Is Social Security Taxable Income In California Like the retirement income benefits once you hit that taxability threshold up to 85 of your SSDI benefits may be taxed again depending on your filing status and how much total income you earned Social Security Disability Insurance is exempt from state taxes in California

Some of your Social Security income may be taxable Visit About Publication 915 Social Security and Equivalent Railroad Retirement Benefits for more information California return Make an adjustment to exclude any of this income if it was included in your federal AGI Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for taxable income AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI

Is Social Security Taxable Income In California

Is Social Security Taxable Income In California

https://www.covisum.com/hs-fs/hubfs/Imported_Blog_Media/WEB_Covisum_tax-chart-SST.png?width=613&name=WEB_Covisum_tax-chart-SST.png

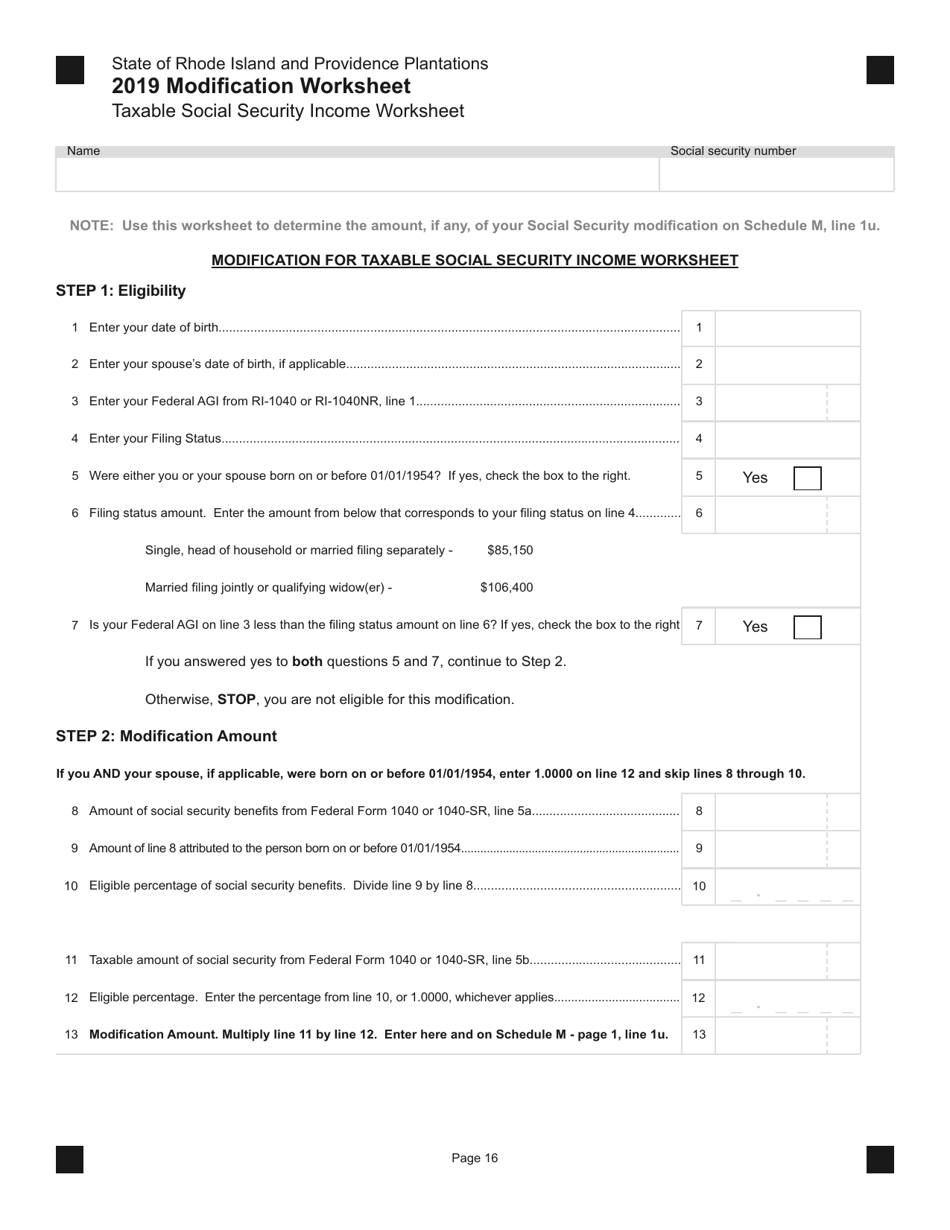

Social Security Taxable Income Worksheet 2021

https://www.irs.gov/pub/xml_bc/26584r03.gif

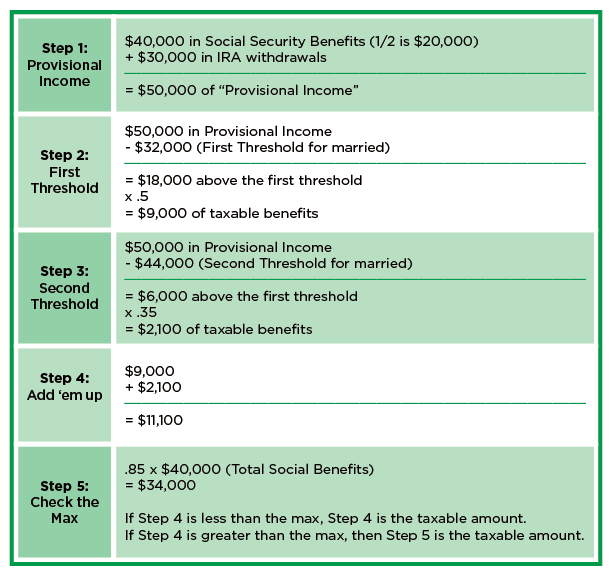

Calculate Taxable Portion Of Social Security TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

Does California tax Social Security benefits No Social Security income is not taxed by the state of California But you may pay federal taxes on a portion of your Social Security benefits depending on your income Tax on Taxable Income Low of 4 7 on up to 20 500 for single filers and 41 000 for joint filers and a high of 5 9 for taxable income exceeding those thresholds for 2024 Social Security

Is Social Security taxable in California Social Security retirement benefits are not taxed at the state level in California Keep in mind however that if you have income from sources besides Social Security you may need to pay federal taxes on your Social Security income Social Security benefits including retirement survivor and disability benefits are not subject to California state income tax However these benefits may be taxed at the federal level based on your total income

More picture related to Is Social Security Taxable Income In California

Taxable Social Security Worksheet 2019

https://data.templateroller.com/pdf_docs_html/2018/20180/2018025/taxable-social-security-income-worksheet-rhode-island_print_big.png

Taxable Social Security Worksheet 2023 Pdf

https://www.moneytree.com/wp-content/uploads/2020/10/taxableSocialSecurity-1.png

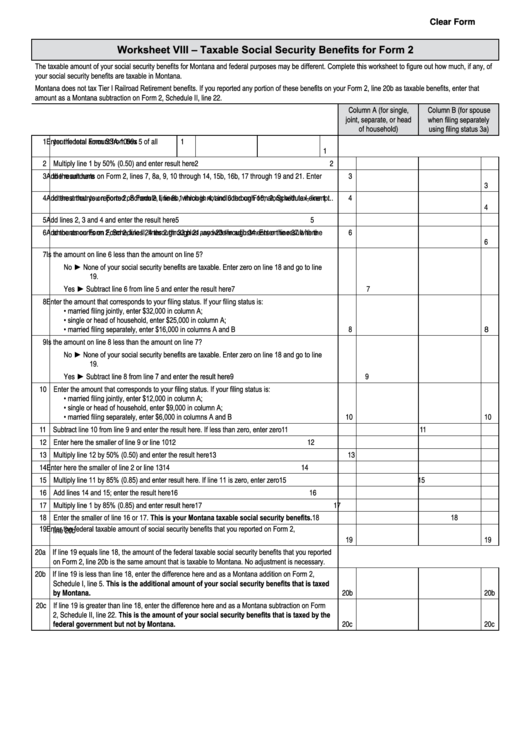

2022 Social Security Taxable Income Worksheet

https://data.formsbank.com/pdf_docs_html/325/3254/325455/page_1_thumb_big.png

In California social security benefits are not subject to state taxation Essentially the portion of social security benefits included in adjusted gross income on one s federal return remains untaxed by California California does not tax Social Security benefits on the state level However individuals withdrawing Social Security benefits may still be required to pay federal taxes on them

Everyone wondering Is Social Security income taxable in California is a retiree or future taxpayer in California This all inclusive guide will explore this subject thoroughly including several parts of federal and California Social Security taxes You must pay income tax up to 50 of your social security benefits if you are single and file separately with an income between 25 000 to 34 000 You will be subject to an 85 percent tax if you have a combined income greater than 34 000

Are My Social Security Benefits Taxable Calculator

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

Taxable Social Security Worksheet 2023 Pdf

http://www.jdunman.com/ww/business/sbrg/graphics/26584r03.gif

https://www.bfadvisors.com/california-social-security-tax

Like the retirement income benefits once you hit that taxability threshold up to 85 of your SSDI benefits may be taxed again depending on your filing status and how much total income you earned Social Security Disability Insurance is exempt from state taxes in California

http://ftb.ca.gov/file/personal/income-types/social-security.html

Some of your Social Security income may be taxable Visit About Publication 915 Social Security and Equivalent Railroad Retirement Benefits for more information California return Make an adjustment to exclude any of this income if it was included in your federal AGI

Social Security Benefit Tax Limit 2025 Brandon Gill

Are My Social Security Benefits Taxable Calculator

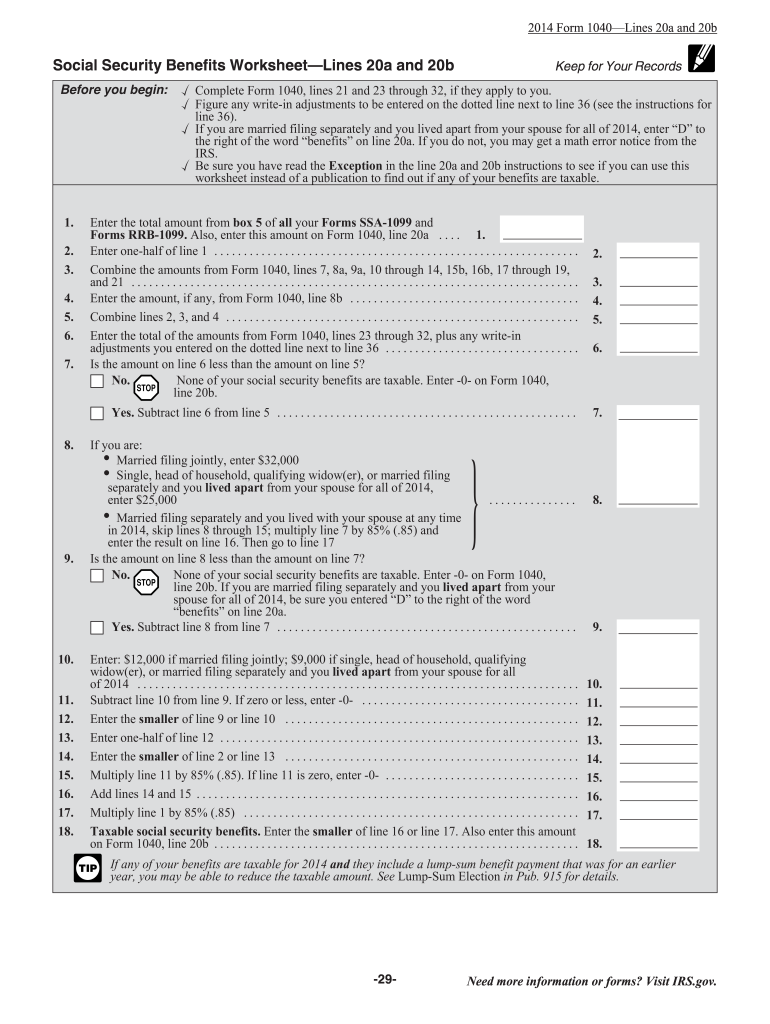

Social Security Benefit Worksheet For 2022

Social Security Taxability Worksheet

Taxable Social Security Benefits Calculator 2024

Social Security Benefits Worksheet 2023

Social Security Benefits Worksheet 2023

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

How Working After Full Retirement Age Affects Social Security Benefits

13 States That Tax Social Security Benefits Tax Foundation

Is Social Security Taxable Income In California - Is Social Security taxable in California Social Security retirement benefits are not taxed at the state level in California Keep in mind however that if you have income from sources besides Social Security you may need to pay federal taxes on your Social Security income