Returned Check Fee A returned check fee also known as an NSF fee or non sufficient funds fee is charged by your bank or credit union whenever you write a check without enough funds in your account to pay the

A returned check fee is a fee your financial institution charges when you write someone a check but there aren t enough funds in your account to cover it It will be denied when the person tries to deposit or cash your check If your bank credited your account for a check deposited by you that was later returned unpaid for insufficient funds the bank can reverse the funds and may charge a fee

Returned Check Fee

Returned Check Fee

https://media.compliancesigns.com/media/catalog/product/o/s/osha-payment-policies-sign-one-33947_1000.gif

Customer Return And Refund Laws In The U S Free Privacy Policy

https://www.freeprivacypolicy.com/public/uploads/2023/07/return-refund-us-laws.jpg

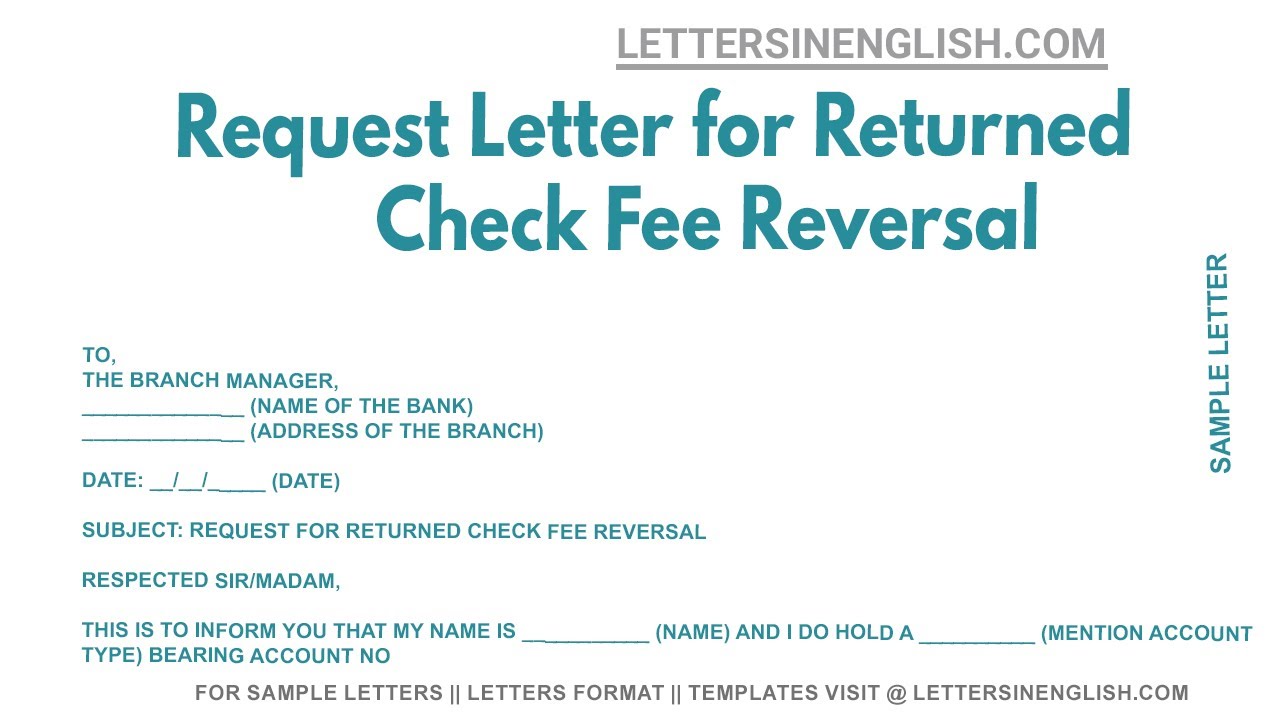

Request Letter For Returned Check Fee Reversal Sample Letter For

https://i.ytimg.com/vi/fmI64jRdh1s/maxresdefault.jpg

A returned check fee is a financial penalty that is charged when a check that you wrote for payment gets returned Here s how to avoid it A returned check fee is a financial penalty charged by a credit card lender or other company when a check you wrote for payment is returned by your bank unpaid This typically happens because your account doesn t have sufficient funds to cover the payment

This guide aims to demystify the concept of returned check fees exploring its causes implications and strategies for avoidance By automating your understanding of this financial phenomenon you can save time improve your financial A return check fee also known as a bounced check fee is a charge levied by a bank or a merchant when a check cannot be processed due to insufficient funds in the issuer s account or other reasons preventing the transaction

More picture related to Returned Check Fee

25 Charge For Returned Checks Sign NHE 17959 Payment Policies

https://www.compliancesigns.com/media/catalog/product/p/a/payment-policies-sign-nhep-17959_1000.gif

Welcome To Shelby County Returned Check Collection System Regarding

https://i.pinimg.com/736x/95/01/fb/9501fb30369389d561cfb93858e46f09.jpg

Please Note Fee Of 20 For All Returned Checks Signs SKU SE 5753

https://images.mydoorsign.com/img/lg/S/fee-for-returned-checks-sign-se-5753.png

A bounced check is returned or bounced to its original bank because the money is not in the check writer s account to process it This can lead to several fees and probably some headaches A returned check fee also called a bounced check fee is a cost that must be paid when a payment made by check can t go through or bounces Writing a bad check can cost anywhere between 35 to 70

[desc-10] [desc-11]

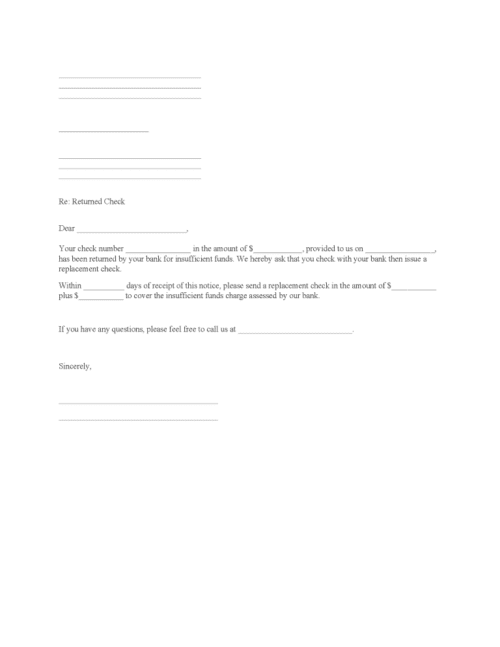

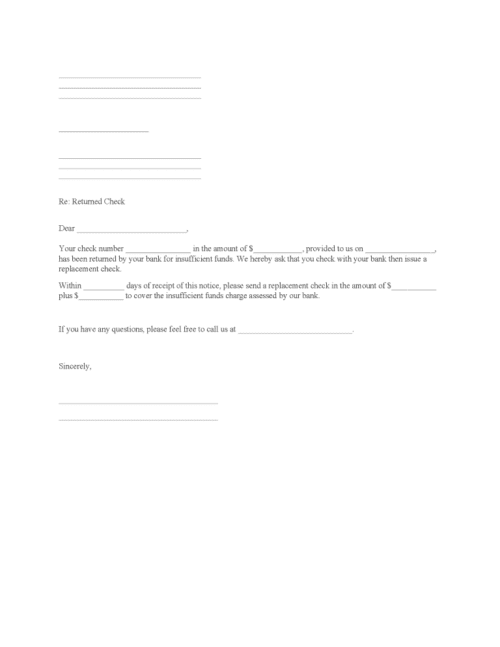

Sample Returned Check Letter To Customer

https://www.freeprintablelegalforms.com/wp-content/uploads/2021/11/Notice-of-Returned-Check-Form-Word-500x647.png

There Is Service Fee Charge For All Returned Checks Portrait Wall Sign

https://cdn11.bigcommerce.com/s-10c6f/images/stencil/640w/products/79352/154753/WS264628__74436.1651614840.jpg?c=2

https://www.forbes.com/advisor/banking/returned...

A returned check fee also known as an NSF fee or non sufficient funds fee is charged by your bank or credit union whenever you write a check without enough funds in your account to pay the

https://www.chime.com/blog/what-is-a-return-check-fee

A returned check fee is a fee your financial institution charges when you write someone a check but there aren t enough funds in your account to cover it It will be denied when the person tries to deposit or cash your check

Eliminate Offline Payments

Sample Returned Check Letter To Customer

5in X 3 5in Notice There Will Be A Fee On All Returned Checks Magnet

Bad Check Letter Template Resume Letter

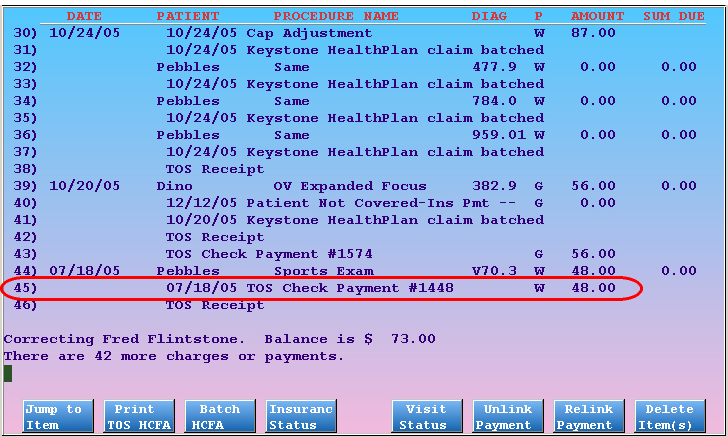

Bounced Checks And Fees PCC Learn

RETURNED CHECK FEE 50 Spicher And Company

RETURNED CHECK FEE 50 Spicher And Company

Post A Returned Check Or Other Payment Reversal PCC Learn

A 25 Service Charge For Returned Checks Sign EGRE 17993 BLKonCSHW

Bounced Check Letter Template Resume Letter

Returned Check Fee - This guide aims to demystify the concept of returned check fees exploring its causes implications and strategies for avoidance By automating your understanding of this financial phenomenon you can save time improve your financial