What Does Reversal Mean On Bank Account What is a Payment Reversal Payment reversal is a blanket term for any situation in which transaction funds are returned to the cardholder s bank account Payment reversals are also known as credit reversals or a reversal payment Authorization reversals refunds and chargebacks are all forms of payment reversals

It basically means that you ve paid for something that was debited from your account but then paid back either in part or in full due to an overpayment or because an order could not be fulfilled A reversal transaction is made before a transaction has been fully processed i e before the funds have arrived in the merchant s account This means it is usually relatively straightforward to reimburse the funds issued

What Does Reversal Mean On Bank Account

What Does Reversal Mean On Bank Account

https://i.ytimg.com/vi/XxBvq7YK890/maxresdefault.jpg

Payment Reversal Your Business Guide To Credit Card Reversals

https://paymentcloudinc.com/blog/wp-content/uploads/2023/01/payment-reversal-1024x682.png

What Is Posting A Check In D365 What Does Reversal Of Check Mean How

https://i.ytimg.com/vi/71eYksRCAMM/maxresdefault.jpg

What is a payment reversal What are the major types of payment reversals How to help avoid payment reversals Learn what you need to do when a bank reversal has been filed against you plus why these reversals can occur and how to A payment reversal happens when funds from a completed purchase are returned to the customer s bank account essentially undoing the transaction They can be costly for businesses leading to lost revenue fees and operational headaches

Payment reversal is an umbrella term describing when transactions are returned to a cardholder s bank after making a payment They can occur for the following reasons There are three common types of payment reversals These are authorisation reversals refunds and chargebacks Let s explore each in more detail Payment reversals are typically the result of an error dispute or fraud where the original payment needs to be undone Payment reversals can occur for various reasons often leading to financial losses and operational challenges for businesses Understanding the common causes is crucial for implementing effective prevention strategies 1

More picture related to What Does Reversal Mean On Bank Account

Reversing Entries When What How And Why YouTube

https://i.ytimg.com/vi/3WPFszBPjn4/maxresdefault.jpg

Bank Account Fraud A New Look For An Old Scam

https://imgix.doingmoretoday.com/app/uploads/2023/03/24131439/Bank-Account-Fraud.jpg

Common Bank Account Scams Landmark National Bank

https://www.banklandmark.com/wp-content/uploads/2022/10/Bank-account-scam.jpg

A payment reversal is the return of funds to a cardholder s bank account Payment reversals can be initiated for various reasons such as fraud out of stock items funds taken out for the wrong amount or product returns In most cases banks can set up a reversal for any payment made on your debit or credit cards even if the transaction was settled or not Payment reversals can be initiated by the cardholder merchant financial institutions that distribute the card

[desc-10] [desc-11]

What Should I Do If I See Rejected Bank Account Status Agoda Homes

https://agodahomeshelp.zendesk.com/hc/article_attachments/10962938389907

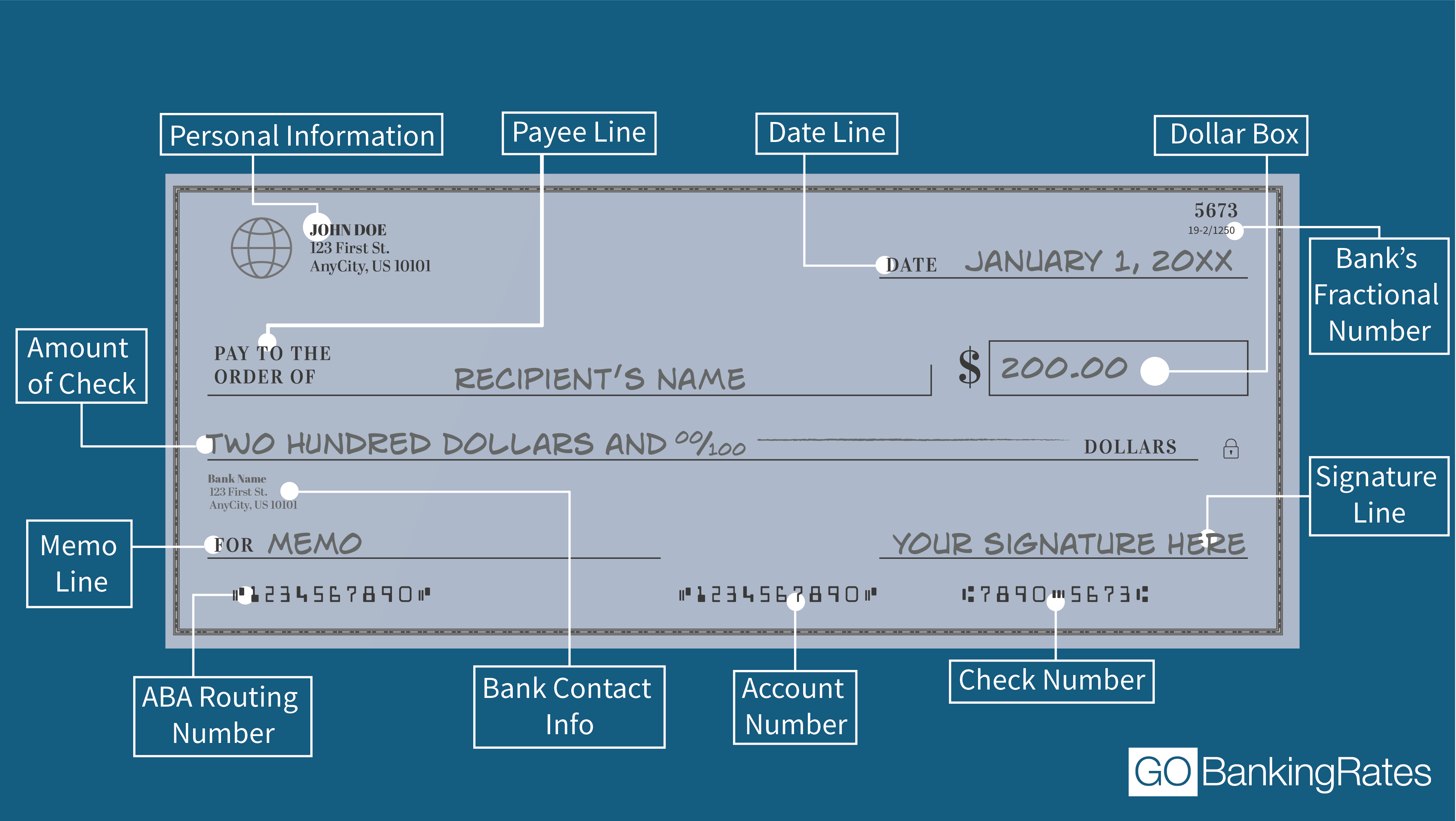

How To Read Routing And Account Number On A Check Stampley Weref2001

https://cdn.gobankingrates.com/wp-content/uploads/2019/07/HowToReadCheck_v3_12.png?quality=75

https://chargebacks911.com › payment-reversal

What is a Payment Reversal Payment reversal is a blanket term for any situation in which transaction funds are returned to the cardholder s bank account Payment reversals are also known as credit reversals or a reversal payment Authorization reversals refunds and chargebacks are all forms of payment reversals

https://www.timesmojo.com › what-does-reversal-mean...

It basically means that you ve paid for something that was debited from your account but then paid back either in part or in full due to an overpayment or because an order could not be fulfilled

Mean Reversal Strategy

What Should I Do If I See Rejected Bank Account Status Agoda Homes

Medical Vocabulary What Does Reversal Learning Mean YouTube

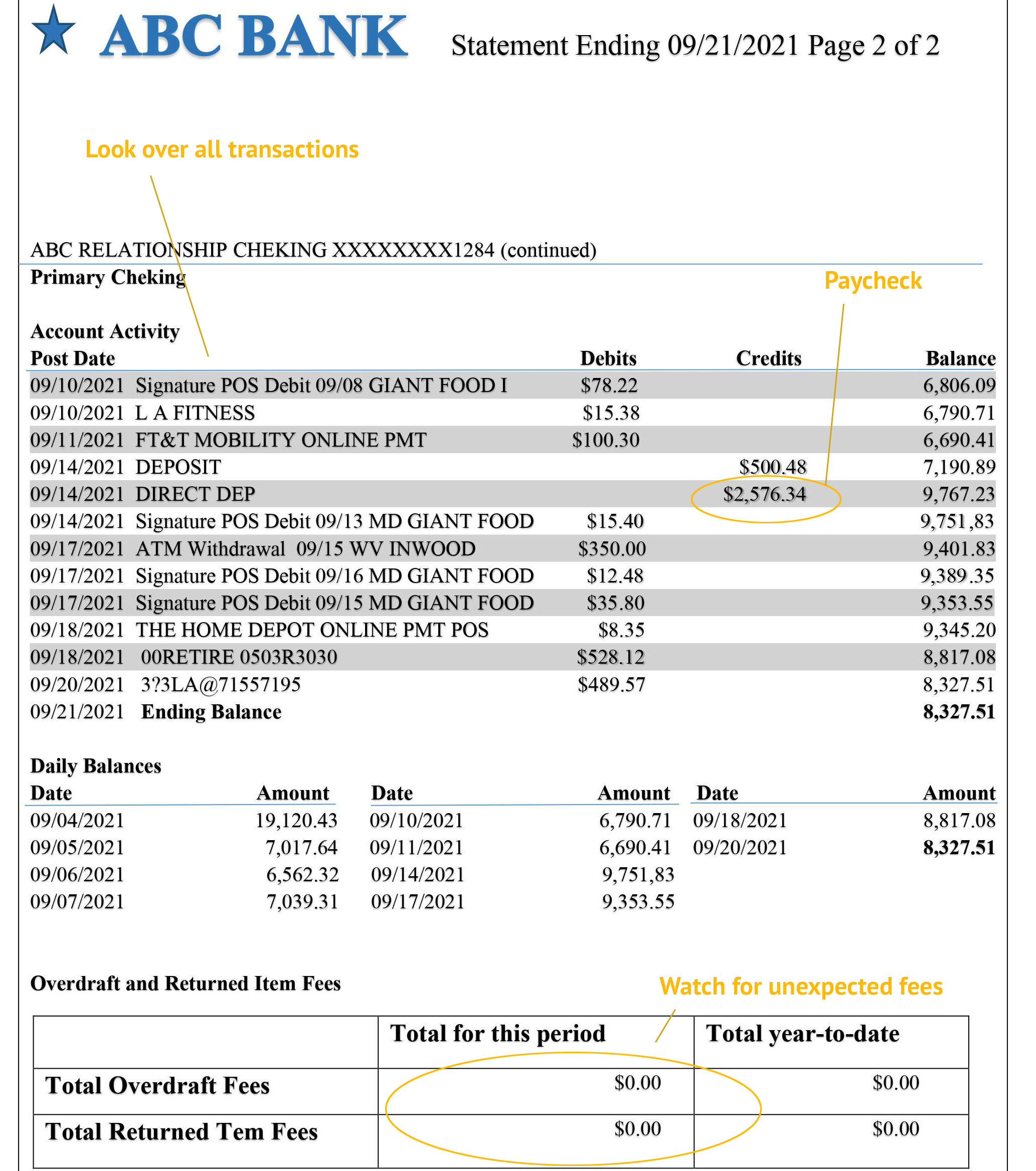

Bank Statement

What Does Reversal Credit Mean Leia Aqui Why Did My Bank Do A Credit

What s A Temporary Credit Reversal Leia Aqui What Does Temporary

What s A Temporary Credit Reversal Leia Aqui What Does Temporary

What Does Food Purchase Reversal Mean On An Ebt Card Own Your Own Future

Bank Account Tax

What Does Reversal Of Credit Mean Leia Aqui Why Did My Bank Do A

What Does Reversal Mean On Bank Account - Payment reversals are typically the result of an error dispute or fraud where the original payment needs to be undone Payment reversals can occur for various reasons often leading to financial losses and operational challenges for businesses Understanding the common causes is crucial for implementing effective prevention strategies 1