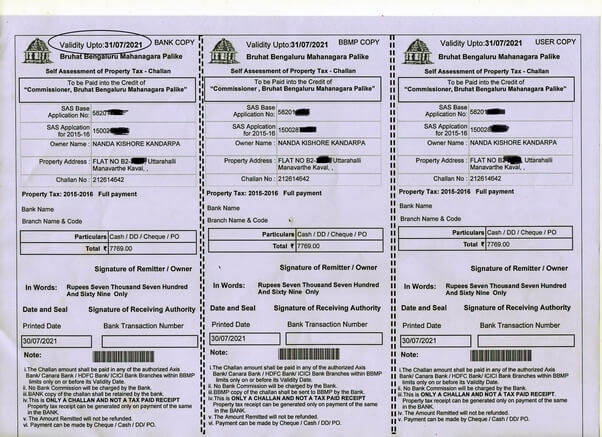

Self Assessment Of Property Tax Challan Direct tax payments facility have been migrated from OLTAS e payment Pay Taxes Online to e Pay Tax facility of E Filing portal Users are advised to navigate to e Pay Tax portal of Income

Right now you can make the payment towards your property tax if you already paid the property tax at least once by using your SAS BASE APPLICATION NUMBER or PID NUMBER Users can do self assessment of property tax for BBMP area The service is provided by Bruhat Bengaluru Mahanagara Palike BBMP Karnataka E Sweekruthi is a citizen service offered

Self Assessment Of Property Tax Challan

Self Assessment Of Property Tax Challan

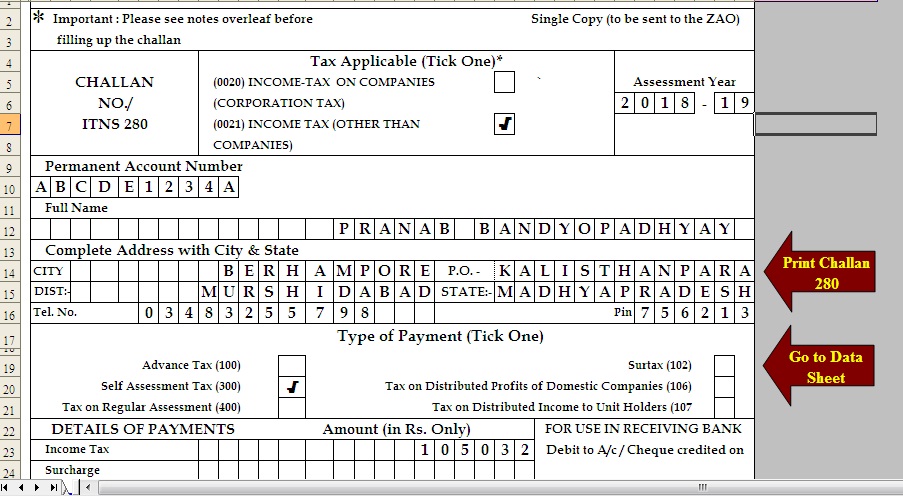

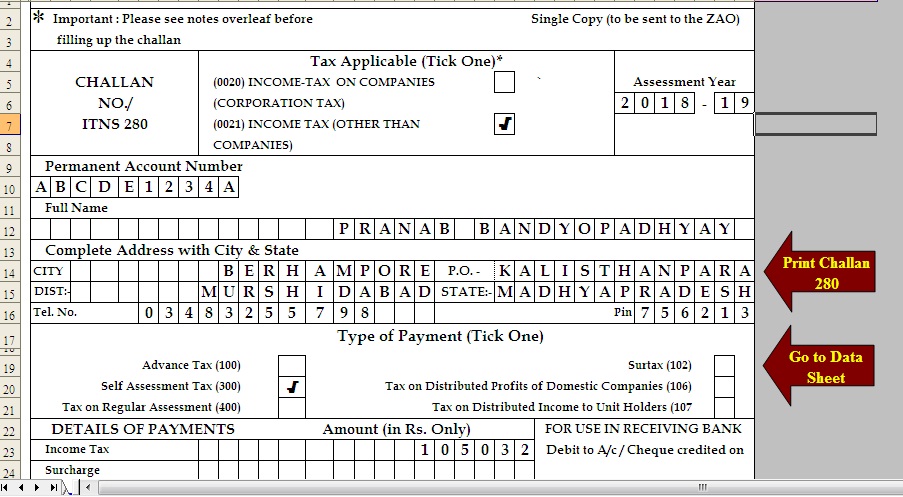

https://1.bp.blogspot.com/-Dso---1Zpq8/XU2SOVgUhHI/AAAAAAAAKCY/ISvYWEFN1a4_oI2THWVEu7rsnxheetNWACLcBGAs/s1600/Picture%2B2%2Bof%2BITNS%2B280.jpg

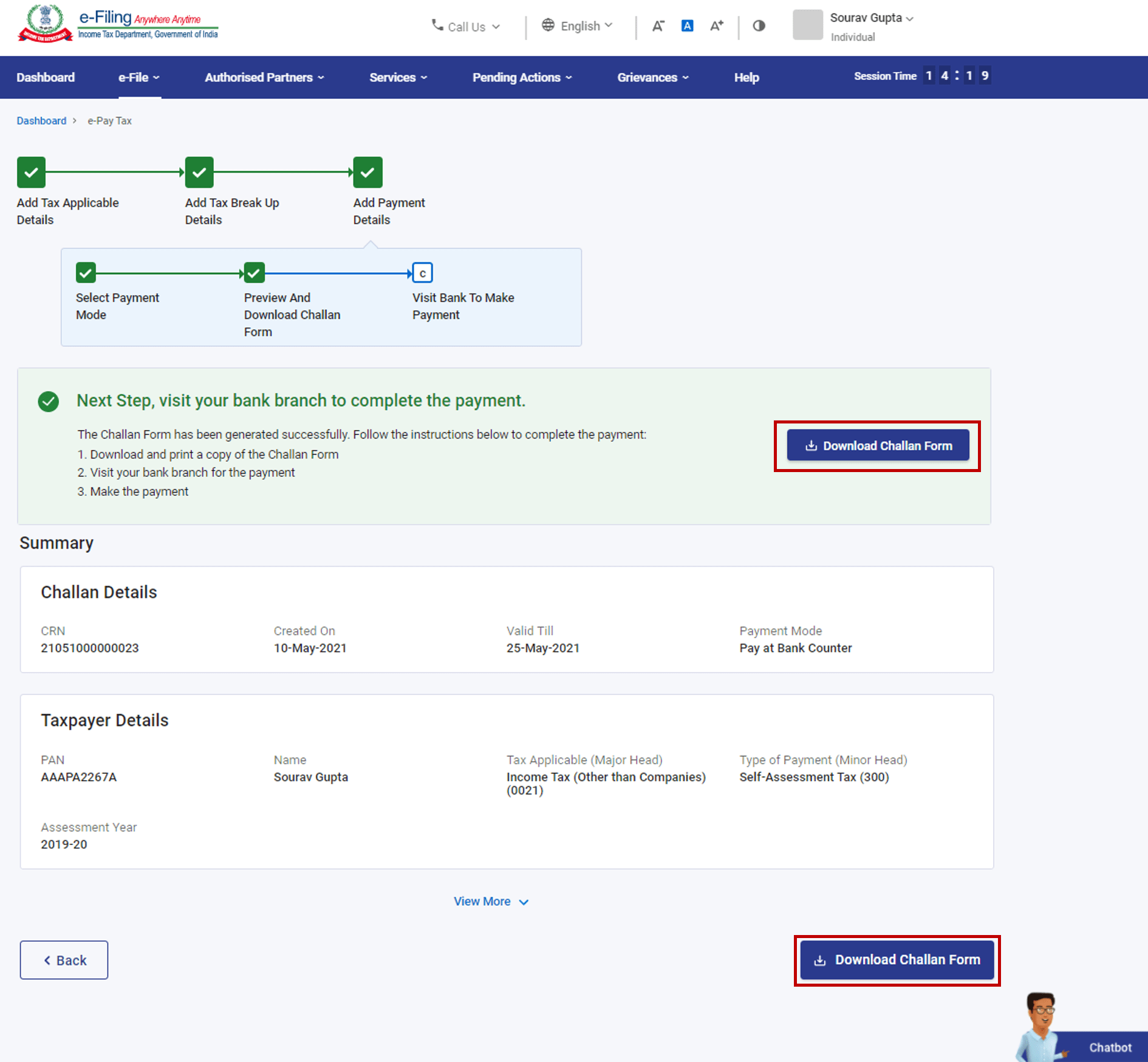

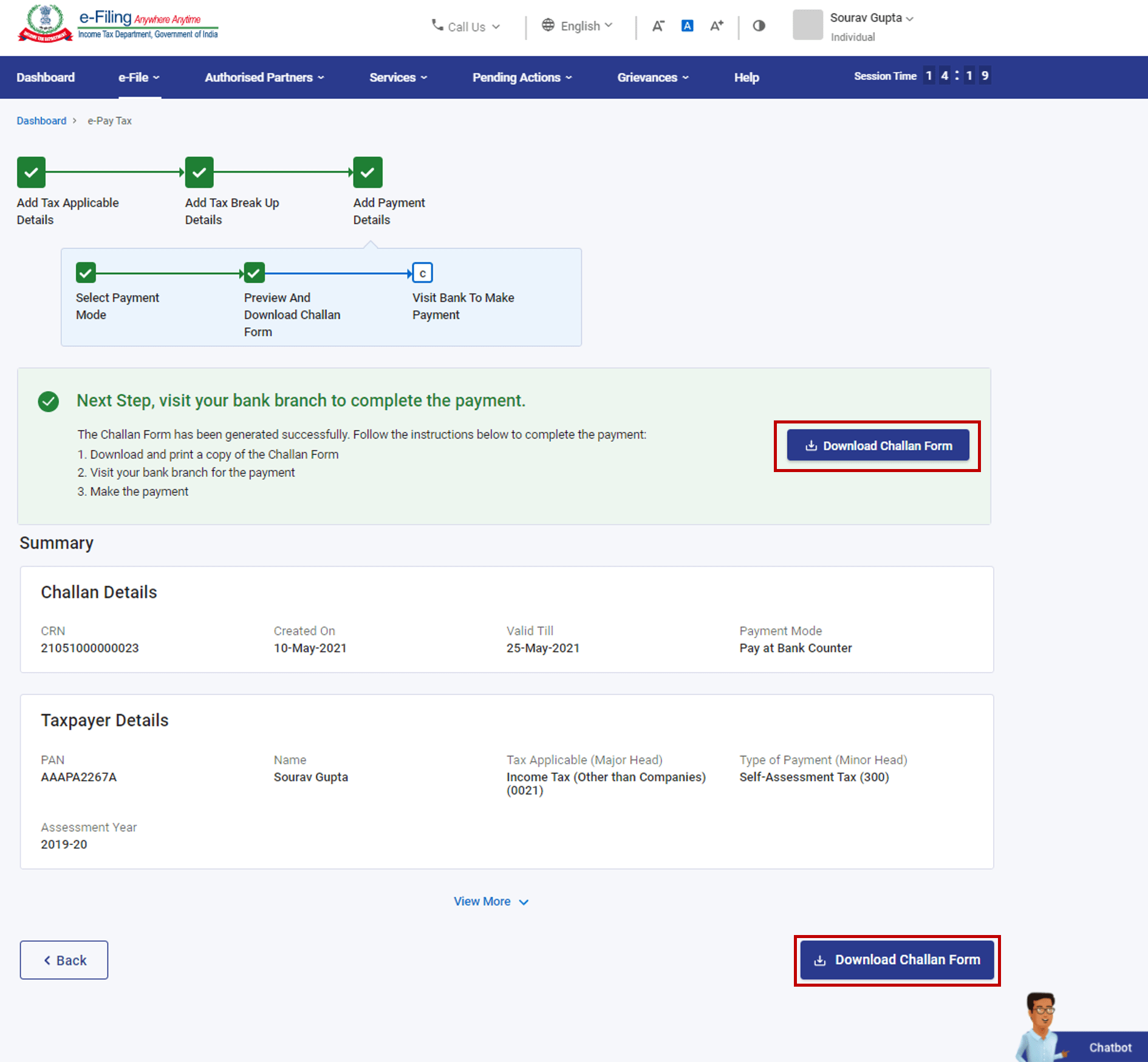

Create Challan Form Crn User Manual Income Tax Department SexiezPicz

https://www.incometax.gov.in/iec/foportal/sites/default/files/inline-images/3.1. Step 7 c c_0.png

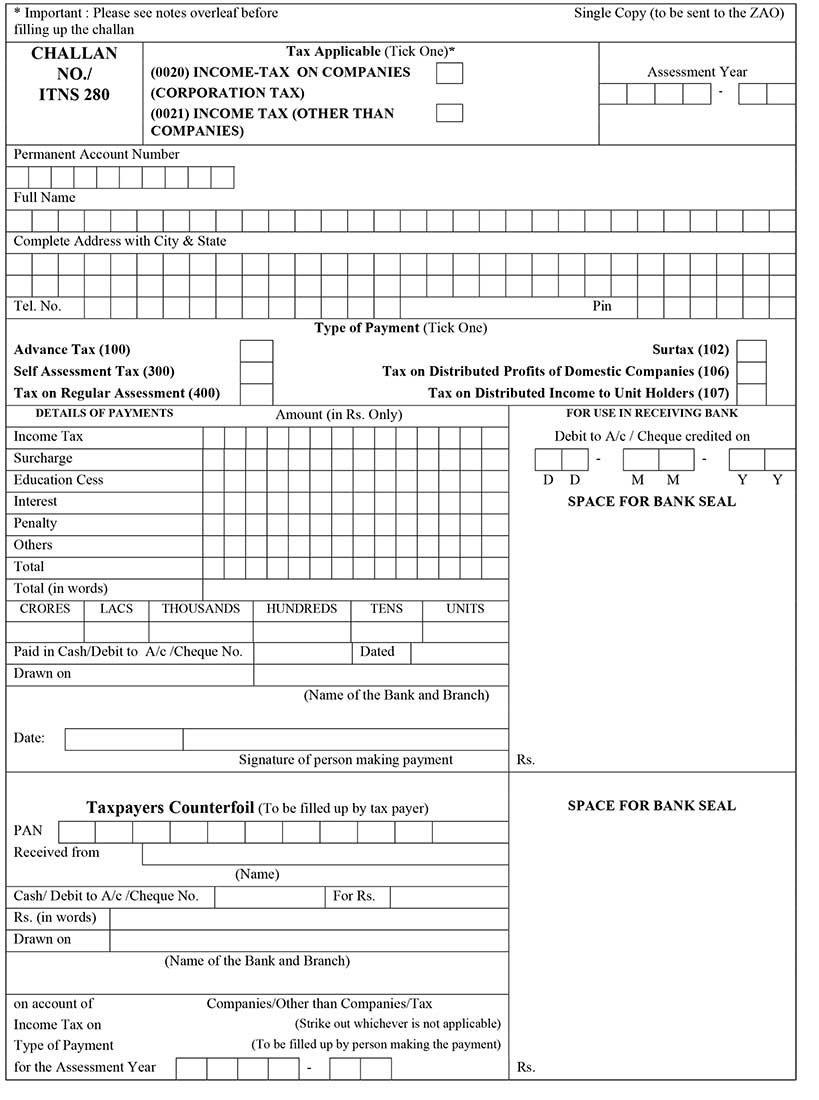

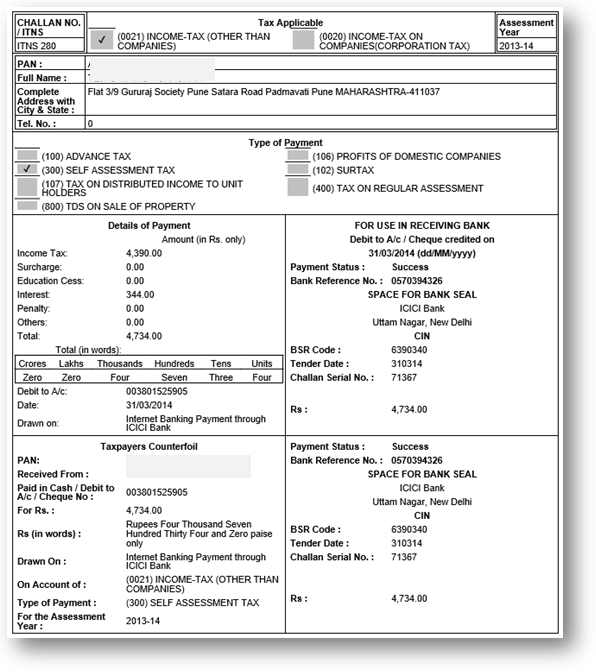

Challan 280 Payment Of Income Tax

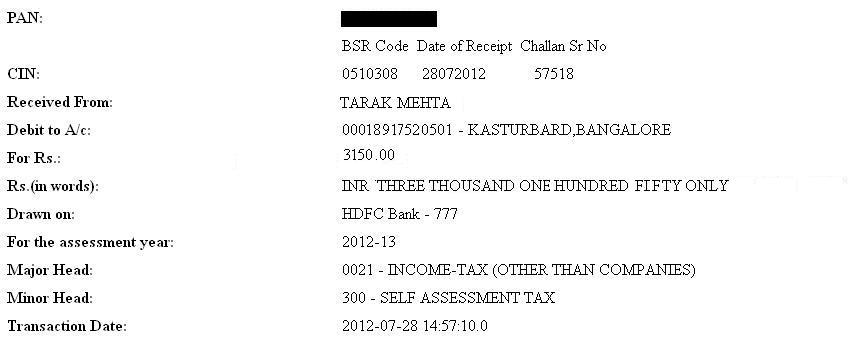

http://bemoneyaware.com/wp-content/uploads/2012/07/self-assessment.jpg

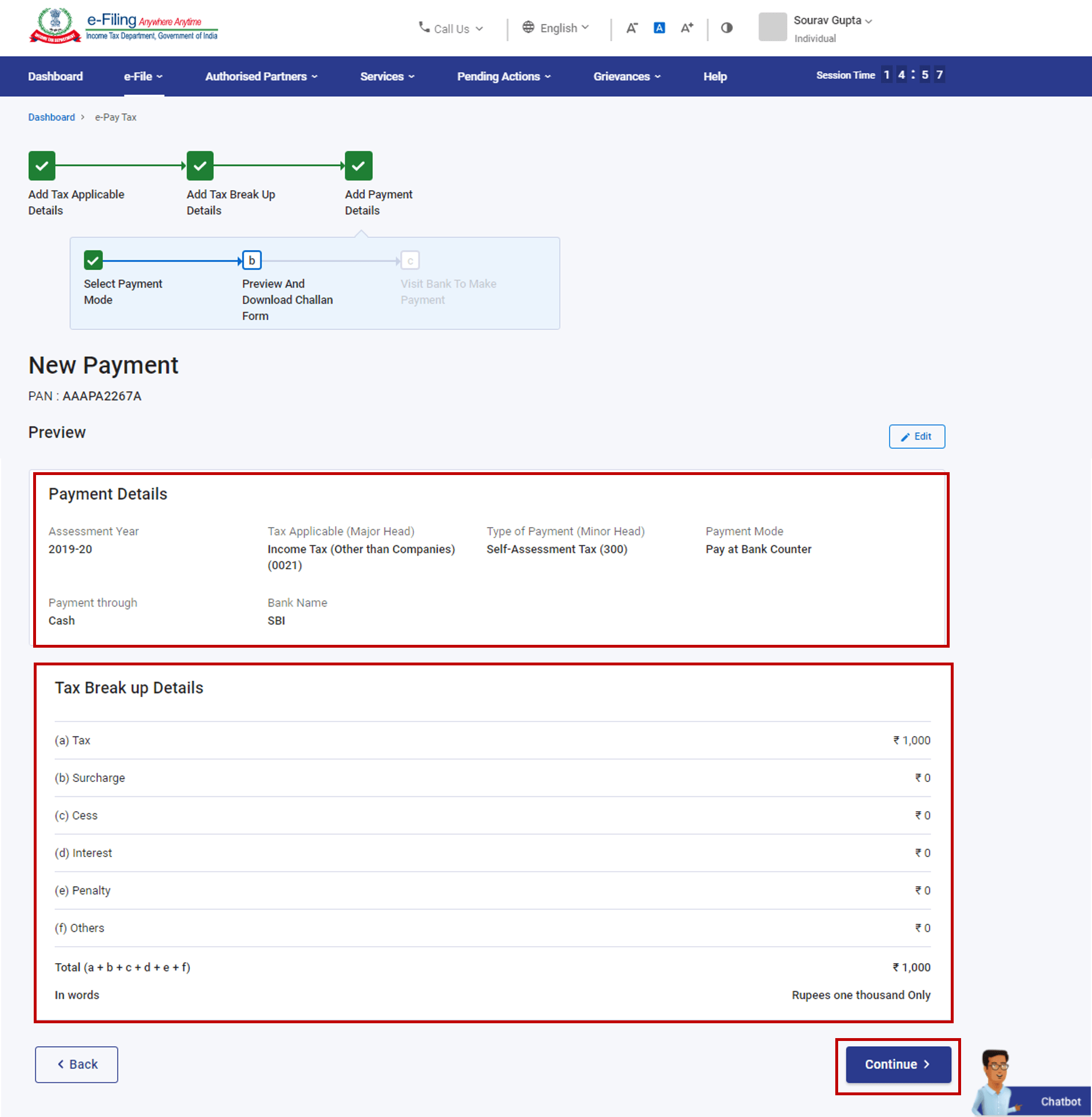

With this service you will be able to generate a Challan Form CRN and subsequently make a tax payment through e Pay Tax service for a selected Assessment Year and type of tax Payment made in bank and payment status Validity expired Awaiting clearance Challan related issues only Discrepancy in Receipts issues related to Name and other related queries Find

Procedure for Self Assessment of Property Tax Step 1 Log on to www nkdamar and click on Assessment and Payment of Property Tax Step 2 After checking all necessary details and information click on Apply for Self The term self assessment of property tax means any pending tax liability at the end of the financial year after calculating total taxable income and reducing deductions and taxes paid Before filing ITR in India the taxpayer

More picture related to Self Assessment Of Property Tax Challan

How To Download Property Tax Challan Form PT 10 Yourself Online

https://i.ytimg.com/vi/dGrnXdp2CBI/maxresdefault.jpg

How To Do Self Assessment Of Property Tax In GHMC YouTube

https://i.ytimg.com/vi/hLxTYVXNh-0/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4EgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLCNjQ3ZFEJznzlgQBY5HQ8tsU2aLQ

Online Self Assessment Tax Income Tax Challan Correction How To

https://i.ytimg.com/vi/Ih9fnPNold0/maxresdefault.jpg

By following these steps you can efficiently generate a challan for Tax on Immovable Property through the FBR s IRIS portal and fulfill your tax obligations Tagged In Get various Income Tax IT challans provided by Income Tax Department Department of Revenue Users can download challans for depositing advance tax self assessment tax tax

Procedure for Self Assessment and Payment Step 1 Log on to www nkdamar and click on Assessment and Payment of Property Tax Step 2 After checking all necessary details and With this service you will be able to generate a Challan Form CRN and subsequently make a tax payment for a selected Assessment Year and type of tax payment Minor Head Users for

Regular Assessment Tax Challan

https://help.myitreturn.com/hc/article_attachments/16032803999641

Advance Tax Challan Download In Excel Format

https://www.bankbazaar.com/images/india/infographic/challan-280-form-image.png

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Direct tax payments facility have been migrated from OLTAS e payment Pay Taxes Online to e Pay Tax facility of E Filing portal Users are advised to navigate to e Pay Tax portal of Income

https://bbmptax.karnataka.gov.in/Forms/Forms.aspx

Right now you can make the payment towards your property tax if you already paid the property tax at least once by using your SAS BASE APPLICATION NUMBER or PID NUMBER

Self assessment Of Property Tax Picks Up In Telangana

Regular Assessment Tax Challan

How Do I Pay The BBMP Property Tax Through Challan

Download Challan Receipt Income Tax

Advance Tax Challan Download In Excel Format

Service Tax Payment Challan Download

Service Tax Payment Challan Download

Create Challan Form CRN User Manual Income Tax Department

How To Download Tax Challan

Regular Assessment Tax Challan

Self Assessment Of Property Tax Challan - After logging in to your account click on Challan Status under Statements Payments menu You can search for a challan by entering challan details You can also view challan