What Age Can You Open A Custodial Roth Ira A Roth IRA for Kids is a tax advantaged retirement account opened for a child who has earned income 2 The account is managed by an adult the custodian and then transferred to the

Once the account is open you ll need to manage the account as their custodian which includes selecting investments once the account is funded Then when your child reaches the termination age which is typically 18 or While your child is still under age 18 the custodian will need to manage the account s assets But when your child reaches the legal age in your state usually 18 or 21

What Age Can You Open A Custodial Roth Ira

What Age Can You Open A Custodial Roth Ira

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1jkSBE.img?w=2666&h=2000&m=4&q=75

When Should I Open A Custodial Roth IRA For My Kids YouTube

https://i.ytimg.com/vi/szHRBLWqVdo/maxresdefault.jpg

At What Age Can You Withdraw From A Roth IRA YouTube

https://i.ytimg.com/vi/WFuUkRpskP8/maxresdefault.jpg

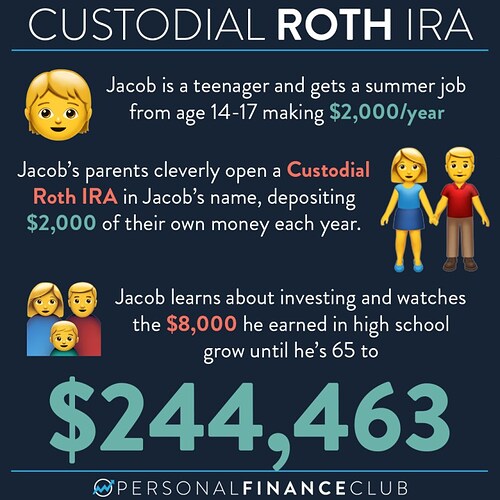

Many children work in some fashion before they reach age 18 The income they earn makes them eligible to contribute to a Roth IRA which can be an extremely smart move for teenagers Yet A traditional or Roth IRA can be opened for a child of any age to help them start saving money and learning about it You ll be the custodian of the account

There are no age limits for custodial Roth IRAs but kids must have earned income and stay within contribution limits Roth IRA providers typically require an adult to open and manage a Can you open a Roth IRA for a child Yes A Roth IRA for kids called a Custodial Roth IRA can be opened by a parent grandparent or other adult for a child of any age as long as the child earns income more on that

More picture related to What Age Can You Open A Custodial Roth Ira

3 Facts To Know About Custodial Accounts SJF Law Group

https://estateandprobatelawyer.com/wp-content/uploads/2023/02/3-Facts-to-Know-about-Custodial-Accounts.jpg

Custodial Roth IRA How And Why To Start A Roth IRA For Kids

https://s.yimg.com/ny/api/res/1.2/RHeqUdue0FkSf2NFJD1seQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en/bankrate_626/55646f1f431da8ef4b3f27a6de329eaf

Custodial ROTH IRAs For Minors Custom Wealth Management

https://static.twentyoverten.com/5be0626a94742a53ce95bdc1/cMExCGefKN/Custodial-ROTH-IRAs-for-Minors-Video.png

A custodial Roth IRA offers the same benefits as a Roth IRA except it s set up for a child and an adult typically a parent manages the account until the child reaches legal adulthood There is no minimum age to set up a Roth As the custodian of your child s account you ll make the contributions and select investments on their behalf Your child will be required to assume control of the assets at age 18 or 21 depending on your state s law

A custodial Roth IRA is a retirement savings account that an adult can open on behalf of a minor child To open a custodial Roth IRA the minor needs to be earning an To be eligible for a custodial IRA a child has to be under 18 or 21 years of age depending on what age their state considers the age of majority But that doesn t mean they

Custodial Roth IRA For A Child Benefits And How To Open One Seeking

https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1208526638/image_1208526638.jpg?io=getty-c-w1080

How To Open A Custodial Roth IRA For Your Kids Blog Posts Personal

https://community.personalfinanceclub.com/uploads/default/optimized/2X/b/beb600848cc73d80568caca2690e0b8add1e379c_2_500x500.jpeg

https://www.fidelity.com › retirement-ira › roth-ira-kids

A Roth IRA for Kids is a tax advantaged retirement account opened for a child who has earned income 2 The account is managed by an adult the custodian and then transferred to the

https://www.schwab.com › learn › story › roth-ira-for-kids

Once the account is open you ll need to manage the account as their custodian which includes selecting investments once the account is funded Then when your child reaches the termination age which is typically 18 or

Building Generational Wealth How Do You OPEN A Custodial Roth IRA

Custodial Roth IRA For A Child Benefits And How To Open One Seeking

Custodial Roth Ira Calculator ConnellFinnan

Custodial Account Definition Pros Cons How To Open One

How To Open A Custodial Roth IRA W Vanguard aka Roth IRA For Kids

How Does A Custodial Roth Ira Work

How Does A Custodial Roth Ira Work

When Does A Custodial Roth IRA Make Sense

Custodial Roth IRA Benefits For Your Children

Can Parents Contribute To A Custodial Roth Ira

What Age Can You Open A Custodial Roth Ira - How old do you have to be to have a Roth IRA At Fidelity the average age of the child when an account is opened is 13 7 years and the average balance is around 2 700