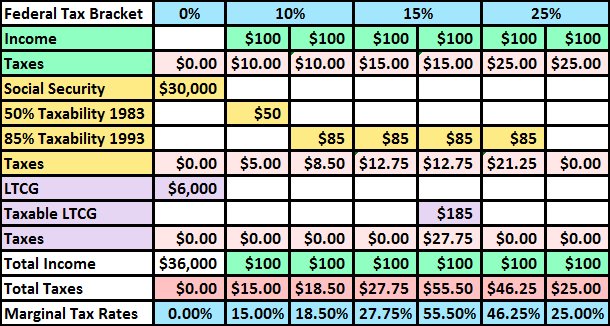

How Do I Calculate The Taxable Amount Of My Social Security Benefits To determine if their benefits are taxable taxpayers should take half of the Social Security money they collected during the year and add it to their other income Other income

Free social security taxable benefits Calculator Use this calculator to estimate how much of your Social Security benefit is subject to income taxes Generally you can figure the taxable amount of the benefits in Are my Social Security or railroad retirement tier I benefits taxable on a worksheet in the Instructions for

How Do I Calculate The Taxable Amount Of My Social Security Benefits

How Do I Calculate The Taxable Amount Of My Social Security Benefits

https://www.covisum.com/hs-fs/hubfs/Imported_Blog_Media/WEB_Covisum_tax-chart-SST.png?width=613&name=WEB_Covisum_tax-chart-SST.png

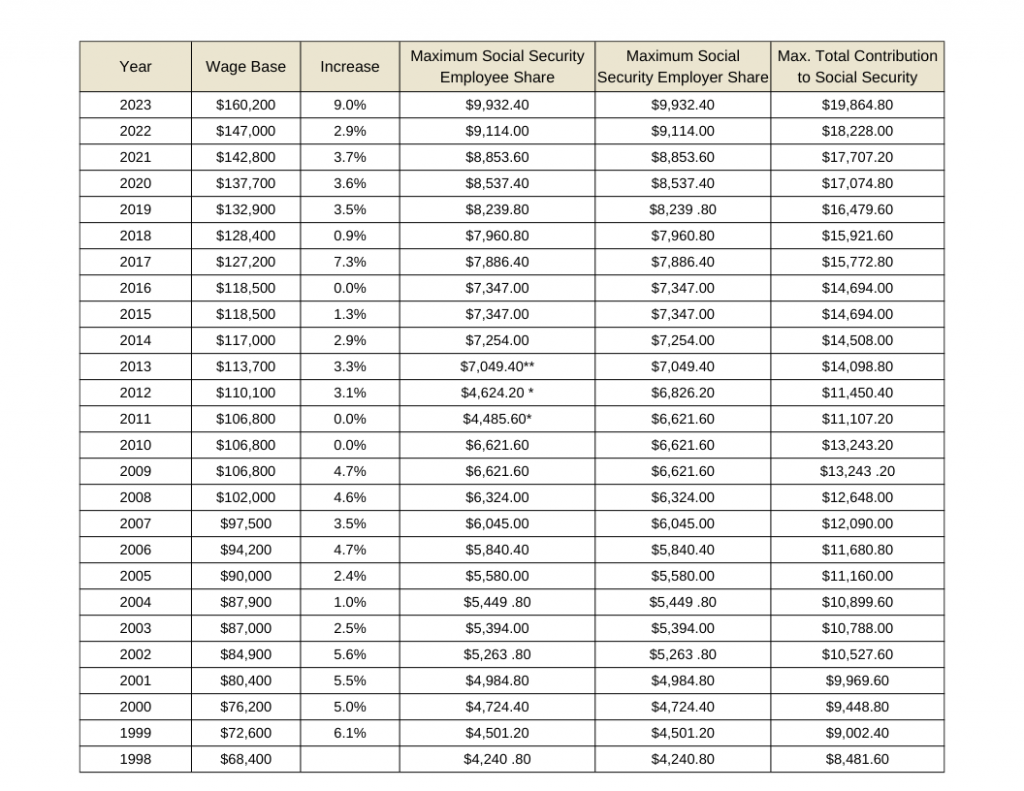

2024 Social Security Cap Miran Minetta

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png

Taxable Income Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

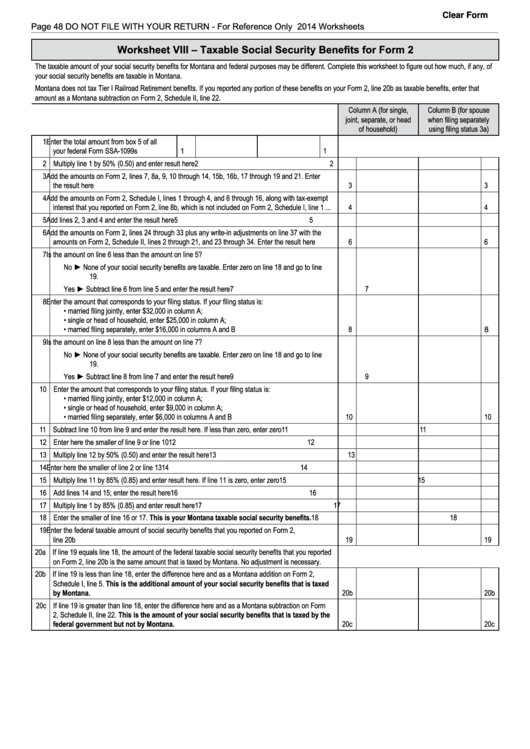

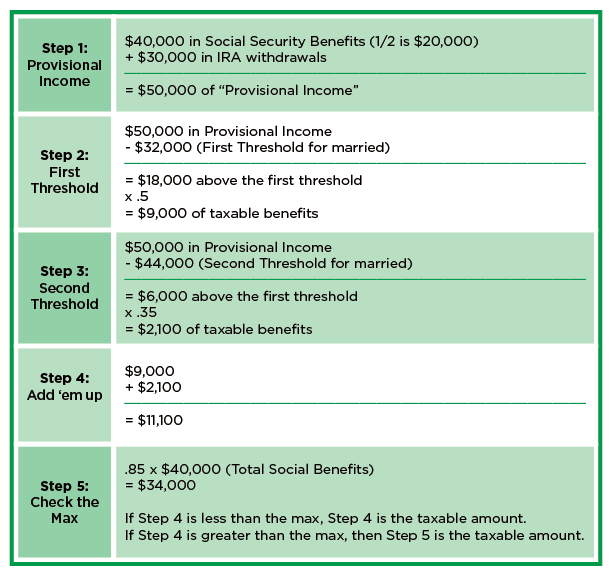

Learn how to calculate the taxable amount of your Social Security benefits based on your combined income and tax bracket Find out how to withhold or pay taxes on your benefits and whether your state taxes them There are two calculations to determine the taxable Social Security Compute them both and use the smaller of the two This one is easy social security benefit times 85 is the maximum

This Taxable Social Security Benefits Calculator helps you determine how much your Social Security benefits will be taxed It looks at your total income including wages To determine this amount the IRS provides tax filers with the 18 step Social Security Benefits Worksheet found in the 1040 instructions for lines 6a and 6b on the current

More picture related to How Do I Calculate The Taxable Amount Of My Social Security Benefits

Is Social Security Taxable Worksheets

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/percent-of-Social-Security-income-that-is-taxable.png

Social Security Tax Impact Calculator Bogleheads

https://www.bogleheads.org/w/images/b/b8/ParallelTaxes.jpg

Social Security Benefits Worksheet 2023 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/6/963/6963800/large.png

Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between 25 000 and 34 000 85 of your Social Security income can be taxed Learn what is taxable how benefit taxes are calculated amp create a strategy to lower your taxable income

It is calculated by adding your adjusted gross income AGI non taxable interest and 50 of your Social Security benefits AGI is your income from all sources such as wages Did you know that up to 85 of your Social Security Benefits may be subject to income tax If this is the case you may want to consider repositioning some of your other income to minimize

How To Calculate If Social Security Benefits Are Taxable

https://i.pinimg.com/originals/81/ed/4b/81ed4b3bd4f8018c79ee99728f33f5b3.jpg

Calculate 2023 Taxable Income

https://data.formsbank.com/pdf_docs_html/333/3331/333120/page_1_thumb_big.png

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

To determine if their benefits are taxable taxpayers should take half of the Social Security money they collected during the year and add it to their other income Other income

https://www.annuityadvantage.com › calculator › social...

Free social security taxable benefits Calculator Use this calculator to estimate how much of your Social Security benefit is subject to income taxes

Taxable Social Security Worksheet 2024

How To Calculate If Social Security Benefits Are Taxable

Social Security Taxable Income Worksheet 2022

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

How Do I Calculate The Taxable Amount Of My Social Security Benefits - Learn how to calculate the taxable amount of your Social Security benefits based on your combined income and tax bracket Find out how to withhold or pay taxes on your benefits and whether your state taxes them