Is Disability Insurance Tax Deductible For An S Corp One of the key advantages of disability insurance for S Corporations is the potential tax deductibility of premiums paid According to the Internal Revenue Service IRS shareholders with more than 2 ownership in an S Corporation are treated as self employed individuals for accident and health benefit purposes

Individual disability income insurance premiums paid may be deducted by the S corporation Because more than 2 shareholder employees are treated as self employed for accident and health benefit purposes the premiums are included in the shareholder s taxable income resulting in tax free benefits Short term and long term disability premiums For 2 shareholders of an S corporation employer paid short and long term disability premiums are subject to FITW and SITW but not to FICA or FUTA Because the disability insurance premiums are paid with after tax dollars any disability insurance proceeds generally would be tax free

Is Disability Insurance Tax Deductible For An S Corp

Is Disability Insurance Tax Deductible For An S Corp

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

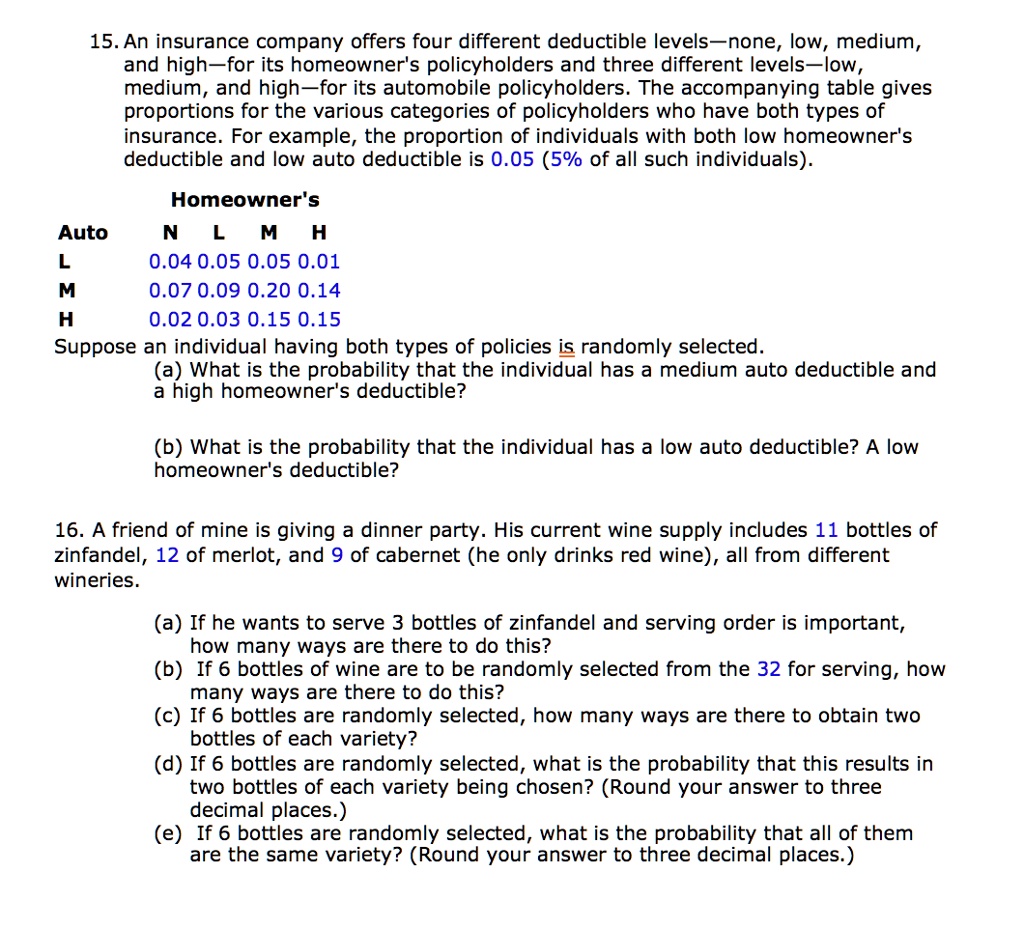

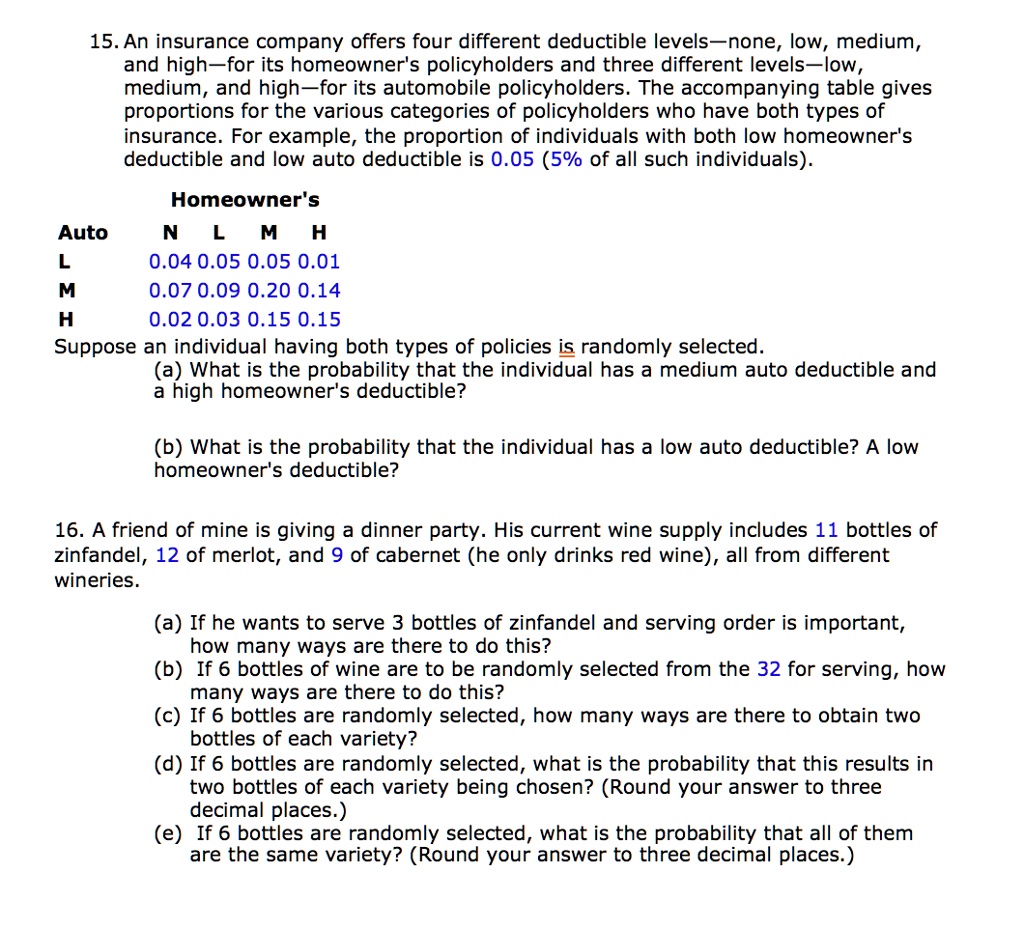

SOLVED 15 An Insurance Company Offers Four Different Deductible Levels

https://cdn.numerade.com/ask_images/2d64aa4d28844106b1edad5dad007b3b.jpg

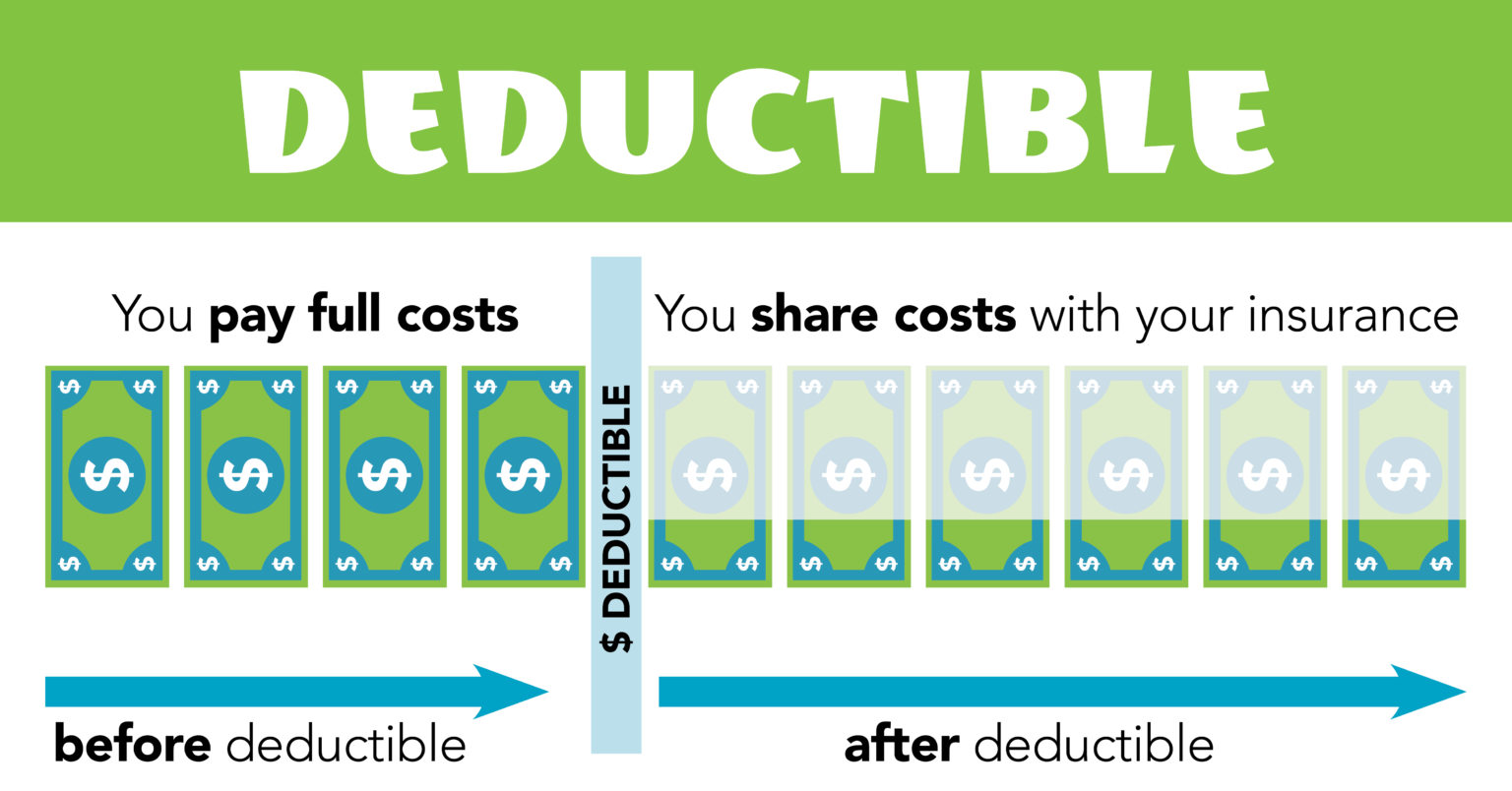

What Are Deductibles Blue Ridge Risk Partners

https://static.fmgsuite.com/media/InlineContent/originalSize/188232ce-b664-4ca9-8454-080b4eb59d4d.jpg

Health and accident insurance premiums paid on behalf of a greater than 2 percent S corporation shareholder employee are deductible by the S corporation and reportable as wages on the shareholder employee s Form W 2 subject to income tax withholding The good news is that individual disability income insurance premiums can be deducted by an S Corporation This is because shareholders with more than 2 of the shares are treated as

Short term and long term disability premiums For 2 shareholders of an S corporation employer paid short and long term disability premiums are subject to FITW and SITW but not to FICA or FUTA Because the disability insurance premiums are paid with after tax dollars any disability insurance proceeds generally would be tax free Disability insurance premiums paid by an S corporation for its employees are generally deductible as a business expense However for 2 percent shareholder employees these premiums must be included in their wages for income tax withholding purposes although they are not subject to Social Security and Medicare taxes

More picture related to Is Disability Insurance Tax Deductible For An S Corp

Pet Care Tax Deduction 2025 Schedule Janey Beatriz

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

List Of Realtor Tax Deductions

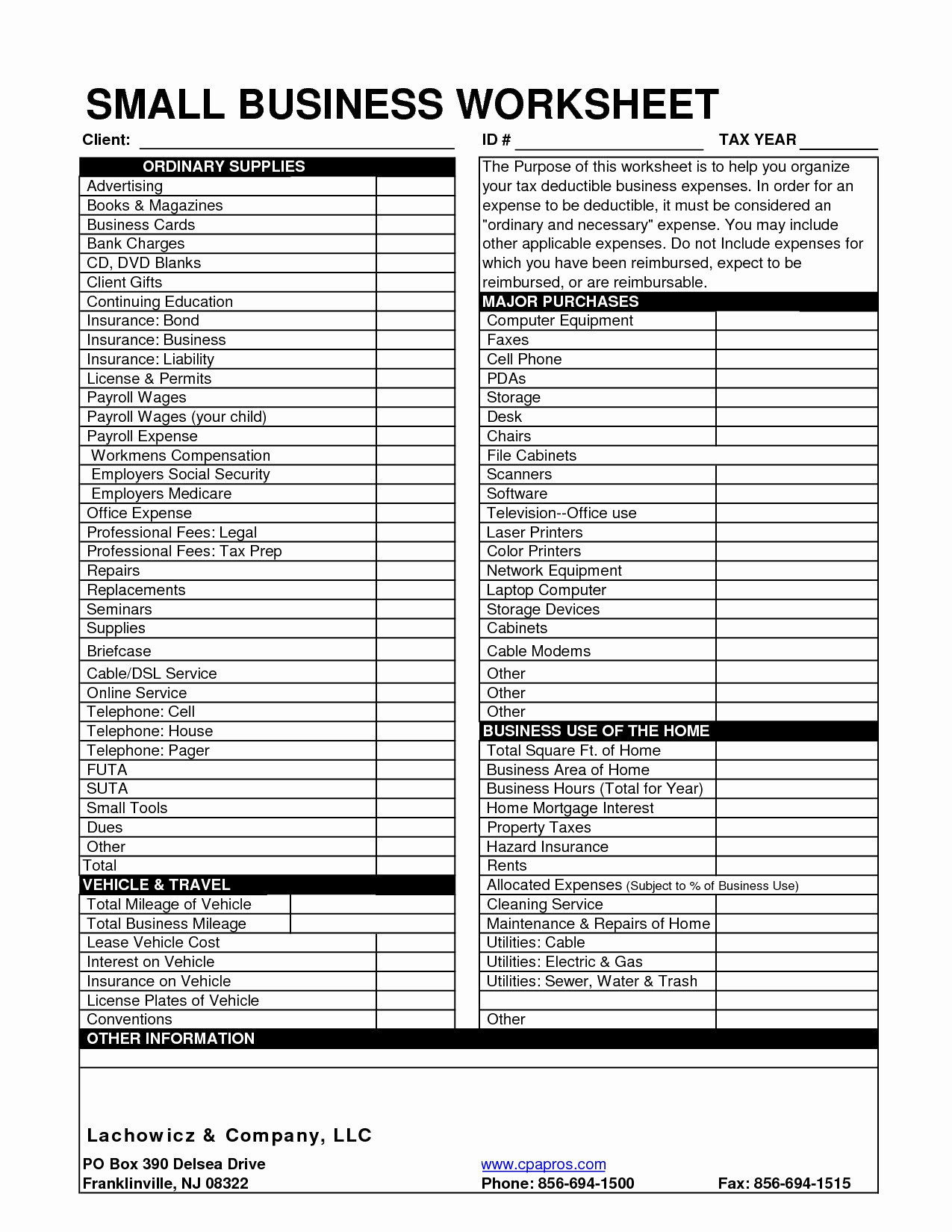

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-spreadsheet-then-small-business-tax-deductions.jpg

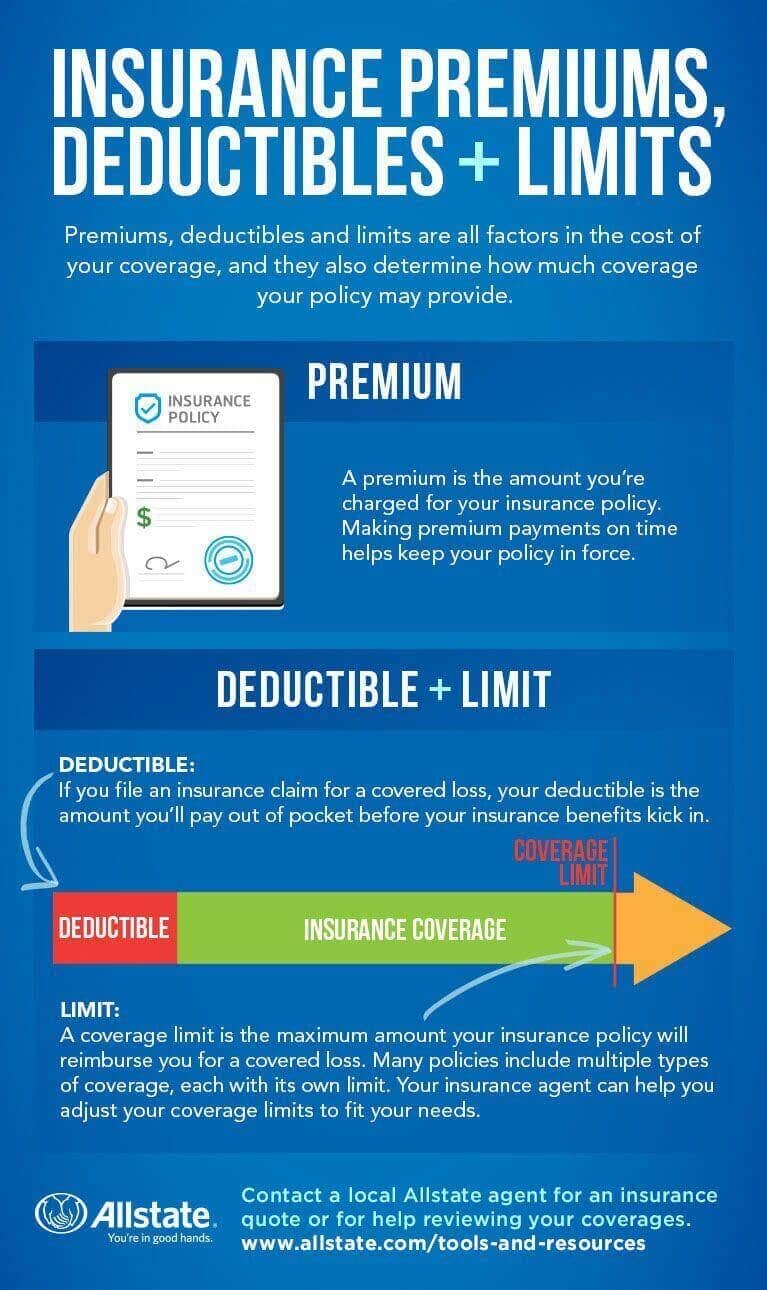

Insurance Premiums Limits And Deductibles Defined Allstate

https://www.allstate.com/resources/Allstate/images/tools-and-resources/insurance-basics/premium-limits-deductibles-infographic-desktop.jpg?v=b54c1d4f-43ae-fd34-8c32-22e40908fc66

Understanding Tax Deductibility for S Corporations The Short Answer Yes disability insurance premiums can be tax deductible for an S Corp but with some exceptions and guidelines Yes an S Corp can pay disability insurance premiums of a 2 shareholder employee and deduct them but it can not deduct them as employee benefits The premiums must be included in the 2 shareholder employee s W 2 wages deducted as officer compensation and reported on their W 2

[desc-10] [desc-11]

![]()

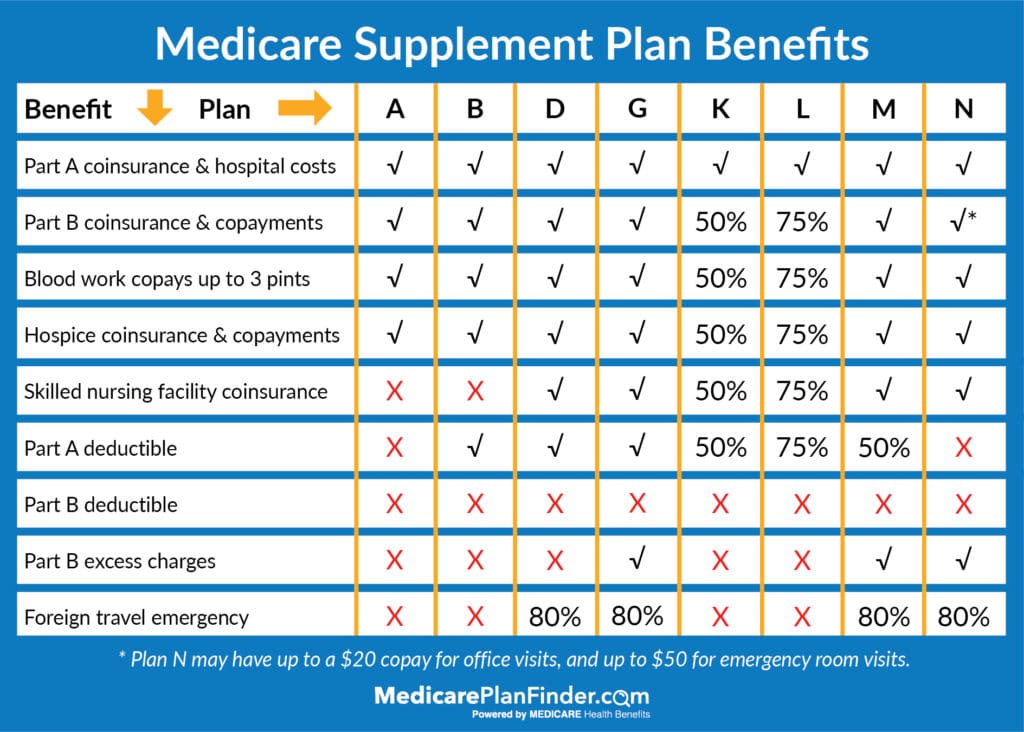

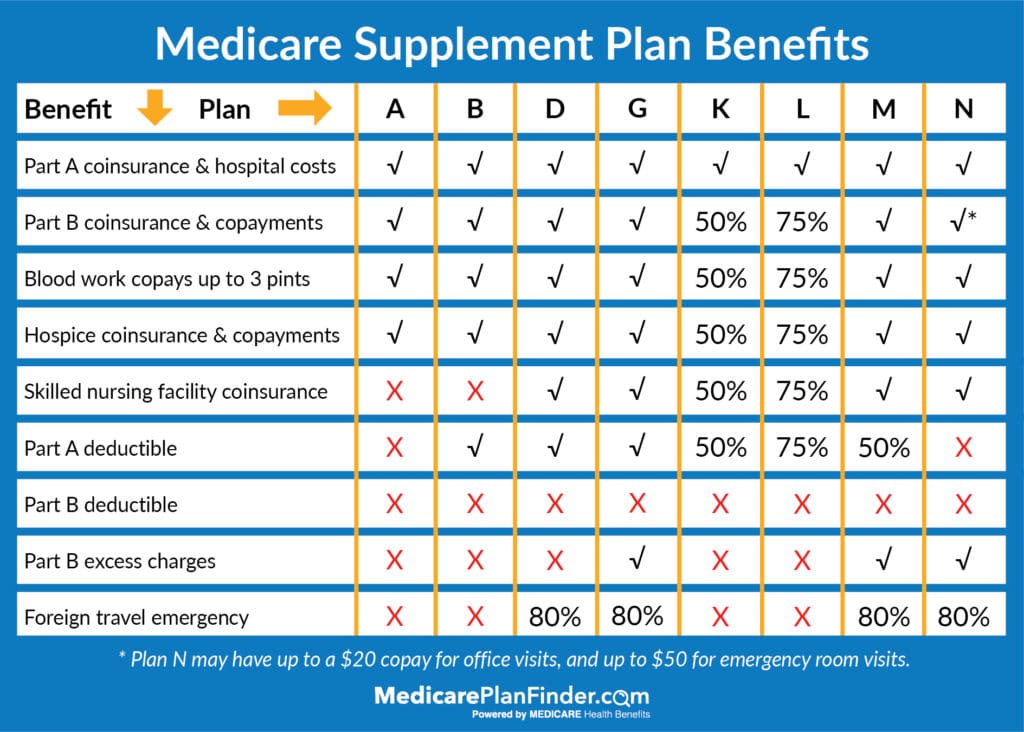

Part A Medicare Deductible 2025 Noushin Paige

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_1680,h_1202/https://www.medicareplanfinder.com/wp-content/uploads/2019/10/2020-Medicare-Supplement-Plan-Benefits-Medicare-Plan-Finder-01-1.jpg

Itemized Deductions Worksheets

https://i.pinimg.com/originals/cb/25/f6/cb25f6562ee2df4fcd8bf4df56bf7685.png

https://www.instead.com › resources › blog › s-corp...

One of the key advantages of disability insurance for S Corporations is the potential tax deductibility of premiums paid According to the Internal Revenue Service IRS shareholders with more than 2 ownership in an S Corporation are treated as self employed individuals for accident and health benefit purposes

https://insuredandmore.com › can-my-s-corp-pay-for...

Individual disability income insurance premiums paid may be deducted by the S corporation Because more than 2 shareholder employees are treated as self employed for accident and health benefit purposes the premiums are included in the shareholder s taxable income resulting in tax free benefits

Is Medicare Deductible Calendar Year Jemmie Dorolice

Part A Medicare Deductible 2025 Noushin Paige

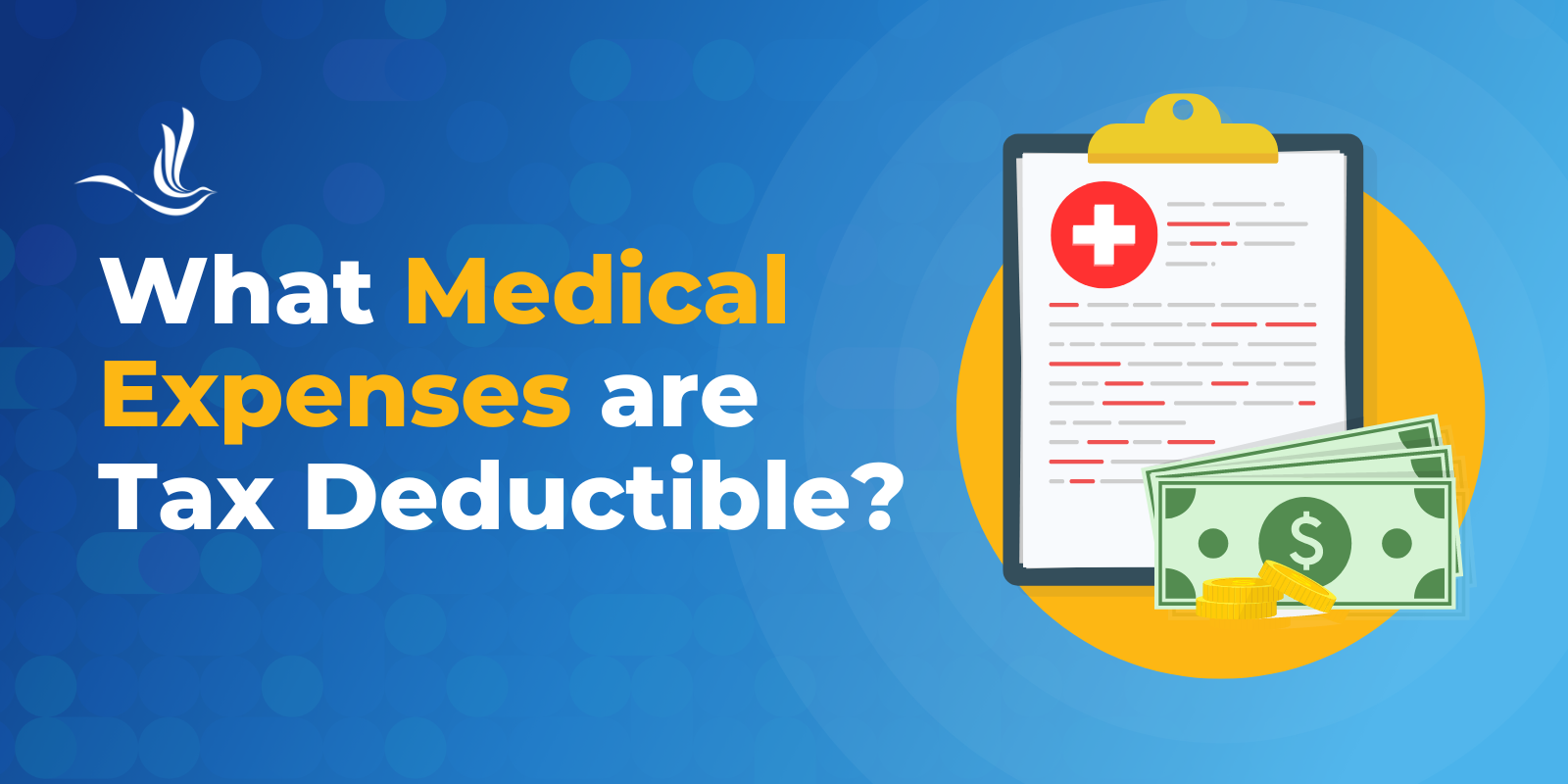

What Medical Expenses Are Tax Deductible Optima Tax Relief

Cost Of Nursing Home Tax Deductible At Helen Persaud Blog

Tax Deduction Worksheet 2023

2025 Medicare Deductible Rates By State Ghasem Dakota

2025 Medicare Deductible Rates By State Ghasem Dakota

In Home Daycare Tax Deduction Worksheet

Medicare Tax Rate 2025 Sophia Lane

Daycare Tax Deductions Worksheet

Is Disability Insurance Tax Deductible For An S Corp - [desc-13]