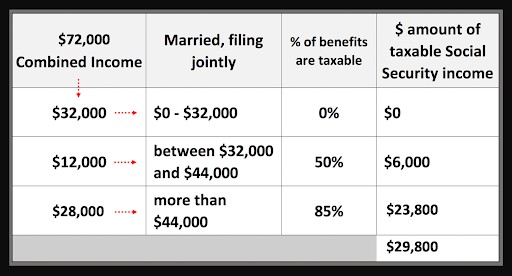

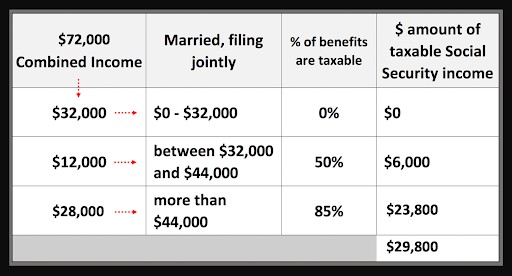

How Is Social Security Tax Calculated When you calculate how much of your Social Security benefit is taxable use the 2 000 month number and multiply that by the number of months to get the annual Social Security benefits In other words add the Medicare Part B premium deducted from your Social Security to your net deposit

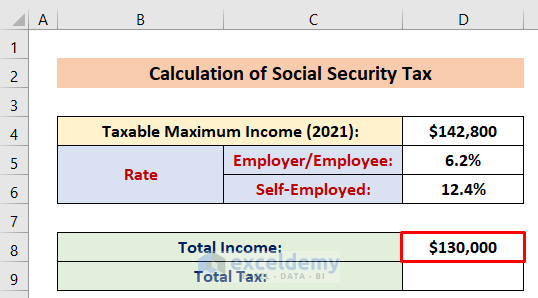

If your Social Security income is taxable depends on your income from other sources Here are the 2024 IRS limits Only income up to the maximum taxable earnings the annually adjusted cap on how much of your earnings are subject to Social Security taxes is counted In 2024 that s work income up to 168 600

How Is Social Security Tax Calculated

How Is Social Security Tax Calculated

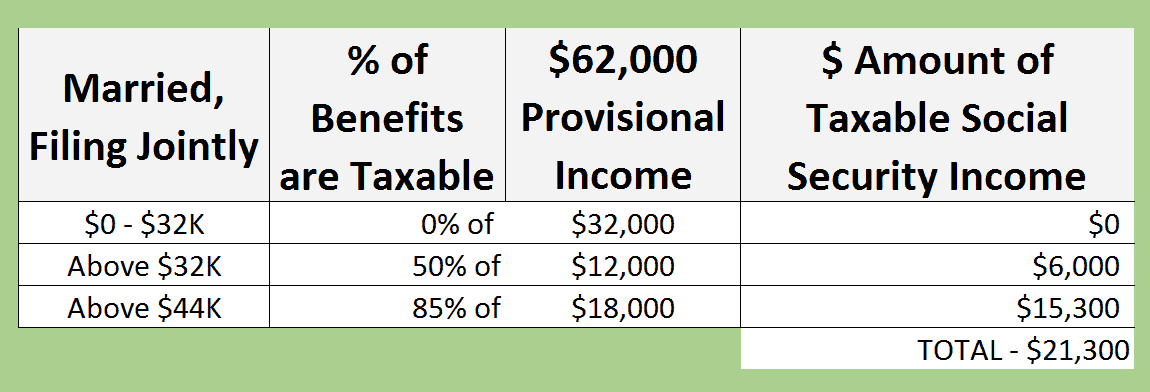

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/percent-of-Social-Security-income-that-is-taxable.png

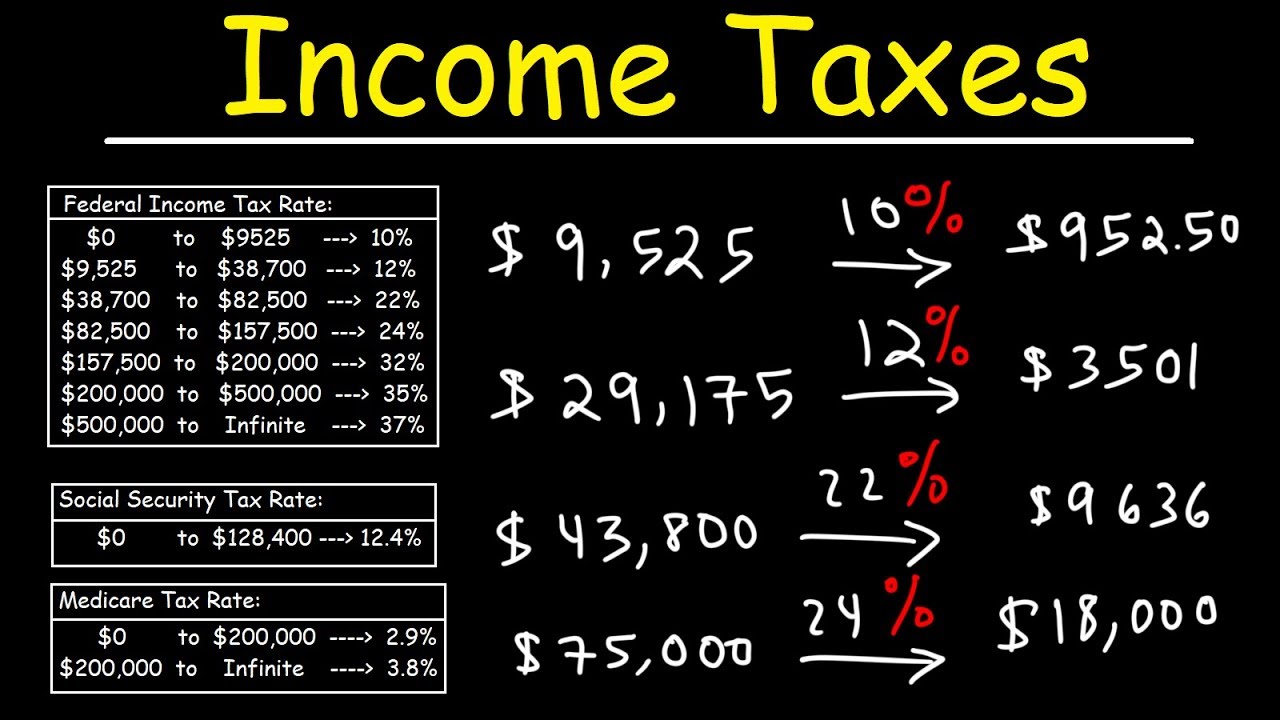

How To Calculate Federal Income Taxes Social Security Medicare

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

https://www.investopedia.com/thmb/0EEaFFfXOTK2iN33P2T3xl7VRZU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg

How is Social Security taxed in 2024 Here are the rules used to calculate how much you might owe on your benefits New Mexico Rhode Island Utah Vermont West Virginia The state tax rates can be highest in Minnesota which can tax as much as 9 85 and Vermont which taxes as much as 8 75 Minnesota uses

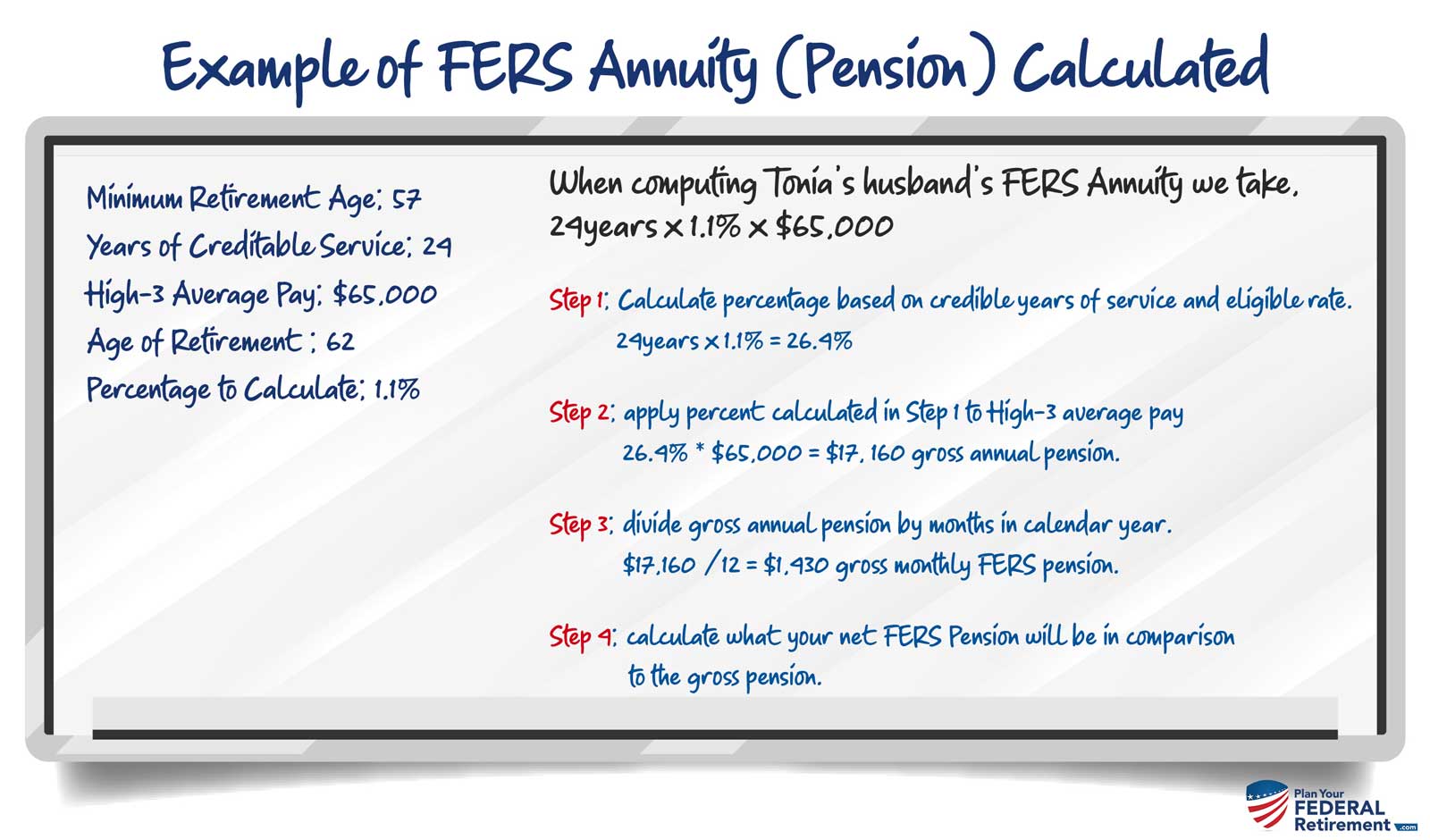

We illustrate the calculation of retirement benefits using two examples labeled case A and case B In each case the worker retires in 2025 Case A born in 1963 retires at age 62 Case B born in 1959 retires at his normal or full retirement age A recent analysis by the nonpartisan Committee for a Responsible Federal Budget CRFB found that Trump s Social Security agenda which also includes ideas like eliminating taxes on tips imposing more tariffs and deporting unauthorized migrants would dramatically worsen the program s finances and move up the insolvency date

More picture related to How Is Social Security Tax Calculated

Social Security Tax Calculation Payroll Tax Withholdings YouTube

https://i.ytimg.com/vi/6WOAQpqxHjo/maxresdefault.jpg

How To Calculate Social Security Tax

https://www.learntocalculate.com/wp-content/uploads/2021/01/social-security-2.png

At What Age Is Social Security No Longer Taxed Social Security Portal

https://i0.wp.com/socialsecurityportal.com/wp-content/uploads/2023/04/At-what-age-is-Social-Security-no-longer-taxed-in-US.png?resize=1024%2C512&ssl=1

You can calculate yours by adding up Your adjusted gross income AGI Your nontaxable interest Half of your annual Social Security benefits Your AGI is your annual income minus certain How Social Security tax is calculated Each January after you begin receiving Social Security benefits you will receive a statement Form SSA 1099 showing the total benefits you received in

[desc-10] [desc-11]

How Social Security Is Calculated 2023 Guide Social Security Genius

https://i0.wp.com/socialsecuritygenius.com/wp-content/uploads/2022/07/How-Social-Security-is-Calculated.png?resize=1024%2C512&ssl=1

How To Calculate Social Security Tax In Excel ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/07/How-to-Calculate-Social-Security-Tax-in-Excel-2.png

https://thefinancebuff.com/social-security-taxable-calculator.html

When you calculate how much of your Social Security benefit is taxable use the 2 000 month number and multiply that by the number of months to get the annual Social Security benefits In other words add the Medicare Part B premium deducted from your Social Security to your net deposit

https://smartasset.com/retirement/is-social-security-income-taxable

If your Social Security income is taxable depends on your income from other sources Here are the 2024 IRS limits

How Are Spousal Social Security Benefits Calculated

How Social Security Is Calculated 2023 Guide Social Security Genius

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

What Is Social Security Tax How Is It Calculated Money Instructor

How To Calculate Social Security And Medicare Taxes

How Much Social Security Is Taxable Social Security Intelligence

How Much Social Security Is Taxable Social Security Intelligence

Social Security Tax Worksheet Calculator

Calculate Taxable Portion Of Social Security TaxableSocialSecurity

How Is Social Security Calculated Money Stuff Podcast Podtail

How Is Social Security Tax Calculated - How is Social Security taxed in 2024 Here are the rules used to calculate how much you might owe on your benefits