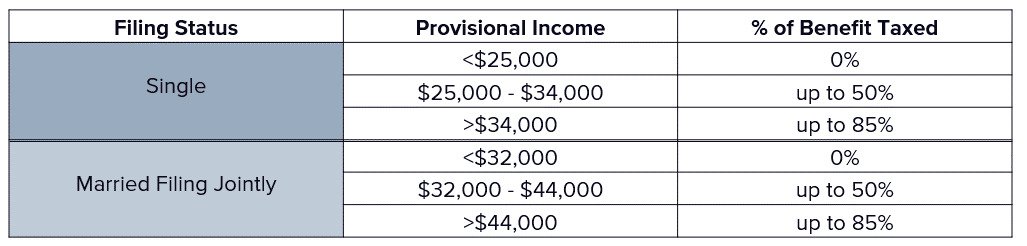

Is Us Social Security Income Taxable In Canada Namely the US social security benefits will be subject to tax only in Canada What this means is that Emily will include in her Canadian taxable income only 85 of the US social security benefits she receives For those of

Under the treaty social security payments are only taxable in the country of residence Therefore for US citizens living in Canada that are currently receiving US social security payments these payments will be taxable only in Income from services performed other than those performed as an employee are taxed in Canada if they are attributable to a permanent establishment in Canada This income is

Is Us Social Security Income Taxable In Canada

Is Us Social Security Income Taxable In Canada

https://www.wealthenhancement.com/cms/delivery/media/MCFMWPXDOK6JBF7BTOD5IE2GD5JY

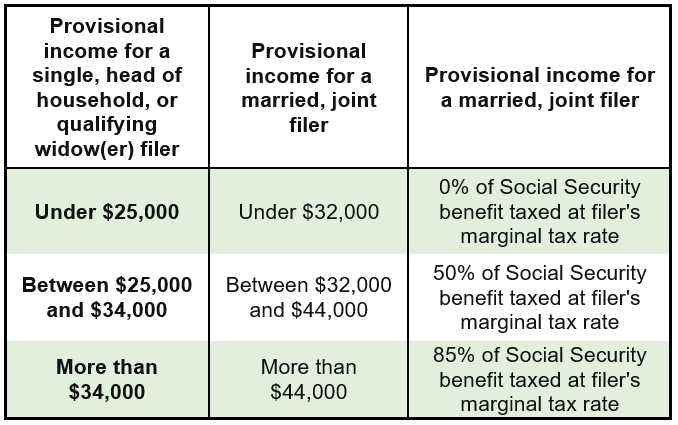

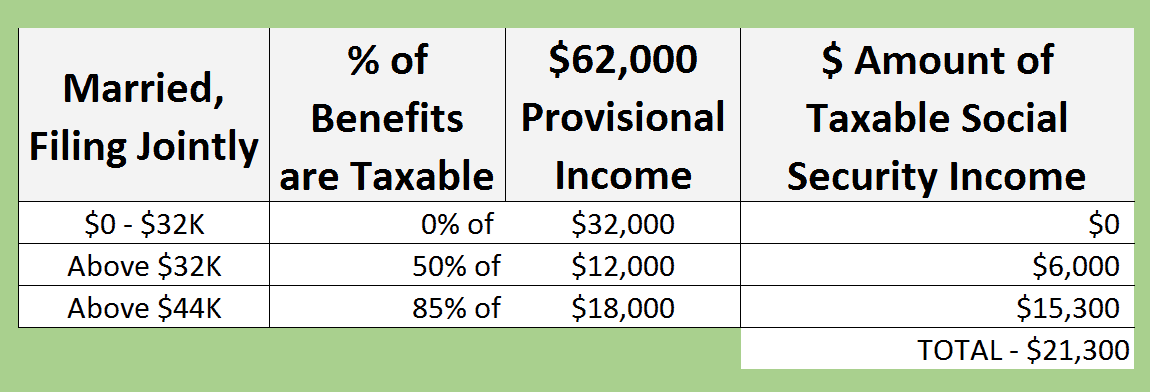

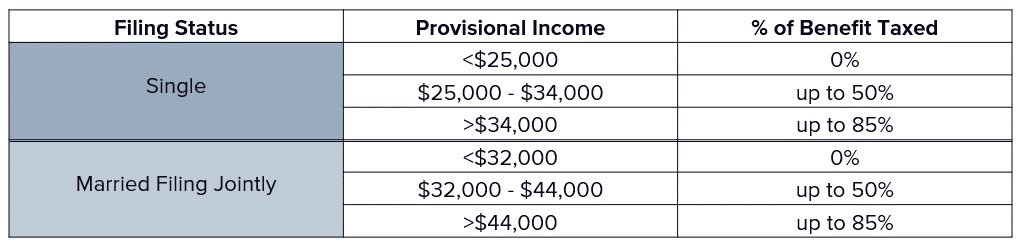

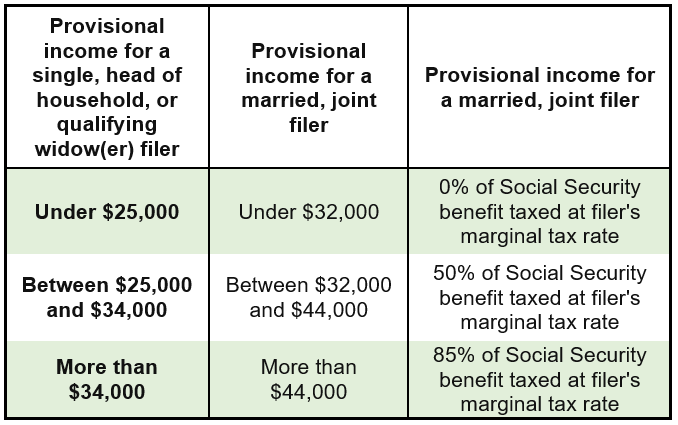

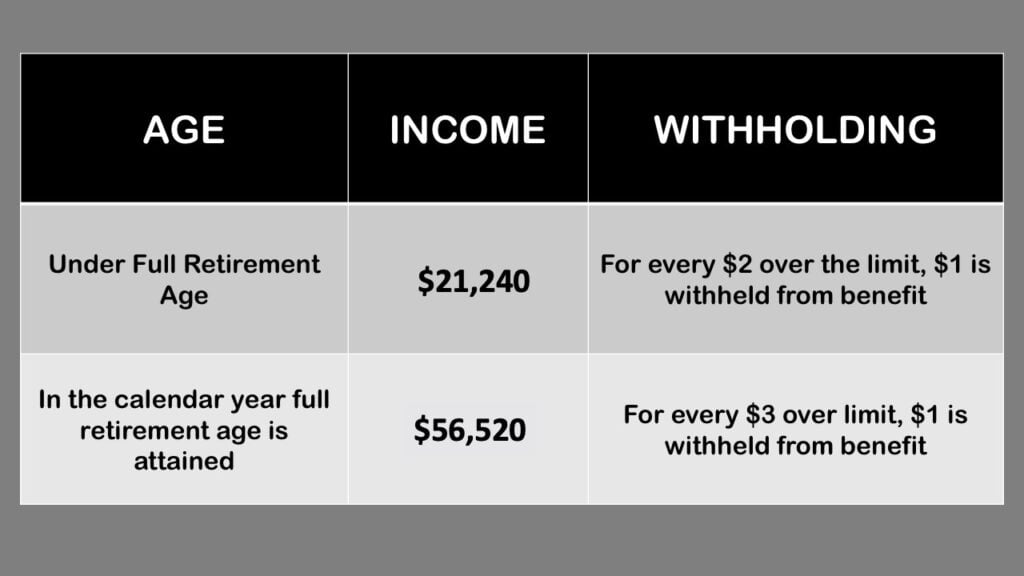

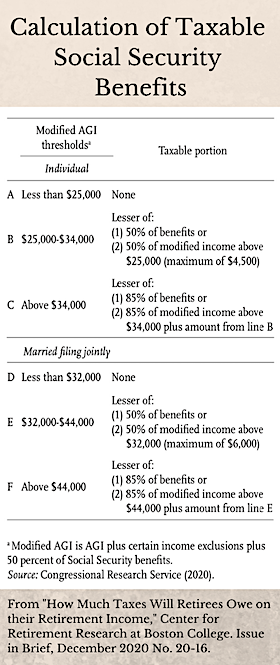

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

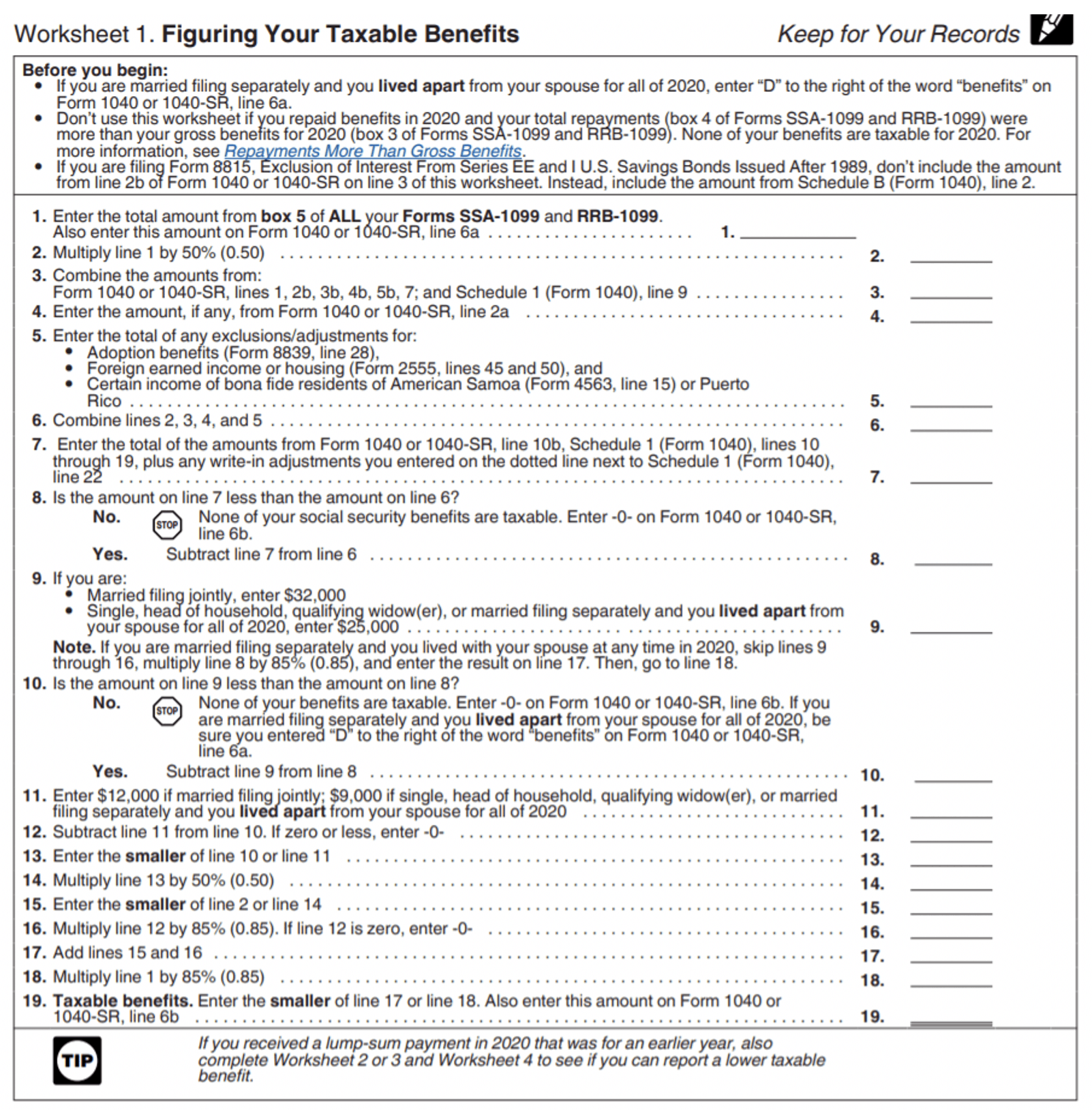

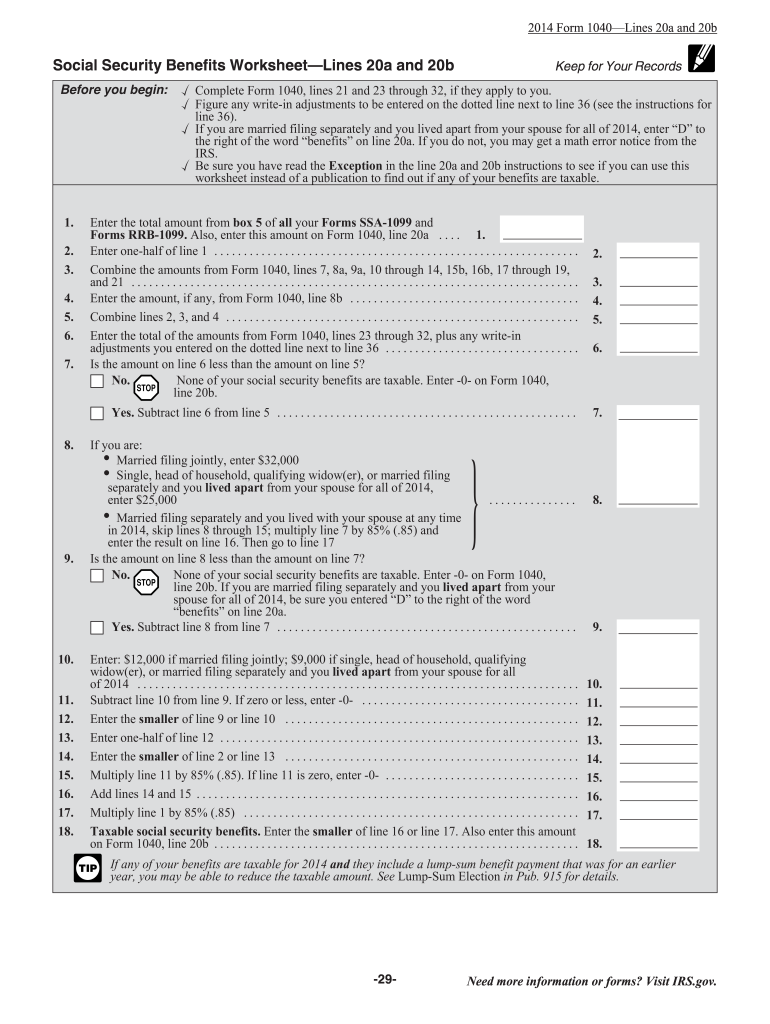

Income Tax Worksheet 2023

https://barberfinancialgroup.com/wp-content/uploads/2021/04/Taxes-on-Retirement-Income-IRS-Publication-915-Worksheet.png

If you re a U S citizen and you receive benefits from a Canadian Pension Plan and the Old Age Security Plan the Internal Revenue Service IRS will treat those benefits the same as U S social security payments for tax In general a portion of US Social Security is taxable in Canada for US Residents in Canada and conversely the US can tax certain social security equivalent payments made by Canada to US residents IRS Summary on Tax Under

Under the Canada United States tax treaty individuals may claim a deduction equal to 20 of their U S Social Security benefits Individuals may claim a deduction equal to 15 of their If you receive a pension from any foreign country including the United States you must include it in your Canadian tax return Due to the tax treaty between the two countries

More picture related to Is Us Social Security Income Taxable In Canada

Social Security Benefit Worksheets 2021

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/percent-of-Social-Security-income-that-is-taxable.png

Social Security Income Limitations YouTube

https://i.ytimg.com/vi/_Vex0vu2Bc8/maxresdefault.jpg

8 Critical Questions To Ask Before Collecting Social Security Income

https://seniordenial.com/wp-content/uploads/2023/07/IMG_1440-scaled.jpg

The Canada U S tax treaty can reduce the withholding tax on Social Security payments to 15 for Canadian residents Social Security benefits must be reported on The U S Canada tax treaty also applies to the Qu bec Pension Plan RRQ Note that the agreement only addresses government issued Social Security benefits not money received

U S social security benefits paid to a resident of Canada are taxed in Canada as if they were benefits under the Canada Pension Plan except that 15 of the amount of the Are reported on Form 1040 U S Individual Income Tax Return or Form 1040A on the line on which U S social security benefits would be reported If the recipient is a U S

Solved 1 What Is Larry s Social Security Taxable Income What Is

https://www.coursehero.com/qa/attachment/35030009/

Taxes On Social Security Benefits Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/11/2022-optima-taxes-social-security.jpg

https://gedeonlawcpa.com › how-canadian-residents...

Namely the US social security benefits will be subject to tax only in Canada What this means is that Emily will include in her Canadian taxable income only 85 of the US social security benefits she receives For those of

https://beaconhillwm.ca › how-are-us-pensions-taxed...

Under the treaty social security payments are only taxable in the country of residence Therefore for US citizens living in Canada that are currently receiving US social security payments these payments will be taxable only in

Foreign Social Security Taxable In Us TaxableSocialSecurity

Solved 1 What Is Larry s Social Security Taxable Income What Is

How Social Security Income Gets Taxed And How You Can Avoid It

Social Security Income Tax Limit 2024 Over 65 Vonny Gabriel

What Is The Maximum Social Security Income And How Do I Get It YouTube

Social Security Taxable Income Worksheet 2021

Social Security Taxable Income Worksheet 2021

Social Security Taxability Worksheets

3 Stocks To Supplement Your Social Security Income The Motley Fool

How To Calculate Your Taxable Income 2023

Is Us Social Security Income Taxable In Canada - U S Social Security If you receive U S Social Security payments you will effectively include only 85 of the payments on your Canadian income tax return However