Is Pension Income Taxable This interview will help you determine if your pension or annuity payment from an employer sponsored retirement plan or nonqualified annuity is taxable It doesn t address Individual Retirement Arrangements IRAs

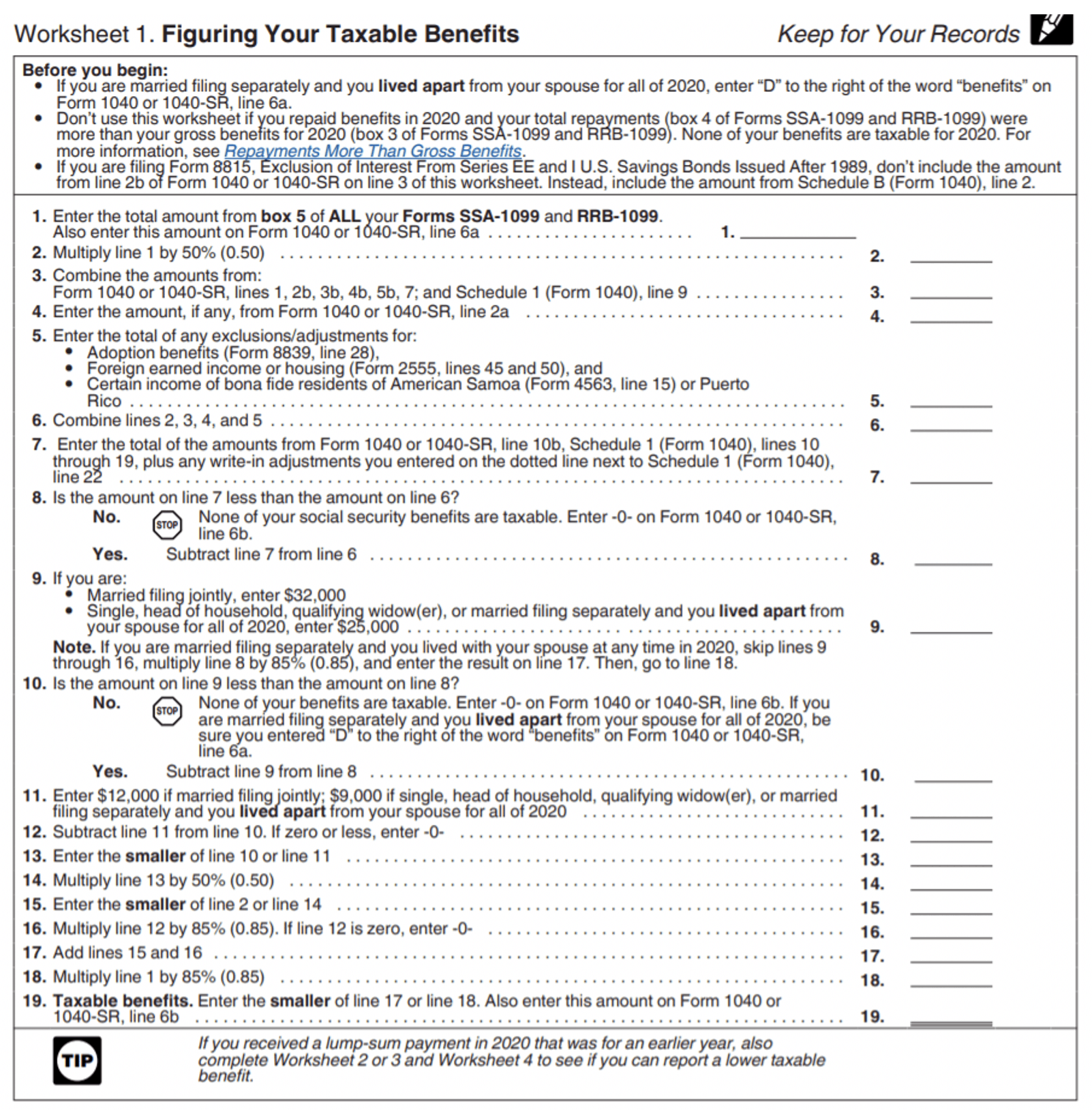

WHY IS MY PENSION INCOME TAXED Your pension will be reported on a Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc Form 1099 R will show you how much you contributed to the plan and how much tax was withheld The taxable part of your pension or annuity payments is generally subject to federal income tax withholding You may be able to choose not to have income tax withheld from your pension or annuity payments or may want to specify how much tax is withheld

Is Pension Income Taxable

Is Pension Income Taxable

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/taxability-of-pension.jpg

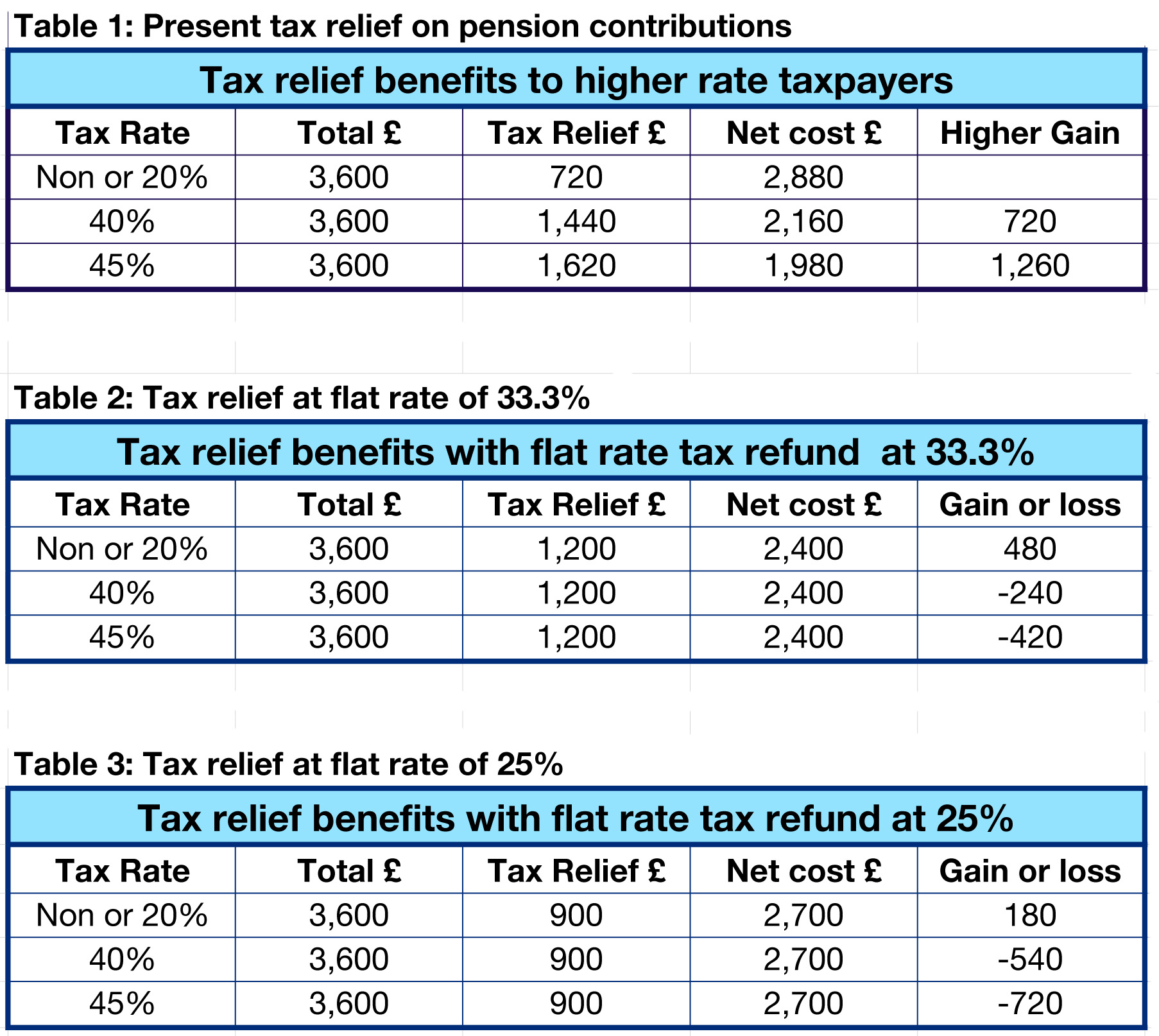

Welfare For The Wealthy Indy Celts

http://wingsoverscotland.com/wp-content/uploads/2016/03/pensiontax.jpg

Benefits Of Filling Income Tax Returns Pension Income Taxable Notice

https://image.slidesharecdn.com/taxarticles-160624104642/95/benefits-of-filling-income-tax-returnspension-income-taxablenoticekhanna-associates-llp-3-638.jpg?cb=1466765724

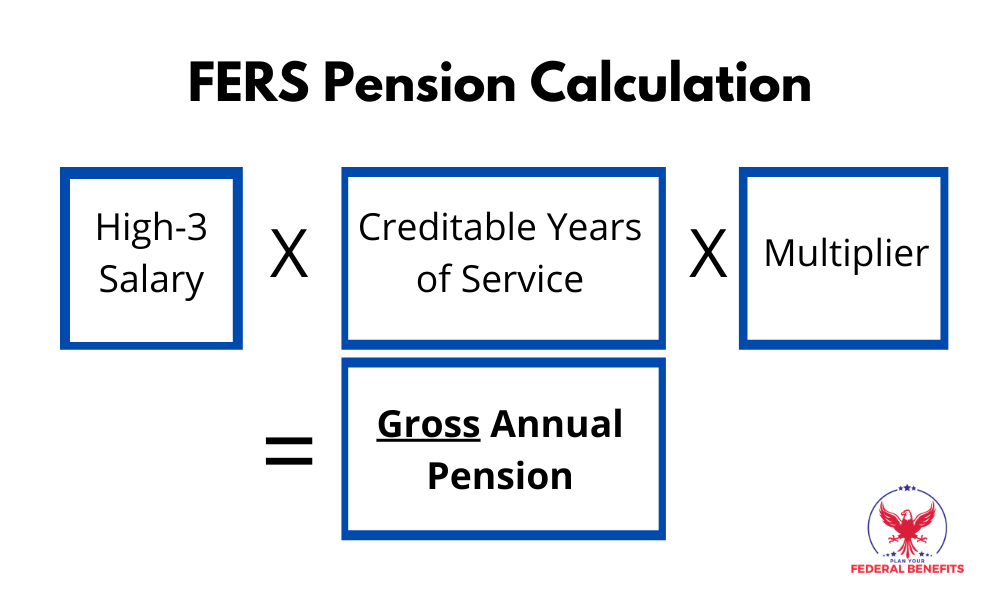

Pension is taxable under the head Income From Salaries Pensions are paid out periodically generally every month However the taxpayer may also choose to receive the pension as a lump sum also called commuted pension instead of a monthly payment Pensions Pension payments are generally fully taxable as ordinary income unless you made after tax contributions Interest Bearing Accounts Interest payments are taxed at ordinary

Understanding the distinction between taxable and nontaxable portions of pension income is crucial Taxability often depends on the nature of contributions to the plan Contributions made with pre tax dollars generally result in taxable distributions as taxes were deferred Pensions are usually funded with pre tax income so you will pay income tax on all pension payments unless you contributed after tax to your pension upon withdrawal There are some states that do not tax pensions So you will not pay state income tax upon withdrawal of the funds Does your state have a retirement exclusion

More picture related to Is Pension Income Taxable

Is Pension Income Taxable In Canada How Is It Taxed TMFG

https://tmfg.ca/wp-content/uploads/2022/06/calculator-gc18d438de_1280.jpg

Pension Taxes For Seniors What To Know Greatsenioryears

https://greatsenioryears.com/wp-content/uploads/2023/12/is-pension-income-taxable-for-senior-citizens-1024x585.jpg

Income Tax On Pension Is Pension Income Taxable Value Research

https://www.valueresearchonline.com/content-assets/images/51127_20220803-pension_2__w660__.jpg

While pensions are often viewed as income determining whether they qualify as earned income is essential as this distinction has significant tax implications The Internal Revenue Service IRS categorizes income into earned passive and portfolio income each carrying distinct tax implications For defined benefit pensions which provide a fixed monthly payment most retirees will find their entire pension is taxable Employers typically fund these plans with pre tax contributions meaning recipients must pay ordinary income tax on the full amount received

[desc-10] [desc-11]

Is Pension Considered Income And Taxable At The Federal Level

https://media.marketrealist.com/brand-img/rf0dzZIIX/1024x536/is-pension-income-taxable-federal-1603886980816.jpg

What Counts As Taxable Income And Non Taxable Income

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

https://www.irs.gov › help › ita › is-my-pension-or...

This interview will help you determine if your pension or annuity payment from an employer sponsored retirement plan or nonqualified annuity is taxable It doesn t address Individual Retirement Arrangements IRAs

https://www.irs.gov › pub › irs-pdf

WHY IS MY PENSION INCOME TAXED Your pension will be reported on a Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc Form 1099 R will show you how much you contributed to the plan and how much tax was withheld

Income Tax Guide On Pension How To File Pension Income In ITR Mint

Is Pension Considered Income And Taxable At The Federal Level

Income Tax Worksheet 2023

Army Travel Pay Calculator Besttravels

Tax Free Retirement Income TransGlobal Holding Company

How To Calculate Exemption On Pension Income

How To Calculate Exemption On Pension Income

EXCEL Of Retirement Calculator For HR xlsx WPS Free Templates

60k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Is Pension Taxable Max Life Insurance

Is Pension Income Taxable - Understanding the distinction between taxable and nontaxable portions of pension income is crucial Taxability often depends on the nature of contributions to the plan Contributions made with pre tax dollars generally result in taxable distributions as taxes were deferred