Formula For Taxable Social Security Benefits The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement

Learn how to calculate the taxable portion of your Social Security benefits Understand income thresholds provisional income and strategies to minimize tax liability To determine this amount the IRS provides tax filers with the 18 step Social Security Benefits Worksheet found in the 1040 instructions for lines 6a and 6b on the current

Formula For Taxable Social Security Benefits

Formula For Taxable Social Security Benefits

https://i4.ytimg.com/vi/y4bf-rThboA/sddefault.jpg

How To Calculate Taxable Social Security Benefits Explained With

https://www.thestreet.com/.image/t_share/MTkyMzU0NzY4MjQzNDAxODI3/thumb-combined-income-js-091322.jpg

Calculate Social Security Taxable Amount TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

85 of your Social Security income can be taxed Learn what is taxable how benefit taxes are calculated amp create a strategy to lower your taxable income It is typical for Social Security benefits to be 85 taxable especially for clients with higher income sources in retirement But the benefit subject to taxation can be lower

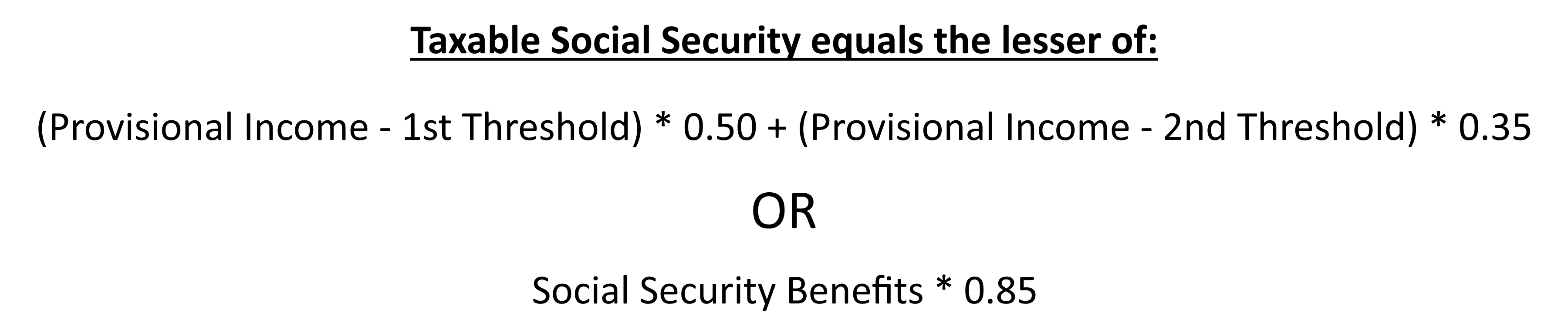

You can use the worksheet in IRS Publication 915 fill out a 1040 or use this formula to calculate the taxable portion of Social Security benefits Calculate the taxable portion of social security benefits with other income and filing status

More picture related to Formula For Taxable Social Security Benefits

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Form1040.png

How To Lower Your Social Security Tax Bill Wiztax

https://www.wiztax.com/wp-content/uploads/2022/12/social-security-tax_m-1355x1020.jpeg

Taxable Social Security Calculator

https://www.covisum.com/hs-fs/hubfs/Imported_Blog_Media/WEB_Covisum_tax-chart-SST.png?width=613&name=WEB_Covisum_tax-chart-SST.png

Generally the formula for total income or what the Social Security administration refers to as combined income for this purpose is your adjusted gross income AGI including any nontaxable interest plus half of your Social Security You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between

It is calculated by adding your adjusted gross income AGI non taxable interest and 50 of your Social Security benefits AGI is your income from all sources such as wages The formula for calculating the taxable portion uses the AGI minus the line 6b part so as an input AGI does not include social security Tax exempt interest is interest income that

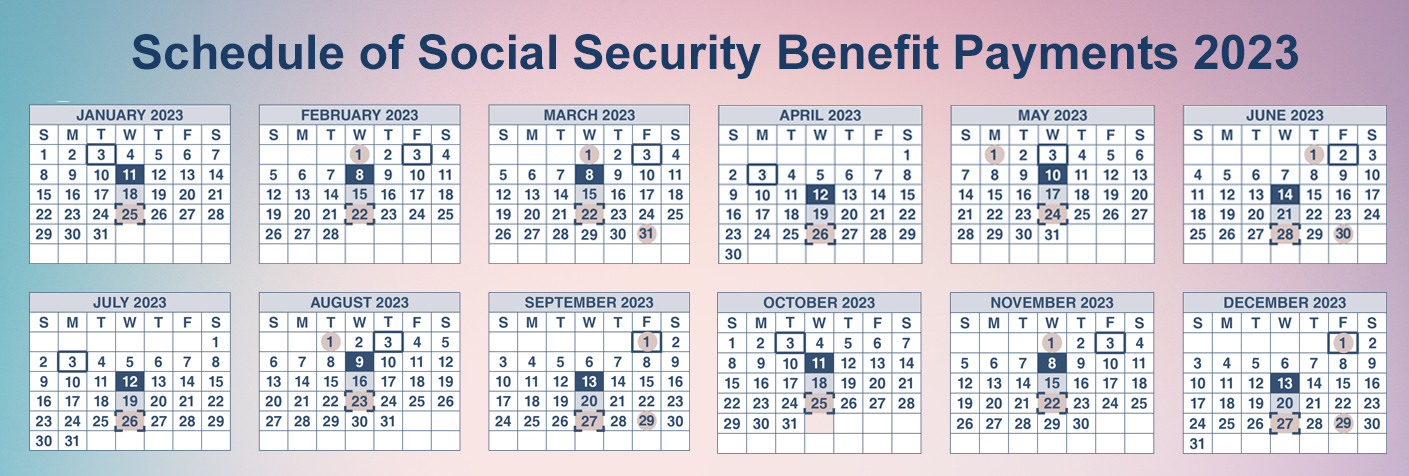

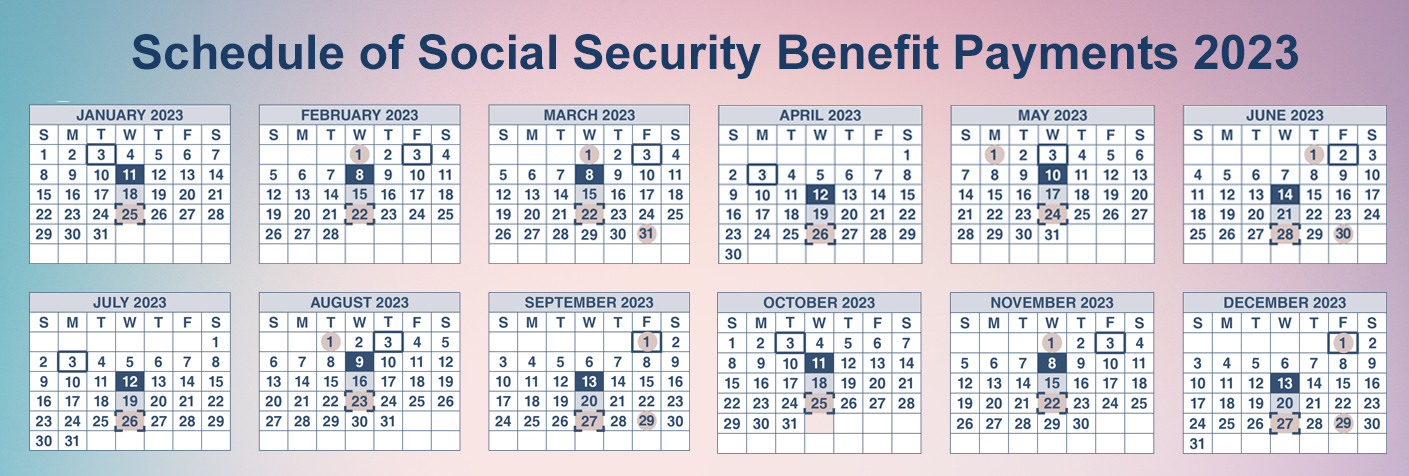

Social Security SSI SSDI Benefit Payments Schedule 2023

https://www.clausonlaw.com/blog/wp-content/uploads/2022/09/MicrosoftTeams-image-7.jpg

2023 Worksheet To Calculate Taxable Social Security

https://i0.wp.com/image.slidesharecdn.com/8ptf1if6qoupik01jizb-140513040818-phpapp01/95/your-social-securitystatement-3-638.jpg?cb=1399954123

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement

https://www.kiplinger.com › retirement › s…

Learn how to calculate the taxable portion of your Social Security benefits Understand income thresholds provisional income and strategies to minimize tax liability

Which States Tax Social Security Benefits In 2023 Internal Revenue

Social Security SSI SSDI Benefit Payments Schedule 2023

2023 Tax Brackets Social Security Benefits Increase And Other

Ssdi Taxable Income Calculator RanaldBraiden

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

Social Security Tax Limit 2024 Know Taxable Earnings Income Increase

Social Security Tax Limit 2024 Know Taxable Earnings Income Increase

Retire Ready Are Social Security Benefits Taxed

Calculating Taxable Social Security Benefits Not As Easy As 0 50

What Is Taxable Social Security Benefits Retire Gen Z

Formula For Taxable Social Security Benefits - 85 of your Social Security income can be taxed Learn what is taxable how benefit taxes are calculated amp create a strategy to lower your taxable income