How Does Disabled Veteran Tax Exemption Work Tax benefits for disabled veterans aren t usually applied as a tax credit or tax deduction on your federal income tax return Instead they re typically spread out over different areas and may work in different ways The tax

How Tax Breaks for Disabled Veterans Work The variety of tax breaks for disabled veterans range from federal to state deductions refunds and exemptions What you qualify for depends on where you live and in some Don t include disability benefits you received from the VA in your gross income Examples of disability benefits include Taxable and Nontaxable Income Publication 525

How Does Disabled Veteran Tax Exemption Work

How Does Disabled Veteran Tax Exemption Work

https://blog.veteransloans.com/wp-content/uploads/2022/08/Blog-Cover-Disabled-Veteran-Property-Tax-Exemption.jpg

Veterans Care Interim HealthCare

https://i0.wp.com/interim-health.com/wp-content/uploads/2021/01/Senior-Veteran.jpg?resize=1536%2C1024&ssl=1

Tax Form For Disability Veteran Veterans Affairs

https://www.zrivo.com/wp-content/uploads/2022/08/Tax-Form-for-Disability-Veteran-Veterans-Affairs-TaxUni-Cover-2.jpg

Veterans with a 100 percent permanent and total disability are exempt from property taxes on their primary residence Honorably discharged veterans may qualify to reduce the taxable value of their property by up to Montana Veterans and spouses can get a property tax exemption if the veteran has a 100 disability rating Nebraska Veterans with a 100 disability rating receive property tax reductions based on marital status and

Any veteran 10 or more disabled is entitled to up to 5 000 exemption on property taxes and 100 disabled veterans receive full exemption Georgia 100 disabled status Georgia veterans as well as those who are otherwise To apply you will need to fill out the Property Tax Exemption for Disabled Veterans and Their Survivors form and gather documentation from the VA or Department of Defense that verifies your disability rating pension payments or medical retirement pay

More picture related to How Does Disabled Veteran Tax Exemption Work

How To File Your Disabled Veteran Property Tax Exemption In Texas YouTube

https://i.ytimg.com/vi/DjBqO-vk0rw/maxresdefault.jpg

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Disabled Veteran Property Tax Exemptions In Texas YouTube

https://i.ytimg.com/vi/4d9PnKtDb-A/maxresdefault.jpg

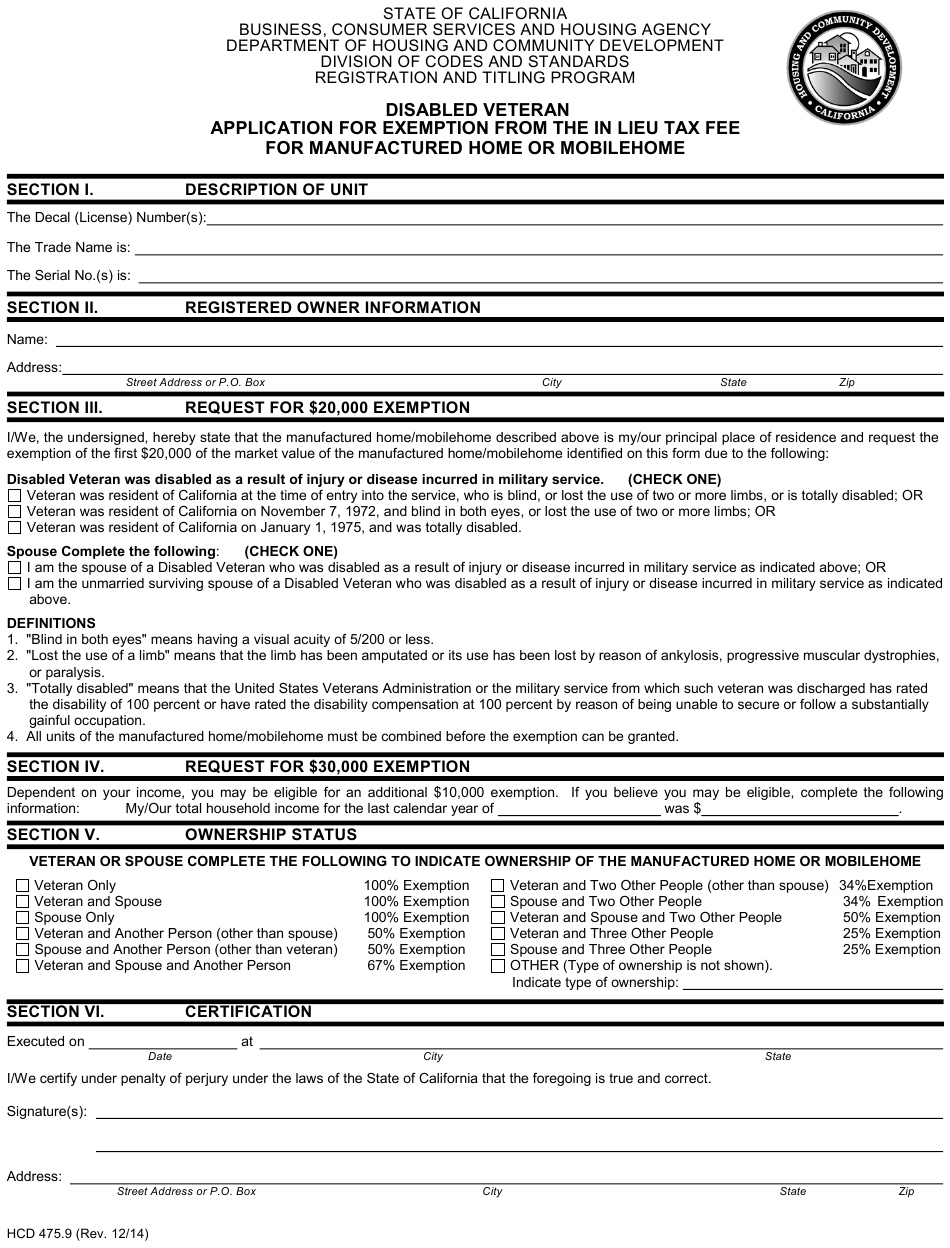

To receive a disabled veteran exemption you must either be a veteran who was disabled while serving with the U S armed forces or the surviving spouse or child under age In simple terms an exemption reduces the taxable value of a veteran s home This means the property tax owed is calculated on a reduced home value leading to lower taxes It s exciting to know that most states across the U S offer property tax exemptions to disabled veterans Here s a snapshot 1 California

Payments from the Department of Veterans Affairs VA including disability compensation pensions for disabilities and grants for wheelchair accessible homes are If you apply and qualify for the current tax year as well as the prior tax year you will be granted the 100 Disabled Veteran Homestead Exemption for both years Effective January 1 2012

EGR Veteran Pushes For Changes To State s Disabled Veterans Exemption

https://ewscripps.brightspotcdn.com/dims4/default/a5e7454/2147483647/strip/true/crop/1082x1406+0+0/resize/1082x1406!/quality/90/?url=http:%2F%2Fewscripps-brightspot.s3.amazonaws.com%2F21%2F60%2Fedaeae2a495e93a2111d21acaa3d%2Fscreen-shot-2023-02-27-at-9.25.40 PM.png

Va Disability Chart 2023 Eligibility

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

https://turbotax.intuit.com › tax-tips › military › top...

Tax benefits for disabled veterans aren t usually applied as a tax credit or tax deduction on your federal income tax return Instead they re typically spread out over different areas and may work in different ways The tax

https://www.militarymoney.com › veterans › tax-breaks...

How Tax Breaks for Disabled Veterans Work The variety of tax breaks for disabled veterans range from federal to state deductions refunds and exemptions What you qualify for depends on where you live and in some

Disabled Veteran Tax Exemption Deadline YouTube

EGR Veteran Pushes For Changes To State s Disabled Veterans Exemption

Disabled Parking Placards And Plates Disabled Veterans

VA Disability And Property Tax Exemptions Common Misconception For A

Disability Car Tax Exemption Form ExemptForm

Disabled Veteran Property Tax Exemption

Disabled Veteran Property Tax Exemption

Tax Exemption Form For Veterans ExemptForm

Disabled Veterans Property Tax Exemption In Washington State Benefits

Disabled Veteran Tax Bill Passed To House Amid Concerns

How Does Disabled Veteran Tax Exemption Work - Veterans with a 100 percent permanent and total disability are exempt from property taxes on their primary residence Honorably discharged veterans may qualify to reduce the taxable value of their property by up to