Social Security Spousal Benefits Only if your spouse is not yet receiving retirement benefits In this case you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files Social Security will not pay the sum of your retirement and spousal benefits you ll get a payment equal to the higher of the two benefits

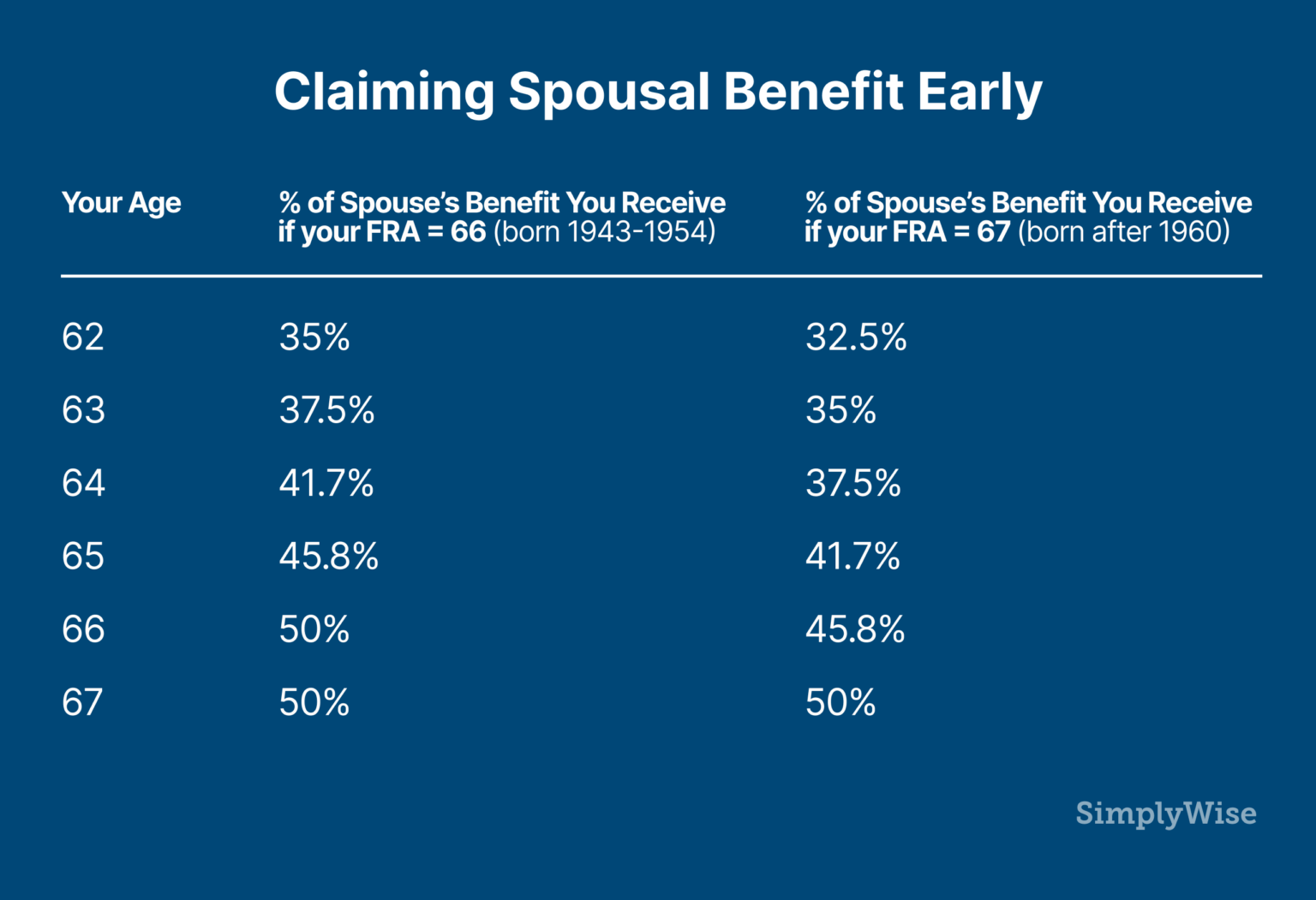

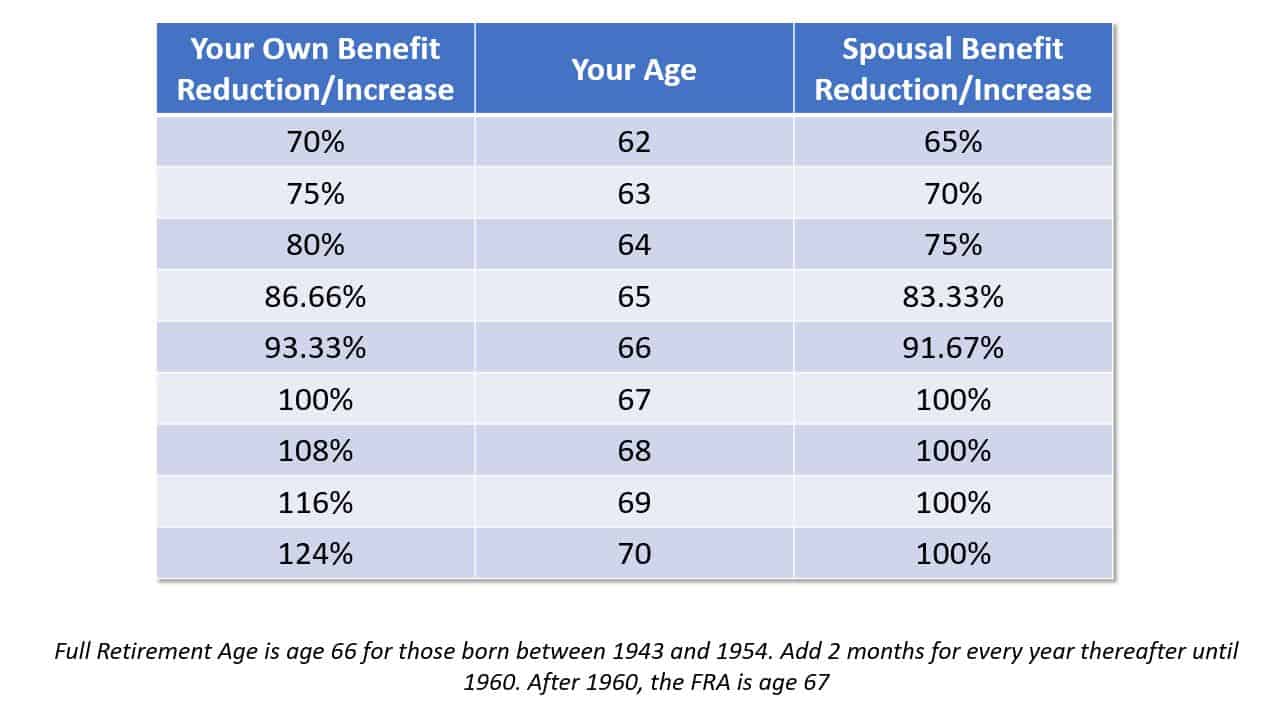

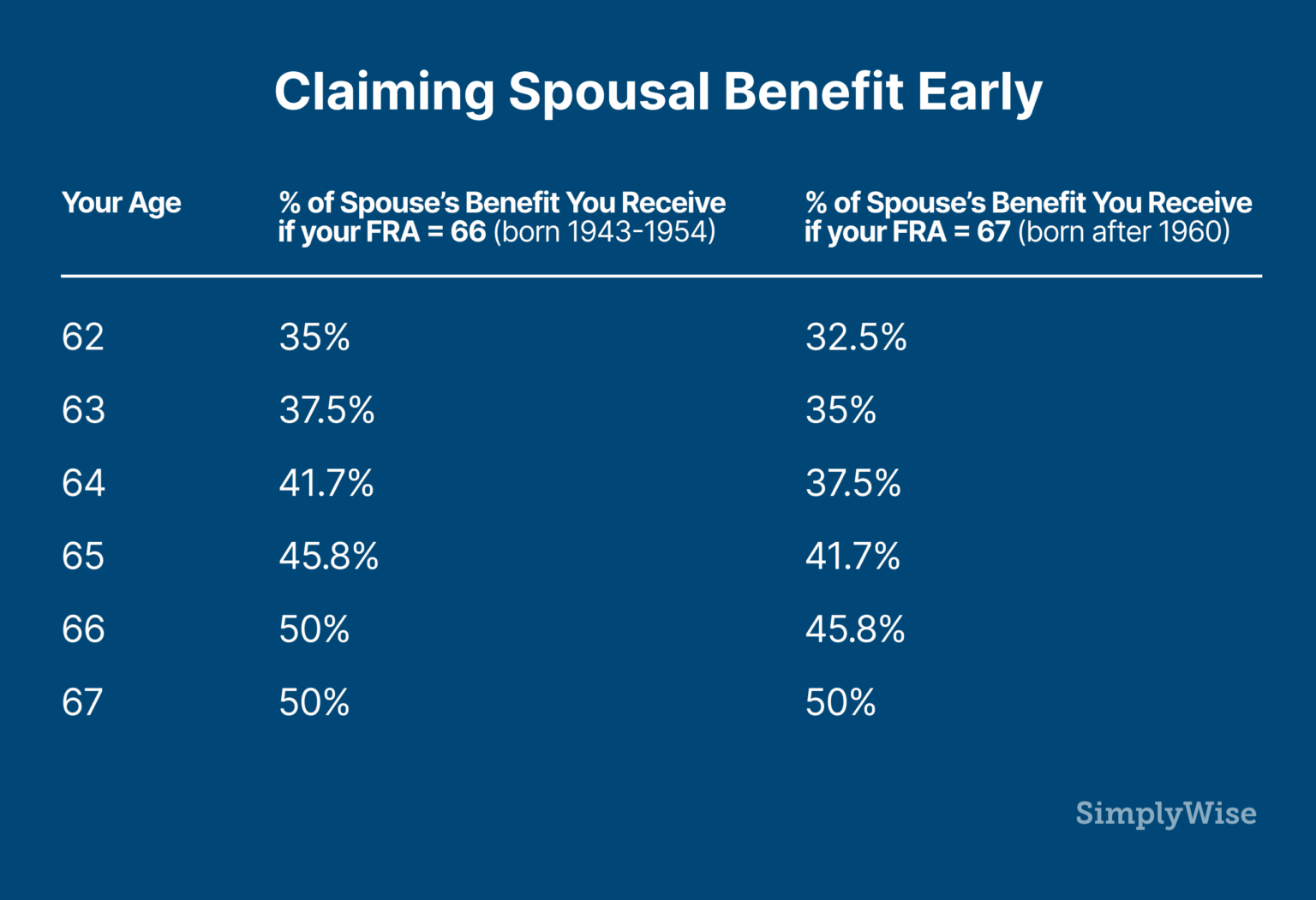

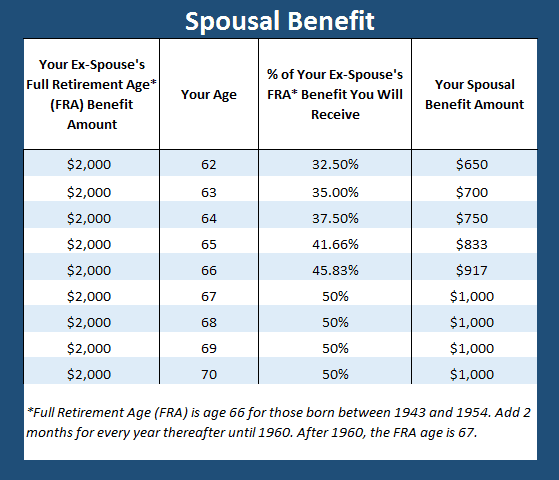

With this method one spouse typically the higher earner in the house filed for Social Security at FRA the age when you can claim 100 percent of the benefit calculated from your earnings history The other partner would then claim spousal benefits which can be up to 50 percent of their mate s full benefit amount If you were already receiving spousal benefits on the deceased s work record Social Security will in most cases switch you automatically to survivor benefits when the death is reported Otherwise you will need to apply for survivor benefits by calling the Social Security Administration SSA at 800 772 1213 or contacting your local Social Security office

Social Security Spousal Benefits

Social Security Spousal Benefits

https://i.pinimg.com/originals/b2/0c/10/b20c109a50578e9b901af3097d509dc3.png

The 2020 Guide To Social Security Spousal Benefits SimplyWise

https://www.simplywise.com/blog/wp-content/uploads/2023/06/Claiming-Spousal-benefits-early-1536x1051.png

/how-the-the-social-security-spouse-benefit-works-2388924-Final-454c6b7b12a44930bd8ab9c5d81a6102-f04fe2b6d5224161bcd1dbb434e494ca.png)

Social Security Spousal Benefits What You Need To Know

https://www.thebalance.com/thmb/cmtV6AdtvchwGRW41c64dZOyrME=/3000x2000/filters:fill(auto,1)/how-the-the-social-security-spouse-benefit-works-2388924-Final-454c6b7b12a44930bd8ab9c5d81a6102-f04fe2b6d5224161bcd1dbb434e494ca.png

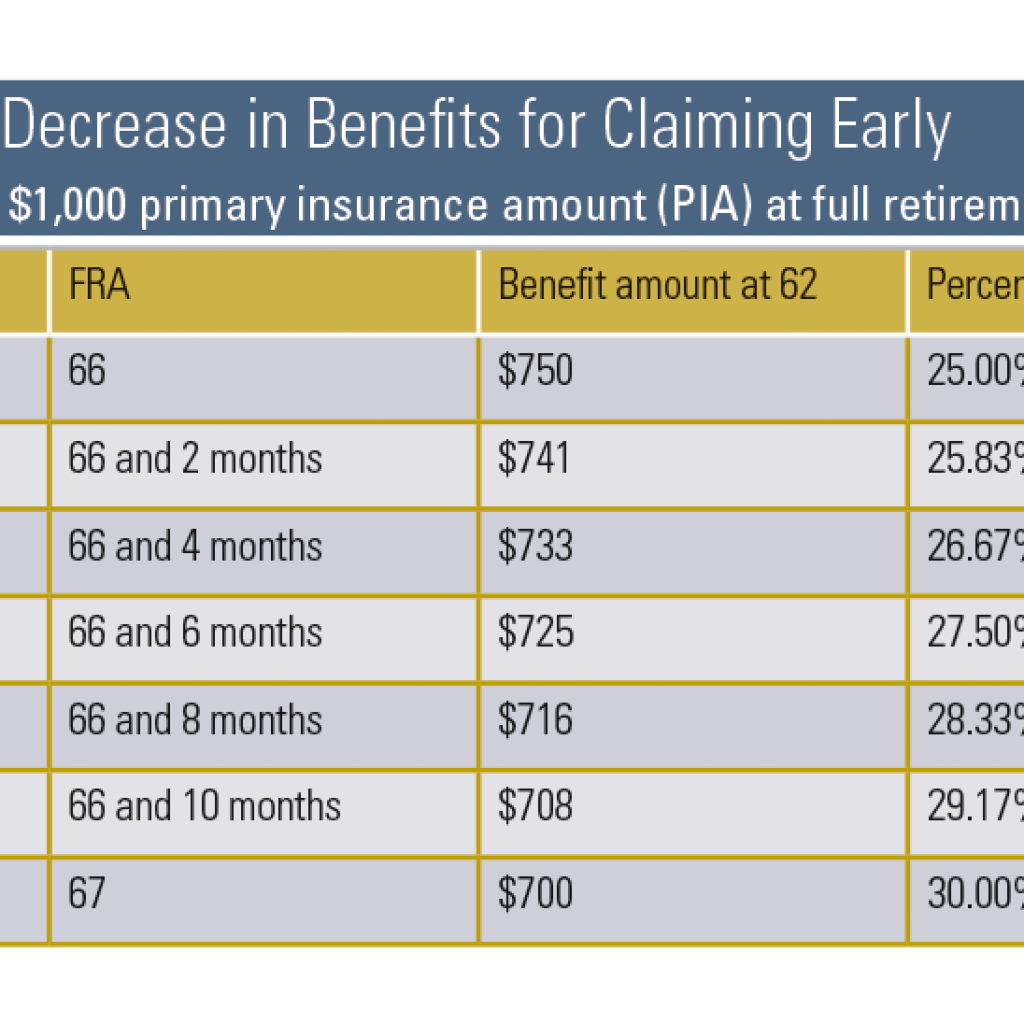

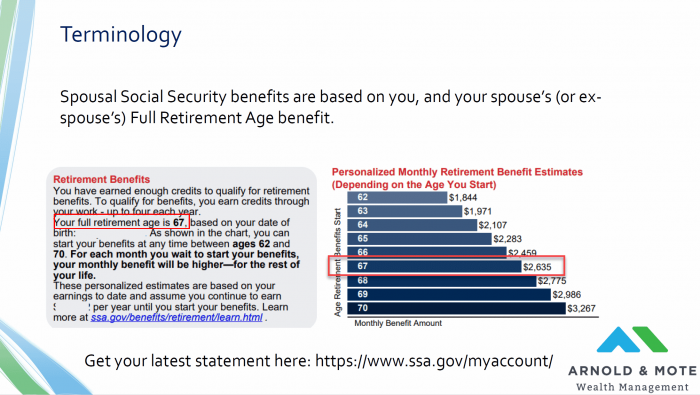

In this case survivor benefits will typically be based on the late spouse s full retirement benefit the amount they would have been entitled to collect from Social Security had they filed at full retirement age or FRA 66 and 8 months for people born in 1958 and incrementally rising to 67 for those born in 1960 or later Your monthly retirement benefit depends on how much you ve earned over your lifetime at jobs including self employment for which you paid Social Security taxes The Social Security Administration SSA includes your 35 highest earning years adjusted for historical wage growth in its benefit calculation

Yes you can collect both Social Security spousal benefits and a government pension without one affecting the other Until recently that wasn t the case A Social Security rule called the Government Pension Offset GPO could reduce your spousal benefits if your pension is from a non covered government job in which the FICA taxes that largely fund Social You can file for any type of Social Security benefit by phone at 800 772 1213 or in person at your local Social Security office call ahead to book an appointment For retirement benefits spousal benefits and Social Security Disability Insurance SSDI you can also apply online in which case it helps to have a My Social Security account

More picture related to Social Security Spousal Benefits

Spousal Benefits Social Security Vets Disability Guide

https://www.vetsdisabilityguide.com/wp-content/uploads/2020/11/Spousal-Benefits-and-Social-Security--1024x576.jpg

Social Security Survivor Benefits Trending US

https://i.pinimg.com/originals/e4/1f/6d/e41f6d32e28afd39cc4a557f2a31aced.png

Social Security Spousal Benefits What You Need To Know

http://socialsecurityintelligence.com/wp-content/uploads/2017/05/spousalbenefitsreductionvsyourown.jpg

Here are some of the basics of spousal benefits In most cases you must be at least 62 to claim them and you and your mate must have been married for at least a year You can t collect them unless your spouse is already receiving Social Security If your spouse is getting their own benefit you would be what Social Security calls dually Under Social Security s deemed filing rule you can t separately claim retirement and spousal benefits When you apply for one you re applying for the other if you re eligible Social Security will pay you whichever benefit amount is higher

[desc-10] [desc-11]

Social Security Spousal Benefits The Easy Guide YouTube

https://i.ytimg.com/vi/avRagH2SqZA/maxresdefault.jpg

How Does Social Security Spousal Benefit Work

https://memphisdivorce.com/wp-content/uploads/2019/06/ss-chart1-1024x1024.png

https://www.aarp.org › ... › questions-answers › switch-social-security-sp…

Only if your spouse is not yet receiving retirement benefits In this case you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files Social Security will not pay the sum of your retirement and spousal benefits you ll get a payment equal to the higher of the two benefits

https://www.aarp.org › retirement › social-security › benefits-couple-strat…

With this method one spouse typically the higher earner in the house filed for Social Security at FRA the age when you can claim 100 percent of the benefit calculated from your earnings history The other partner would then claim spousal benefits which can be up to 50 percent of their mate s full benefit amount

SOCIAL SECURITY SPOUSAL DEATH BENEFITS MAXIMIZING BENEFITS WITH

Social Security Spousal Benefits The Easy Guide YouTube

Social Security Spousal Benefits That Couples Should Know About

Calculating Social Security Spousal Benefits With Dual Entitlement

Social Security And Divorce What Women Need To Know Social Security

Social Security Spousal Benefits YouTube

Social Security Spousal Benefits YouTube

Social Security Spousal Benefits 2021 Inflation Protection

Social Security Benefits For Spouses Military

Spousal Social Security Benefits Strategies To Maximize Your Benefits

Social Security Spousal Benefits - Yes you can collect both Social Security spousal benefits and a government pension without one affecting the other Until recently that wasn t the case A Social Security rule called the Government Pension Offset GPO could reduce your spousal benefits if your pension is from a non covered government job in which the FICA taxes that largely fund Social