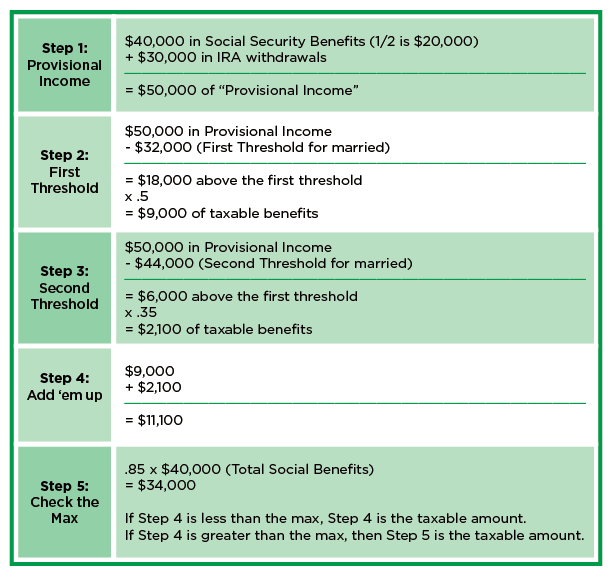

How Do I Calculate Taxable Social Security Benefits Learn how to calculate the taxable portion of your Social Security benefits Understand income thresholds provisional income and strategies to minimize tax liability

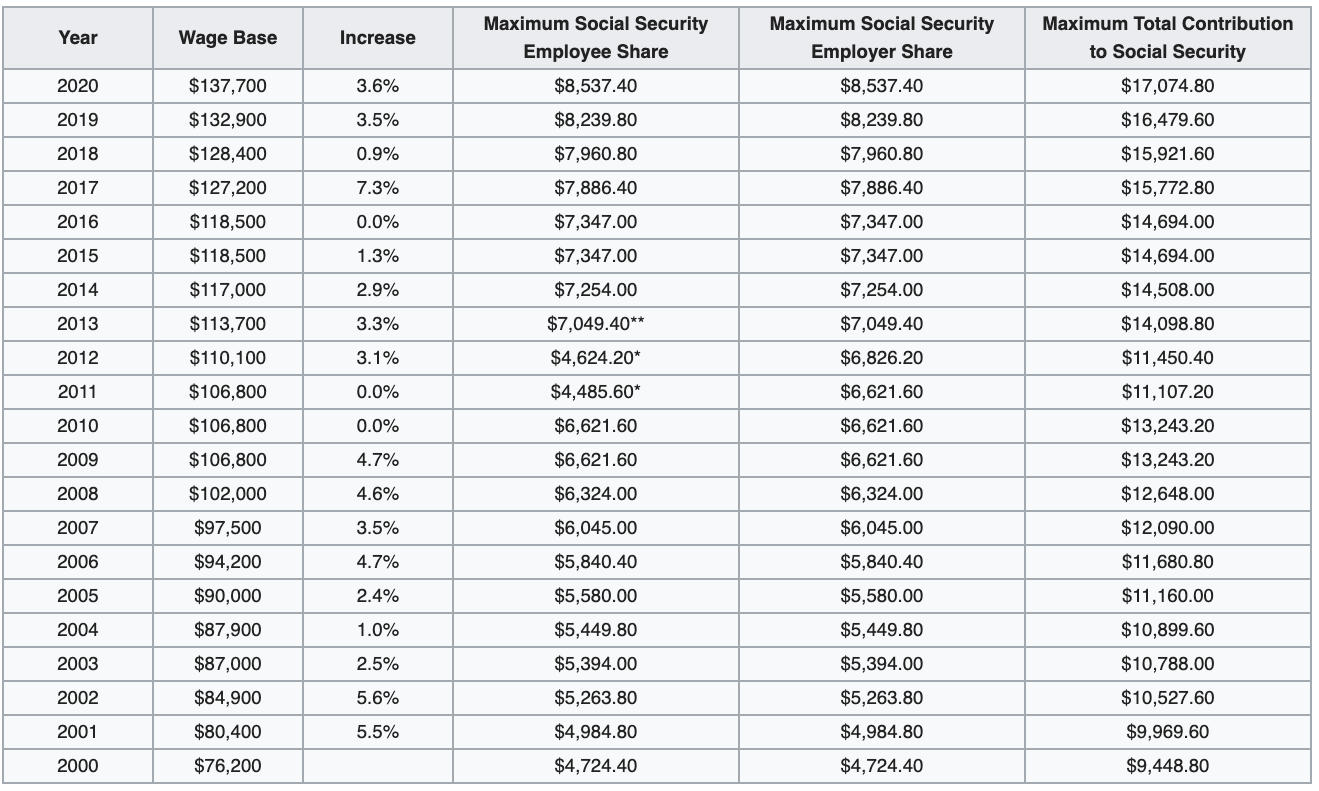

To determine if their benefits are taxable taxpayers should take half of the Social Security money they collected during the year and add it to their other income Other income Learn how to calculate the taxable portion of your Social Security benefits with a step by step guide to understanding income thresholds and tax reporting

How Do I Calculate Taxable Social Security Benefits

How Do I Calculate Taxable Social Security Benefits

https://i.ytimg.com/vi/q342U65tAgA/maxresdefault.jpg

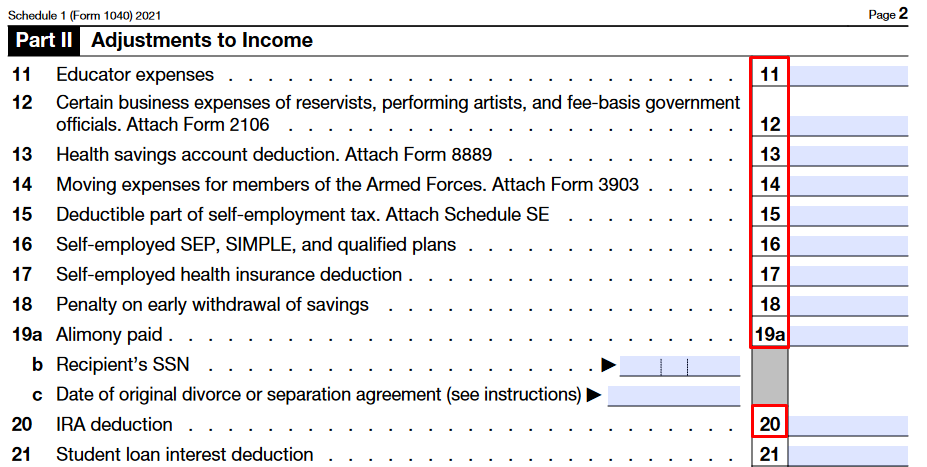

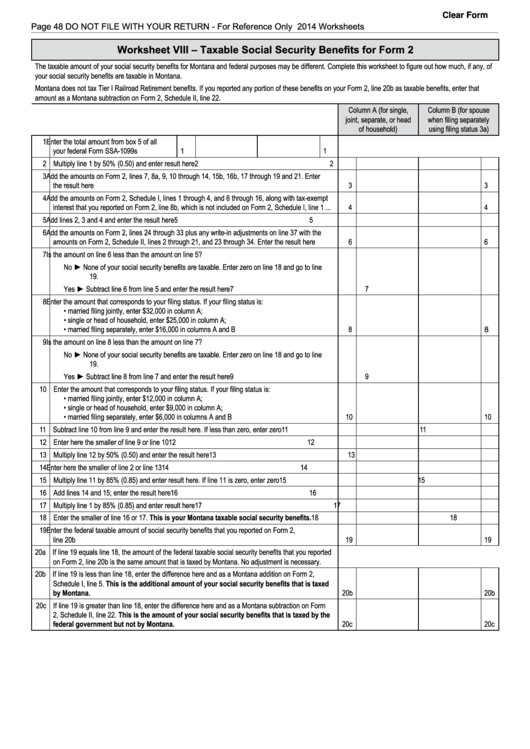

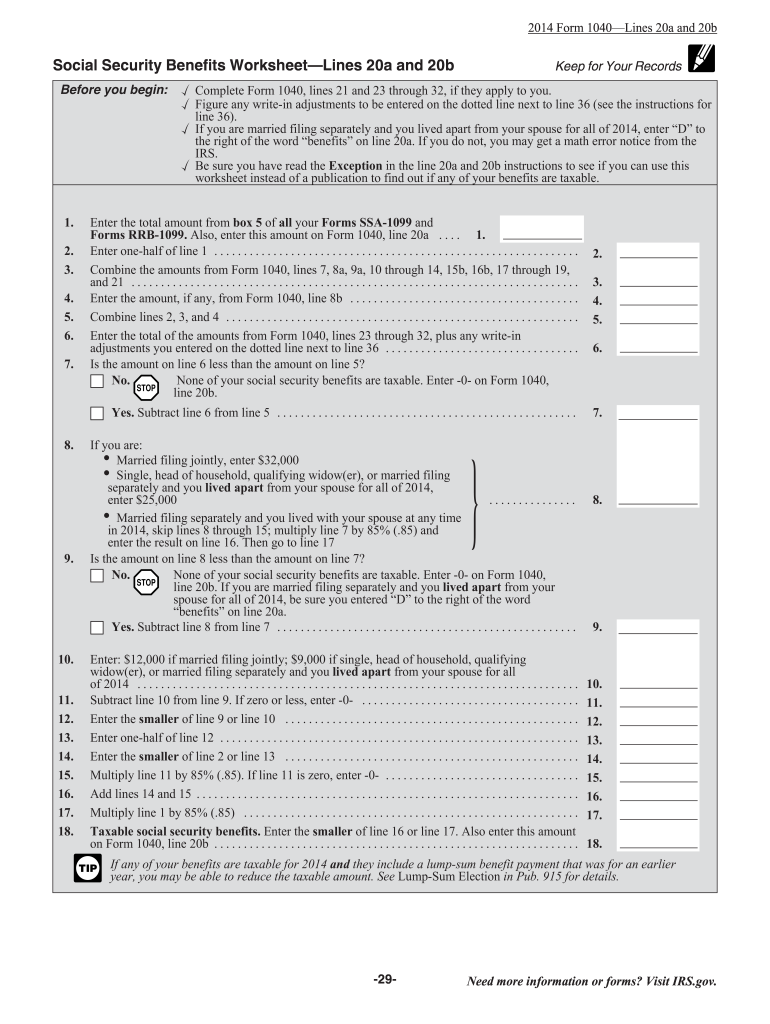

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Form1040.png

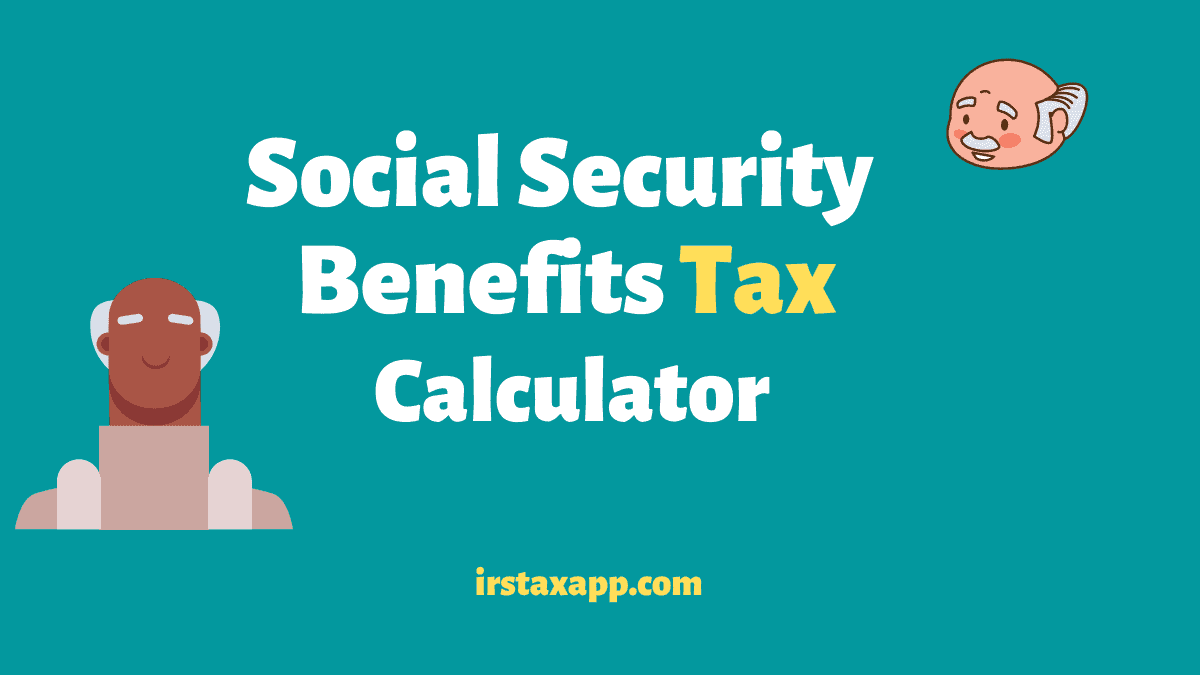

Calculate Social Security Taxable Amount TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

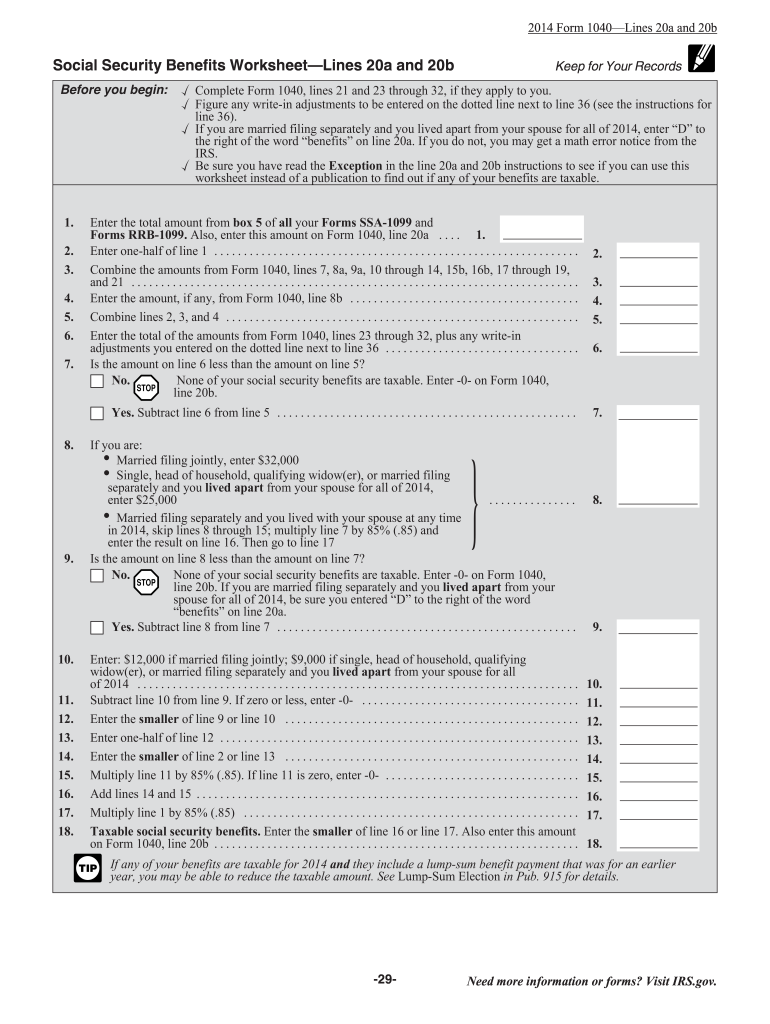

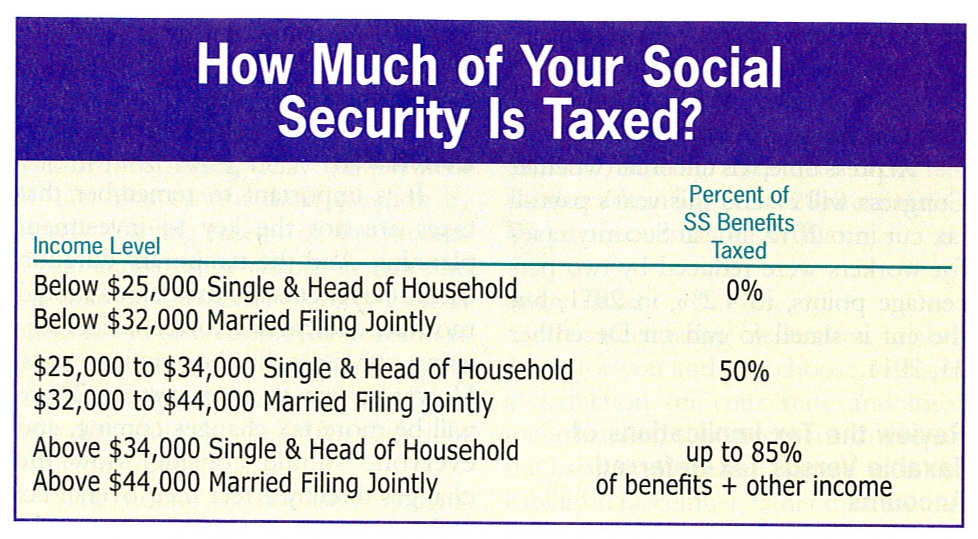

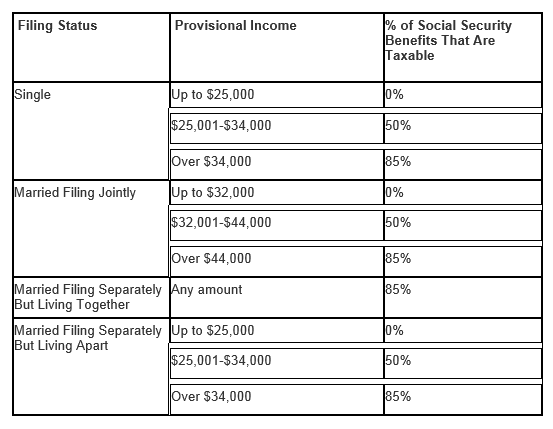

Your taxable Social Security Form 1040 Line 6b can be anywhere from 0 to a maximum of 85 of your total benefits To determine this amount the IRS provides tax filers How is Social Security taxed in 2024 Here are the rules used to calculate how much you might owe on your benefits

Social Security benefit taxes are based on what the Social Security Administration SSA refers to as your combined income That consists of your adjusted gross income plus any nontaxable A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive The tool then automatically calculates the

More picture related to How Do I Calculate Taxable Social Security Benefits

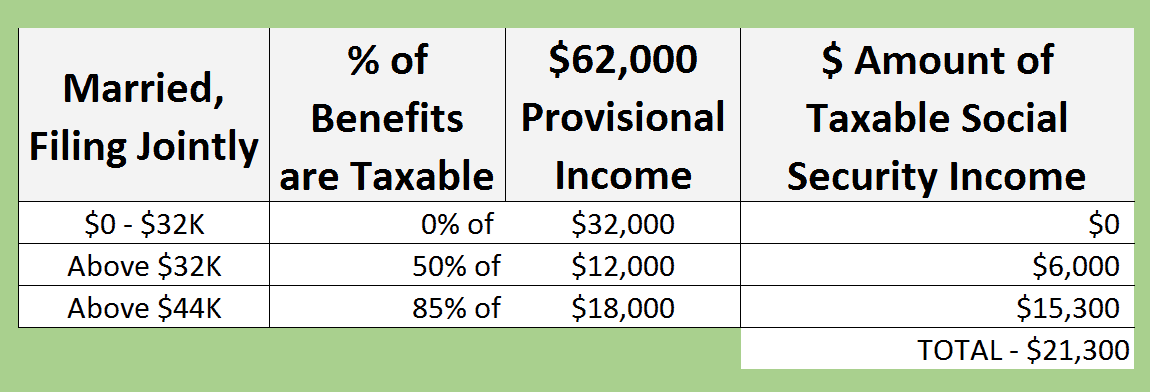

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Schedule1-11-20.png

Social Security Benefit Worksheets 2021

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/percent-of-Social-Security-income-that-is-taxable.png

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Form1040-768x317.png

It is calculated by adding your adjusted gross income AGI non taxable interest and 50 of your Social Security benefits AGI is your income from all sources such as wages How does the IRS calculate how much of your social security benefits are taxable The formula is complicated our tax pro walks retirees through it with examples

If you find that your Social Security benefits are taxable you can voluntarily have Social Security withhold federal income tax by filing IRS Form W 4V You may have 7 10 To calculate how much of your Social Security benefits are taxable use the IRS Social Security Benefits Worksheet This tool helps determine the taxable portion based on

Social Security Taxable Income Worksheet 2021

https://www.irs.gov/pub/xml_bc/26584r03.gif

Irs Social Security Tax Calculator 2020 AidanNovalee

https://www.irstaxapp.com/wp-content/uploads/2020/03/social-security-benefits-calculator.png

https://www.kiplinger.com › retirement › social...

Learn how to calculate the taxable portion of your Social Security benefits Understand income thresholds provisional income and strategies to minimize tax liability

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

To determine if their benefits are taxable taxpayers should take half of the Social Security money they collected during the year and add it to their other income Other income

Tax Calculator For Social Security Benefits Internal Revenue Code

Social Security Taxable Income Worksheet 2021

Taxable Social Security Calculator

Ssa Taxable Income Worksheet

Taxable Social Security Benefits Worksheet

How To Calculate Your Taxable Income 2023

How To Calculate Your Taxable Income 2023

Are My Social Security Benefits Taxable Calculator

Social Security Taxability Worksheet

Do I Get Taxed On Social Security Income Tax Walls

How Do I Calculate Taxable Social Security Benefits - How is Social Security taxed in 2024 Here are the rules used to calculate how much you might owe on your benefits