How Much Of Your Social Security Benefits Are Taxed To determine if their benefits are taxable taxpayers should take half of the Social

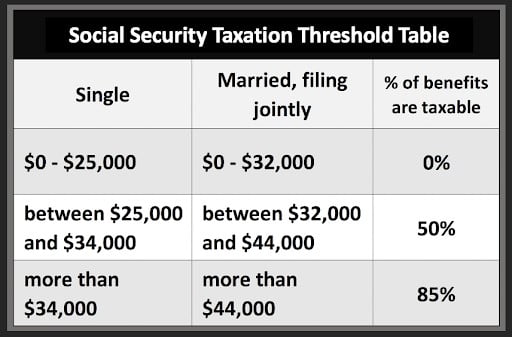

If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and disability

How Much Of Your Social Security Benefits Are Taxed

How Much Of Your Social Security Benefits Are Taxed

https://i.ytimg.com/vi/0FFLvqQiDOI/maxresdefault.jpg

How Much Social Security Benefits On 60 000 Income YouTube

https://i.ytimg.com/vi/zPToUEW2wGY/maxresdefault.jpg

How Is Social Security Taxed How Much Of Your Social Security Income

https://i.ytimg.com/vi/_b3sVqfoOFQ/maxresdefault.jpg

As much as 85 of your Social Security income can be taxed Learn what is taxable how The taxable portion of the benefits that s included in your income and used to

The IRS has an online tool you can use to calculate how much of your benefit Up to 85 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is more than 34 000 You file a joint return and you

More picture related to How Much Of Your Social Security Benefits Are Taxed

Social Security Administration Update 2024 Kayla Melania

https://floridadocument.com/wp-content/uploads/2022/09/EXAMPLE_SOCIAL_SECURITY_BENEFIT_LETTER_1-791x1024.png

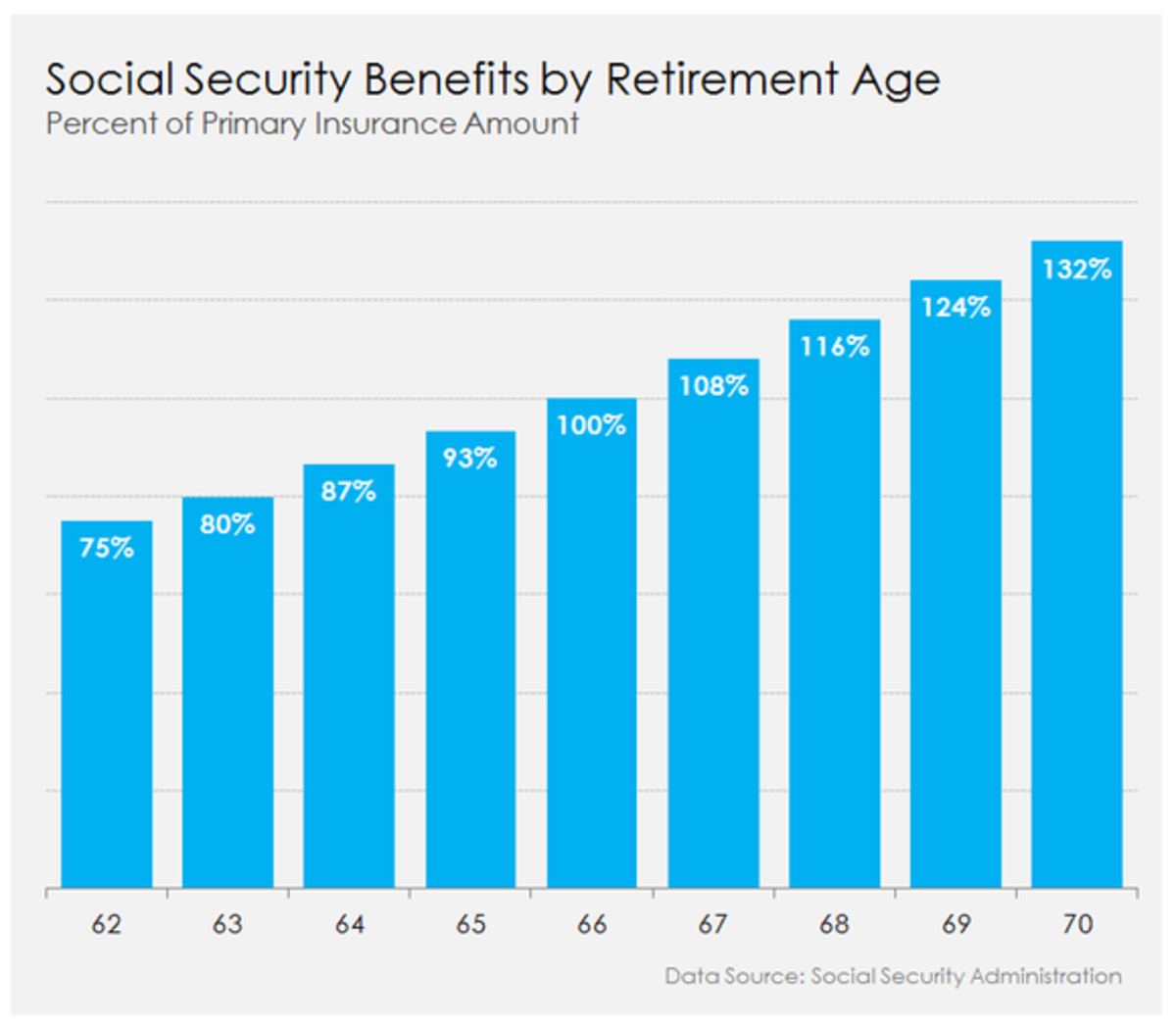

Social Security Retirement Income Limit 2025 Julie M Hibbs

https://smartzonefinance.com/wp-content/uploads/2018/06/retirement-a03-g01.png

Social Security Cap For 2025 Claire Berenice

https://www.thestreet.com/.image/t_share/MTczNjE2NDYwMjQzOTM2NjY4/allen-062920.png

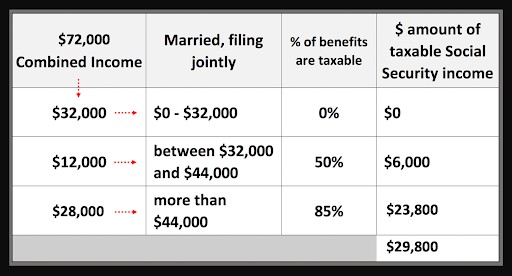

For single filers with countable incomes between 25 000 and 34 000 and joint filers with incomes between 32 000 and 44 000 up to half of your benefits can be included in taxable income How your Social Security benefits are taxed depends on your combined income

Up to 50 or even 85 of your Social Security benefits are taxable if your provisional or total income as defined by tax law is above a certain base amount Your Social Security income may not be taxable at all if your total Those minimum thresholds haven t changed since taxation of benefits was

Social Security Tax Calculator 2025 Zaidah Noor

https://www.irstaxapp.com/wp-content/uploads/2020/03/social-security-benefits-calculator.png

How Much Social Security Is Taxable Social Security Intelligence

https://www.socialsecurityintelligence.com/wp-content/uploads/2022/03/unnamed-1.jpg

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

To determine if their benefits are taxable taxpayers should take half of the Social

https://smartasset.com › retirement › is-social...

If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits

How Much Social Security Is Taxable Social Security Intelligence

Social Security Tax Calculator 2025 Zaidah Noor

Do I Get Taxed On Social Security Income Tax Walls

2025 Maximum Social Security Tax Aaron Malik

Social Security Tax Limit 2025 Withholding Table Irena Lyndsie

How Do I Back Out Tax From A Total Amount On Sale Aria database

How Do I Back Out Tax From A Total Amount On Sale Aria database

Ssi Increase 2025 Calculator Luna Mariyah

Social Security Taxable Worksheet 2022

Is Social Security Taxable In 2025 In Texas Paule Magdaia

How Much Of Your Social Security Benefits Are Taxed - How Much of Your Social Security Income Is Taxable Determining how much of