What Expenses Can A Corporation Write Off Expenses on which you did not pay GST or HST such as goods and services acquired from non registrants for example small suppliers most expenses you incurred outside Canada for

These include small items such as pens pencils paper clips stationery and stamps For office expenses related to your workspace see Line 8811 Office stationery and supplies below T2SCH130 Excessive Interest and Financing Expenses Limitation 2023 and later tax years Download instructions for fillable PDFs

What Expenses Can A Corporation Write Off

What Expenses Can A Corporation Write Off

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

I m A Business Owner What Expenses Can I Write Off On My Taxes

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a5bd3b848/2022/11/writeoff-2.jpg

Can An S Corp Hire Employees The Mumpreneur Show

https://myclearpathadvisors.com/wp-content/uploads/CPA-Blog-SCorp-Get-Paid.jpg

If you paid moving expenses for your move from Canada you may be eligible to claim the moving expense deduction For more information see Income Tax Folio S1 F3 C4 Operating expenses paid by employee to third party Under the CRA administrative policy if you made an automobile available to your employee and you require your employee to pay a third

What are child care expenses 1 1 The term child care expense is defined in subsection 63 3 In general terms the definition provides that a child care expense is an expense incurred for the Moving expenses reasonable moving expenses that have not been claimed as moving expenses on anyone s tax return to move a person who has a severe and prolonged mobility

More picture related to What Expenses Can A Corporation Write Off

Pin On Small Biz

https://i.pinimg.com/originals/c8/eb/0a/c8eb0ac840e3a1c89c0e42f0ff3ac131.png

Home Office Deduction Worksheet Excel Printable Word Searches

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png

What Expenses Can A Sole Trader Claim Maximise Accounting

https://maximiseaccounting.com/wp-content/uploads/2023/05/HBPF-3-of-5-scaled.jpg

Any income in respect of a property net of applicable expenses must be reported for tax purposes While your election is in effect you can designate the property as your principal Typical out of pocket expenses not incurred as agent Typical out of pocket expenses not generally incurred as agent that a registered supplier may charge a client include any of the

[desc-10] [desc-11]

![]()

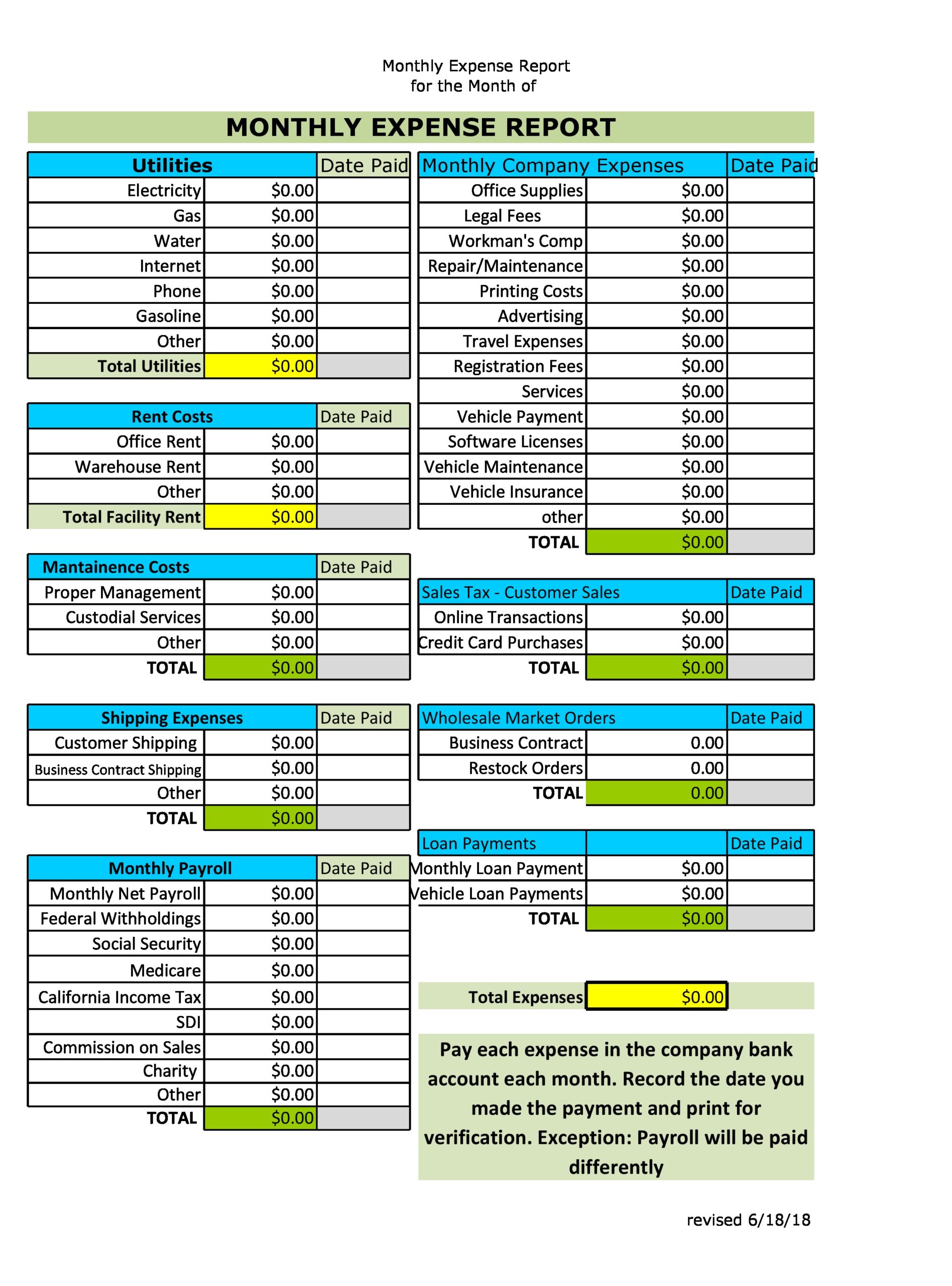

Business Expenses Template Excel Templates

https://db-excel.com/wp-content/uploads/2019/01/examples-of-business-expenses-spreadsheets-throughout-business-expense-tracking-spreadsheet-with-small-business-expenses.jpg

Maximizing Your Business Expense Write Offs A Comprehensive Guide

https://www.pc-mobile.net/wp-content/uploads/2023/06/how-to-write-off-business-expenses.jpg

https://www.canada.ca › ... › forms-publications › publications › employm…

Expenses on which you did not pay GST or HST such as goods and services acquired from non registrants for example small suppliers most expenses you incurred outside Canada for

https://www.canada.ca › en › revenue-agency › services › forms-publicat…

These include small items such as pens pencils paper clips stationery and stamps For office expenses related to your workspace see Line 8811 Office stationery and supplies below

What Are Expenses Its Types And Examples Tutor s Tips

Business Expenses Template Excel Templates

Free Small Business Spreadsheet For Income And Expenses 2024

Hyenabranch3 MurakamiLab

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How To Calculate Cost Of Goods Sold In Accounting Haiper

Expenses

Expenses

EXCEL Of Expenses Claim Sheet xlsx WPS Free Templates

How To Write Off Business Expenses TheAdviserMagazine

What Types Of Expenses Can t Be Written Off By Your Business Maillie LLP

What Expenses Can A Corporation Write Off - Moving expenses reasonable moving expenses that have not been claimed as moving expenses on anyone s tax return to move a person who has a severe and prolonged mobility