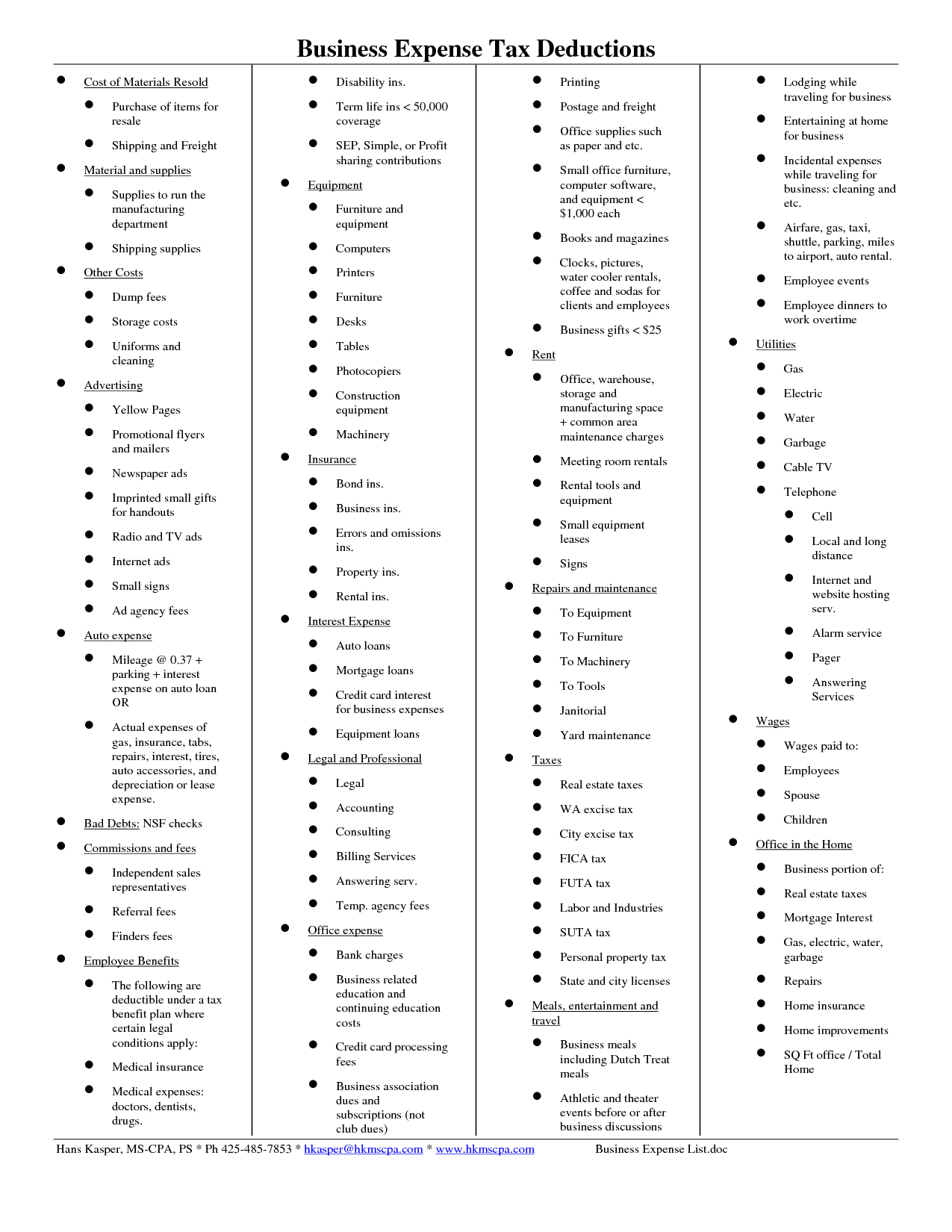

What Business Expenses Are 100 Tax Deductible Furniture purchased entirely for office use is 100 percent deductible in the year of purchase Office equipment such as computers printers and scanners are 100 percent deductible

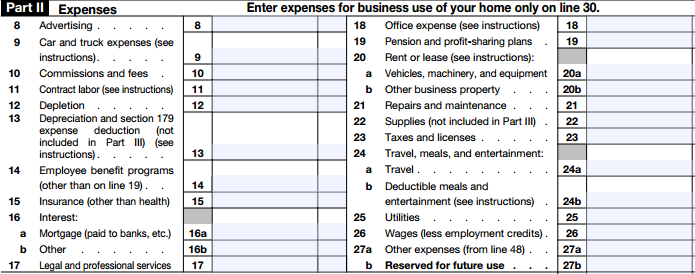

All of the following expenses will be 100 deductible unless noted otherwise Tax deductions for small businesses Advertising Bad debts Bank charges Business meals Computer expenses Contract labor Credit and The top 17 small business tax deductions Each of these expenses are tax deductible Consider this a checklist of small business tax write offs

What Business Expenses Are 100 Tax Deductible

What Business Expenses Are 100 Tax Deductible

https://www.worksheeto.com/postpic/2010/07/small-business-expenses-tax-deductions-list_449336.png

Investment Expenses What s Tax Deductible 2024

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-1.png

What Medical Expenses Are Tax Deductible Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2023/05/23-optima-medical-tax-deductible.png

Business expenses are deductible and lower the amount of taxable income The total of business expenses is subtracted from revenue to arrive at a business total amount of taxable income Generally speaking you need receipts canceled checks or bills to deduct business expenses on your taxes Some expenses simply aren t deductible even if you think they should be It s important to distinguish

Are business expenses 100 tax deductible No not all business expenses are 100 tax deductible While you can write off 100 of some essential purchases like office supplies or insurance other expenses have There are many business expenses that you can deduct for tax purposes You need to keep track of these expenses along with all revenue to properly complete your income tax statement You can

More picture related to What Business Expenses Are 100 Tax Deductible

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

Did You Know Marketing Expenses Are Tax Deductible Kaleidoscope

http://static1.squarespace.com/static/62c4b6a68c246338c9725657/t/656e3fee0763c62d60c92343/1701724142671/6.png?format=1500w

Pin On Small Biz

https://i.pinimg.com/originals/c8/eb/0a/c8eb0ac840e3a1c89c0e42f0ff3ac131.png

Discover which business expenses are deductible under current tax laws Learn how to save money and maximize deductions for your business Lower your taxable income 100 Percent Tax Deductions includes business expenses where IRS rules allow you to claim 100 on your income taxes Primary categories included as 100 Percent tax deductions are

Discover what tax deductible expenses you can claim for your business Learn how to maximise deductions and reduce your tax liability effectively Read now Meals Any food or beverage provided for customers and employees e g coffee snacks are 100 deductible Employee meals and meals purchased during business travel

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Did You Know Marketing Expenses Are Tax Deductible Kaleidoscope

https://images.squarespace-cdn.com/content/v1/62c4b6a68c246338c9725657/8cd04691-efbb-4aaa-82fc-17019b1300a4/1.jpg?format=1500w

https://legalknowledgebase.com

Furniture purchased entirely for office use is 100 percent deductible in the year of purchase Office equipment such as computers printers and scanners are 100 percent deductible

https://tax-queen.com › the-big-list-of-tax...

All of the following expenses will be 100 deductible unless noted otherwise Tax deductions for small businesses Advertising Bad debts Bank charges Business meals Computer expenses Contract labor Credit and

Itemized Deductions Worksheet Excel

Tax Deductions You Can Deduct What Napkin Finance

A Blue Poster With The Words Common Deductible Business Expenies On It

Are You Unsure What Expenses Are Deductible For You Business This

Home The Sensible Business Owner

Tax Guide For Non Emergency Medical Transportation Businesses

Tax Guide For Non Emergency Medical Transportation Businesses

What Expenses Are 100 Tax Deductible Leia Aqui What Tax Deductions

Tax Deductible Business Expenses Under Federal Tax Reform CCG

How To Deduct Business Expenses On Your Income Tax Return Tax Rates

What Business Expenses Are 100 Tax Deductible - While you may not be able to avoid paying all taxes there are tax breaks that allow you to lower your 2022 tax bill Tax deductions lower your taxable income how much of