What Cars Qualify For Business Tax Write Off 101 rowsWhat vehicles qualify for the Section 179 deduction in 2025 Eligible

Using a Section 179 deduction you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50 of the time for business purposes Qualifying Section 179 allows businesses to deduct the cost of qualifying vehicles weighing over 6 000 pounds This helps businesses save on taxes You can use this deduction for vehicles that are used mostly for business which

What Cars Qualify For Business Tax Write Off

What Cars Qualify For Business Tax Write Off

https://i.ytimg.com/vi/xp96iJCUpa8/maxresdefault.jpg

Here Are The Electric Vehicles That Are Eligible For The 7 500 Federal

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

Is Popular Streaming Content Being Purged For Tax Write Offs Kiplinger

https://cdn.mos.cms.futurecdn.net/i7PsPR3evfUe3o8yMUNF35.jpg

You can write off up to 11 160 for qualifying cars and 11 560 for qualifying trucks and vans as long as you use the vehicle for business purposes more than 50 of the time Can I deduct Section 179 deductions allow companies to write off up to 30 500 of the purchase price of a qualifying vehicle used for business purposes Some buyers might also be eligible for bonus

Many small business owners are pleased to learn that a vehicle they purchased for use in their company may qualify for a Section 179 tax deduction Carefully using Section 179 vehicles can bring tax benefits that If you use a car or truck for business you may be eligible for a Section 179 vehicles tax deduction on all or part of the purchase price To qualify however you must claim

More picture related to What Cars Qualify For Business Tax Write Off

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

https://pluginreport.com/wp-content/uploads/2020/11/which-electric-cars-qualify-for-a-tax-credit.jpg

17 Big Tax Deductions Write Offs For Businesses Accracy Blog

https://assets-global.website-files.com/645d153299ce00e5b32eb70b/64a72ea086c87c63f632eccb_2022_Small_Business_Tax_Deductions.png

Is A Luxury Car A Tax Write Off In The Philippines shorts askjem

https://i.ytimg.com/vi/hFkCPVWl3qY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYSyAcKH8wDw==&rs=AOn4CLCsH9EVnXQT4FWP03ouKX-EX7lW5Q

Business owners or those who are self employed may be able to write off part of the cost of their vehicle the first year using their vehicle for their business The property s You may qualify to deduct some of your vehicle related expenses if you use your car for business purposes The IRS defines a car as any four wheeled vehicle including a truck or van intended for use on public streets

Standard tax forms used to write off a car for business use are Schedule C A or E of Form 1040 or Form 2106 depending on your situation Table of Contents What Qualifies Here s a quick rundown of the forms to use to write off a car for business on your tax return Self employed individuals use Schedule C of Form 1040 Partners and members of

List Of Electric Cars That Qualify For Federal Tax Credits

https://worldevnews.com/wp-content/uploads/2023/04/evs-qualify-for-federal-ev-tax-credit-1024x576.jpg

A Business Vehicle Tax Write off Trick

https://i.ytimg.com/vi/j3Sig6CW0IY/maxresdefault.jpg

https://www.crestcapital.com

101 rowsWhat vehicles qualify for the Section 179 deduction in 2025 Eligible

https://taxsharkinc.com › write-off-car-expenses-for-business

Using a Section 179 deduction you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50 of the time for business purposes Qualifying

3 Things To Know Tax Wise Before Buying A Car For Your Business FP

List Of Electric Cars That Qualify For Federal Tax Credits

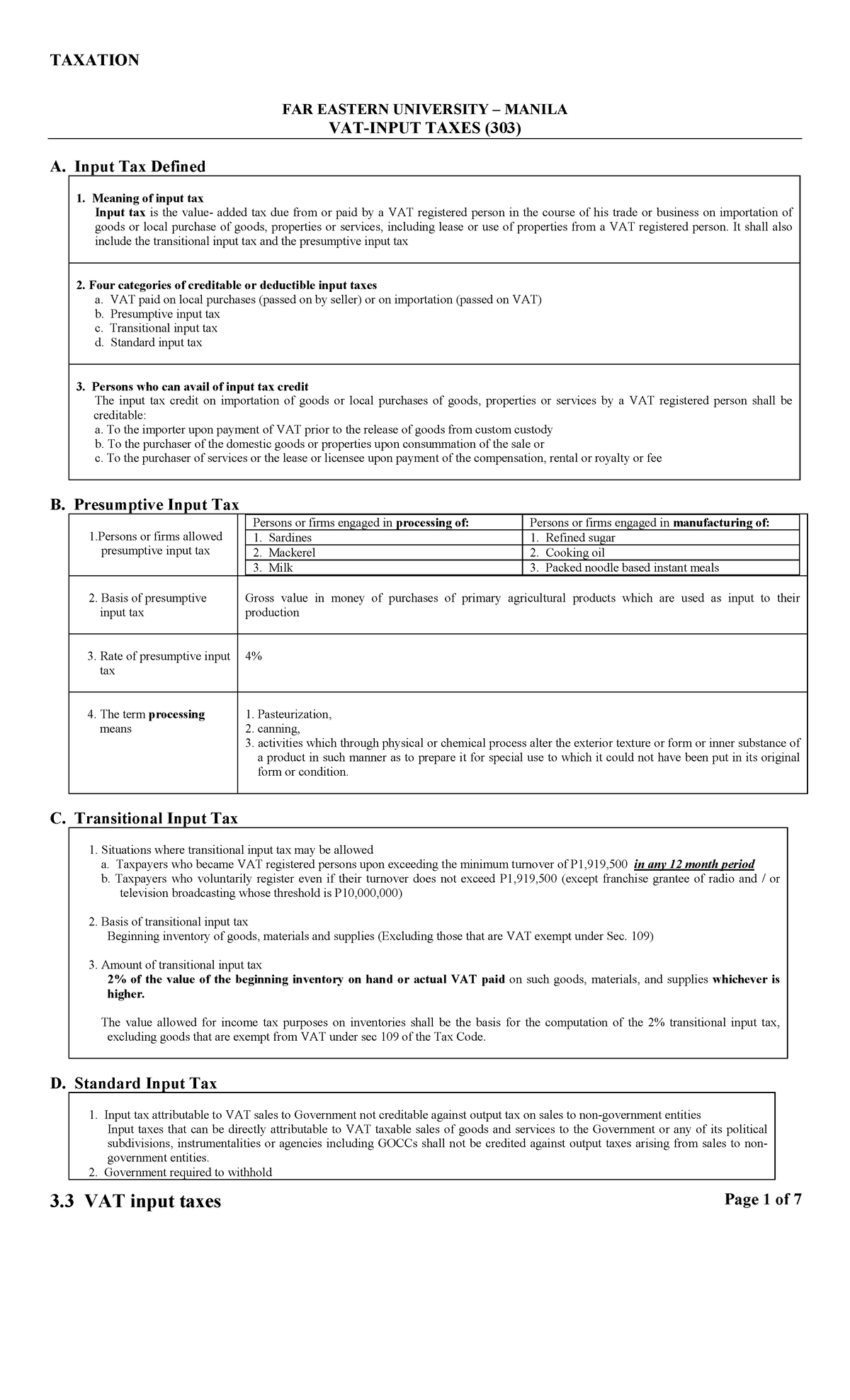

3 3 VAT Input Taxes TAXATION FAR EASTERN UNIVERSITY 3 MANILA VAT

Average Cost Of Tax Preparation By CPA My CPA Coach Fees

New Opportunities For Business Tax Write Offs In 2024

How Do Tax Deductions Work When Donating A Car Dollars Bag

How Do Tax Deductions Work When Donating A Car Dollars Bag

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy Australia

2023 Complete or Is It List Of Eligible Cars For The IRS 7500 Tax

Buying A Car For Business Tax Write off Australia 2022 Lakhiru

What Cars Qualify For Business Tax Write Off - Many small business owners are pleased to learn that a vehicle they purchased for use in their company may qualify for a Section 179 tax deduction Carefully using Section 179 vehicles can bring tax benefits that