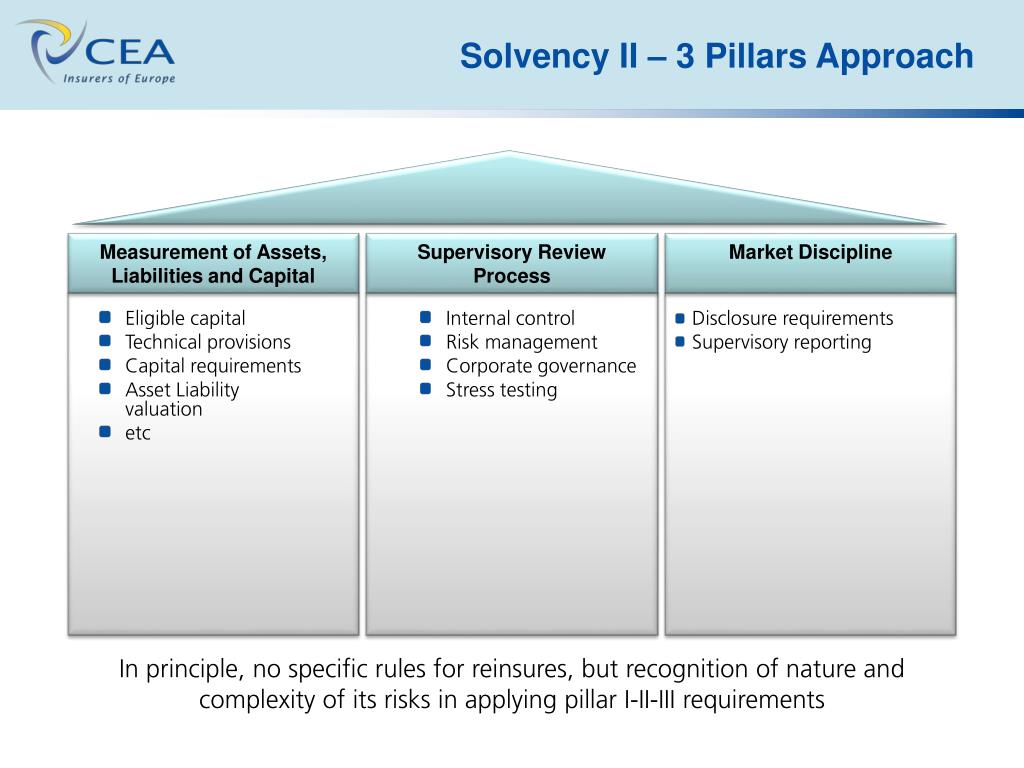

Solvency Ii Requirements Rules relating to the valuation of assets and liabilities technical provisions own funds Solvency Capital Requirement Minimum Capital Requirement and investment rules

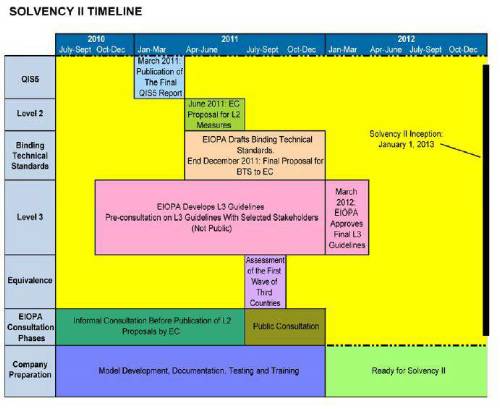

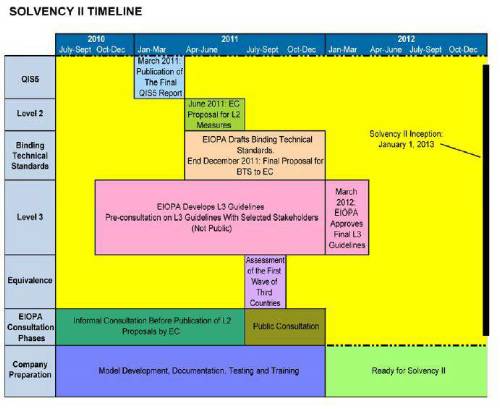

Since Directive 73 239 EEC was introduced in 1973 more elaborate risk management systems developed Solvency II reflects new risk management practices to define required capital and manage risk While the Solvency I Directive was aimed at revising and updating the current EU Solvency regime Solvency II has a much wider scope A solvency capital requirement may have the following purposes Under Solvency II insurers will need enough capital to have 99 5 per cent confidence they could cope with the worst expected losses over a year The rules take a risk based approach to

Solvency Ii Requirements

Solvency Ii Requirements

https://image2.slideserve.com/5027600/slide7-l.jpg

Solvency II A Basel For Insurers Policy Watch Bloomberg

https://data.bloomberglp.com/professional/sites/10/imported/professional/sites/4/Solvency-2.png

Strategy Manager SimCorp

https://www.simcorp.com/-/media/images/1-solution-section/strategy-manager/solvency-ii-analytics-768x475.jpg?la=en&hash=492B5346D82B8B29878D0D09DA846CD9D9E769DF

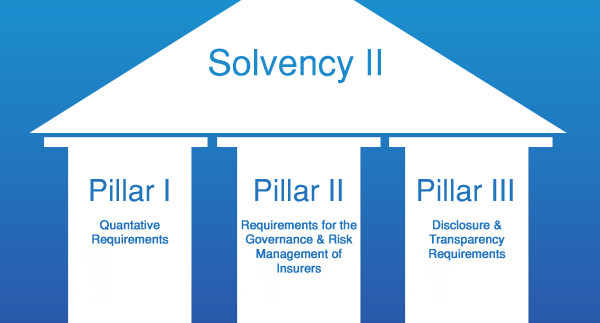

A pilot Rulebook for Solvency II is being published comprising Directive 138 2009 EC Delegated Regulation EC 2015 35 Delegated Regulation EC 2016 467 Delegated Regulation EC Solvency II sets out regulatory requirements for insurance firms and groups covering financial resources governance and accountability risk assessment and

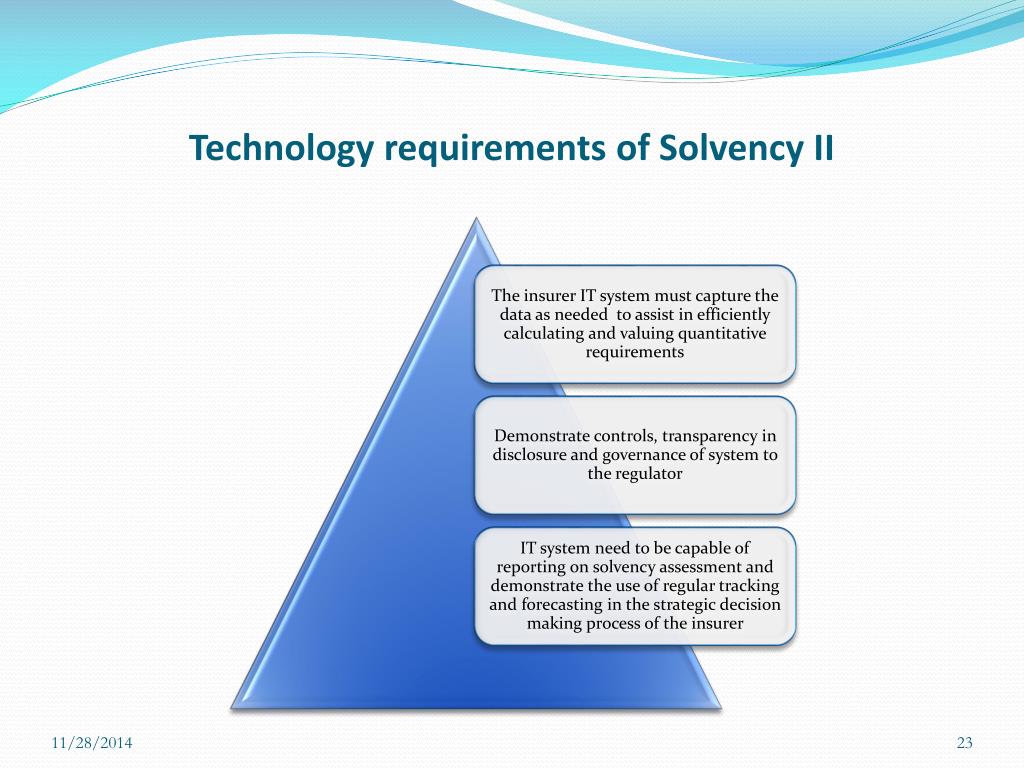

Solvency II imposes formal governance requirements mandating roles such as a risk management function an independent audit function an actuarial function and a compliance Solvency II is not just about capital It is a comprehensive programme of regulatory requirements for insurers covering authorisation corporate governance supervisory reporting public

More picture related to Solvency Ii Requirements

Solvency II Back On Track But Hurdles Remain Bank Insurance Hybrid

http://bihcapital.com/wp-content/uploads/2014/02/SolvencyIIchart.jpg

Solvency II Has Some New Sustainability Impact Requirements And They

https://dwtyzx6upklss.cloudfront.net/Pictures/1024x536/9/3/1/16931_shutterstock_1904756512_8818.jpg

Solvency Capital Requirement SCR Download Scientific Diagram

https://www.researchgate.net/profile/Frederic_Planchet/publication/258383599/figure/download/fig14/AS:325601547309061@1454640866116/Solvency-Capital-Requirement-SCR.png

Regulation EU 2015 35 bundles the delegated acts under Solvency II and sets out detailed requirements for applying the Solvency II framework It is the core of the single prudential rule Under Solvency II capital requirements are determined on the basis of a 99 5 value at risk measure over one year meaning that enough capital must be held to cover the market

This section focuses on the Solvency II requirements for non life insurance and reinsurance undertakings There are separate but broadly equivalent requirements for life and health TITLE I GENERAL RULES ON THE TAKING UP AND PURSUIT OF DIRECT INSURANCE AND REINSURANCE ACTIVITIES

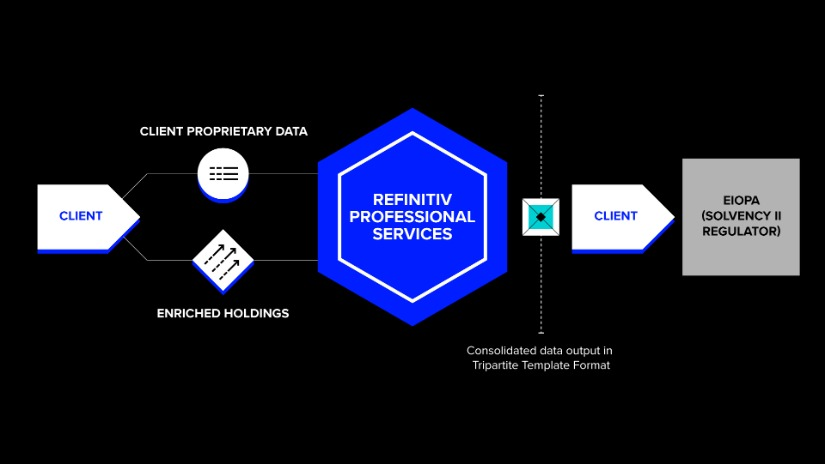

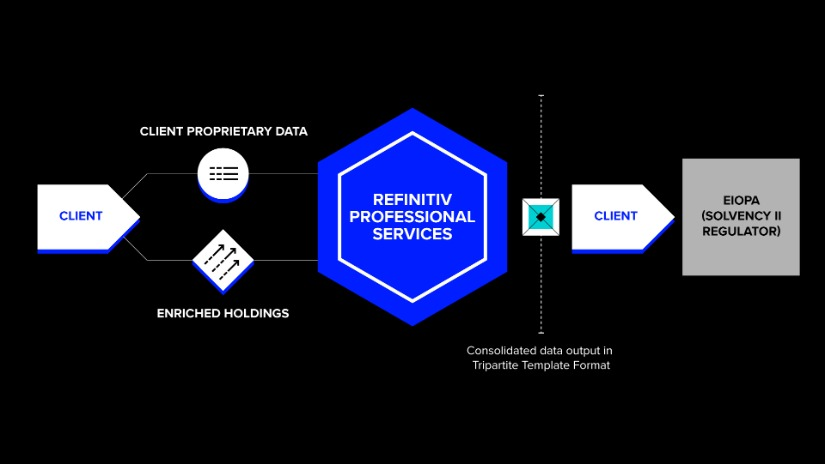

Solvency II Requirements Refinitiv

https://www.refinitiv.com/content/dam/marketing/en_us/images/artworked-images/solvency-ii-stage-3.png.transform/rect-825/q82/image.png

Three Pillars Of Solvency II Download Scientific Diagram

https://www.researchgate.net/profile/Asier_Garayeta/publication/270157084/figure/fig2/AS:669349220216854@1536596698558/Three-pillars-of-Solvency-II.png

https://eur-lex.europa.eu › eli › dir › oj

Rules relating to the valuation of assets and liabilities technical provisions own funds Solvency Capital Requirement Minimum Capital Requirement and investment rules

https://en.wikipedia.org › wiki › Solvency_II

Since Directive 73 239 EEC was introduced in 1973 more elaborate risk management systems developed Solvency II reflects new risk management practices to define required capital and manage risk While the Solvency I Directive was aimed at revising and updating the current EU Solvency regime Solvency II has a much wider scope A solvency capital requirement may have the following purposes

THE THREE PILLARS OF SOLVENCY II

Solvency II Requirements Refinitiv

PPT Moving Towards Solvency II Solvency Modernization PowerPoint

Solvency II Has Some New Sustainability Impact Requirements And They

Solvency UK What Will Change KPMG Global

Succeeding Under Solvency II Pillar One Capital Requirements

Succeeding Under Solvency II Pillar One Capital Requirements

Why Proof Of Solvency Indepthorb

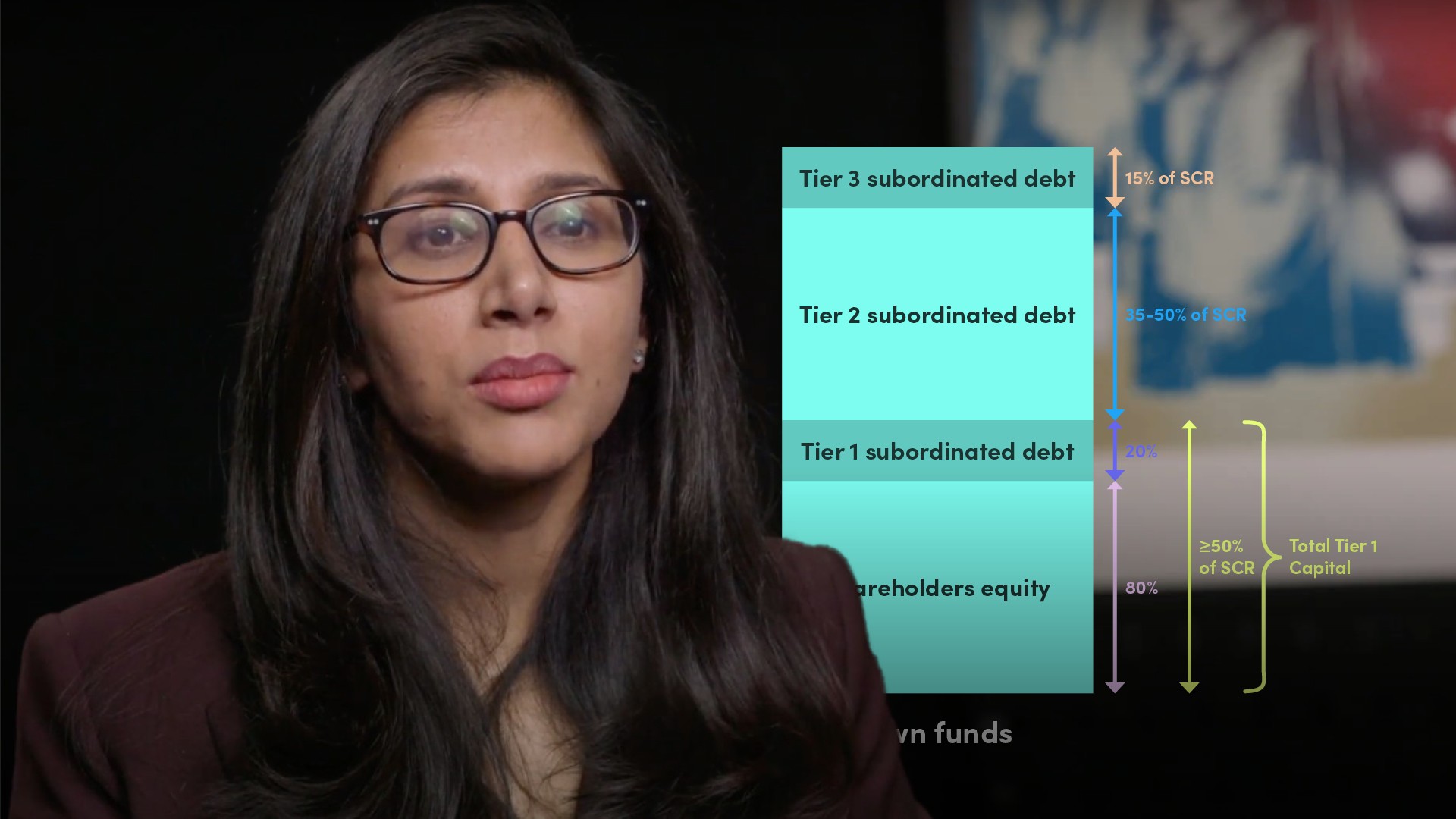

EU Solvency II Capital Requirements Illustration Euromoney Learning

Double Materiality Built Around The New Solvency II Directive Finch

Solvency Ii Requirements - A pilot Rulebook for Solvency II is being published comprising Directive 138 2009 EC Delegated Regulation EC 2015 35 Delegated Regulation EC 2016 467 Delegated Regulation EC