How Much Is Military Retirement Taxed In California California Taxes on Military Retired Pay Military retired pay received by California residents is taxed in California Thrift Savings Plan TSP does not withhold taxes for state

Military retirees and surviving relatives pay state and federal income taxes in California but receive exemptions on military death benefits paid to qualified survivors pay for First and foremost it is worth repeating California does not tax military retirement pay This exemption provides significant financial relief to veterans who have dedicated years of their

How Much Is Military Retirement Taxed In California

How Much Is Military Retirement Taxed In California

https://greatsenioryears.com/wp-content/uploads/2023/04/Value-of-military-pension-examples-1-1024x714.png

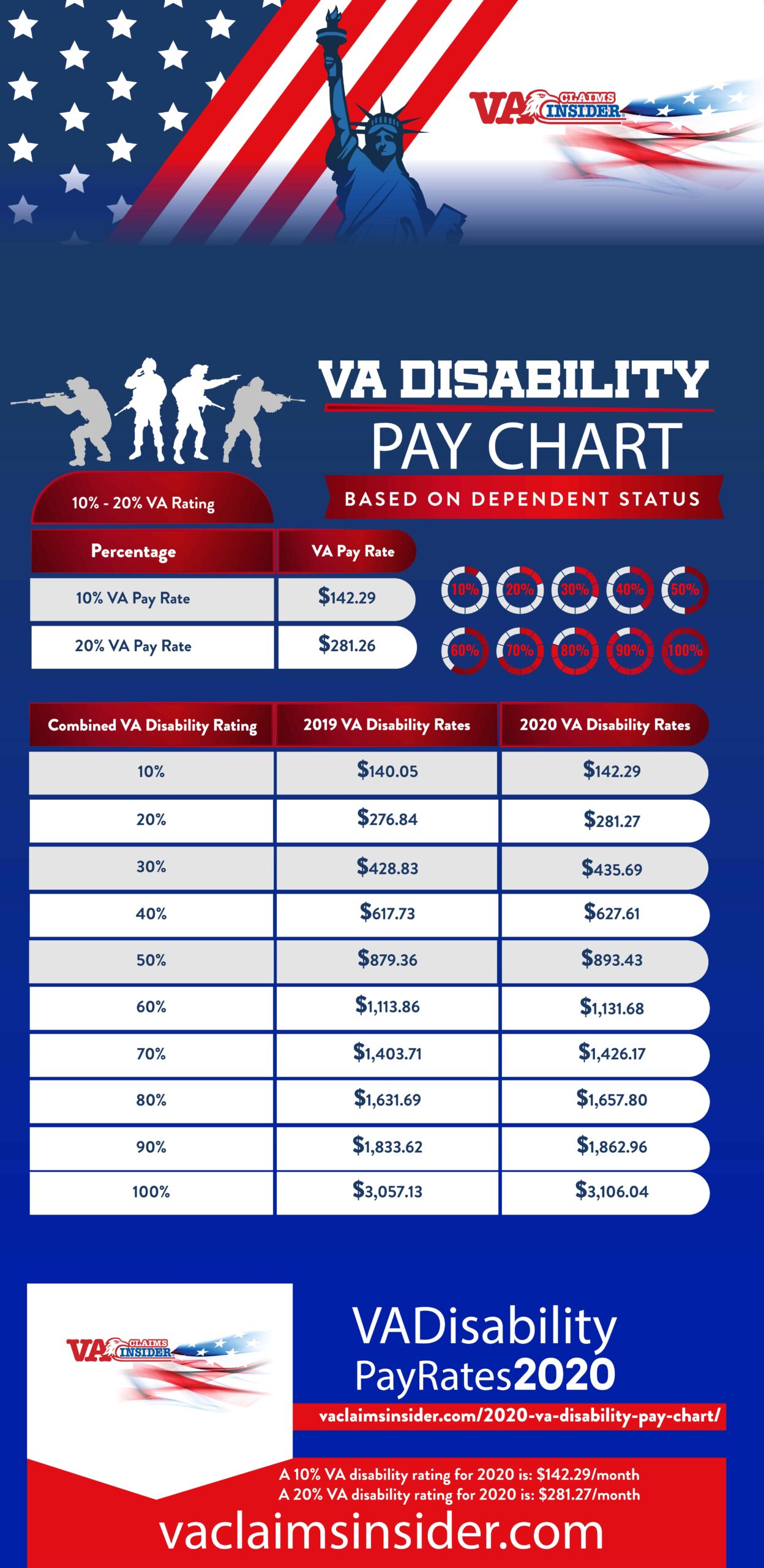

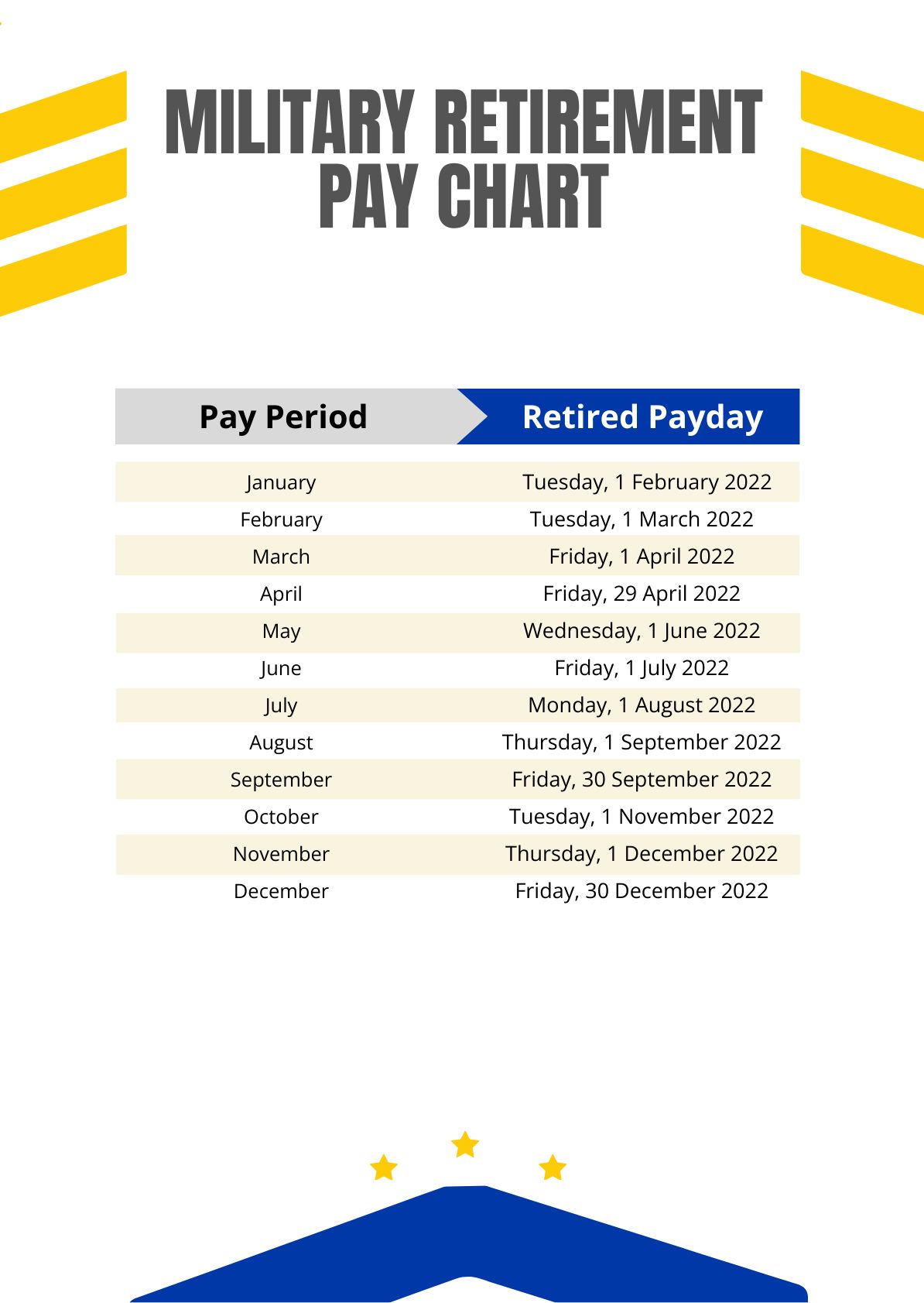

Va Benefits Pay Chart 2025

https://vaclaimsinsider.com/wp-content/uploads/2019/10/2020-VA-Disability-Pay-Chart.jpg

Wait Is Military Retirement Pay Taxable Or Not Article The United

https://api.army.mil/e2/c/images/2019/04/30/551375/original.jpg

The straightforward answer is Military retirement income is not taxed in California California provides a full exemption for military retirement pay This includes retired pay California Military income Military pay is taxable if stationed in California Retired pay Follows federal tax rules Survivor Benefit Plan Follows federal tax rules Social Security

For retirees in general up to 5 060 is exempt if gross income is less than 42 140 for the 2023 tax year Starting in the 2024 tax tear taxpayers ages 65 and over will receive a 5 500 Any income earned or received before leaving California is considered California source income and is taxable on the CA return To subtract the military pay from your taxable income follow

More picture related to How Much Is Military Retirement Taxed In California

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2022/01/military-benefits-map-2500x1875.jpg

Is Military Retirement Taxable YouTube

https://i.ytimg.com/vi/3bWyZohn95Q/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBSKE0wDw==&rs=AOn4CLBgCi57NUAVTzehAskjrgYlkhlhDQ

States That Don t Tax Military Retirement 2023 Wisevoter

https://wisevoter.com/wp-content/uploads/2022/10/States-That-Dont-Tax-Military-Retirement.png

Currently If you re a California resident your military retirement pay is taxable including all military pension income according to the California Franchise Tax Board FTB According to the California Website Military Retirement is taxable and is included in gross income on the return This applies to a military pension received while the retiree is a California

Military retirees in California receive approximately 29 000 each annually a total of about 4 billion a year as of 2022 according to the Department of Finance Surviving A bill pending in the state Legislature would exempt retirees and surviving spouses from paying California income taxes on military pensions for the next decade

States That Don t Tax Military Retirement Pay Discover Here

https://www.thesoldiersproject.org/wp-content/uploads/2023/04/military-retirement-tax-exemption.png

These States Don t Tax Military Retirement

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a1c3633df/2022/10/feeling-proud-because-he-served-to-us-forces-picture-id1131838882.jpg

https://myarmybenefits.us.army.mil › ... › California

California Taxes on Military Retired Pay Military retired pay received by California residents is taxed in California Thrift Savings Plan TSP does not withhold taxes for state

https://www.desertsun.com › story › news › nation › ...

Military retirees and surviving relatives pay state and federal income taxes in California but receive exemptions on military death benefits paid to qualified survivors pay for

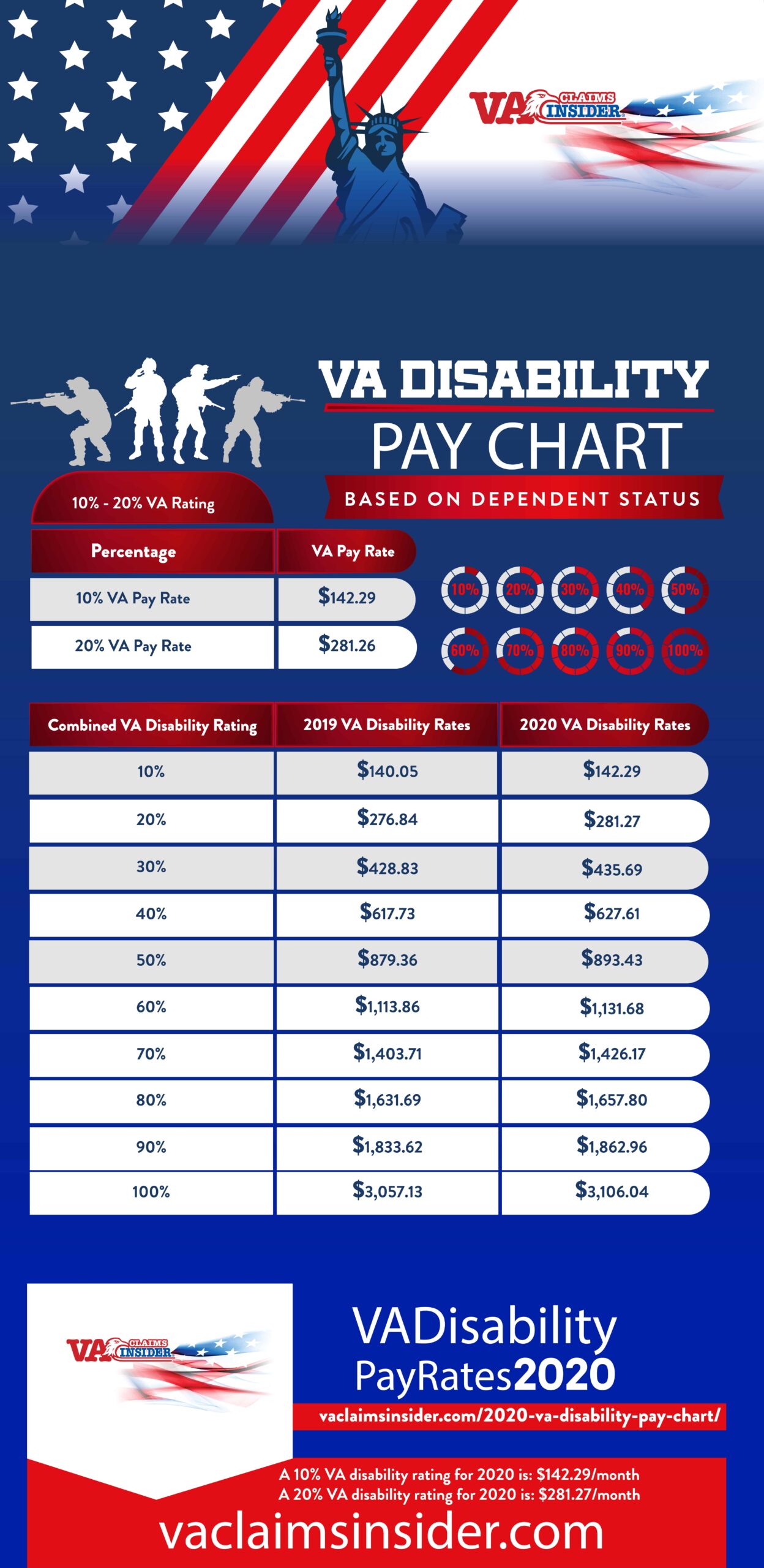

Military Retirement Chart

States That Don t Tax Military Retirement Pay Discover Here

Military Divorce The Process Challenges And Resources Tamara Like

The Most Common Sources Of Retirement Income SmartZone Finance

How Much Is Military Retirement Pay Military

Uncover Why Is Military Retirement Taxed So High Elder Proofing

Uncover Why Is Military Retirement Taxed So High Elder Proofing

How Much Is The Down Payment For A 300 000 House Moreira Team Mortgage

How Is Income In Retirement Taxed Plan To Rise Above

Navy Officer Pay Chart 2024 Aaren Annalee

How Much Is Military Retirement Taxed In California - There are a few exceptions to retirement income taxation in California Military retirement pay is exempt from state income taxes and some disability pensions may also be