Tax Benefits For Disabled 2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused

Tax Benefits For Disabled

Tax Benefits For Disabled

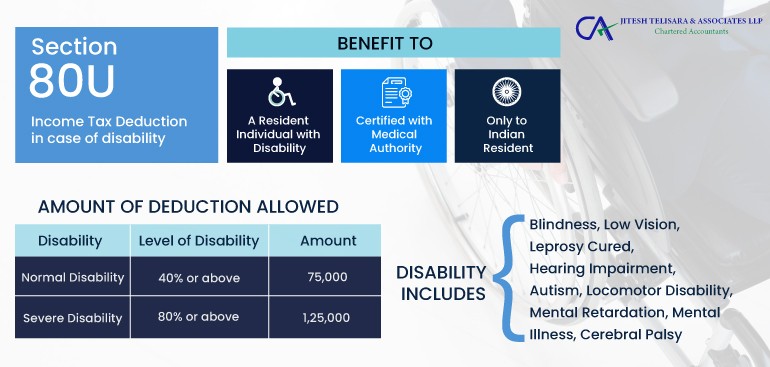

https://www.cajiteshtelisara.com/wp-content/uploads/2020/08/80U.jpg

Federal Tax Benefits For Disabled Veterans

https://mymilitarybenefits.com/wp-content/uploads/income-tax-gdad212ef9_640-jpg.webp

Tax Benefits For Disabled The Offers Does The IRS Provide

https://www.lamansiondelasideas.com/en/wp-content/uploads/2023/10/IRS-Tax-Relief-Elderly-and-Disabled-1024x631.jpg

If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on The Canada Revenue Agency is inviting individuals to use the SimpleFile by Phone service again this year You may also be invited to try out a new digital option as part of a pilot as we work

The bulk of tax relief will go to those with incomes in the two lowest tax brackets i e those with taxable income under 114 750 in 2025 including nearly half to those in the The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

More picture related to Tax Benefits For Disabled

Tax Benefits Available To Disabled Taxpayers

https://worthtax.com/wp-content/uploads/2022/01/Tax-Benefits-for-Disabled-Taxpayers.jpg

Save Tax By Claiming Children Education Expenses In Income Tax Income

https://i.ytimg.com/vi/SumGe2SD7LA/maxresdefault.jpg

Benefits For Disabled Adults Living With Their Parents

https://www.bergerandgreen.com/wp-content/uploads/2019/07/faqs-are-there-any-benefits-for-disabled-adults-still-living-with-their-parents.jpeg

Since this date falls on a Sunday the CRA will consider your income tax and benefit return filed on time if it is received on or before June 16 2025 The CRA provides free April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are

[desc-10] [desc-11]

Blog CloudTax Pro What Are The Tax Benefits For Having A Dependant

https://uploads-ssl.webflow.com/63f3057cb222cb5f4d2ef33e/63f84f3998df86aa3f2b65a1_post05.webp

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

https://www.canada.ca › en › revenue-agency › services › tax › individual…

2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

Taxpayers Tips For The Disabled Spouse Tax Credit Guiding Cents

Blog CloudTax Pro What Are The Tax Benefits For Having A Dependant

Additional Benefits For 100 Disabled Veterans CCK Law

Income Tax Benefits 2024 7 Income Tax Exemptions Applicable For New

Disabled Veteran Benefits Guide

The Nepal Weekly Seats Should Be Reserved In The Parliamentary

The Nepal Weekly Seats Should Be Reserved In The Parliamentary

A Guide To Health Insurance For Disabled People 3442 Serial Buzz

Real Estate Agent Inflation Protection

Tax Benefits Of Buying Stewart Brown Jr Mortgage Loan Originator

Tax Benefits For Disabled - If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on