchange Rate Definition

https://i2.wp.com/marketbusinessnews.com/wp-content/uploads/2018/05/Floating-exchange-rate.jpg?fit=1031%2C944&ssl=1

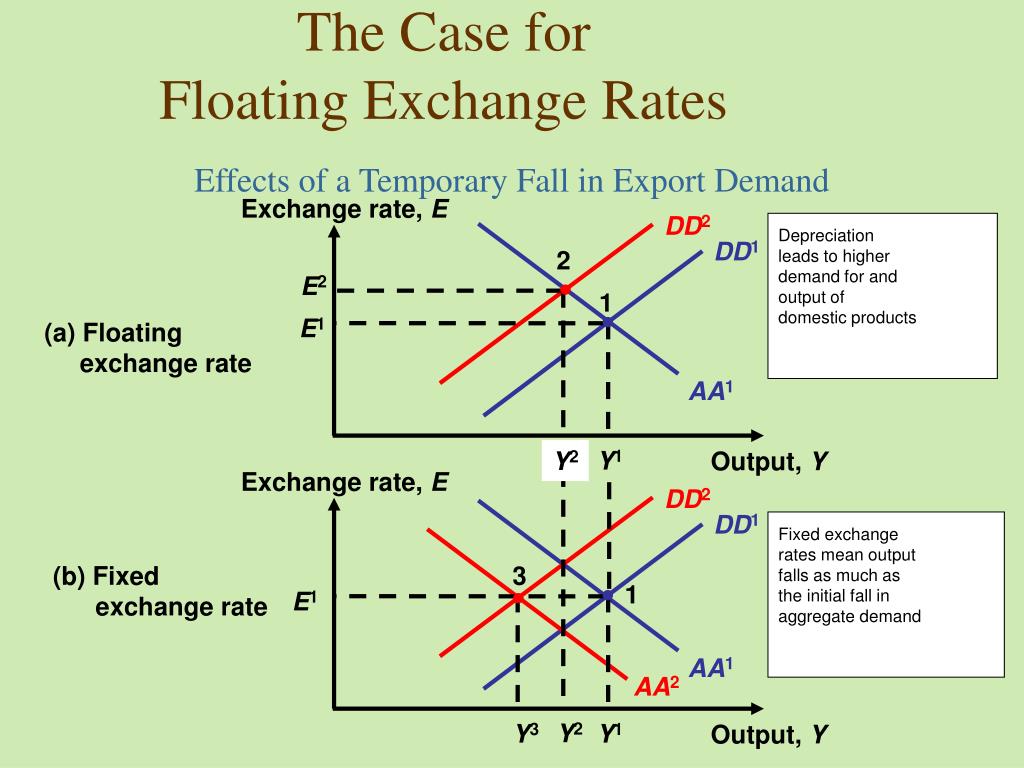

PPT The Case For Floating Exchange Rates PowerPoint Presentation

https://image1.slideserve.com/2019843/slide2-l.jpg

Floating Exchange Rate Definition Example Advantages

https://www.wallstreetmojo.com/wp-content/uploads/2020/04/Floating-Exchange-Rate.jpg

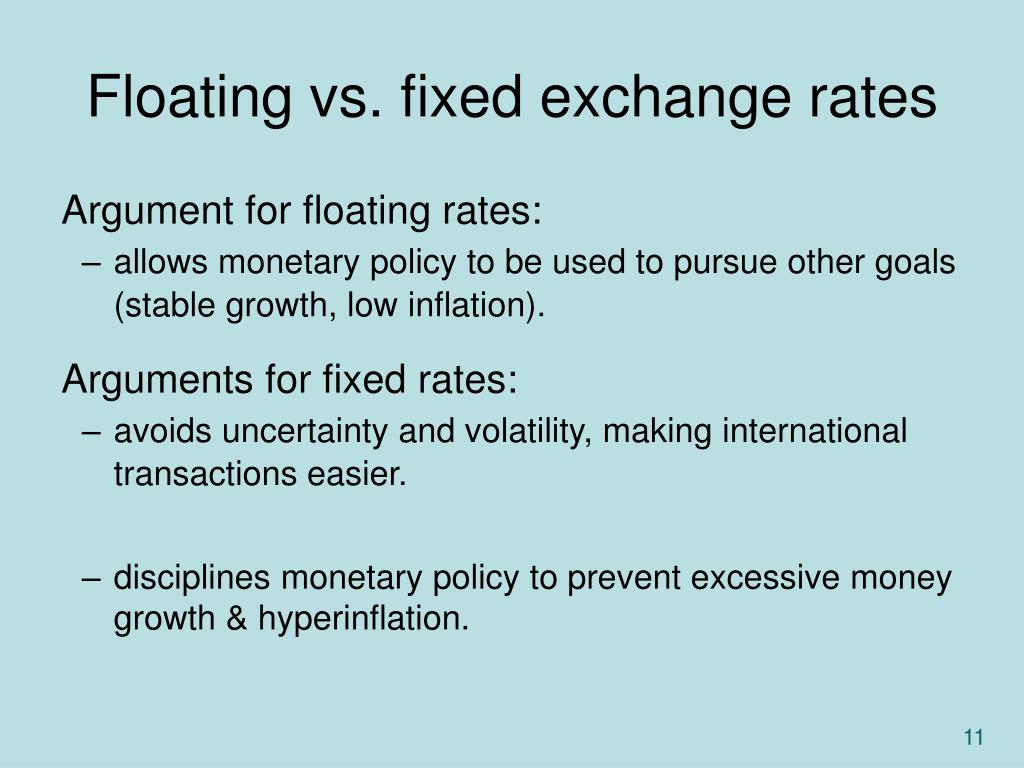

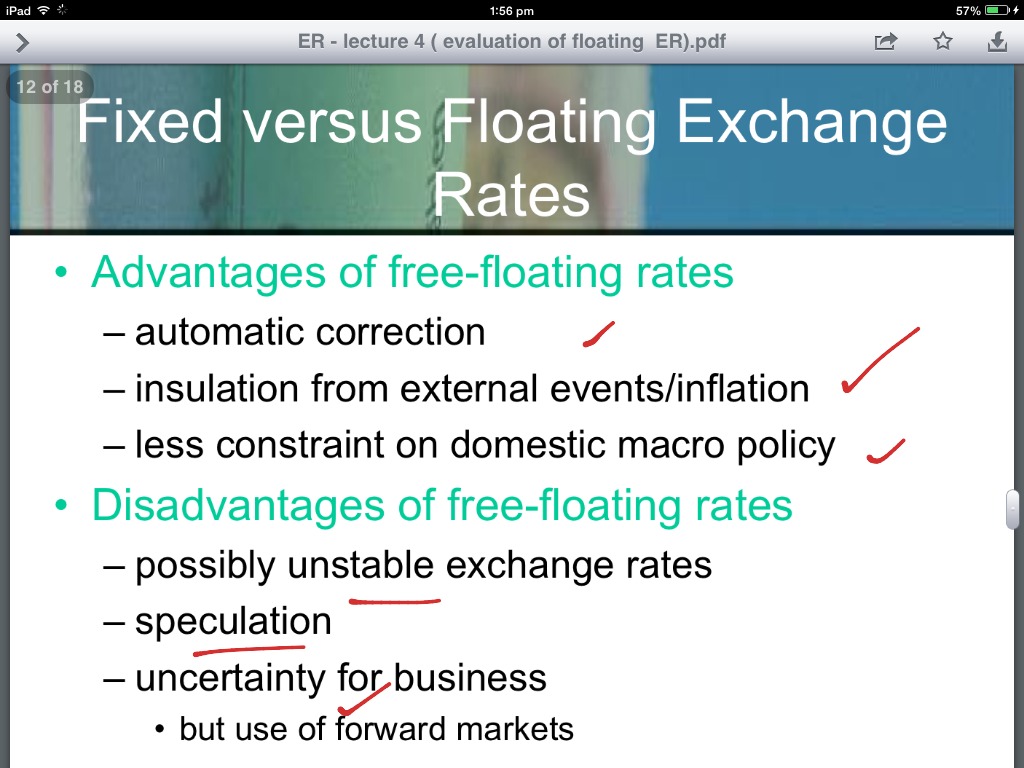

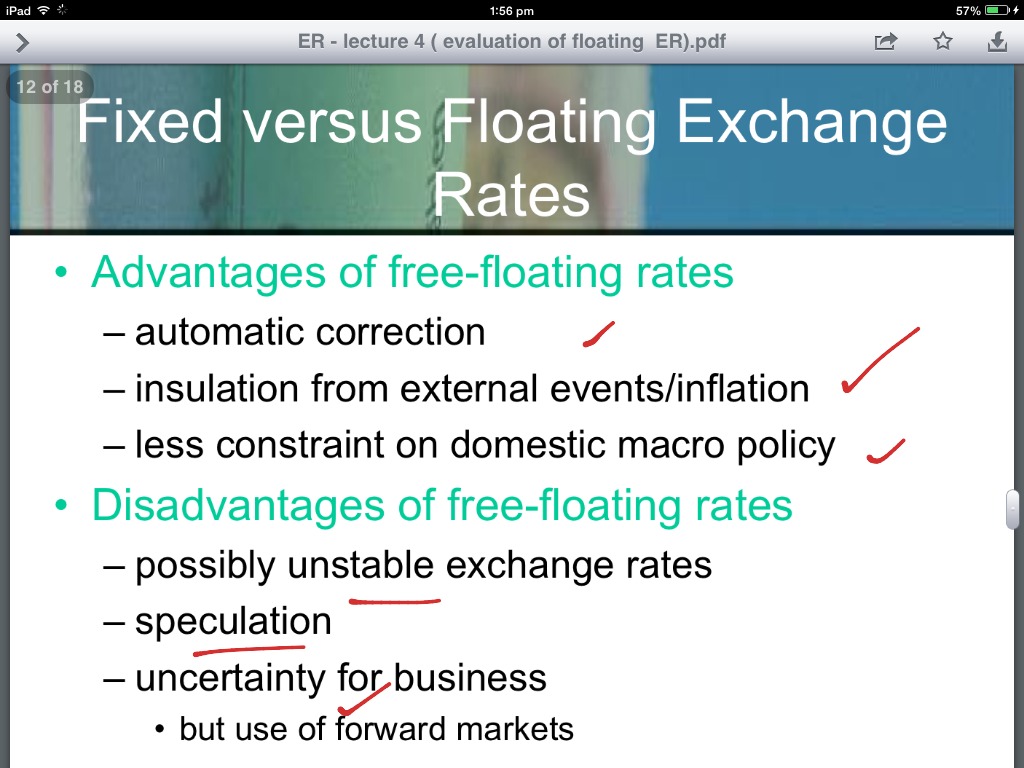

In floating exchange rates such as the U S economy the currency exchange rate appreciates or depreciates according to the market For example if China which regulates the exchange rate of the yuan to a baseline made up of a basket of international currencies had an exchange rate to the U S Dollar of 1 Chinese Yuan 14661 U S Dollars The existence and argument for these types of fixed rates is that the fixed exchange rate facilitates trade and investment between the two countries with the pegged currencies It can be especially beneficial for the smaller country which depends more heavily on international trade A fixed exchange rate also has its weaknesses once pegged to

Example of Foreign Exchange Let s say you purchase 100 000 euros a standard lot at the EUR USD exchange rate of 1 5000 This means it costs 1 5 U S dollars to purchase 1 euro Within a week the rates change and it takes 1 5200 to For example if the international currency exchange rate for one U S dollar to one Canadian dollar is 0 75 then one U S dollar can be exchanged for 0 75 of a Canadian dollar International currency exchange rates change either because the demand for a particular currency changes or in some cases a government forcibly sets the rate The

More picture related to Floating Exchange Rate Definition

Difference Between Fixed And Floating Exchange Rate Compare The

https://www.differencebetween.com/wp-content/uploads/2017/04/Difference-Between-Fixed-and-Floating-Exchange-Rate-1.png

Floating Exchange Rate Overview Functions Benefits Limitations

https://cdn.corporatefinanceinstitute.com/assets/floating-exchange-rate-1024x683.jpeg

Definition Of Floating Exchange Rate On The Currency Market

https://trade-in.forex/wp-content/uploads/2020/06/Floating-Exchange-Rate-scaled.jpg

Company XYZ offers you a floating interest rate loan at prime plus 5 That means the interest rate on the loan equals whatever the prime rate is plus 5 So if the prime rate is 4 then your loan carries an interest rate of 9 The bank may reset the rate from time to time as the prime rate changes This means that if the prime rate goes up The party paying the floating rate leg of the swap believes that interest rates will go down If they do the party s interest payments will go down as well The party paying the fixed rate leg of the swap doesn t want to take the chance that rates will increase so they lock in their interest payments with a fixed rate Company XYZ

[desc-10] [desc-11]

The Determinants Of Exchange Rates In A Floating Exchange Rate System

https://i.ytimg.com/vi/1Gs1KrTBIBM/maxresdefault.jpg

Floating Exchange Rate Definition And How It Works Dumb Little Man

https://www.dumblittleman.com/wp-content/uploads/2022/07/floating-exchange-rate-850x560.jpg

https://investinganswers.com/dictionary/p/pegged-exchange-rate

A pegged exchange rate fixes one country s currency to another country s currency In order to maintain a pegged exchange rate a central bank must maintain a high level of currency reserves The rate is beneficial in that it facilitates trade and investment between two countries with the pegged currencies It can be especially advantageous

https://investinganswers.com/dictionary/e/exchange-rate

Exchange Rate Example Let s say the current exchange rate between the dollar and the euro is 1 23 This means that to obtain one euro you would need 1 23 dollars Conversely if you were about to take a vacation to Europe you could take 1 000 to the bank and receive 813 01 Exchange rates can be fixed or floating

What Is A Fixed Exchange Rate Definition And Examples

The Determinants Of Exchange Rates In A Floating Exchange Rate System

/dotdash-floatingexchangerate-FINAL-d2e0c610285d484eb8c88396e78c6a6d.jpg)

Ausrichten Herunter Nehmen Kr he Exchange Rate Mechanism Spr hen

PPT Chapter 3 Mundell Fleming Model Asst Prof Dr Mete Feridun

Fixed And Floating Exchange Rate What Is A Floating Exchange Rate

Disadvantages Of Floating Exchange Rate System Economics ShowMe

Disadvantages Of Floating Exchange Rate System Economics ShowMe

What Is A Foreign Exchange Rate Definition Examples TheStreet

:max_bytes(150000):strip_icc()/dotdash-floatingexchangerate-FINAL-d2e0c610285d484eb8c88396e78c6a6d.jpg)

Floating Exchange Rate Definition And History

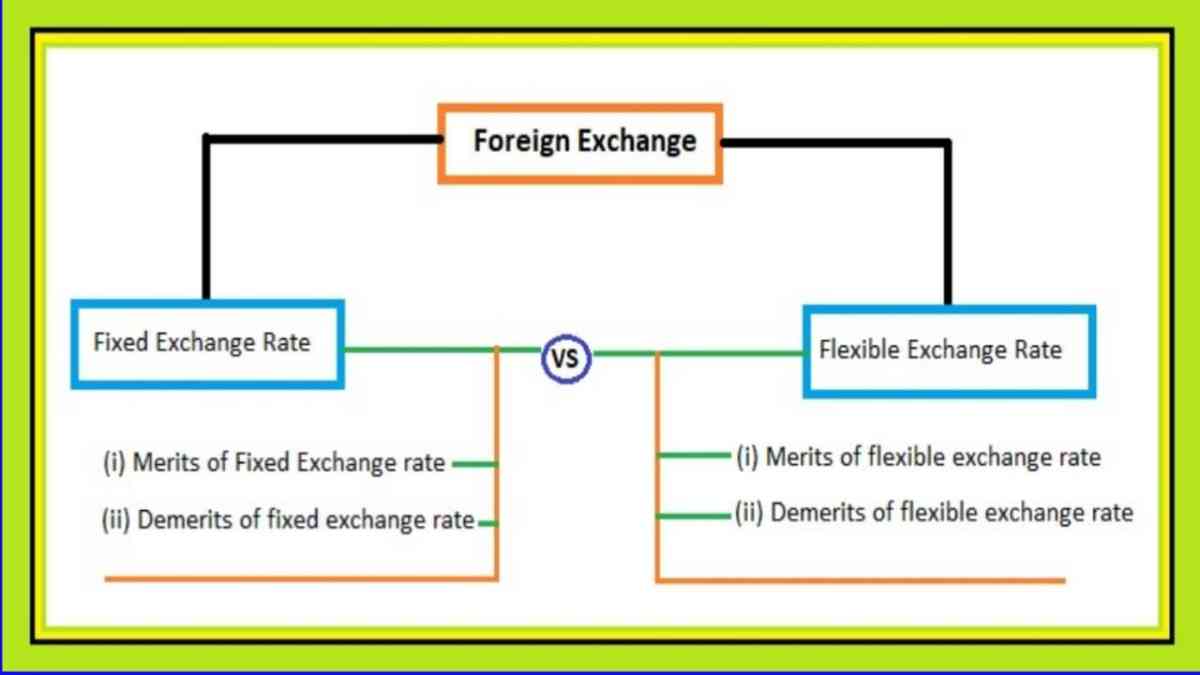

Fixed And Flexible Exchange Rate Difference Between Fixed And

Floating Exchange Rate Definition - In floating exchange rates such as the U S economy the currency exchange rate appreciates or depreciates according to the market For example if China which regulates the exchange rate of the yuan to a baseline made up of a basket of international currencies had an exchange rate to the U S Dollar of 1 Chinese Yuan 14661 U S Dollars