Is Student Loan Repayment By Employer Taxable Income WASHINGTON With the fall college semester quickly approaching the Internal Revenue Service today reminded employers and employees that under federal law employers

No an employee s student loan repayment benefit from their employer is not taxed as income now through the end of December Thanks to the CARES Act employees can take advantage of up to 5 250 in tax free With the new Coronavirus Aid Relief and Economic Security Act CARES Act a temporary tax free provision is provided for employer student loan assistance programs Section 2206 of the CARES Act allows a portion of

Is Student Loan Repayment By Employer Taxable Income

Is Student Loan Repayment By Employer Taxable Income

https://www.edvisors.com/media/images/edvisors-site/advertisements/student-loan-repayment-scholarship-edv.png?v=20231213T233549

Understanding Student Loans In 2024 A Comprehensive Guide

https://www.bridgeofsolutions.com/wp-content/uploads/2023/12/Understanding-Student-Loans-in-2024-A-Comprehensive-Guide-min.png

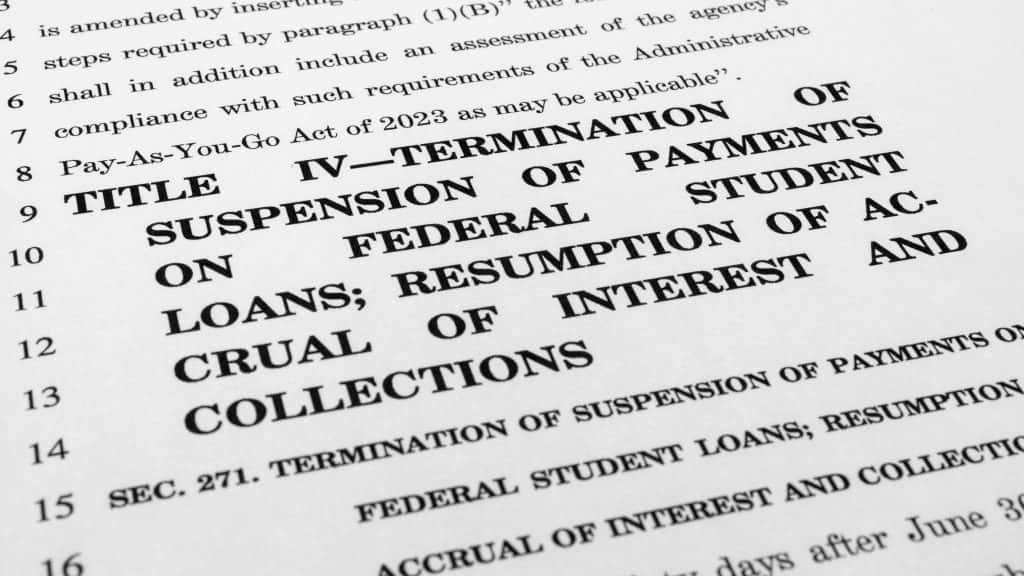

Student Loan Repayments Will Resume Soon Here s What To Know

https://www.courier-journal.com/gcdn/presto/2023/06/01/USAT/da411a60-6de7-4b0e-bc81-cd1f5edf53dd-VPC_STUDENT_LOAN_REPAYMENT_getty.jpg?crop=1911,1075,x4,y0&width=1911&height=1075&format=pjpg&auto=webp

This employer sponsored student loan repayment assistance is tax free because the IRS doesn t consider the assistance provided by the employer to be taxable income for the employee However The employer student loan repayment benefit is double tax exempt What does this mean Employers and employees both do not have to pay income tax on up to 5 250 of student loan repayment assistance in 2020

The bottom line Is employer student loan repayment taxable No up to 5 250 per employee How popular is it In 2019 only 8 of companies offered this employee benefit But because student loan Currently employers can provide up to 5 250 in student loan repayment annually as a tax free benefit for employees Understanding how these programs work and how to qualify can bring you

More picture related to Is Student Loan Repayment By Employer Taxable Income

Guide To Student Loan Interest Rates And How Much You Will Pay

https://www.gannett-cdn.com/-mm-/3095bbe1c7b29d9ac3460534e28a55c79c2eb0ef/c=0-226-1942-1318/local/-/media/2019/02/28/USATODAY/usatsports/MotleyFool-TMOT-d92ea364-student-loans.jpg?width=3200&height=1680&fit=crop

Alumni Financial Tools Financial Student Loan Payment Financial

https://i.pinimg.com/originals/58/c4/fa/58c4fac18f7bf517eea5f9437b493252.jpg

32 Upenn Financial Aid Calculator DaynahFidel

https://embed.filekitcdn.com/e/n4GdVRUNfqNSkwnm5UCy4F/93pY8c4G6TGSpWxm3DR6cC

Employers can offer employees up to 5 250 annually in student loan repayment benefits tax free through 2025 That provision was included in pandemic relief legislation enacted in 2020 Employers provide student loan repayment assistance programs because they are really good recruiting and retention tool The employer can exclude the LRAP contributions

You don t have to pay taxes on up to 5 250 in annual employer student loan repayment assistance This tax break was introduced in the Coronavirus Aid Relief and The student loan repayment due for the year is calculated from your income in the tax year NOT the amount of debt remaining The calculated repayment amount will be a

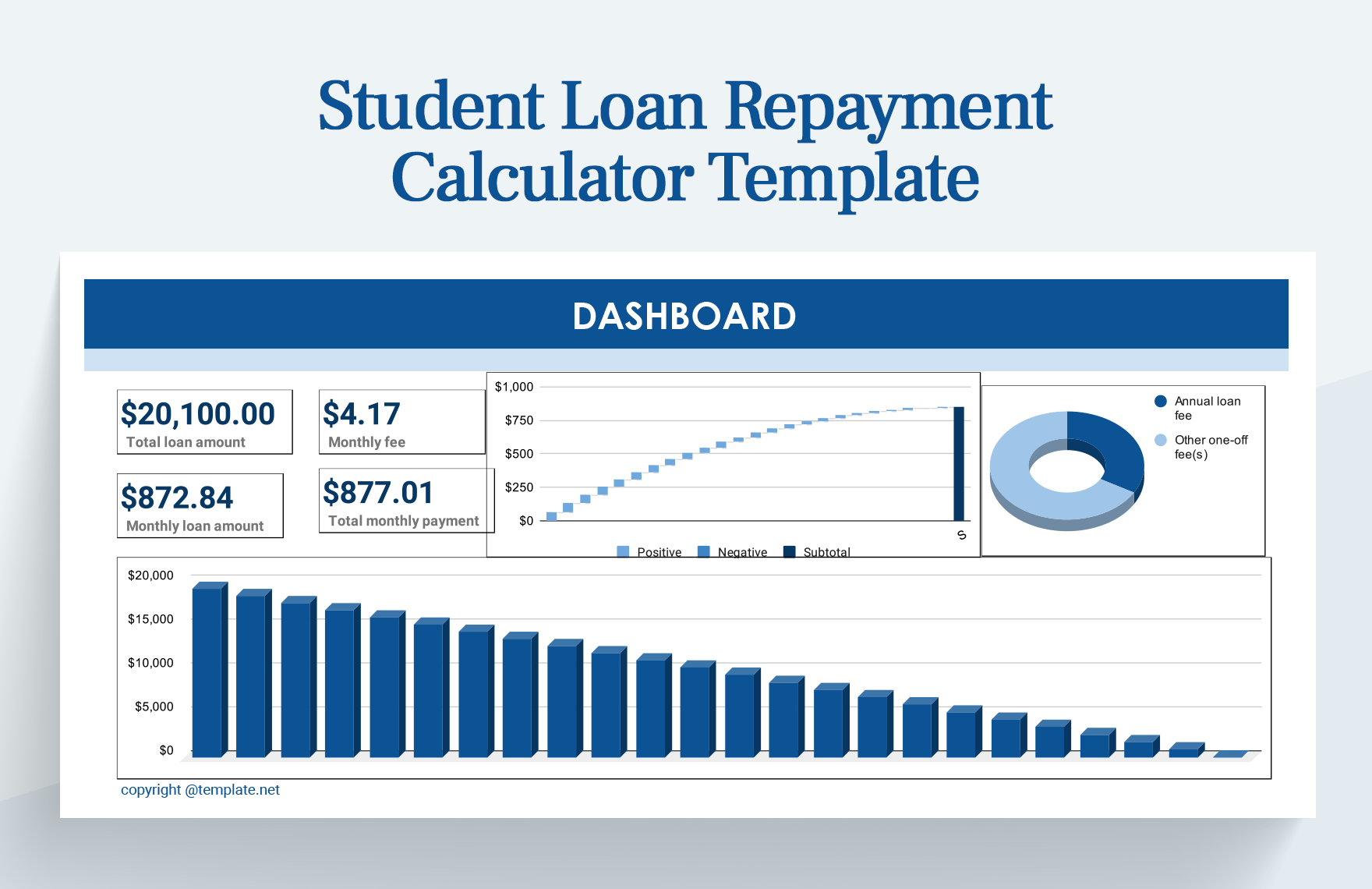

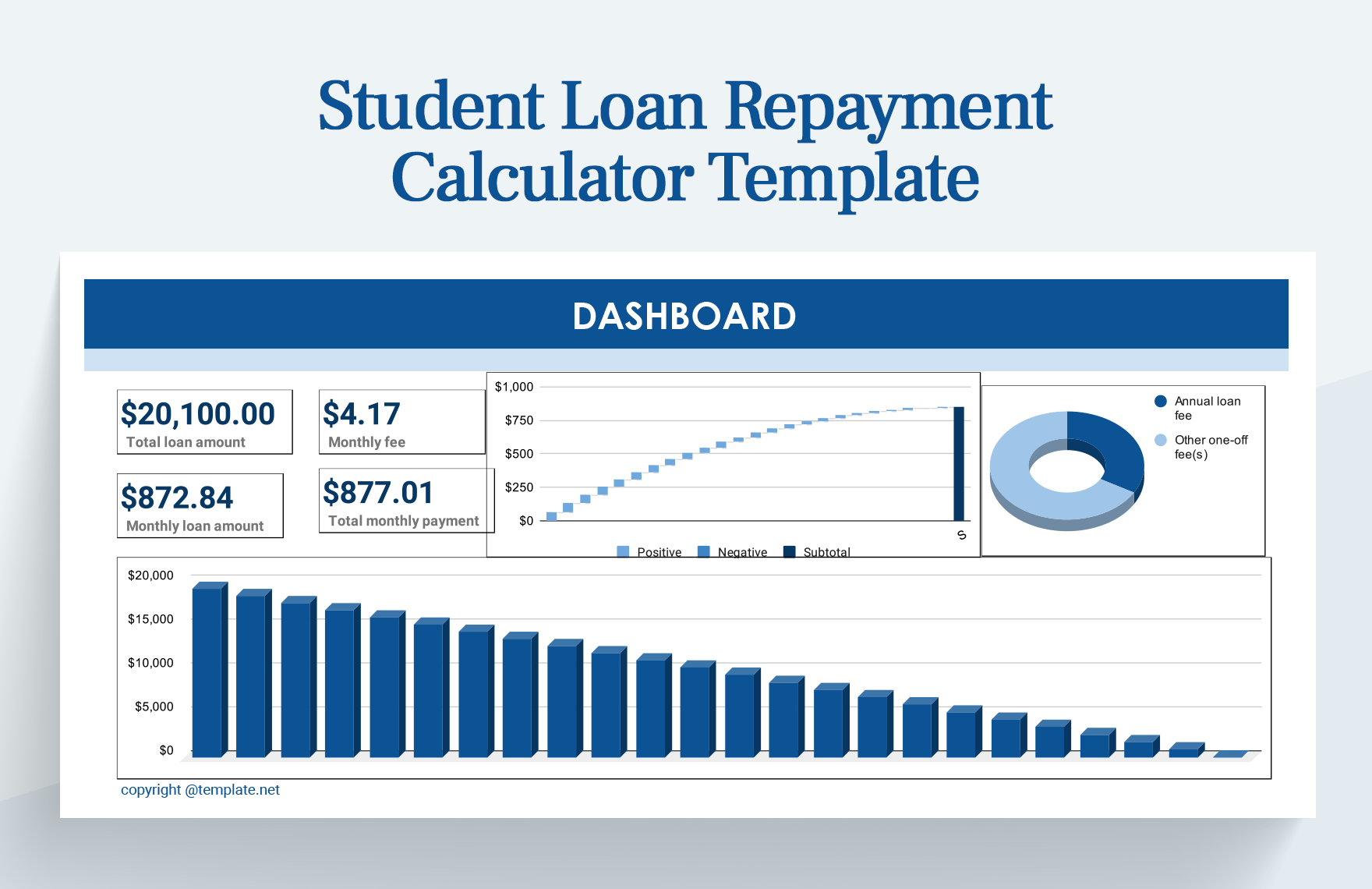

Student Loan Repayment Calculator Selectdolf

https://images.template.net/133620/student-loan-repayment-calculator-template-mn6vr.png

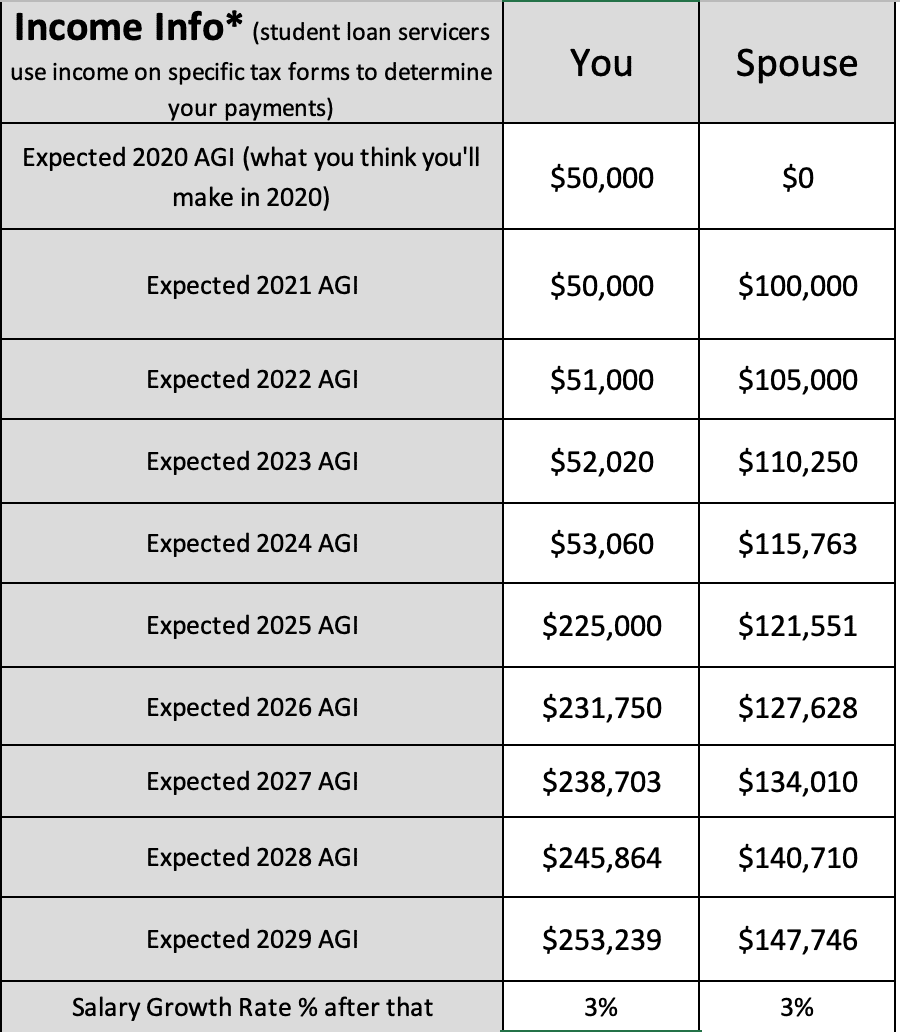

Student Loan Income Based Repayment Calculator Navient EoghainRozaria

https://www.studentloanplanner.com/wp-content/uploads/2021/10/c1f7c2a3-c36d-47c5-895d-36aa0789f8bb_Screen20Shot202021-10-0720at203.23.4220PM.png

https://www.irs.gov/newsroom/reminder-to-employers...

WASHINGTON With the fall college semester quickly approaching the Internal Revenue Service today reminded employers and employees that under federal law employers

https://www.sofi.com/learn/content/stud…

No an employee s student loan repayment benefit from their employer is not taxed as income now through the end of December Thanks to the CARES Act employees can take advantage of up to 5 250 in tax free

PNC Student Loan Rates A Comprehensive 2023 Review

Student Loan Repayment Calculator Selectdolf

SAVE Student Loan Repayment Plan Applications Available How To Apply

How Much Are My Student Loans INFOLEARNERS

.jpg)

What Financial Experts Need You To Know About Nursing Student Loan

Private Student Loans 101 Everything You Need To Know About Interest

Private Student Loans 101 Everything You Need To Know About Interest

Millions Of Students Can Use New Affordable Option To Decrease Their

Repayment Plan Chart Student Loan Borrowers Assistance

Student Loan Repayment Resumes Following Debt Ceiling Deal PelhamPlus

Is Student Loan Repayment By Employer Taxable Income - 4 As of this writing the CARES Act s exclusion from income for employer made student loan repayments is set to expire after 2020 The exclusion is subject to a 5 250 limit