How Much Social Security Will I Get If I M Self Employed If you are self employed you will need to report your net earnings to Social Security and the Internal Revenue Service IRS Net earnings for Social Security are your gross earnings from

You can earn up to four Social Security credits a year and in 2023 every 1 640 in earnings gets you one credit If you are married and self employed your spouse s Social Security benefit will factor into your benefit Find out how much you ll pay in Social Security taxes if you re self employed how to do so and how to claim your benefits

How Much Social Security Will I Get If I M Self Employed

How Much Social Security Will I Get If I M Self Employed

https://i.ytimg.com/vi/td7KqG5iCNw/maxresdefault.jpg

How Much Your Social Security Benefits Will Be If You Make 30 000

https://i.ytimg.com/vi/nwSXV3Rlcrw/maxresdefault.jpg

Social Security Benefits At Age 63 How Much Will You Receive

https://www.clausonlaw.com/blog/wp-content/uploads/2022/08/data-1.png

Before self employed people can earn Social Security credits for any year they usually must have net earnings of at least 400 However people with self employment net To qualify for Social Security benefits you need to accumulate 40 credits which equates to about 10 years of work Each year you can earn up to four credits based on your earnings This is an important milestone for self

If You Make 100 000 Per Year How Much Social Security Will You Get If You Put 1 000 in Your 401 k Every Month for 15 Years You Could Have This Much Cash by Retirement I would also get a rough idea on how much you are due in Social Security benefits You can pull estimates on early retirement 62 to full retirement age full retirement 66 for most Americans

More picture related to How Much Social Security Will I Get If I M Self Employed

Social Security Payment How Much Social Security Will I Get If I Make

https://phantom-marca.unidadeditorial.es/dccf9a73cc64a98403a01a024f02ff51/resize/1320/f/jpg/assets/multimedia/imagenes/2023/06/07/16861253731164.jpg

How Social Security Is Calculated 2023 Guide Social Security Genius

https://socialsecuritygenius.com/wp-content/uploads/2022/07/How-much-Social-Security-will-I-get-for-10-worked-years.png

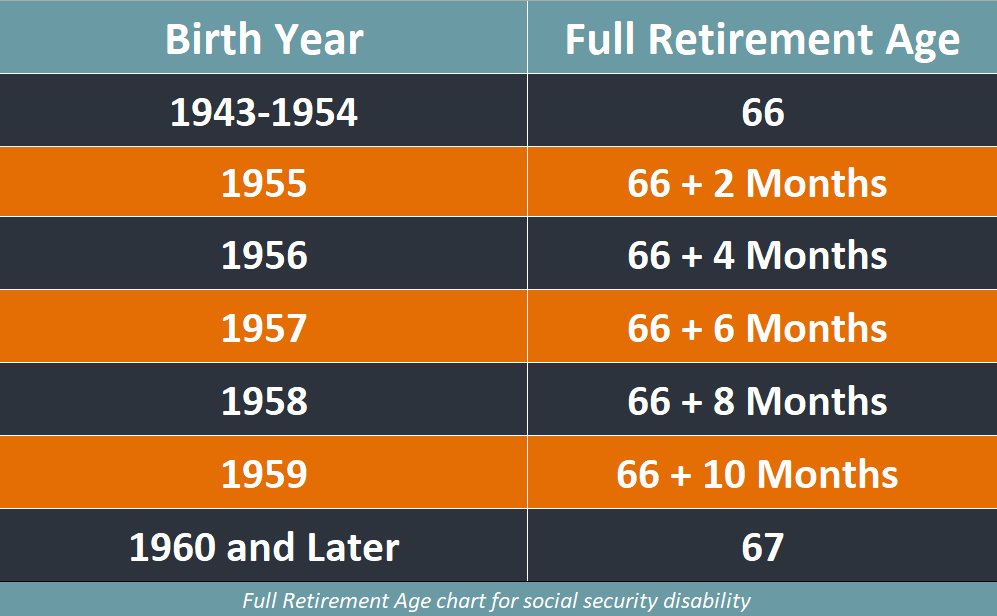

How Much Social Security Will I Get If I Was Born In 1960 Insightful Guide

https://elderproofing.net/wp-content/uploads/2023/12/how-much-social-security-will-i-get-if-i-was-born-in-1960-1.jpg

Covered earnings are work related earnings which are subject to Social Security taxation Covered earnings include most types of wage income and self employment income Today As the law is currently written you can receive an unlimited amount of income from the sources above and receive your full Social Security benefit The income that does count in the earnings limit is employment income That means gross

Self employed individuals must pay a self employment tax of 15 3 on their net earnings up to a certain threshold This tax comprises two components 12 4 for Social How much Social Security do I pay as self employed The self employment tax rate is 15 3 The rate consists of two parts 12 4 for social security old age survivors and disability

How Much Will I Get From Social Security YouTube

https://i.ytimg.com/vi/bHRRFzBfKCA/maxresdefault.jpg

How Much Social Security Will I Get If I Only Worked 10 Years Expert

https://40plusfinance.com/wp-content/uploads/How-Much-Social-Security-Will-I-Get-if-I-Only-Worked-10-Years-1024x576.jpg

https://www.ssa.gov › benefits › retirement › planner › netearns.html

If you are self employed you will need to report your net earnings to Social Security and the Internal Revenue Service IRS Net earnings for Social Security are your gross earnings from

https://glassnercarltonfinancial.com › ...

You can earn up to four Social Security credits a year and in 2023 every 1 640 in earnings gets you one credit If you are married and self employed your spouse s Social Security benefit will factor into your benefit

How Much Social Security Will I Get If I Was Born In 1960 Insightful Guide

How Much Will I Get From Social Security YouTube

How Much Social Security Will I Get If I Make 25000 A Year Whatsmind

How Much Social Security Will I Get If I Average 100 000 A Year

How Much Social Security Will I Get Here s What You Need To Know

Maximum Social Security Payment 2024 Mag Imojean

Maximum Social Security Payment 2024 Mag Imojean

Social Security Benefits Chart MoneyMatters101

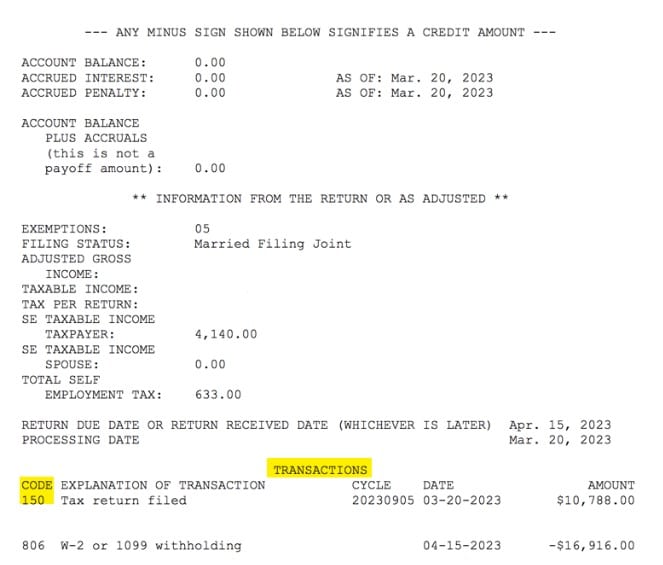

What Is IRS Code 150 On My Tax Transcript

What You Need To Know About The New Social Security Benefit Increase

How Much Social Security Will I Get If I M Self Employed - If You Make 100 000 Per Year How Much Social Security Will You Get If You Put 1 000 in Your 401 k Every Month for 15 Years You Could Have This Much Cash by Retirement