How Much Taxes Should I Have Withheld From My Social Security Check According to the IRS you should add one half of the social security money during the year to your other income If you re single and the total comes to more than 25 000 part of your

You can have 7 10 12 or 22 percent of your monthly benefit withheld for taxes Only these percentages can be withheld Flat dollar amounts are not accepted Sign the form and return it A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive The tool then automatically calculates the

How Much Taxes Should I Have Withheld From My Social Security Check

How Much Taxes Should I Have Withheld From My Social Security Check

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

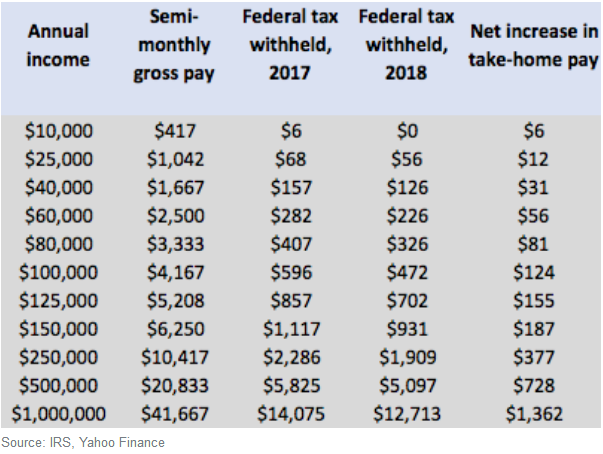

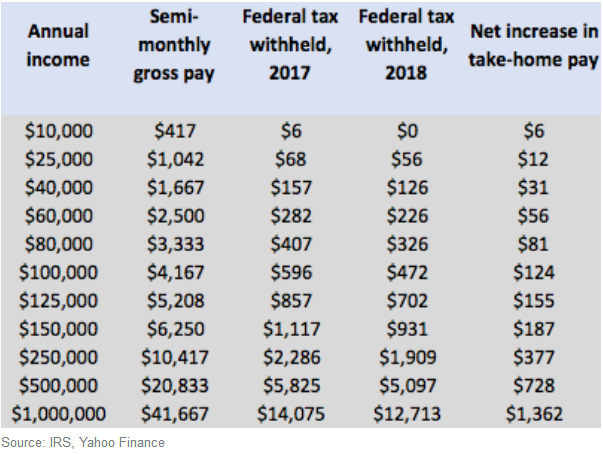

New IRS Tax Withholding Tables Mean Your Paycheck Might Be Getting A

https://clark.com/wp-content/uploads/2018/01/irs-withholding.png

What Is Tax Withholding All Your Questions Answered By Napkin Finance

https://napkinfinance.com/wp-content/uploads/2016/11/NapkinFinance-TaxWithholding-Napkin-10-05-20-v04.jpg

As mentioned one way to avoid tax surprises is to have federal income taxes withheld from your Social Security payments To do this complete IRS Form W 4V Voluntary Withholding Request and How much tax should I have withheld from my Social Security check When you complete the form you will need to select the percentage of your monthly benefit amount you

How much tax should I withhold from my Social Security check When you complete the form you will need to select the percentage of your monthly benefit amount you If you expect to owe taxes on your benefits you can effectively prepay part of the bill by having taxes withheld from your monthly Social Security payments

More picture related to How Much Taxes Should I Have Withheld From My Social Security Check

[img_title-4]

[img-4]

[img_title-5]

[img-5]

[img_title-6]

[img-6]

To determine the standard amount of tax to be withheld from your Social Security check input your filing status estimated annual income and any additional deductions The calculator will Your Social Security benefits are taxable only if your overall income exceeds 25 000 for an individual or 32 000 for a married couple filing jointly If the income you report

You can elect to have federal income tax withheld from your Social Security benefits if you think you ll end up owing taxes on some portion of them Federal income tax can be withheld at a rate of 7 10 12 or 22 as of Those who owe taxes on their Social Security payments may either make estimated quarterly payments to the IRS or request that the IRS withhold these taxes from

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://marketrealist.com › should-i-have-t…

According to the IRS you should add one half of the social security money during the year to your other income If you re single and the total comes to more than 25 000 part of your

https://www-origin.ssa.gov › benefits › retirement › ...

You can have 7 10 12 or 22 percent of your monthly benefit withheld for taxes Only these percentages can be withheld Flat dollar amounts are not accepted Sign the form and return it

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

How Much Taxes Should I Have Withheld From My Social Security Check - As much as 85 of your Social Security income can be taxed Learn what is taxable how taxes are calculated and how to minimize taxes owed