Social Security Tax Income Limit 2024 If your Social Security income is taxable depends on your income from other sources Here are the 2024 IRS limits

For 2024 the Social Security tax limit is 168 600 Last year the tax limit was 160 200 So if you earned more than 160 200 this last year you didn t have to pay the Social Security Only the Social Security tax has a wage base limit The wage base limit is the maximum wage that s subject to the tax for that year For earnings in 2024 this base is 168 600

Social Security Tax Income Limit 2024

Social Security Tax Income Limit 2024

https://matricbseb.com/wp-content/uploads/2023/11/Social-Security-Tax-Limit-2024-All-You-Need-to-Know-About-Tax-Limit-on-Social-Security-in-2024-1024x683.jpg

Social Security Tax Limit 2024 What Is It And Everything You Need To

https://www.contentcreatorscoalition.org/wp-content/uploads/2023/11/Social-Security-Tax-Limit-2024-What-is-It-and-Everything-You-Need-to-Know-1024x683.jpg

Social Security Tax Limit 2024 Know Rate Earnings Benefits

https://www.nalandaopenuniversity.com/wp-content/uploads/2024/01/SOCIAL-SECURITY-TAX-LIMIT-2024-1024x683.jpg

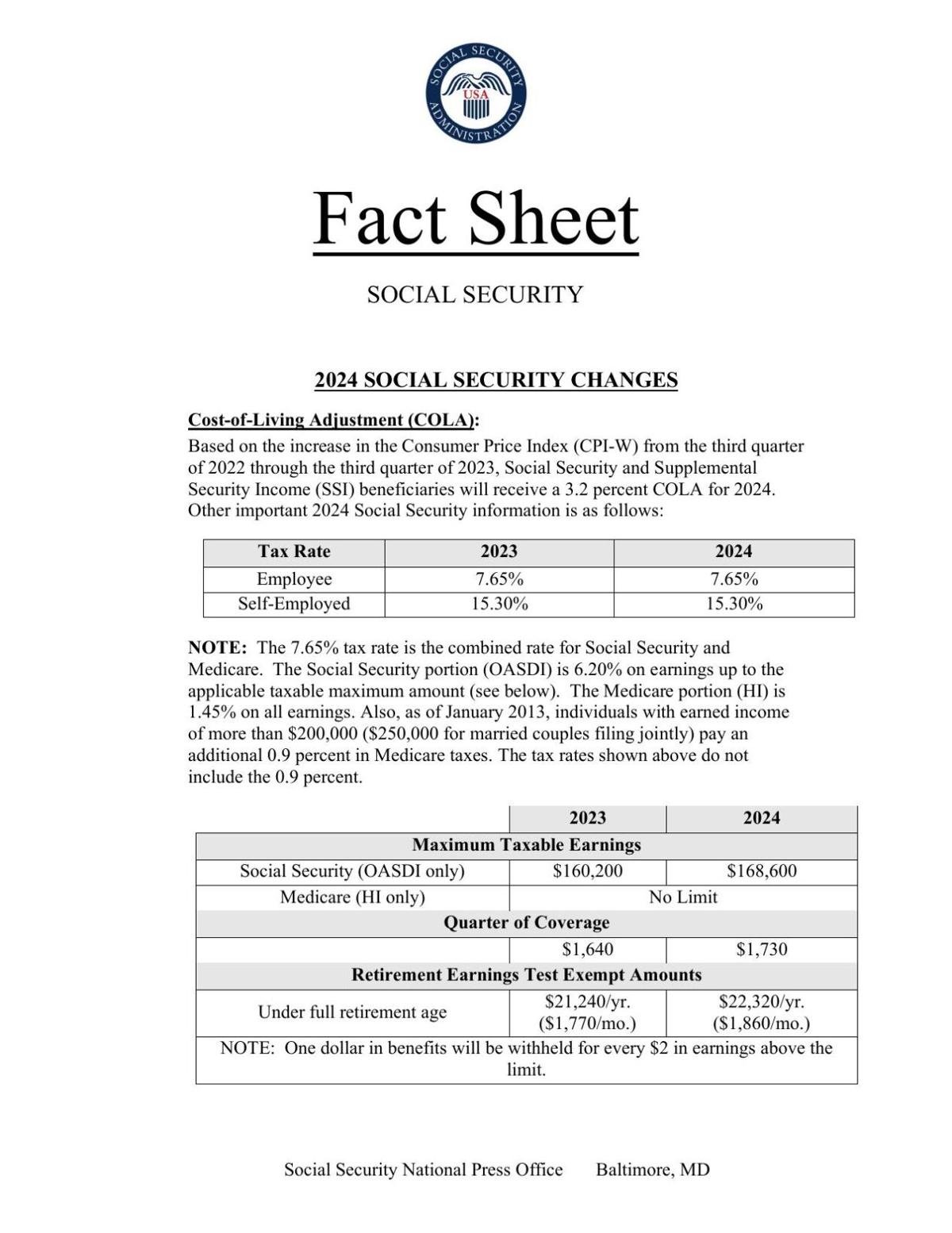

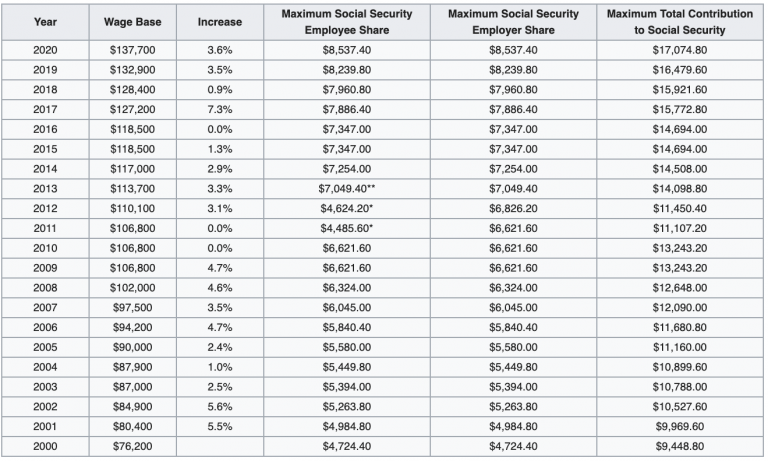

The federal government sets a limit on how much of your income is subject to the Social Security tax For 2024 the Social Security tax limit is 168 600 and it will increase to 176 100 in If you are working there is a limit on the amount of your earnings that is taxable by Social Security This amount is known as the maximum taxable earnings and changes each year The maximum taxable earnings have changed over the years as shown in the chart below

The Social Security Administration SSA announced that the maximum earnings subject to Social Security OASDI tax will increase from 160 200 to 168 600 in 2024 an increase of 8 400 The maximum Social Security employer contribution will increase by The Social Security tax limit is set each year In 2023 the limit was 160 200 For 2024 the Social Security tax limit is 168 600

More picture related to Social Security Tax Income Limit 2024

:max_bytes(150000):strip_icc()/iStock_92129291_MEDIUM.social.security.bldg-e5e3b3bde3db445ab7edf3bb24fd255a.jpg)

Social Security Tax Limit 2024 THE BHARAT EXPRESS NEWS

https://www.investopedia.com/thmb/YGYrQlfYraOBKhYr42HGANXBh2Y=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/iStock_92129291_MEDIUM.social.security.bldg-e5e3b3bde3db445ab7edf3bb24fd255a.jpg

Are My Social Security Benefits Taxable Calculator

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

Social Security Checks To Get Big Increase In 2019 Social Security

https://i.pinimg.com/originals/33/55/6b/33556ba693ff68b3c911e28dfacf40c0.png

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits The Social Security limit is 168 600 for 2024 meaning any income you make over 168 600 will not be subject to social security tax Given these factors the maximum amount an employee and employer would have to pay is 10 453 20 each 20 906 40 for self employed

Social Security s Old Age Survivors and Disability Insurance OASDI program limits the amount of earnings subject to taxation for a given year The same annual limit also applies when those earnings are used in a benefit computation Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between 25 000 and 34 000 You file a joint return

What Is The Social Security Increase For 2024 Over 65 Caro Martha

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png

Should We Increase The Social Security Tax Limit

https://www.socialsecurityintelligence.com/wp-content/uploads/2023/01/Slide4.jpeg

https://smartasset.com/retirement/is-social-security-income-taxable

If your Social Security income is taxable depends on your income from other sources Here are the 2024 IRS limits

https://www.kiplinger.com/taxes/social-security...

For 2024 the Social Security tax limit is 168 600 Last year the tax limit was 160 200 So if you earned more than 160 200 this last year you didn t have to pay the Social Security

Social Security Announces 3 2 Percent Benefit Increase For 2024 News

What Is The Social Security Increase For 2024 Over 65 Caro Martha

Social Security Limit 2024 Taxable Minne Christabella

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Taxes On Social Security Social Security Intelligence

Social Security Max 2024 Tax Brackets Tera Abagail

Social Security Max 2024 Tax Brackets Tera Abagail

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Maximum Taxable Income Amount For Social Security Tax FICA

[img_title-16]

Social Security Tax Income Limit 2024 - In 2024 you can earn up to 22 320 without having your Social Security benefits withheld But beyond that point you ll have 1 in benefits withheld per 2 of earnings The limit is much