Social Security Tax Rate 2024 For Retirees Retirees 65 and older may deduct up to 24 000 Income Tax on Taxable Income Flat rate of 4 25 for the 2024 tax year More Colorado Sending Billions in TABOR Refunds Social Security is not

Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your Social Security income remains tax free This taxable portion goes up as your income rises but it will never exceed 85 Based on the increase in the Consumer Price Index CPI W from the third quarter of 2022 through the third quarter of 2023 Social Security and Supplemental Security Income SSI beneficiaries will receive a 3 2 percent COLA for 2024 Other important 2024 Social Security information is as follows

Social Security Tax Rate 2024 For Retirees

Social Security Tax Rate 2024 For Retirees

https://i.ytimg.com/vi/p4vDWdgVhEM/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYUyBNKGUwDw==&rs=AOn4CLCOFPjDjqGvlpYHPzRlH6OEwkExAg

Social Security Tax Limit 2024 Know Taxable Earnings Income Increase

https://cwccareers.in/wp-content/uploads/2024/01/Social-Security-Tax-Limit-2024.png

Understanding Social Security Tax 2024 Rates Limits And Calculators

https://goindiajob.in/wp-content/uploads/Social-Security-Tax.jpg

With the income limit for Social Security tax set at 168 600 in 2024 both employees and self employed individuals need to understand how much tax they will owe For retirees being mindful of taxable Social Security income can help reduce the tax burden on Social Security benefits collected in 2024 may be taxed at the federal and state levels Most retirees know that Social Security benefits are adjusted annually to account for

For 2024 the 3 2 COLA increase resulted from inflation during 2023 In October 2023 the average retirement benefit was 1 796 31 With the next COLA increase that amount will go up by In 2024 whether your benefits are taxed depends on your combined income which includes your adjusted gross income AGI non taxable interest and half of your Social Security benefits Social Security is a vital source of income for many retirees but tax implications can sometimes be confusing

More picture related to Social Security Tax Rate 2024 For Retirees

Social Security Tax Increase In 2023 City Of Loogootee

https://cityofloogootee.com/wp-content/uploads/2022/10/cropped-Social-Security-Tax-Increase-in-2023.jpg

Tips To Reduce Social Security Tax In Retirement YouTube

https://i.ytimg.com/vi/w1oG6LvMD0M/maxresdefault.jpg

See The Social Security Tax Limits To See If You Must Pay Federal

https://i.ytimg.com/vi/JYYLsZt1j34/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYfyA-KCswDw==&rs=AOn4CLBp_uD9nYognjfO8Shw4yebnP-Quw

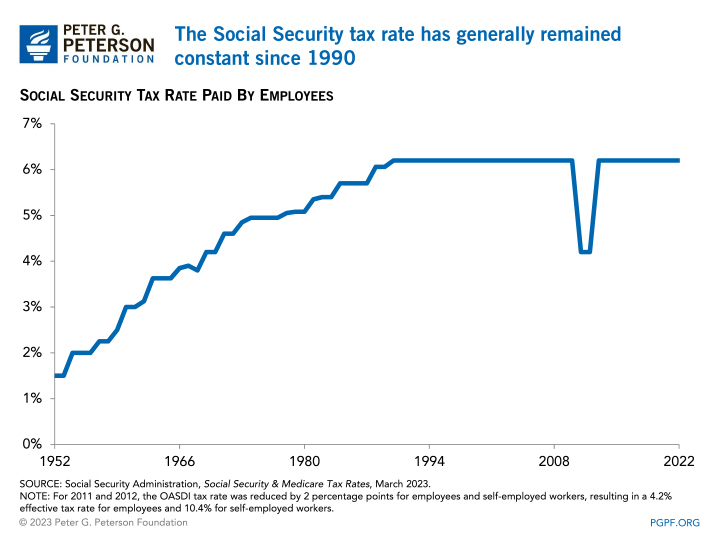

In 2024 several changes were made to Social Security many of which could directly affect your paycheck and bank account As AARP explained Social Security benefits are largely funded via payroll taxes and that tax rate is 12 4 of earnings Retirement Earnings Test Exempt Amounts CY 2024 Retirement Earnings Test applies only to people below FRA Annual exempt amount 2024 is a year before the year FRA is attained 22 320

[desc-10] [desc-11]

Social Security Tax Limit 2024 What Is It And Everything You Need To

https://www.contentcreatorscoalition.org/wp-content/uploads/2023/11/Social-Security-Tax-Limit-2024-What-is-It-and-Everything-You-Need-to-Know-1024x683.jpg

Social Security GuangGurpage

https://static01.nyt.com/images/2022/10/16/business/16Strategies-illo/16Strategies-illo-superJumbo.jpg

https://www.kiplinger.com › retirement

Retirees 65 and older may deduct up to 24 000 Income Tax on Taxable Income Flat rate of 4 25 for the 2024 tax year More Colorado Sending Billions in TABOR Refunds Social Security is not

https://thefinancebuff.com › social-security-taxable-calculator.html

Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your Social Security income remains tax free This taxable portion goes up as your income rises but it will never exceed 85

Social Security Tax Provisional Income Calculation YouTube

Social Security Tax Limit 2024 What Is It And Everything You Need To

States That Reduce Taxes On Social Security Social Security Tax

Important Tax Changes In 2023 Morningstar

Payroll Taxes What Are They And What Do They Fund 2023

Tax Rates For The 2024 Year Of Assessment Just One Lap

Tax Rates For The 2024 Year Of Assessment Just One Lap

Social Security Tax Rate 2024 For Retirees Xenia Karoline

Maximize Your Retirement Strategic Social Security Tax Planning

Australian Income Tax Brackets 2024 2024 Company Salaries

Social Security Tax Rate 2024 For Retirees - Social Security benefits collected in 2024 may be taxed at the federal and state levels Most retirees know that Social Security benefits are adjusted annually to account for