How To Calculate Federal Tax On Retirement Income A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive The tool then automatically calculates the

For new retirees you will generally use the simplified method to compute the taxable portion of your pension The worksheet to determine the taxable and non taxable portion of your pension Here s a breakdown of some common retirement income sources and a brief description of their federal tax implications More below on state taxes on retirement income Social Security

How To Calculate Federal Tax On Retirement Income

How To Calculate Federal Tax On Retirement Income

https://www.taxdefensenetwork.com/wp-content/uploads/2021/11/states-and-retirement-taxes-1-2500x1875.jpg

7 Steps To Tax Efficient Retirement Income Tax Planning To Grow Your

https://i.ytimg.com/vi/g1rI8TcXmiM/maxresdefault.jpg

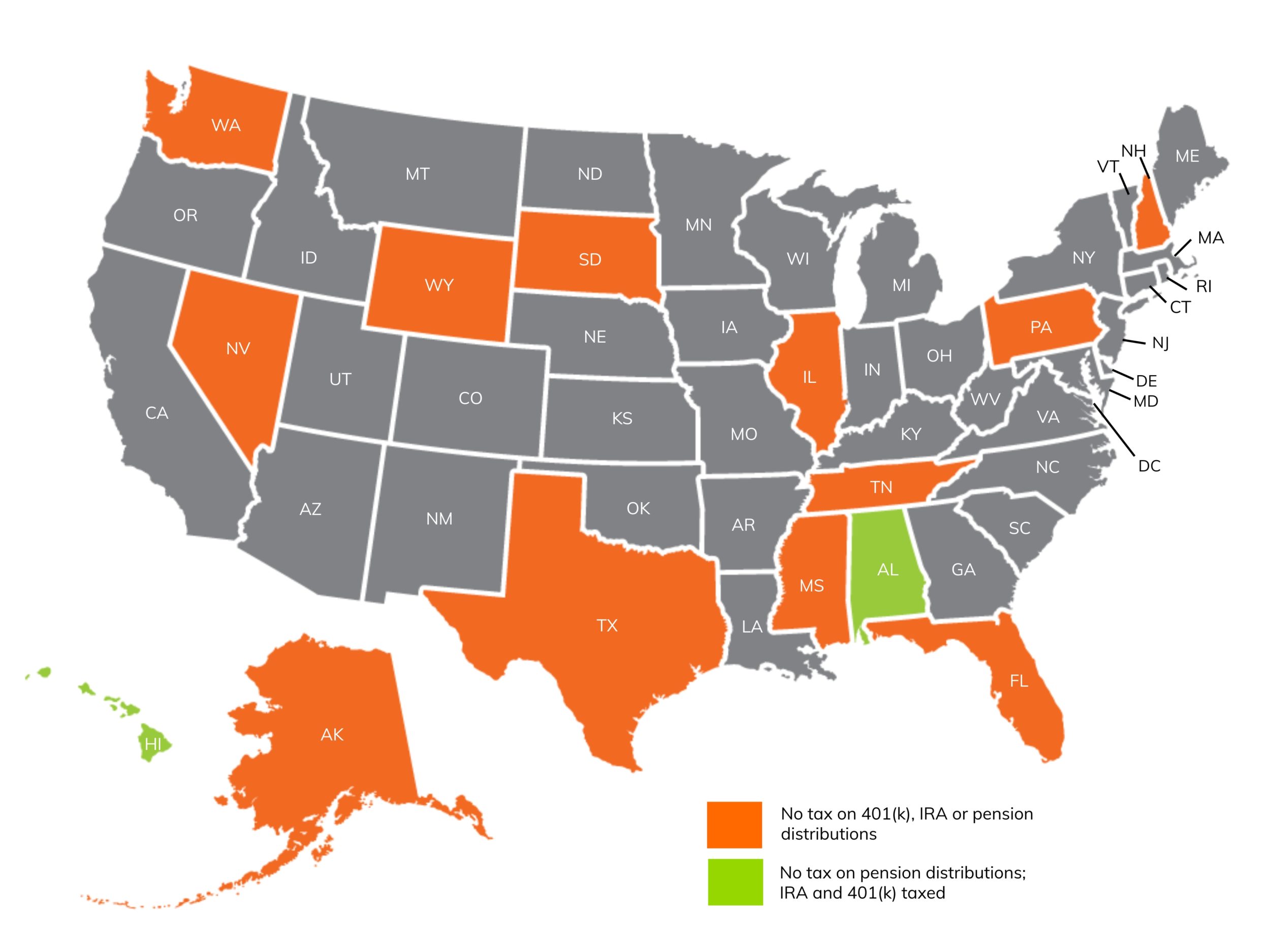

States With No Tax On Retirement Income Benzinga

https://cdnwp-s3.benzinga.com/wp-content/uploads/2023/01/09160353/Untitled-design-28-768x384.jpg?width=1200&height=800&fit=crop

You fill out a pretend tax return and calculate that you will owe 5 000 in taxes That is a 10 rate You can have 10 in federal taxes withheld directly from your pension and IRA distribution so that you would receive a net This calculator only calculates how much of your Social Security benefits is taxable i e counts as income on your tax return or as you said exposure to tax The

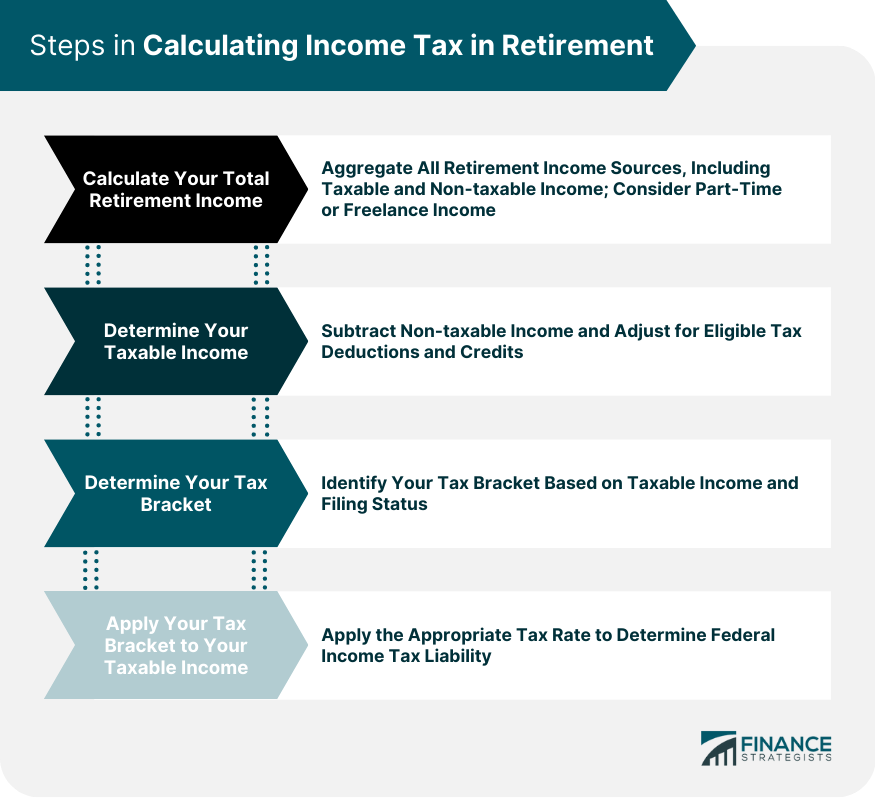

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax The Key steps include calculating total retirement income determining taxable income by subtracting non taxable income and applying deductions credits identifying your tax bracket and applying the appropriate

More picture related to How To Calculate Federal Tax On Retirement Income

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

How To Calculate Taxes On Retirement Income

https://www.thebalancemoney.com/thmb/-LW2MdV2t4ff5yh_RqjiixyZkXQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

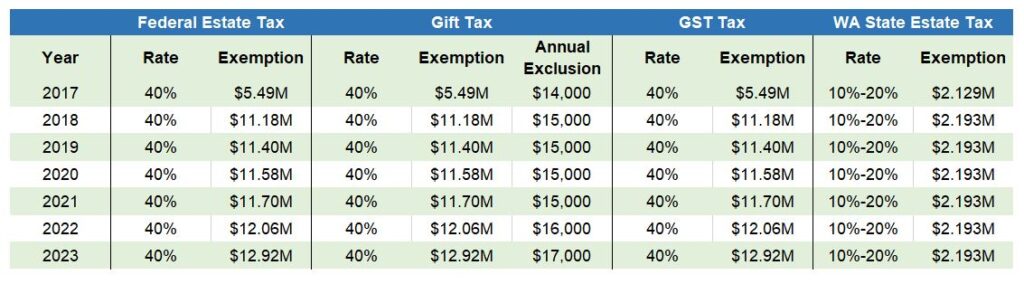

Annual Individual Gift Tax Exclusion Chart My XXX Hot Girl

https://www.helsell.com/wp-content/uploads/23-EP-Table-1024x284.jpg

The W 4P withholding calculator helps retirees determine the appropriate federal tax amount to withhold from pension or annuity payments ensuring they meet tax obligations Find out how to calculate your income tax bracket during retirement and determine the tax rate on any income capital gains and retirement fund distributions

Find out with our retirement income tax calculator This retirement calculator can help you understand the impact inflation and taxes will have on your retirement savings The Net Retirement Income Calculator determines a retiree s after tax income by assessing factors like retirement savings social security or pension benefits expected returns and

Federal Tax On Retirement Pension How It Works

https://profitjets.com/wp-content/uploads/2024/05/Featured-Image-2024-05-20T173855.550.webp

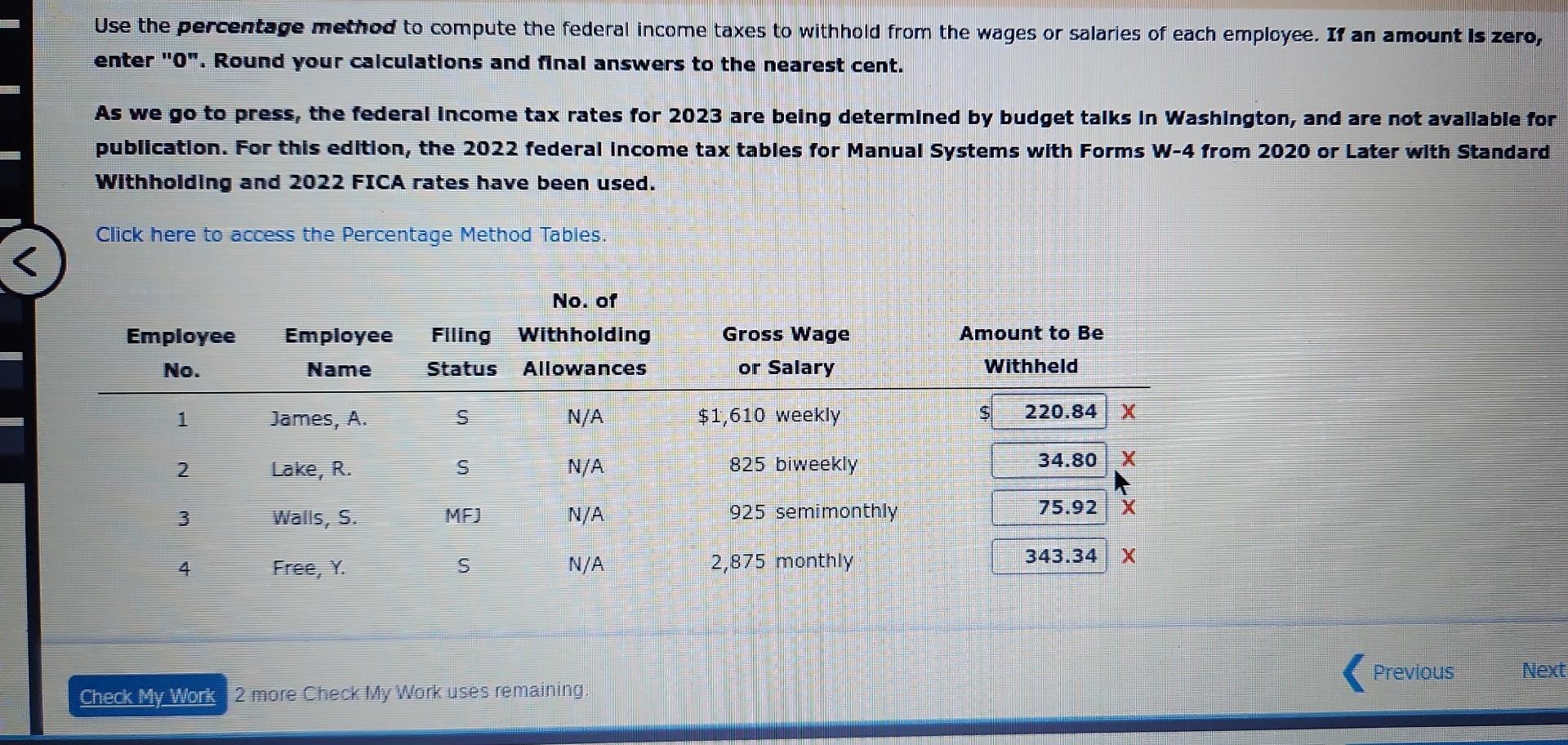

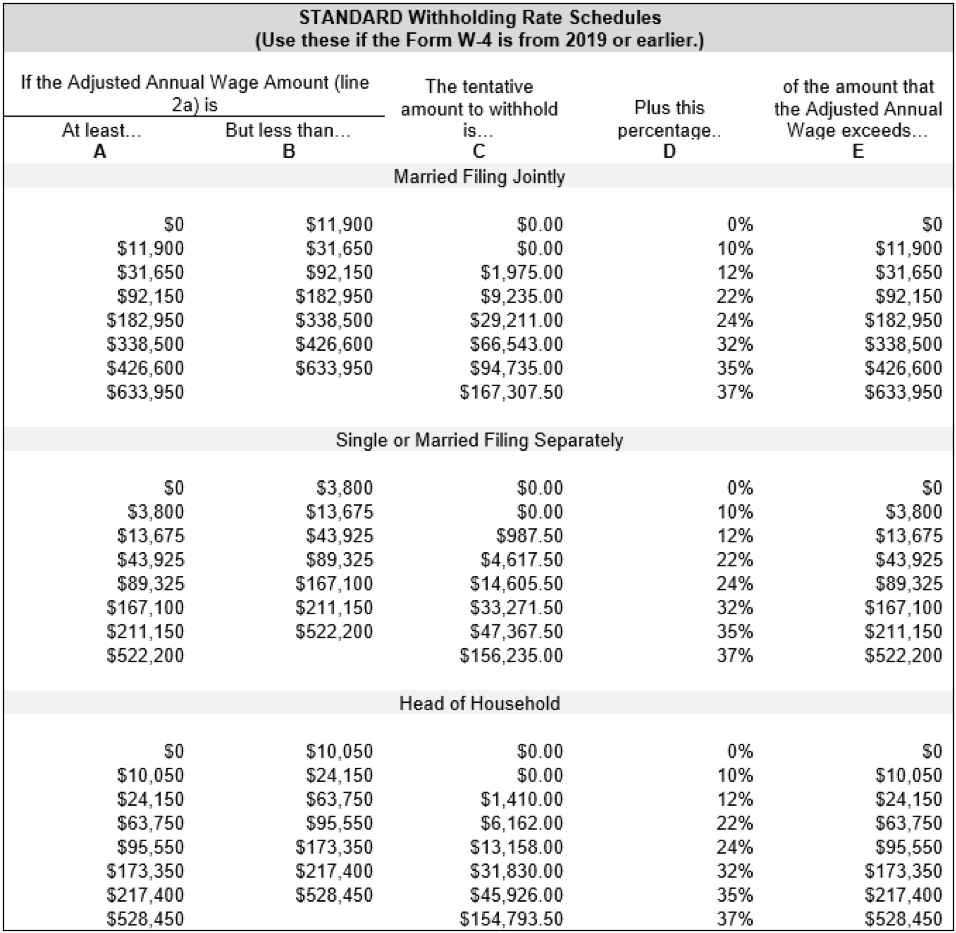

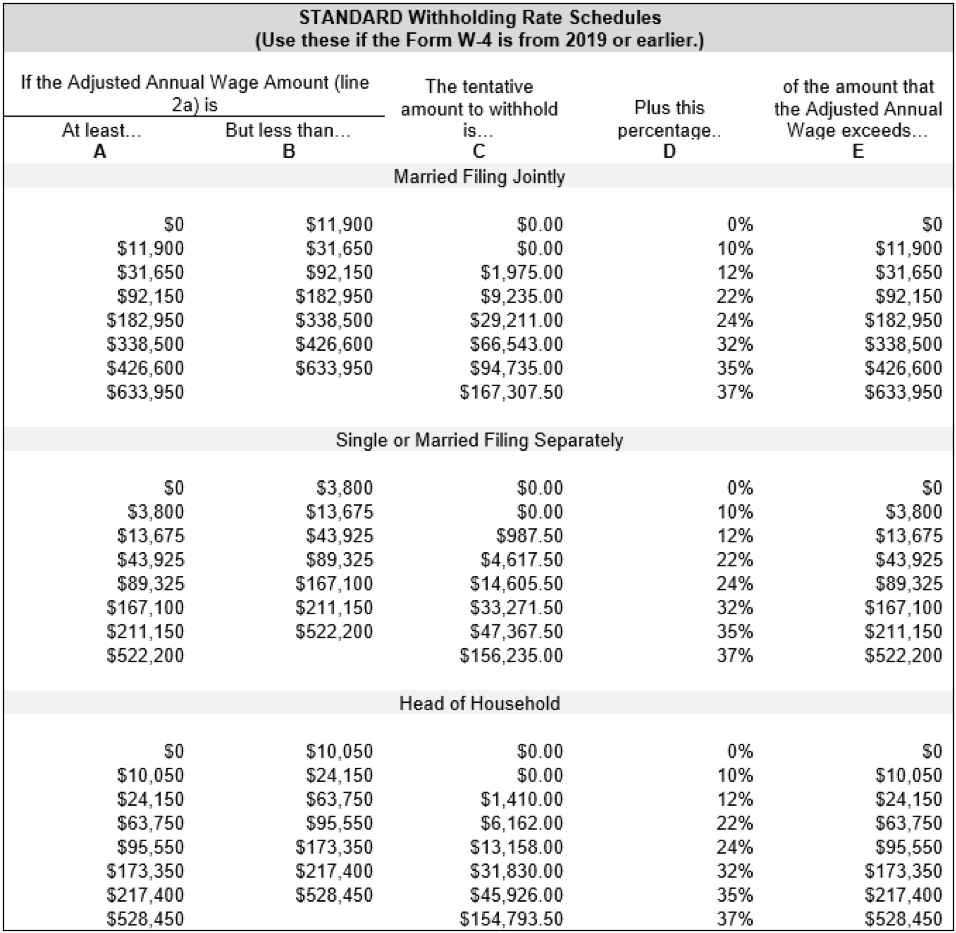

Use The Percentage Method To Compute The Federal Chegg

https://media.cheggcdn.com/study/724/7249ecb8-d142-4a06-9865-446456975411/image.jpg

https://www.irs.gov › newsroom › tax-withholding...

A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive The tool then automatically calculates the

https://www.irs.gov › pub › irs-pdf

For new retirees you will generally use the simplified method to compute the taxable portion of your pension The worksheet to determine the taxable and non taxable portion of your pension

How To Calculate Income Tax In Retirement Finance Strategists

Federal Tax On Retirement Pension How It Works

Every State With A Progressive Tax Also Taxes Retirement Income

How To Calculate Federal Income Tax

7 States That Do Not Tax Retirement Income

Tax Brackets 2024 Philippines Withholding Ryann Claudine

Tax Brackets 2024 Philippines Withholding Ryann Claudine

The Most Common Sources Of Retirement Income SmartZone Finance

Excel Income Tax Calculator How To Make Income Tax SexiezPix Web Porn

How To Calculate Federal Tax On A Salary Of 80000 Beem

How To Calculate Federal Tax On Retirement Income - You have two ways to satisfy the year round tax payment obligation for retirement income Taxes can be withheld from your benefits and distributions or you can make