Social Security Taxable Income Limit 2024 Fifty percent of a taxpayer s benefits may be taxable if they are Filing single head of household or qualifying widow or widower with 25 000 to 34 000 income Married filing separately and lived apart from their spouse for all of 2020 with 25 000 to 34 000 income

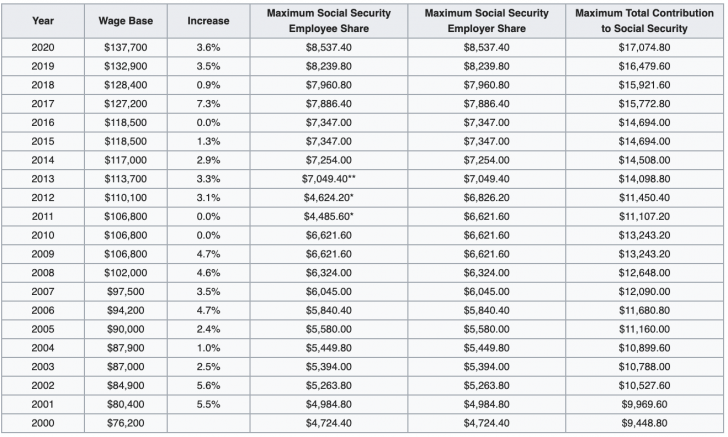

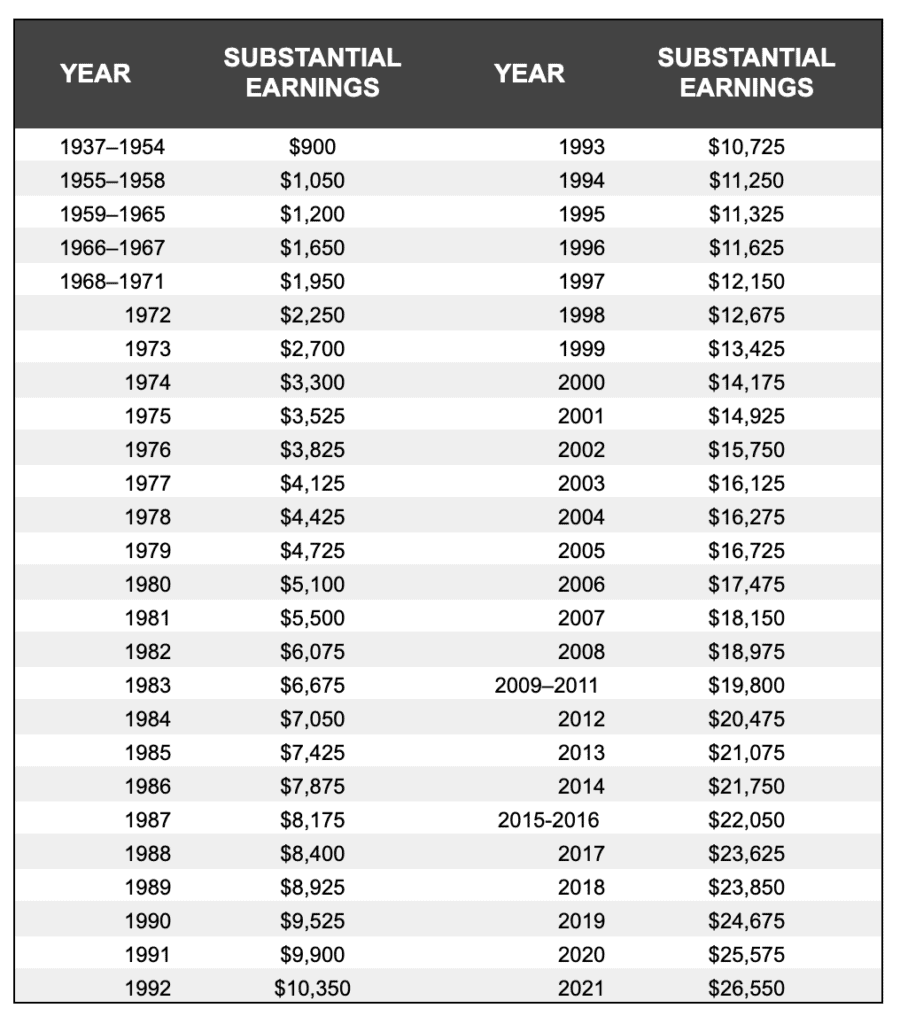

If you are working there is a limit on the amount of your earnings that is taxable by Social Security This amount is known as the maximum taxable earnings and changes each year The maximum taxable earnings have changed over the years as shown in the chart below Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between 25 000 and 34 000 You file a joint return

Social Security Taxable Income Limit 2024

Social Security Taxable Income Limit 2024

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

Social Security Taxable Income Limit 2024 Over 65 Alli Luella

https://socialsecurityintelligence.com/wp-content/uploads/2021/04/2021-04-28_18-16-35-900x1024.png

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png?fit=1456

The wage base or earnings limit for the 6 2 Social Security tax rises every year The 2024 limit is 168 600 up from 160 200 in 2023 The federal government sets a limit on how much of your income is subject to the Social Security tax For 2024 the Social Security tax limit is 168 600 and it will increase to 176 100 in

The 2024 tax limit is 8 400 more than the 2023 taxable maximum of 160 200 and 61 800 higher than the 2010 limit of 106 800 The taxable maximum was just 76 200 in 2000 and 51 300 in 1990 In 2024 the maximum amount of earnings on which you must pay Social Security tax is 168 600 We raise this amount yearly to keep pace with increases in average wages There is no maximum earnings amount for Medicare tax

More picture related to Social Security Taxable Income Limit 2024

Social Security Tax Limit 2024 Know Taxable Earnings Income Increase

https://cwccareers.in/wp-content/uploads/2024/01/Social-Security-Tax-Limit-2024.png

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits-728x437.png?fit=1456

Social Security Taxable Income Limit 2024 Irs Norry Kessiah

http://ww1.prweb.com/prfiles/2016/01/26/13184899/TSCL_SocialSecurity_Chart.jpg

How Retirement Income is Taxed by the IRS Social Security Tax Limit Jumps 4 4 for 2025 Federal Income Tax Brackets and Rates We call this annual limit the contribution and benefit base This amount is also commonly referred to as the taxable maximum For earnings in 2025 this base is 176 100 The OASDI tax rate for wages paid in 2025 is set by statute at 6 2 percent for employees and employers each

For 2024 the Social Security tax limit is 168 600 Last year the tax limit was 160 200 So if you earned more than 160 200 this last year you didn t have to pay the Social Security Social Security looks at your adjusted gross income non taxable interest income and half your Social Security benefit to see how much of that benefit is taxable

Social Security Taxable Income Limit 2024 Over 65 Alli Luella

https://www.financialsamurai.com/wp-content/uploads/2014/12/Maximum-taxable-earnings-each-year-social-security.png

Social Security Limit 2024 Taxable Minne Christabella

https://www.socialsecurityintelligence.com/wp-content/uploads/2016/11/2021-Income-Limit-1536x961.png

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

Fifty percent of a taxpayer s benefits may be taxable if they are Filing single head of household or qualifying widow or widower with 25 000 to 34 000 income Married filing separately and lived apart from their spouse for all of 2020 with 25 000 to 34 000 income

https://www.ssa.gov › benefits › retirement › planner › maxtax.html

If you are working there is a limit on the amount of your earnings that is taxable by Social Security This amount is known as the maximum taxable earnings and changes each year The maximum taxable earnings have changed over the years as shown in the chart below

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

How Working After Full Retirement Age Affects Social Security Benefits

Social Security Taxable Income Limit 2024 Over 65 Alli Luella

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Self Employed Paycheck Calculator BrookLalayne

Are Social Security Benefits Taxable Social Security Intelligence

Social Security Disability Benefits Pay Chart 2021

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Social Security Taxable Income Limit 2024 - In 2024 the maximum amount of earnings on which you must pay Social Security tax is 168 600 We raise this amount yearly to keep pace with increases in average wages There is no maximum earnings amount for Medicare tax