Is Long Term Disability Payment Taxable Income When employees pay their long term disability insurance premiums with after tax dollars the benefits they receive are generally tax free This favorable treatment stems from

The IRS explains that when your employer paid the premiums long term disability payments are taxable But if you paid any or all the Under the tax code most payments to compensate you for being injured including most legal settlements may be taxable or not depending on your injuries If you have non physical

Is Long Term Disability Payment Taxable Income

Is Long Term Disability Payment Taxable Income

https://image.isu.pub/221004094355-74a380a8c9b240552874ac68f52e7d67/jpg/page_1.jpg

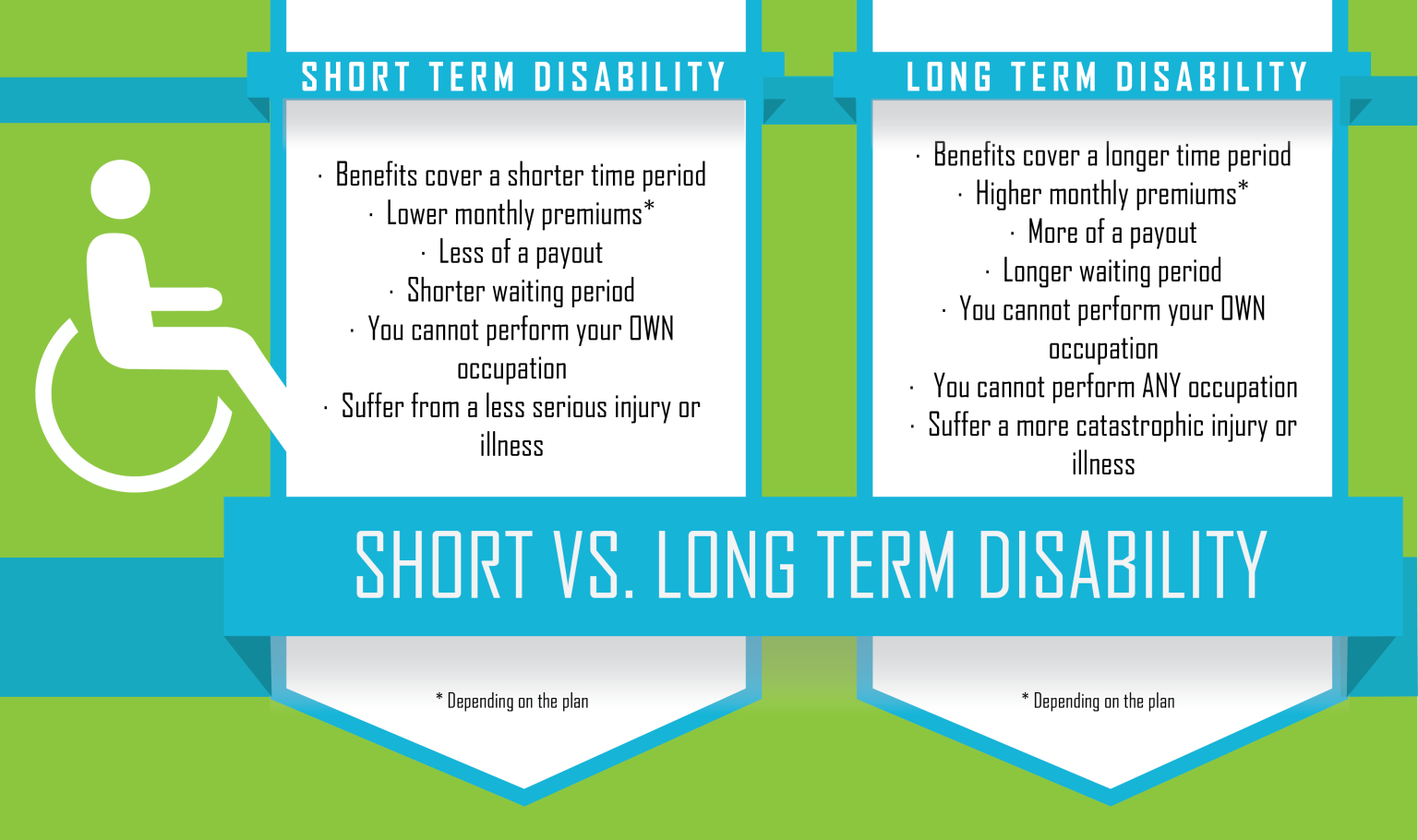

Is Short Term Disability Taxable Taxation Portal

https://lh5.googleusercontent.com/K55xicJOgjnT4f_84U0SJ3OcMIlDVQ4nmH_FSM4pJ5eg32sZJl_MXWbkwBfJPn7EKN9hfFf2oEGAf3YWJVMVMr1Swzo0sPgOERi4w_D9iltuwfUsfojFgOwP-Er7HndU8KqDRZvY

Is Social Security Disability Income Taxable How To Know For Sure

https://moneybliss.org/wp-content/uploads/2023/03/is-social-security-disability-taxable-683x1024.jpg

The taxable portion of your long term disability benefits will typically be reported in Box 2a of Form 1099 R You will need to include this amount on your tax return as taxable income Tax considerations for long term disability benefits vary depending on individual circumstances such as policy types and who pays the premiums In the following sections this article will provide a comprehensive breakdown of

Disability benefits may or may not be taxable You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars This includes A employer sponsored policy you contributed to with Generally you must pay taxes on long term disability payments from an employer paid accident or health insurance plan If both you and your employer paid premiums only the payments arising from your employer s

More picture related to Is Long Term Disability Payment Taxable Income

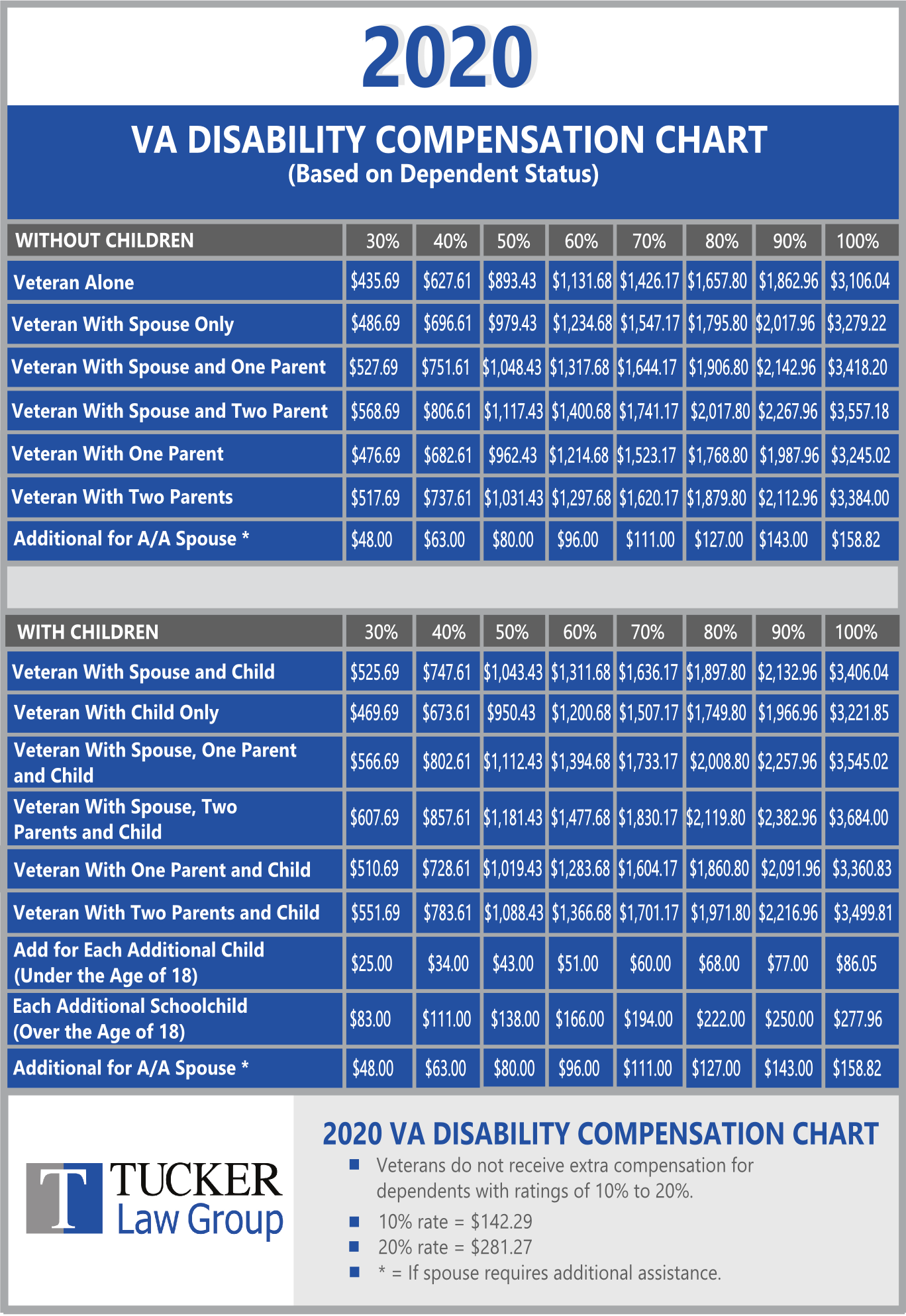

Va Disability Payment Table 2024

https://tuckerdisability.com/wp-content/uploads/2020/02/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1.png

Long Term Disability Insurance Insurance Noon

https://insurancenoon.com/wp-content/uploads/2021/11/Long-Term-Disability-Insurance.jpeg

VA Disability Pay Chart 2024 Know Rates Amount Payment Dates

https://cwccareers.in/wp-content/uploads/2024/01/VA-DISABILITY-PAY-CHART-2024-1.jpg

The long term disability settlement will typically be tax free if you paid for the premium with money that had already been taxed such as taxable income However if you paid for the insurance premium with money that Your Long Term Disability LTD benefits might be taxable It depends on how the premiums for your policy were paid If your employer paid the premiums or you used pre tax money your

Whether long term disability LTD benefits are taxable tax free or tax deductible depends on 1 who pays the premiums for the insurance policy and 2 whether you paid the The taxability of long term disability benefits largely depends on who and when the premiums for the disability insurance are paid The benefits are typically not taxed if the

How Much Does Disability Insurance Cost PolicyAdvisor

https://blog.policyadvisor.com/wp-content/uploads/2021/12/how-much-does-disability-insurance-cost.jpg

Social Security Disability Missoula Workers Compensation And Social

https://clarkforklaw.com/wp-content/uploads/2017/06/iStock-183295330.jpg

https://accountinginsights.org › are-long-term...

When employees pay their long term disability insurance premiums with after tax dollars the benefits they receive are generally tax free This favorable treatment stems from

https://marketrealist.com › taxes › is-long-t…

The IRS explains that when your employer paid the premiums long term disability payments are taxable But if you paid any or all the

Short Term Disability Insurance

How Much Does Disability Insurance Cost PolicyAdvisor

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)

Disability Income DI Insurance What It Is And How It Works

Long Term Disability Taxable Vs Nontaxable RespectCareGivers

The Ultimate Guide To Voluntary Long Term Disability Insurance

The Pros Cons Of Long Term Disability Insurance Healthynewage

The Pros Cons Of Long Term Disability Insurance Healthynewage

Is Long Term Disability Taxable Grants For Medical

How Much Does Long Term Disability Pay Disability Insurance Pay

Long Term Disability LTD Claims For Bank Tellers CCK Law

Is Long Term Disability Payment Taxable Income - Generally you must pay taxes on long term disability payments from an employer paid accident or health insurance plan If both you and your employer paid premiums only the payments arising from your employer s