Is Federal Medical Retirement Taxable If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in most cases

Your retirement contributions are not taxable but interest included in the payment is taxable You should contact the IRS for more information If you re a federal government worker with a medical condition you may be able to take advantage of the federal government s medical retirement Civil service medical retirement is possible if you are a civil servant with a

Is Federal Medical Retirement Taxable

Is Federal Medical Retirement Taxable

https://www.thetechedvocate.org/wp-content/uploads/2023/09/FERS-Pension-Calculation-768x461-1.png

How Asset Location Can Help Minimize Taxes And Maximize Returns

https://www.ishares.com/blk-one-c-assets/cache-1681928983000/images/media-bin/web/ishares/us/charts/ish-chart-asset-types-for-various-tax-accounts.png

Tax Brackets 2024 Irs Single Tasia Fredrika

https://topdollarinvestor.com/wp-content/uploads/2022/11/2022-Federal-Income-Tax-Brackets-1.png

A key difference is that in OPM Disability Retirement the qualifying medical condition can predate your first day of Federal employment Under OPM Disability Retirement If you are under age 62 Federal retirement law requires your disability benefits under FERS to be reduced by 100 percent of your social security benefit for any month in which you are entitled

In that case when you are disabled and the coverage kicks in the benefits you receive are taxable However what if you paid for your disability insurance yourself with after Federal employees may choose from several retirement options including FERS disability retirement Learn how disability benefits work and how to apply

More picture related to Is Federal Medical Retirement Taxable

56 Of Social Security Households Pay Tax On Their Benefits Will You

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

Retire Ready Are Social Security Benefits Taxed

https://3.bp.blogspot.com/-CdXz1lKcPuQ/Tx3wgcF-ewI/AAAAAAAAAXk/cqo4tkyoGoQ/s1600/SS%2BTax.jpg

The Health Savings Account Even Better Than A Roth IRA Live Free MD

https://i1.wp.com/www.livefreemd.com/wp-content/uploads/2017/06/Retirement-Accounts-Updated.jpg?resize=1024%2C474

If you retired early on disability you must include in income any disability pension you receive under a plan that is paid for by your employer You report your taxable disability payments as Is Federal Disability Retirement taxed Yes under the rules of the Internal Revenue Service your Federal Disability Retirement is subject to Federal Tax This is something to consider when

In order to be eligible for federal disability retirement benefits an employee must serve for at least 5 years CSRS employees do not pay social security taxes and in most cases are not eligible Federal employees and retirees will encounter taxes on benefits they receive spanning Social Security annuities insurance premiums and health savings accounts

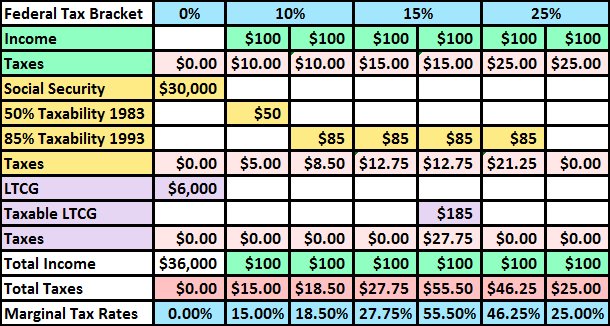

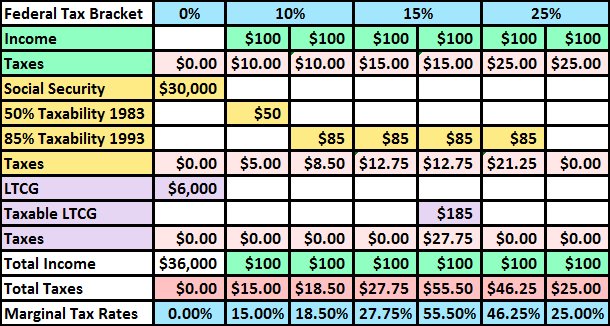

Social Security Tax Impact Calculator Bogleheads

https://www.bogleheads.org/w/images/b/b8/ParallelTaxes.jpg

[img_title-8]

[img-8]

https://www.irs.gov/publications/p525

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in most cases

https://www.opm.gov/support/retirement/faq/taxes...

Your retirement contributions are not taxable but interest included in the payment is taxable You should contact the IRS for more information

[img_title-9]

Social Security Tax Impact Calculator Bogleheads

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Is Federal Medical Retirement Taxable - Federal employees may choose from several retirement options including FERS disability retirement Learn how disability benefits work and how to apply