How Are Risk Retention Groups Regulated Under the McCarran Ferguson Act most insurance matters are regulated at the state rather than federal level However in the late 1970s Congress faced an unprecedented crisis in insurance markets during which many businesses were unable to obtain product liability coverage at any cost Congress was forced to take action and after several years of study enacted the Product Liabi

How does the LRRA address regulation of RRGs a Under 3902 of the LRRA with the exception of the domiciliary state RRGs are exempt from all state laws rules regulations or How Does a Risk Retention Group Differ from Traditional Insurance Companies While RRGs and traditional insurance companies both provide liability coverage there are several key differences between the two

How Are Risk Retention Groups Regulated

How Are Risk Retention Groups Regulated

https://www.hertvik.com/wp-content/uploads/sites/136/2020/05/Risk-Retention-Groups-scaled.jpg

5 Individual Risk Factors Impacting Work Related MSDs

https://carrierchronicles.com/wp-content/uploads/2022/09/GettyImages-1292352798.jpg

The Differences Between Risk Retention Groups And Traditional Insurance

https://gdiinsurance.com/wp-content/uploads/2018/07/pexels-photo-1020313.jpeg

How are Risk Retention Groups Unique The liability Risk Retention Act passed by the Congress in 1986 allowed people or entities in the same or similar businesses to join together pool their money and form an insurance company Learn about Risk Retention Groups a type of liability insurer owned by policyholders sharing the same type of business and liability risks Understand how they

A risk retention group RRG is a liability insur ance company that is owned by its members RRGs must be a licensed insurer in one state Once licensed an RRG can insure members in Risk Retention Groups also known as RRGs are an entity owned by their insureds and authorized to underwrite the liability risks of their owners RRGs provide an effective and

More picture related to How Are Risk Retention Groups Regulated

The Significance Of Risk Management Function s Integration In Business

https://image.isu.pub/230518182430-edf0dedb8c9ae4ec26672627a7989204/jpg/page_1.jpg

Risk Retention Groups

https://static.wixstatic.com/media/209352_d89a65d4445045dd9200da485d94d70e~mv2.png/v1/fill/w_1000,h_531,al_c,q_90,usm_0.66_1.00_0.01/209352_d89a65d4445045dd9200da485d94d70e~mv2.png

Risk Retention Groups

https://static.wixstatic.com/media/209352_e0975a4f2330407aa652321bb5979c05~mv2.png/v1/fill/w_936,h_438,al_c,q_90,enc_auto/209352_e0975a4f2330407aa652321bb5979c05~mv2.png

RRGs look feel and act like commercial carriers but they are primarily regulated under state captive statutes However the National Association of Insurance Commissioners NAIC which regulates the state How does the LRRA address regulation of RRGs a Under 3902 of the LRRA with the exception of the domiciliary state RRGs are exempt from all state laws rules

Risk Retention Groups RRGs are regulated in the state in which the RRG is domiciled The domiciliary state has primary regulatory authority over the entity How many Risk Retention Best Practices Risk Retention Groups The domiciliary state maintains authority and has responsibility to regulate the formation and operation of a Risk Retention Group

Examples Of Risk Retention Caitlin Morgan Insurance Services

https://www.caitlin-morgan.com/wp-content/uploads/2020/12/Risk-retention.jpg

38 Risk Factor Examples 2024

https://helpfulprofessor.com/wp-content/uploads/2023/07/protective-factors-vs-risk-factors.jpg

https://en.wikipedia.org › wiki › Risk_Retention_Group

Under the McCarran Ferguson Act most insurance matters are regulated at the state rather than federal level However in the late 1970s Congress faced an unprecedented crisis in insurance markets during which many businesses were unable to obtain product liability coverage at any cost Congress was forced to take action and after several years of study enacted the Product Liabi

https://content.naic.org › sites › default › files › inline-files

How does the LRRA address regulation of RRGs a Under 3902 of the LRRA with the exception of the domiciliary state RRGs are exempt from all state laws rules regulations or

Retention Letter For Employee Performance

Examples Of Risk Retention Caitlin Morgan Insurance Services

Control Or Limit Loss Concept Risk Assessment Analyze Potential

:max_bytes(150000):strip_icc()/RRG_final-ddaf9e85996f402f8102dc67b788c176.png)

Risk Retention Group RRG Meaning Benefits History

What Are Risk Profile Risk Appetite And Risk Rating GCash

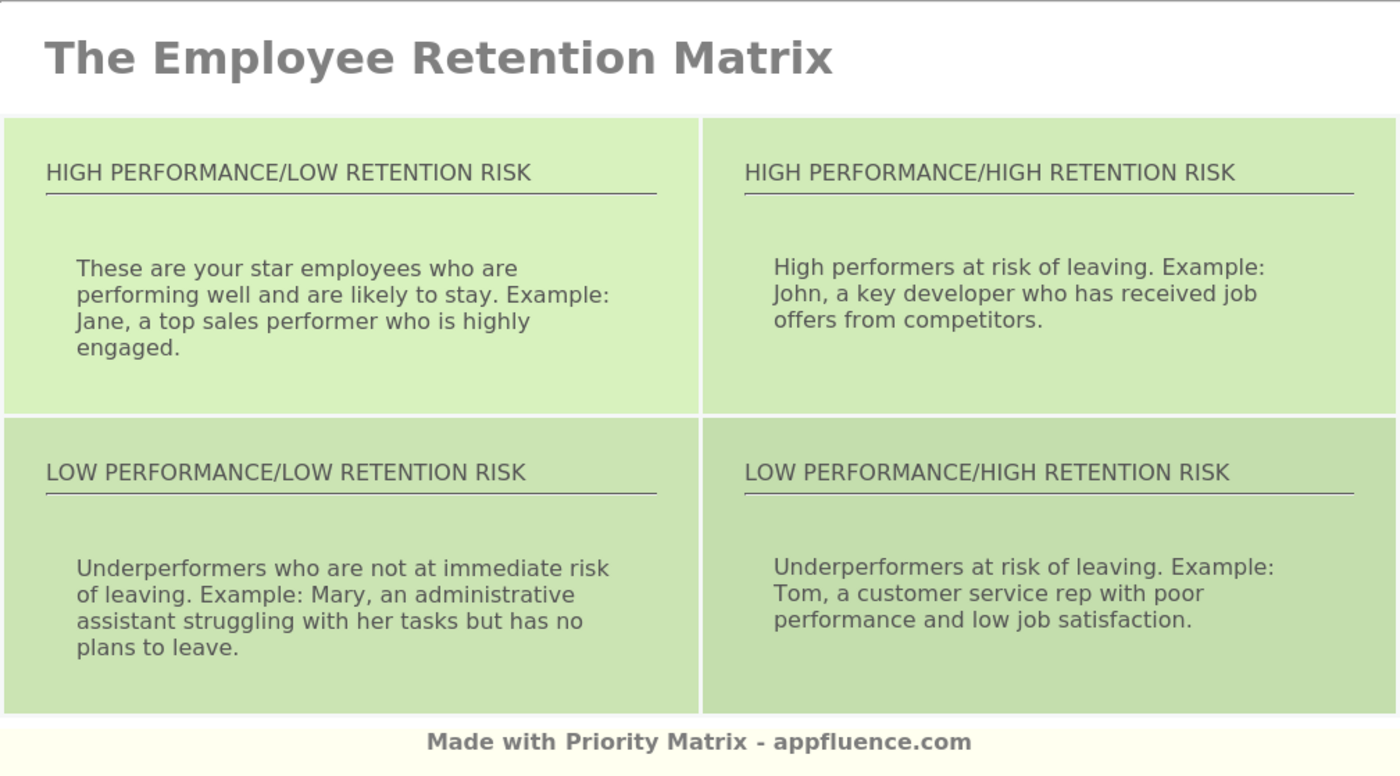

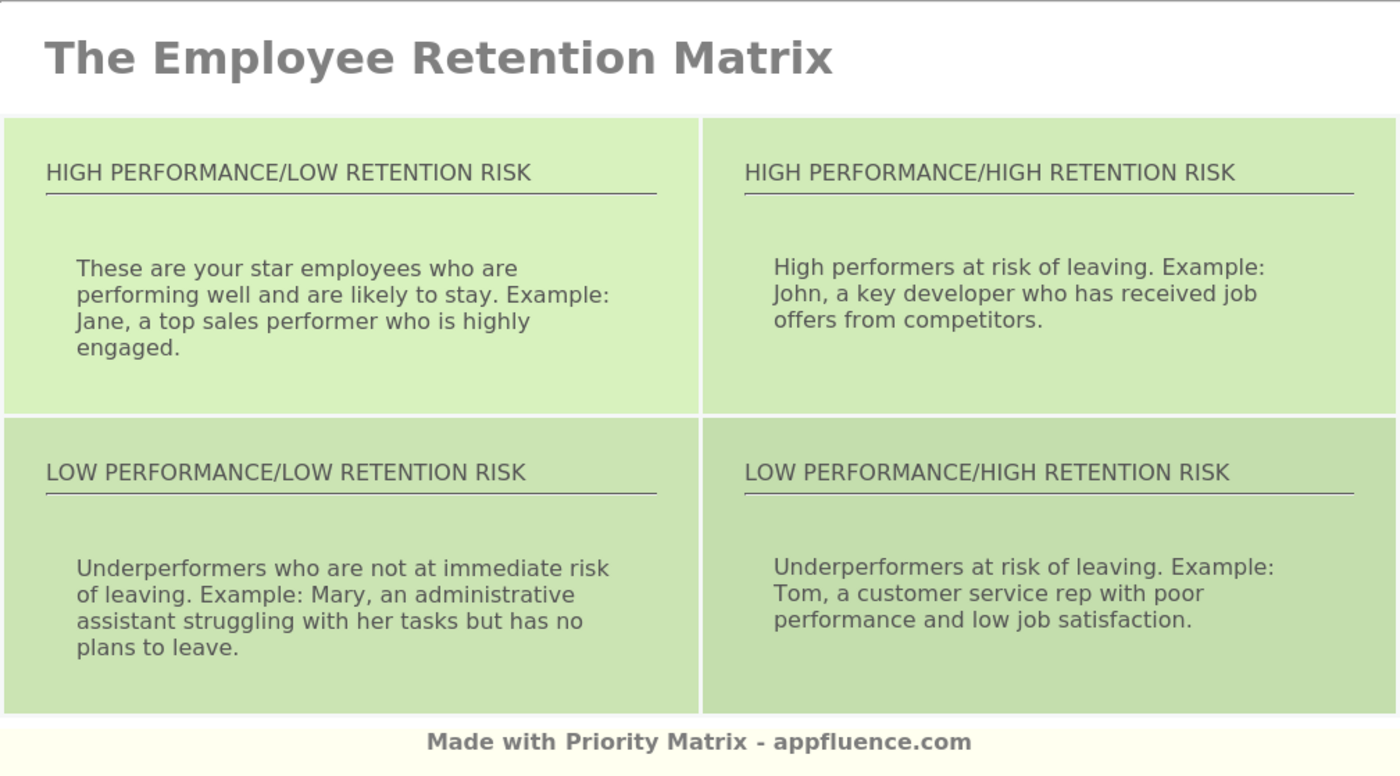

Employee Retention Matrix Free Download

Employee Retention Matrix Free Download

PAS For Risk Retention Groups WaterStreet Company

High Risk Vs Low Risk Investments What s Right For You

Employee Retention Rate An Easy Formula To Calculate It

How Are Risk Retention Groups Regulated - A risk retention group RRG is a liability insur ance company that is owned by its members RRGs must be a licensed insurer in one state Once licensed an RRG can insure members in