What Expenses Can I Claim For On My Tax Return If I Am Self Employed How to claim Keep records of all your business expenses as proof of your costs Add up all your allowable expenses for the tax year and put the total amount on your Self Assessment tax

If you re self employed you ll be charged tax based on the amount of profit you ve made in a tax year but there are a number of expenses you can claim that will lower your tax bill HMRC allows you to deduct the costs of certain purchases In this guide we tell you how to reduce your tax if you re self employed and a list of allowable expenses you can claim as deductible from HMRC

What Expenses Can I Claim For On My Tax Return If I Am Self Employed

What Expenses Can I Claim For On My Tax Return If I Am Self Employed

https://www.maxxia.com.au/sites/default/files/styles/infographic/public/2021-11/MAX_Blog_Article_WhatExpensesCanIClaim_800x392.jpg?itok=FgEoQAM_

What Expenses Can I Claim In My Tax Return TaxAssist Accountants

https://assets.taxassist.ie/file-uploads/gcs/1663150132_expenses.jpg

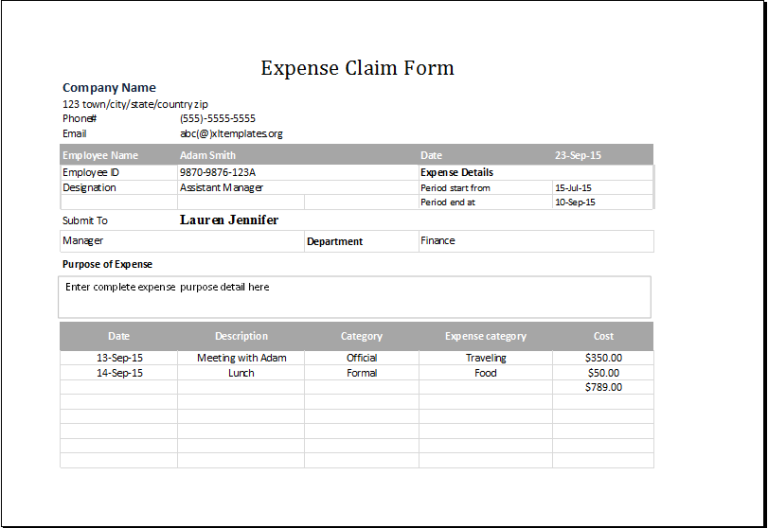

Expenses Claim Form Template Excel

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

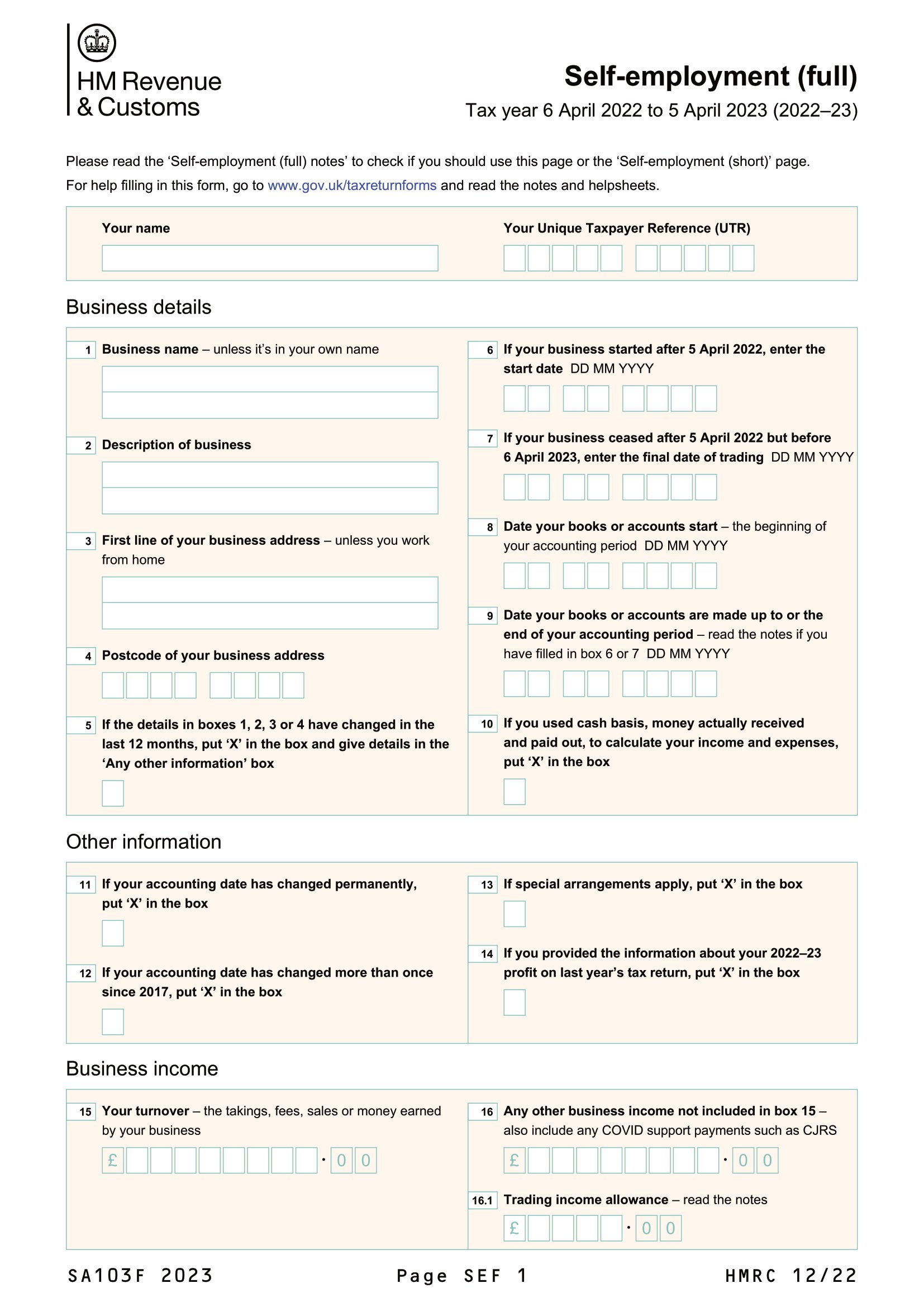

You need to claim allowable expenses in the self employment section of your tax return If your business turnover is less than 85 000 you ll have the option to fill in the simplified version of this part of the tax return If you re self employed allowable expenses can reduce your Self Assessment tax bill In this article we talk about what you can and can t make a claim for Here s what we

If you re self employed there are a number of expenses you claim depending on your occupation Claiming expenses will reduce the amount of tax you pay There are two main ways in which you ll be able to claim your self As a self employed individual it s crucial to claim all the allowable expenses you re entitled to as this can significantly reduce your tax bill By keeping detailed records

More picture related to What Expenses Can I Claim For On My Tax Return If I Am Self Employed

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)

Income Tax Return Form

https://www.investopedia.com/thmb/DPa_w90U8Wx_lL-et-1ESMTYzwY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg

What Expenses Can I Claim As An Employee Growthwise

https://www.growthwise.com.au/uploads/partners/_868xAUTO_fit_center-center_85/2_230604_100320.png

Self Employed Allowable Expenses Accounting Basics Best Accounting

https://i.pinimg.com/originals/de/81/c7/de81c7177a75fa53363d95cb5e077283.png

Find out what expenses you can claim when you re self employed to lower your tax bill and submit your Self Assessment form with ease I am employed and have expenses do I need to fill in a tax return Lots of employed people can claim back a tax rebate for work related expenses If your expenses are 2500 or over in any

Expenses deductible from your PAYE for employed status are incurred wholly exclusively and necessarily incurred for employment You can complete an HMRC tax return form if your To reap the benefits of tax write offs on your adjusted gross income AGI for your tax return you need to know what expenses are tax deductible especially if you work from

Expense Claim Form Template Excel Printable Word Searches

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

What Is Line 15000 On Tax Return RightFit Advisors

https://rightfitadvisors.ca/wp-content/uploads/What-is-Line-15000-on-tax-return-1.jpg

https://www.gov.uk › expenses-if-youre-self-employed › how-to-claim

How to claim Keep records of all your business expenses as proof of your costs Add up all your allowable expenses for the tax year and put the total amount on your Self Assessment tax

https://www.which.co.uk › ...

If you re self employed you ll be charged tax based on the amount of profit you ve made in a tax year but there are a number of expenses you can claim that will lower your tax bill HMRC allows you to deduct the costs of certain purchases

Can I Claim Car Finance On My Tax Return 2024 Updated RECHARGUE

Expense Claim Form Template Excel Printable Word Searches

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

Business Expenses Template Excel Templates

Expense Claim Sheet

Can I Amend My Tax Return If I Claimed CA Refund As Income

Can I Amend My Tax Return If I Claimed CA Refund As Income

The Ultimate List Of Self Employed Expenses You Can Claim

Self Employed Tax Return In The UK A Step by Step Guide Health

Can I Write Off The Rent I Pay Leia Aqui Can I Use My Rent As A Tax

What Expenses Can I Claim For On My Tax Return If I Am Self Employed - If you re self employed allowable expenses can reduce your Self Assessment tax bill In this article we talk about what you can and can t make a claim for Here s what we