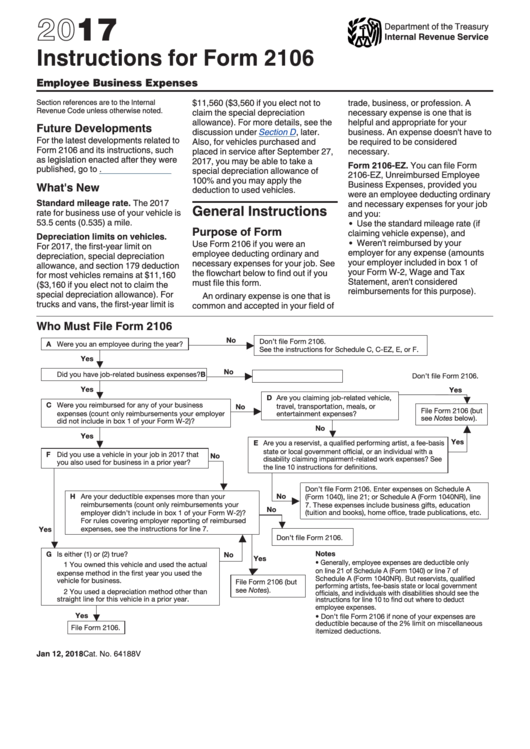

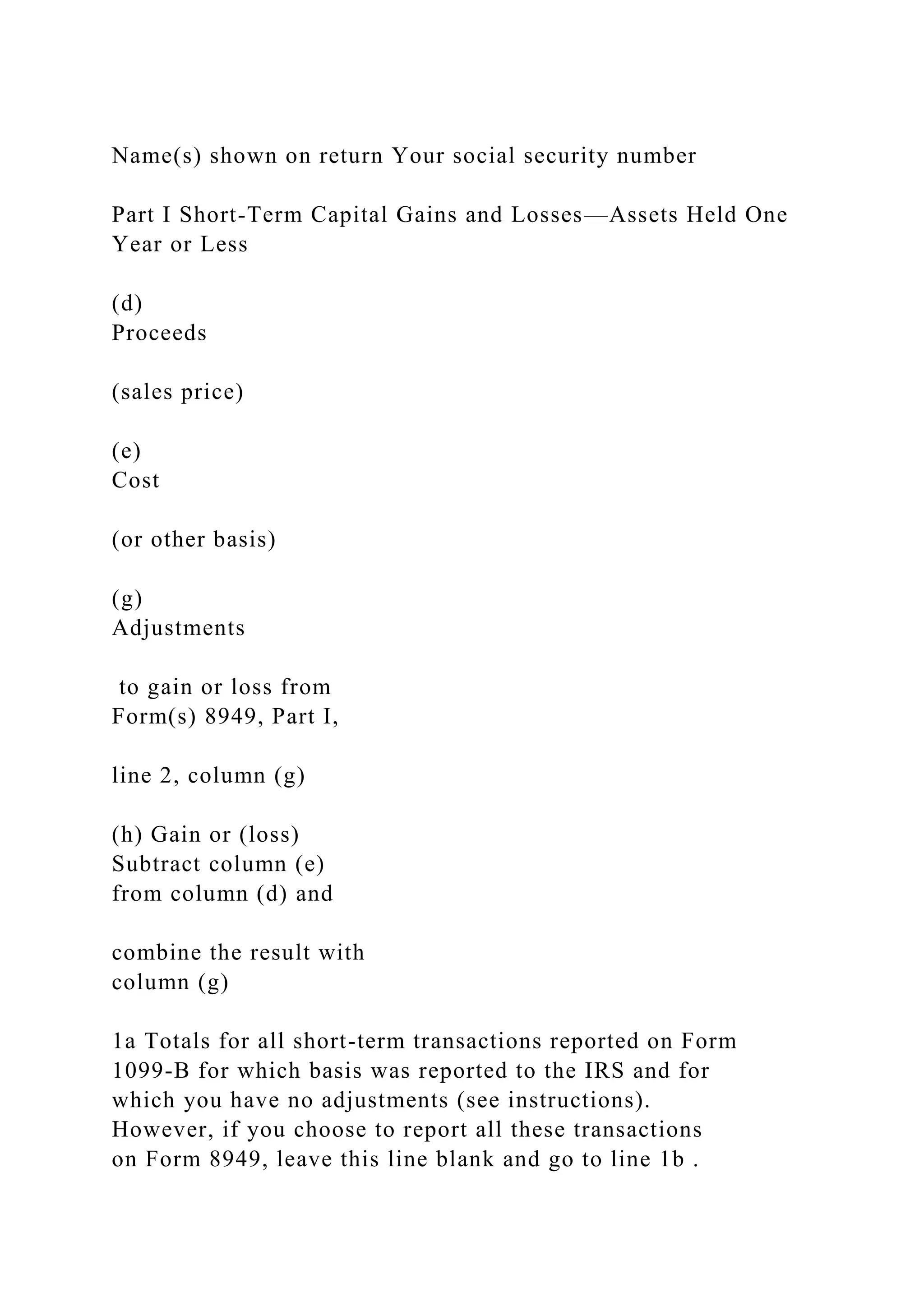

Form 2106 Recinded Til 2025 Schedule Use Form 2106 to deduct employee business expenses if you are a reservist a performing artist a state or local official or an employee with impairment related work expenses Learn how to fill out the form what expenses to record and what rates to use for travel and depreciation

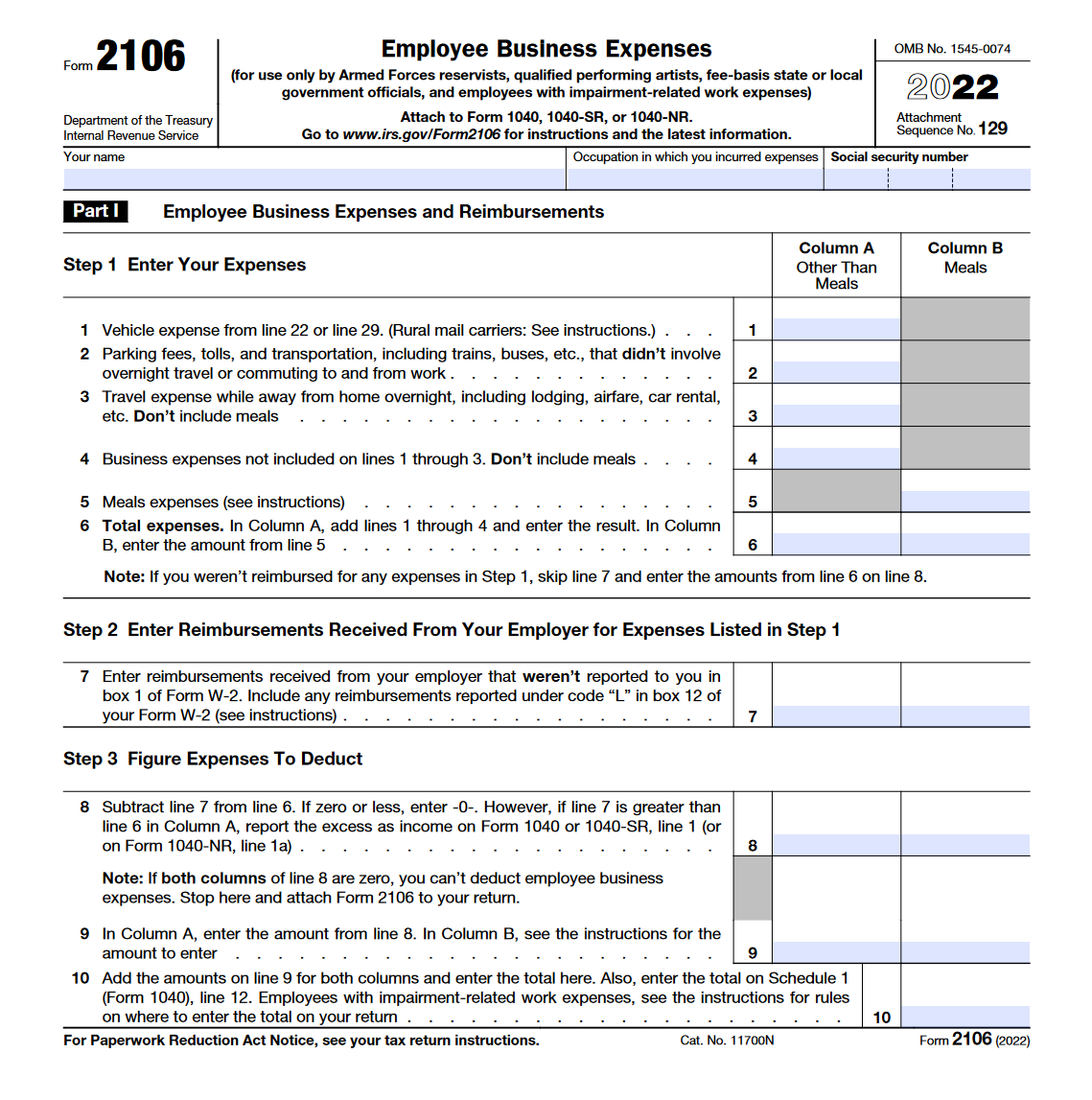

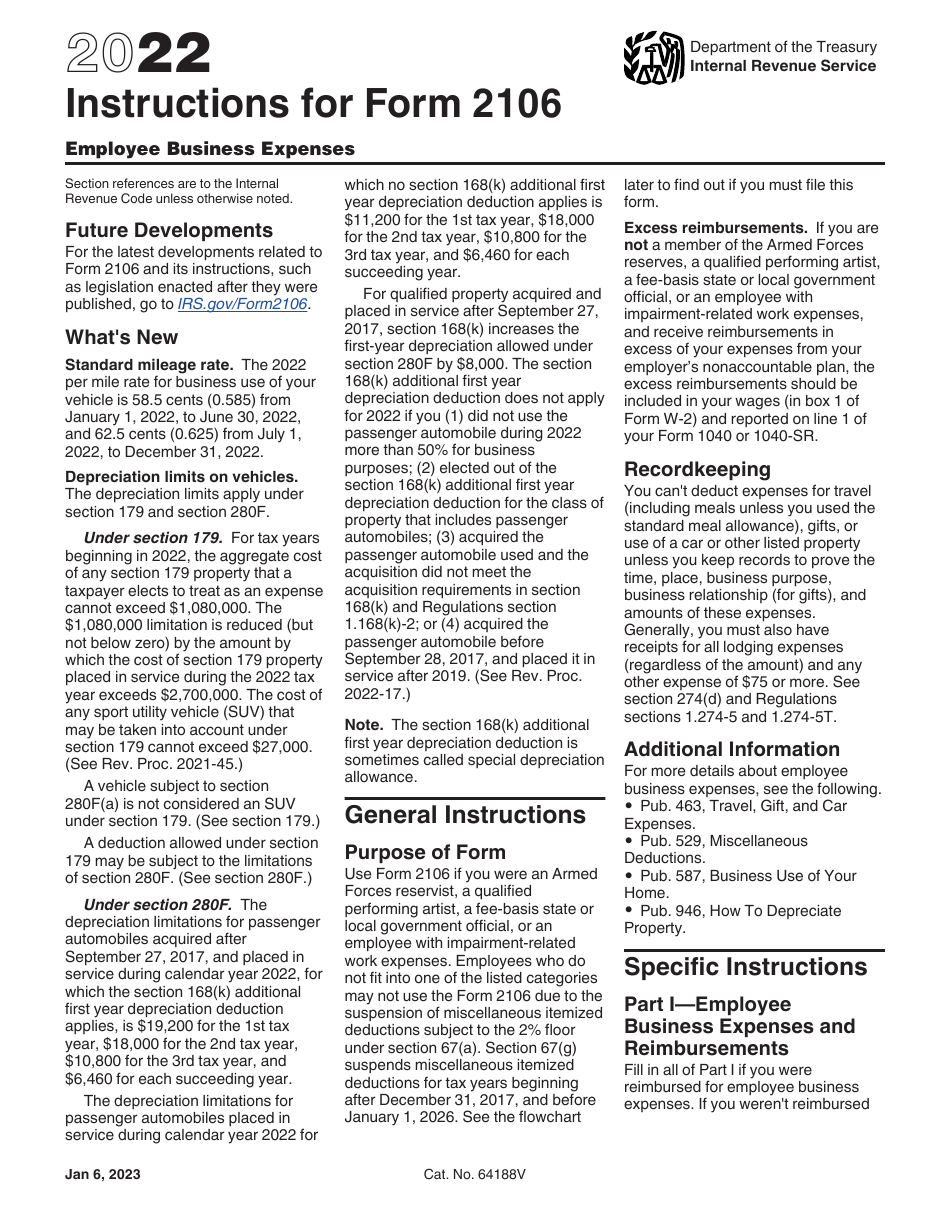

Download and print the current revision of Form 2106 which employees use to deduct ordinary and necessary expenses for their job Find instructions related forms and publications and recent developments for this form Form 2106 is an IRS tax form that employees can use to report out of pocket business expenses for potential deductions on their taxes This can include things like travel meals or use of vehicles as part of their job duties

Form 2106 Recinded Til 2025 Schedule

Form 2106 Recinded Til 2025 Schedule

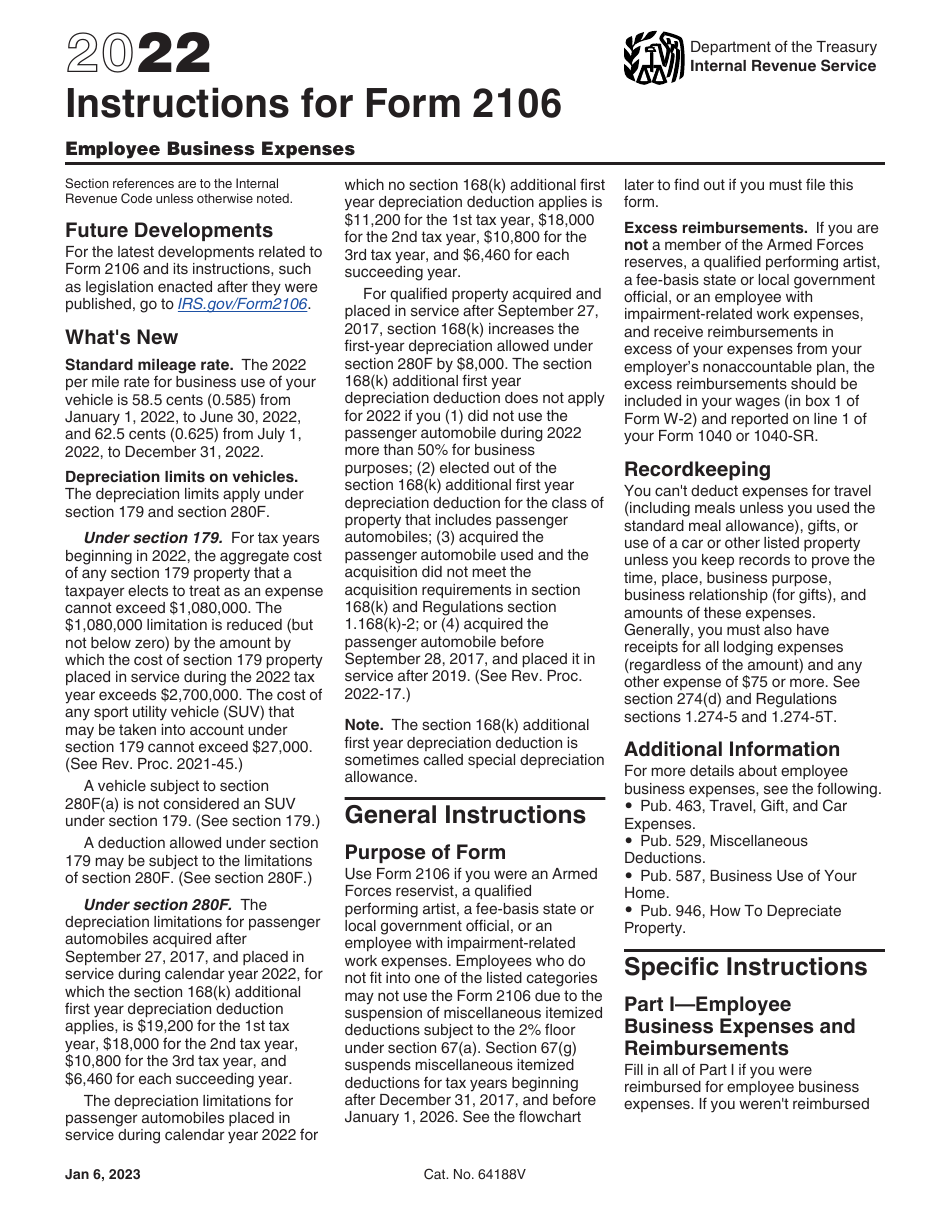

https://data.templateroller.com/pdf_docs_html/2580/25808/2580863/instructions-for-irs-form-2106-employee-business-expenses_print_big.png

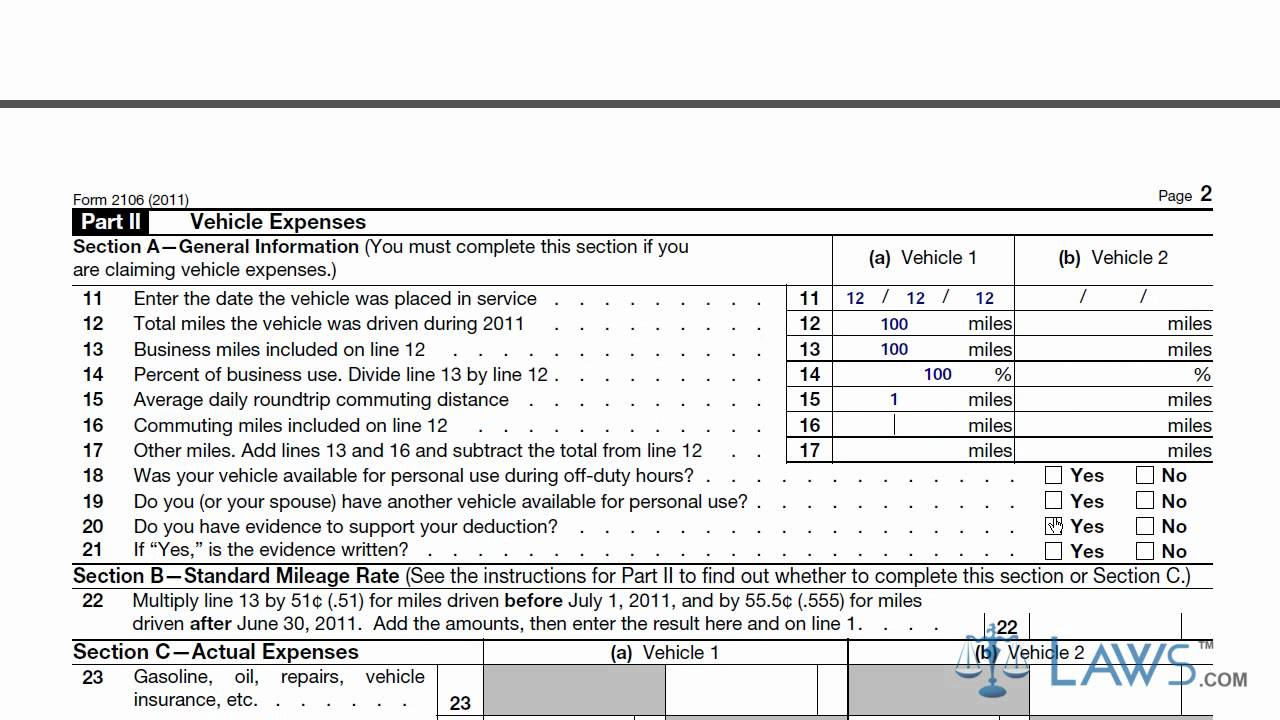

Form 2106 YouTube

https://i.ytimg.com/vi/GrLlBREnz8Y/maxresdefault.jpg

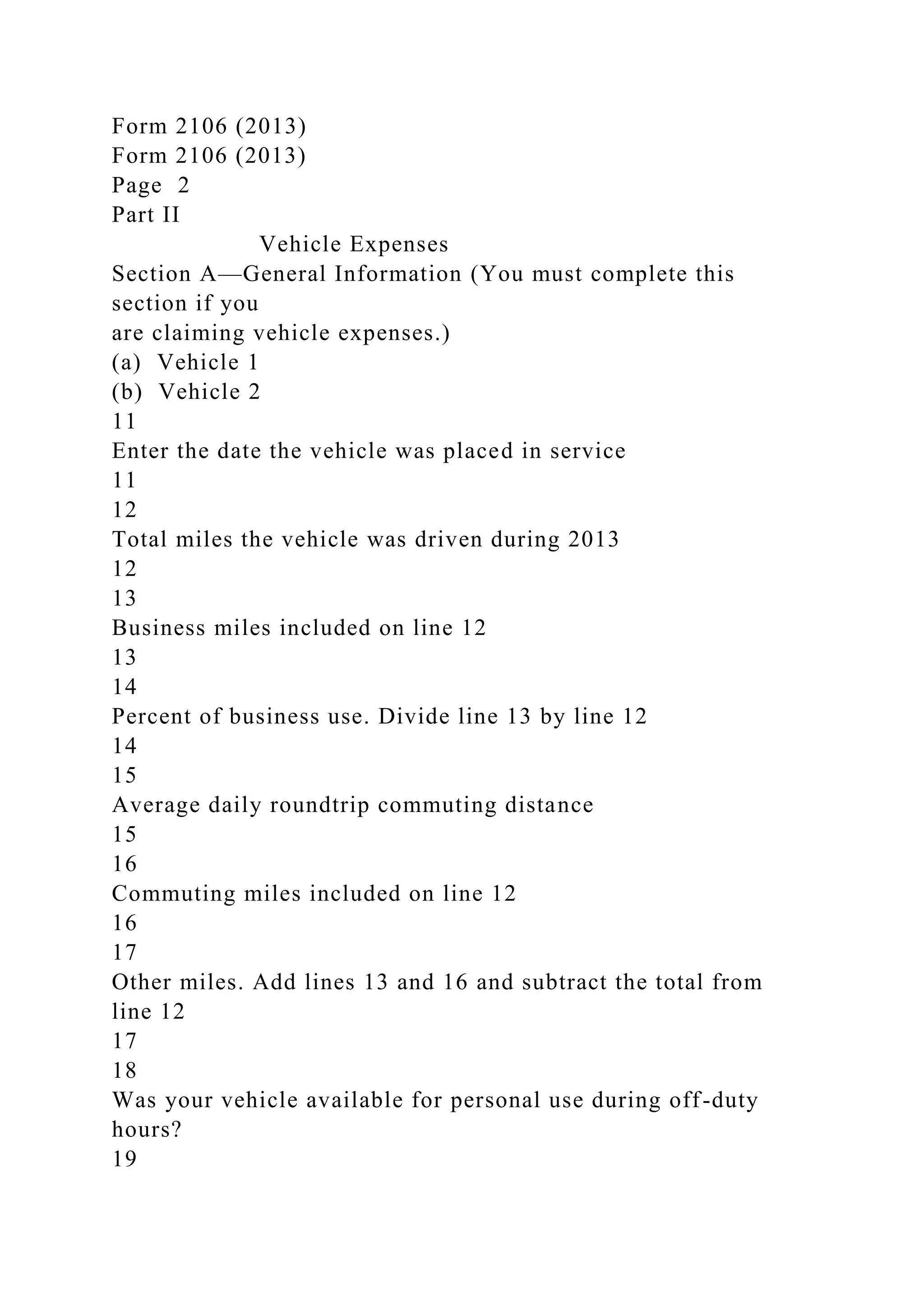

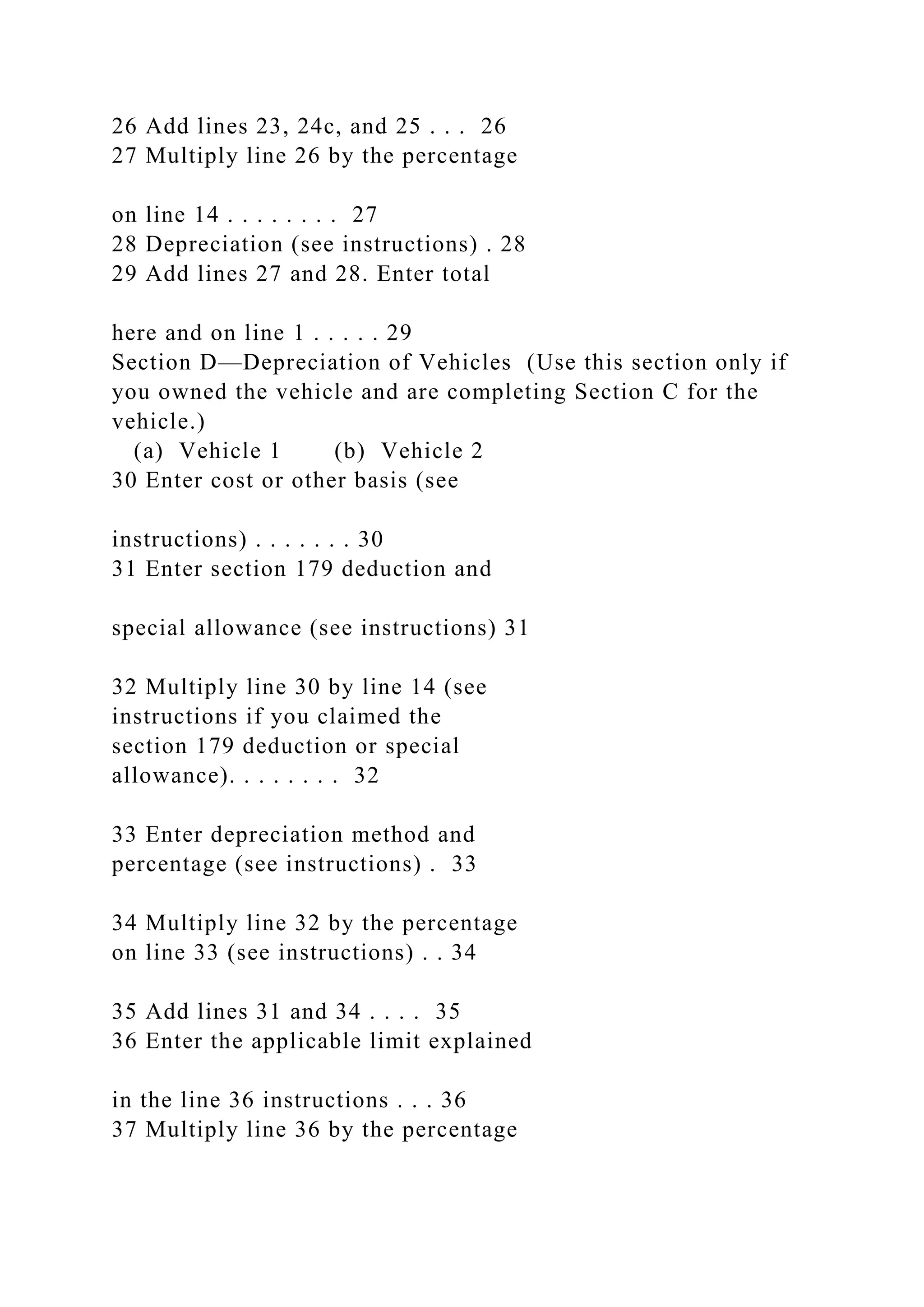

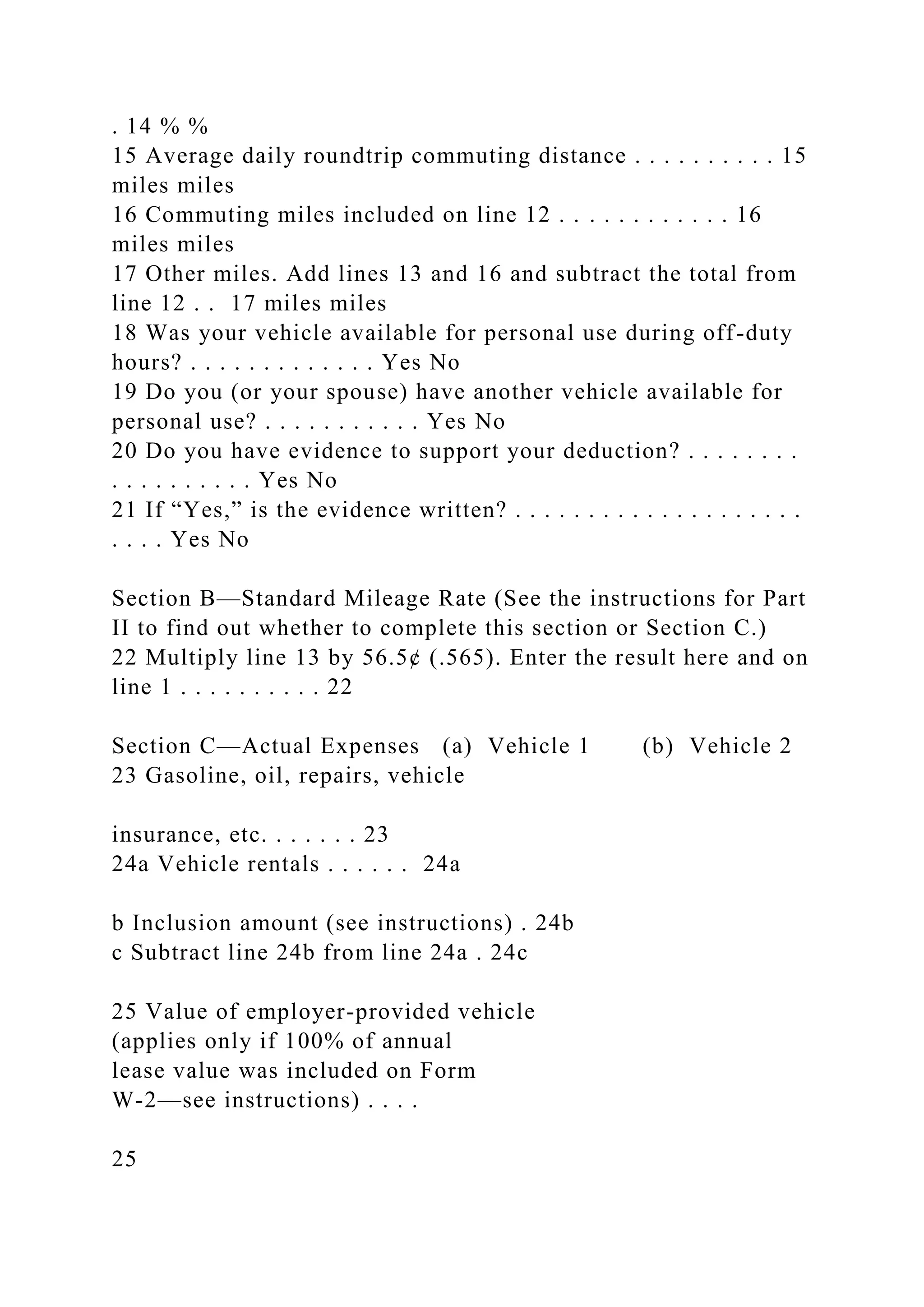

Form 2106 Department Of The Treasury Internal Revenue Se docx

https://image.slidesharecdn.com/form2106departmentofthetreasuryinternalrevenuese-221109051238-3cf17d11/75/form-2106-department-of-the-treasury-internal-revenue-sedocx-11-2048.jpg?cb=1667972187

Form 2106 is for employees who incur business expenses but do not receive reimbursements from their employers Learn who can file Form 2106 what expenses are deductible and how to report them on your tax return Form 2106 Employee Business Expenses If you have expenses that are not reimbursed by your employer or if your employer does not use an accountable plan you ll generally have to claim the nonreimbursed expenses on Form 2106 In some cases you may be able to use Form 2106 EZ Unreimbursed Employee Business Expenses

Form 2106 Per Diem Meals Deduction To enter meals as an unreimbursed employee expense on Form 2106 From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click Federal To enter unreimbursed employee expenses in your TaxAct return go to our Form 2106 Entering Unreimbursed Employee Expenses in Program FAQ TaxAct will use the higher of your itemized deductions or the standard deduction for your filing status in order to

More picture related to Form 2106 Recinded Til 2025 Schedule

Form 2106 Department Of The Treasury Internal Revenue Se docx

https://image.slidesharecdn.com/form2106departmentofthetreasuryinternalrevenuese-221109051238-3cf17d11/75/form-2106-department-of-the-treasury-internal-revenue-sedocx-39-2048.jpg?cb=1667972187

Instructions For Form 2106 Employee Business Expenses 2017 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/362/3628/362814/page_1_thumb_big.png

Form 2106 Department Of The Treasury Internal Revenue Se docx

https://image.slidesharecdn.com/form2106departmentofthetreasuryinternalrevenuese-221109051238-3cf17d11/75/form-2106-department-of-the-treasury-internal-revenue-sedocx-6-2048.jpg?cb=1667972187

Learn how to use IRS Form 2106 to claim deductions for non reimbursed work related expenses such as travel meals entertainment or transportation if you itemize deductions Find out the eligibility criteria the limitations and the methods to calculate your deductions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return Instructions for Form 2106 Employee Business Expenses 2023 01 30 2024 Page Last Reviewed or Updated 08 Oct 2024 Share Facebook Twitter Linkedin Print Footer Navigation

Form 2106 through tax year 2025 including if you were an Armed Forces What type of entity is my business by TurboTax 18 Updated February 14 2024 Form 2553 to elect S Form 2106 2021 Employee Business Expenses for use only by Armed Forces reservists qualified performing artists fee basis state or local government officials and employees with impairment related work expenses Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form2106

IRS Form 2106 Walkthrough Employee Business Expenses YouTube

https://i.ytimg.com/vi/-2D4bruguz0/maxresdefault.jpg

IRS Form 2106 Employee Business Expenses Forms Docs 2023

https://blanker.org/files/images/form-2106.png

https://www.irs.gov/instructions/i2106

Use Form 2106 to deduct employee business expenses if you are a reservist a performing artist a state or local official or an employee with impairment related work expenses Learn how to fill out the form what expenses to record and what rates to use for travel and depreciation

https://www.irs.gov/forms-pubs/about-form-2106

Download and print the current revision of Form 2106 which employees use to deduct ordinary and necessary expenses for their job Find instructions related forms and publications and recent developments for this form

Form 2106 Adjustments Worksheet

IRS Form 2106 Walkthrough Employee Business Expenses YouTube

Form 2106 Department Of The Treasury Internal Revenue Se docx

Ssurvivor Form 2106 Instructions

Form 2106 Department Of The Treasury Internal Revenue Se docx

Form 2106 Department Of The Treasury Internal Revenue Se docx

Form 2106 Department Of The Treasury Internal Revenue Se docx

Form 2106 Department Of The Treasury Internal Revenue Se docx

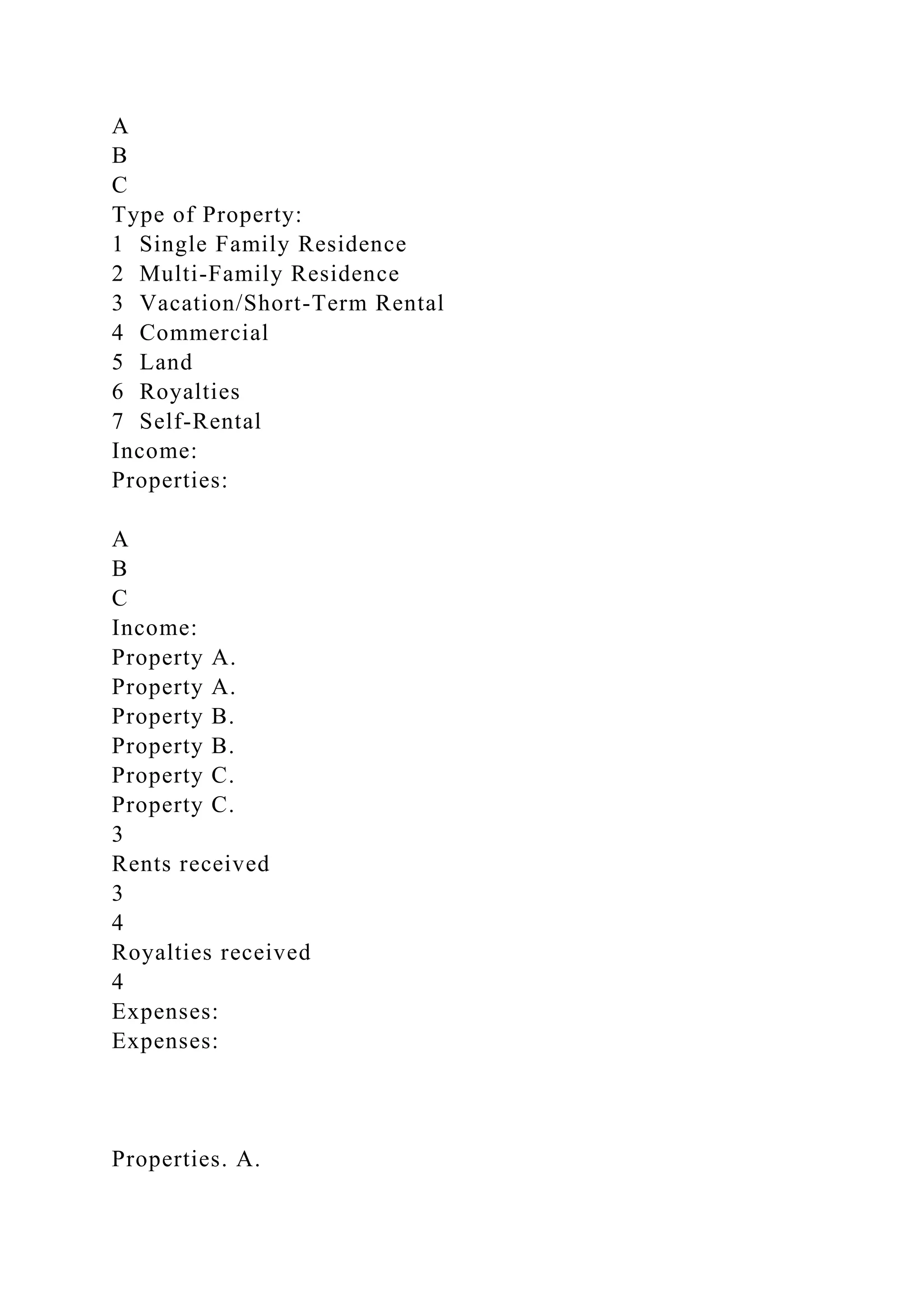

Use Form 1040 Schedule Form 2106 And Form Chegg

Use Form 1040 Schedule Form 2106 And Form Chegg

Form 2106 Recinded Til 2025 Schedule - Miscellaneous deductions subject to the 2 limit including unreimbursed job expenses reported on Form 2106 have been repealed for tax years 2018 2025 Affected deductions include Job search expenses