How Much Do You Pay Federal Taxes On Pensions In Florida The federal tax rate on pensions is the ordinary income tax rate although not all pension distributions are taxable If you contributed post tax dollars to the pension you will not be taxed on those amounts The same is true for other

52 rowsOver 65 retirement income exclusion up to 6 000 single Visit You could have taxes withheld from your IRA distribution set up quarterly tax payments of 824 50 per quarter or ask your pension to withhold

How Much Do You Pay Federal Taxes On Pensions In Florida

How Much Do You Pay Federal Taxes On Pensions In Florida

https://www.bizprofitpro.com/wp-content/uploads/2019/03/tax2-1200x800.jpeg

Tax Brackets 2025

https://smartzonefinance.com/wp-content/uploads/2018/06/taxes-a03-g01.png

Tax Rates 2025 Roger S Sims

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min.jpg

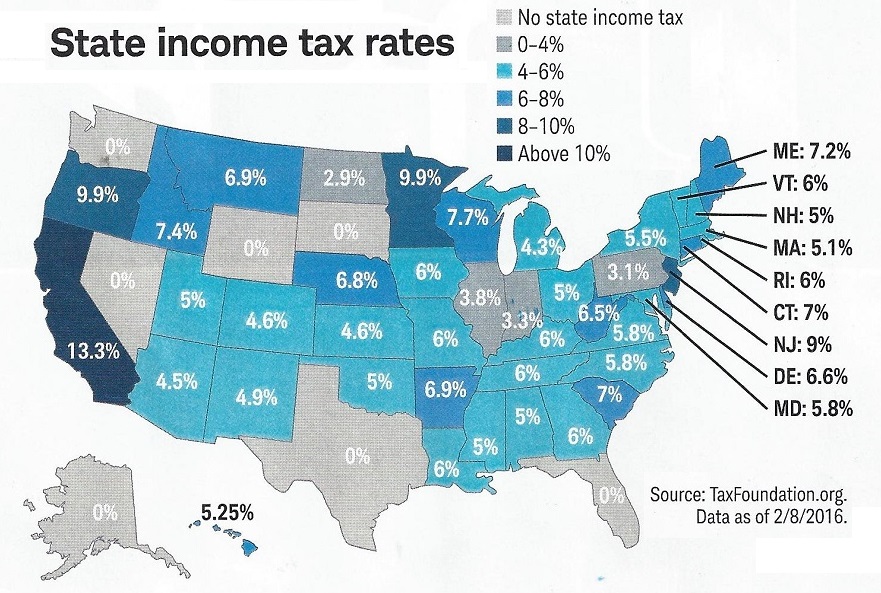

Here again there are many states 14 to be precise that do not tax pension income at all Alaska Florida Nevada South Dakota Tennessee Texas Washington Wyoming New Hampshire When you start a pension you can choose to have federal and state taxes withheld from your monthly checks The goal is to withhold enough taxes that you won t owe much money when you file your tax return You don t

Florida retirees still have to pay federal income taxes However if social security is your only source of income it will most likely be low enough for income tax exempt Expect to pay taxes for up to 50 of your SS if you make No Tax on Social Security Benefits Retirees can enjoy their full federal retirement benefits without state deductions No Tax on Retirement Income Income from pensions IRAs and 401 k s is completely tax free at the state level No

More picture related to How Much Do You Pay Federal Taxes On Pensions In Florida

Tax Brackets 2025 Jameel Willow

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

Tax Refund Schedule 2025 Carlee Brittani

http://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

2025 Tax Calculator Tax Tables Mia Ann

https://federal-withholding-tables.net/wp-content/uploads/2021/07/federal-income-tax-payroll-5.jpg

Form W4 P specifying the federal income tax withholding for your benefit NOTE If you choose not to have federal income tax withheld from your monthly retirement payment the IRS may Our Florida retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401 k and IRA income

Some retirees might pay an income tax rate as high as 14 4 if they are still working and their taxable income reaches 1 000 000 but most retirees will pay a lower rate Yes but you may pay federal taxes on a portion of your Social Security benefits depending on your income 1 Does Florida tax Social Security benefits No Florida does not

Tax Bracket Changes From 2025 To 2025 Tacoma Aurora Jade

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2020-income-tax-brackets-pasivinco.png

Age Pension Calendar 2025 Sylvia R Dahlstrom

https://cdn.gobankingrates.com/wp-content/uploads/2019/02/retirement-plan-and-pension-folders-on-desk-shutterstock_171944858.jpg

https://www.sapling.com › federal-tax-rate...

The federal tax rate on pensions is the ordinary income tax rate although not all pension distributions are taxable If you contributed post tax dollars to the pension you will not be taxed on those amounts The same is true for other

https://rpea.org › ... › pension-tax-by-state

52 rowsOver 65 retirement income exclusion up to 6 000 single Visit

Tax File Free 2025 Mika Sky

Tax Bracket Changes From 2025 To 2025 Tacoma Aurora Jade

2025 Income Tax Calculator Faris Nolan

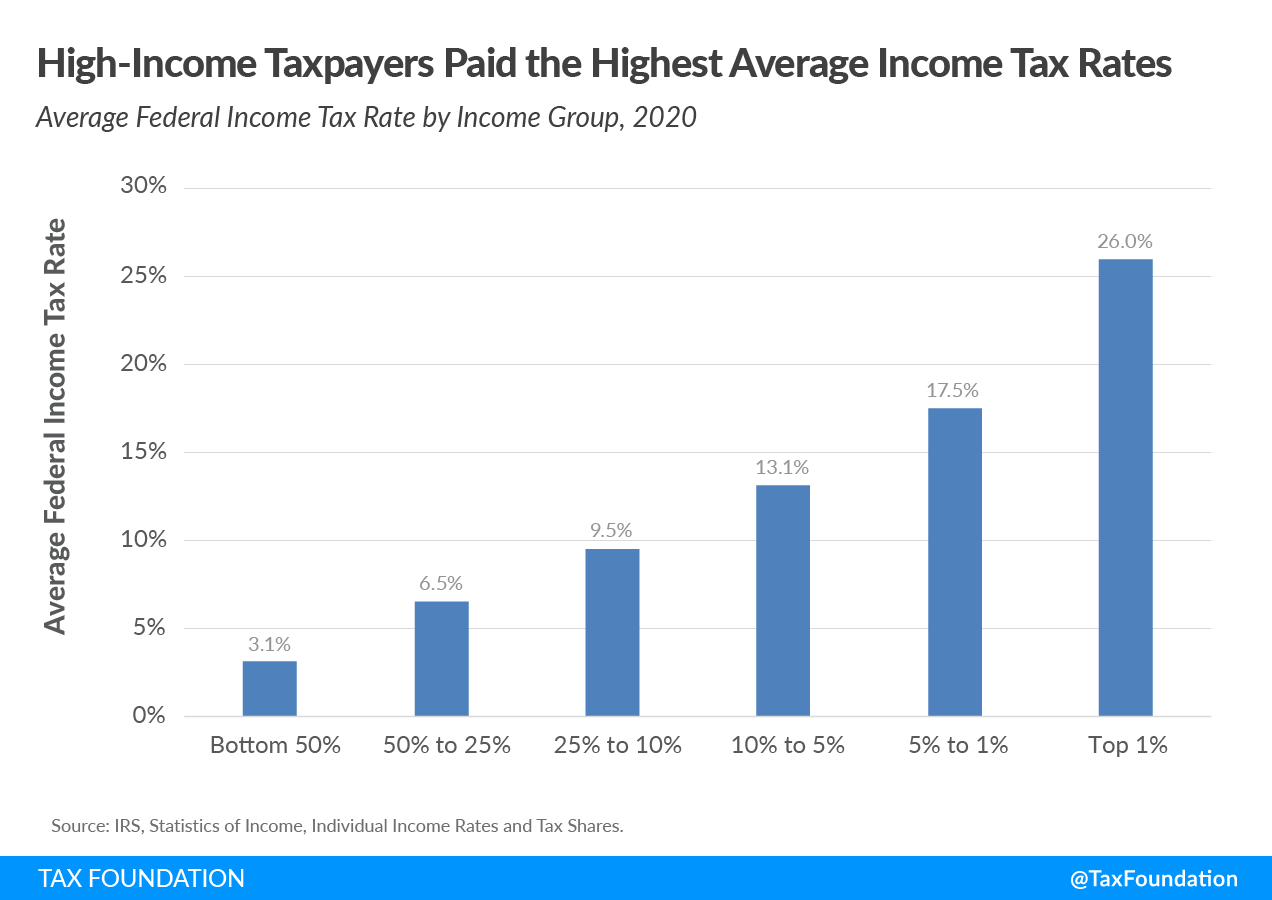

Average Tax Rate TaxEDU Glossary

Arizona Income Tax Rates 2025 Lori J Hinerman

Federal Income Tax Rate Florida 2024 Ediva Cthrine

Federal Income Tax Rate Florida 2024 Ediva Cthrine

Indiana Casino Tax Revenue

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Michigan Colleges With Unsere Download Delivers Per Month

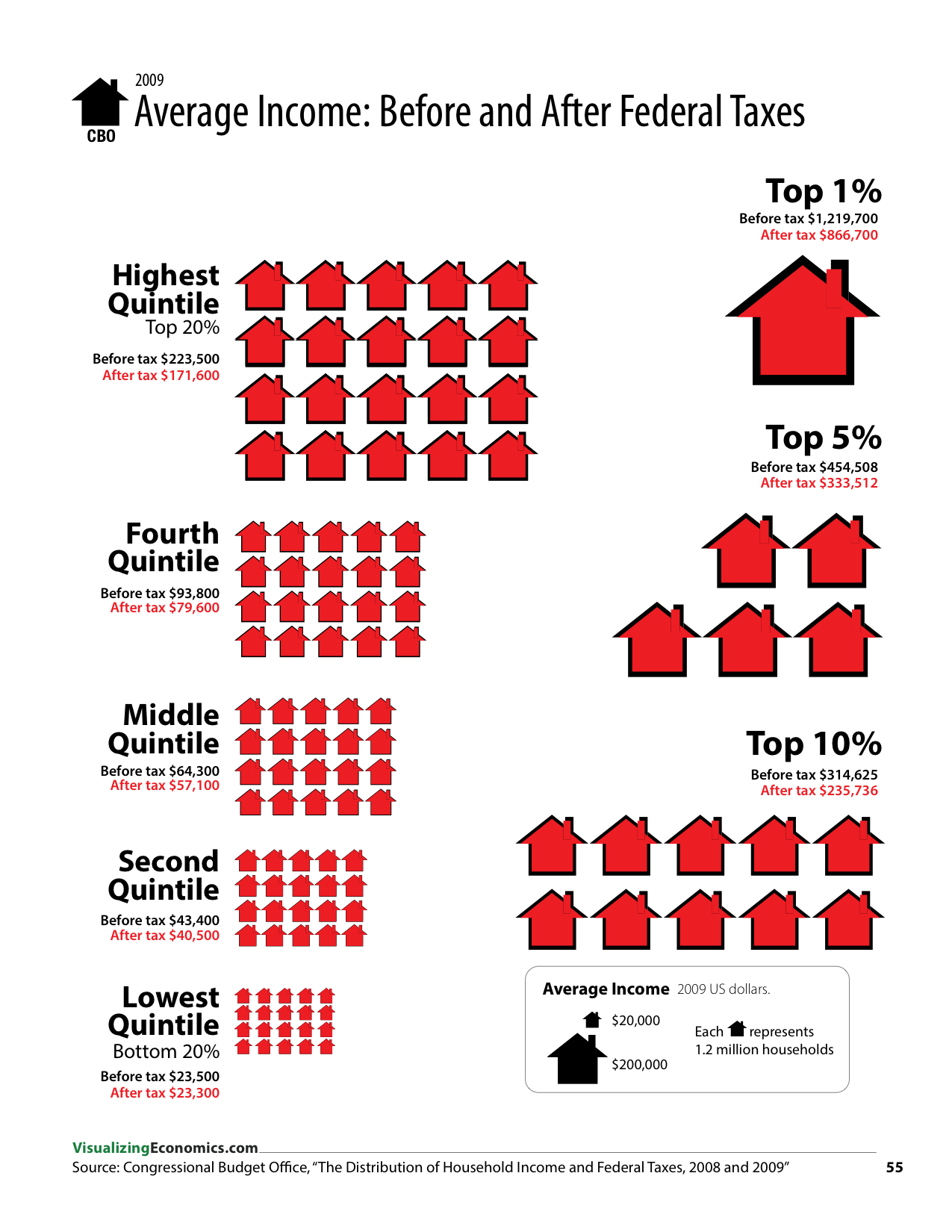

How Much Do Federal Taxes Redistribute Income Visualizing Economics

How Much Do You Pay Federal Taxes On Pensions In Florida - Here again there are many states 14 to be precise that do not tax pension income at all Alaska Florida Nevada South Dakota Tennessee Texas Washington Wyoming New Hampshire