What Is A Repayment Supplement From Hmrc This thread is about HMRC paying out interest known as repayment supplement Do you mean you have been charged late payment interest If so you would need to give

Repayment supplement is a form of compensation paid when HMRC delays a legitimate VAT repayment claim by more than 30 net days Learn how to qualify calculate and HMRC internal manual VAT Repayment Supplement Manual From HM Revenue Customs Published 26 April 2016 Updated 17 February 2025 See all updates Search this manual Search

What Is A Repayment Supplement From Hmrc

What Is A Repayment Supplement From Hmrc

https://jupiter.money/content/images/size/w2000/2022/01/loan-repayment.jpg

Interest On VAT Repayments From HMRC The Current Rules And Proposed

https://cloud9accountingteam.co.uk/wp-content/uploads/2022/03/llll.jpg

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

Hi As the repayment is for the 2023 24 tax year and repaid in November 2024 then no repayment supplement will be due If repayment supplement is due this will be Income Tax Earnings and Pensions Act 2003 provides for a payment in compensation to be made where there is a delay in making a repayment The Act calls this payment a repayment

Hi I have a repayment supplement marked as interest from my HMRC account Does this need to be included in my tax return as income interest Thanks If the repayment is not authorised within that time limit the business will receive compensation in the form of a repayment supplement being five per cent of the repayment or 50 whichever is the greater paid

More picture related to What Is A Repayment Supplement From Hmrc

What Is A Digital Pound Really Useful For Digital Pound Foundation

https://digitalpoundfoundation.com/wp-content/uploads/2023/01/What-is-a-digital-Pound-really-useful-for.jpg

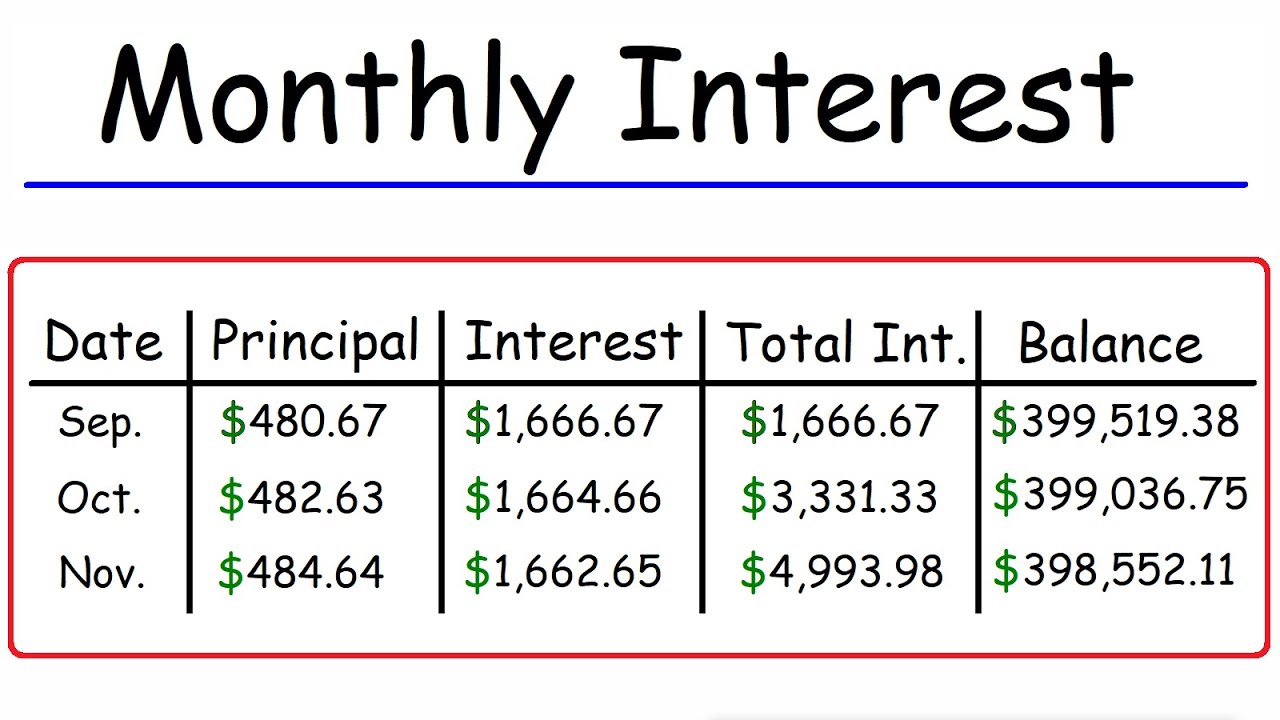

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

HMRC To Abolish Repayment Supplement For 0 5 Interest Payment Cloud

http://www.cloudbookkeeper.co.uk/wp-content/uploads/2021/06/VAT2-1.jpg

HMRC will pay 0 5 annual interest on delayed VAT claims from April 2022 But the end of the repayment supplement scheme will be a bigger loss says Neil Warren This guidance note outlines the scenarios where HM Revenue Customs HMRC would be obligated to pay a repayment supplement to a business The repayment supplement regime

Repayment supplement is a form of compensation paid subject to certain conditions if HMRC does not issue a written instruction to pay a return or claim within 30 days of the receipt of the This manual provides technical policy and procedural guidance to HMRC staff about circumstances when HMRC might become liable to pay a repayment supplement to a

HMRC To Abolish Payment Supplement Business Advice

https://www.sas-yorkshire.com/wp-content/uploads/sites/12/2023/03/20467921_s.jpg

What Is A Zero Knowledge Proof ZKPs Explained 2024

https://blog.thirdweb.com/content/images/size/w2000/2023/04/What-is-a-zero-knowledge-proof--ZKP---Zero-knowledge-proofs-explained.png

https://forums.moneysavingexpert.com › discussion › ...

This thread is about HMRC paying out interest known as repayment supplement Do you mean you have been charged late payment interest If so you would need to give

https://www.gov.uk › guidance › treatment-of-vat...

Repayment supplement is a form of compensation paid when HMRC delays a legitimate VAT repayment claim by more than 30 net days Learn how to qualify calculate and

Interest On VAT Repayments From HMRC The Current Rules And Proposed

HMRC To Abolish Payment Supplement Business Advice

HMRC EoghannAsa

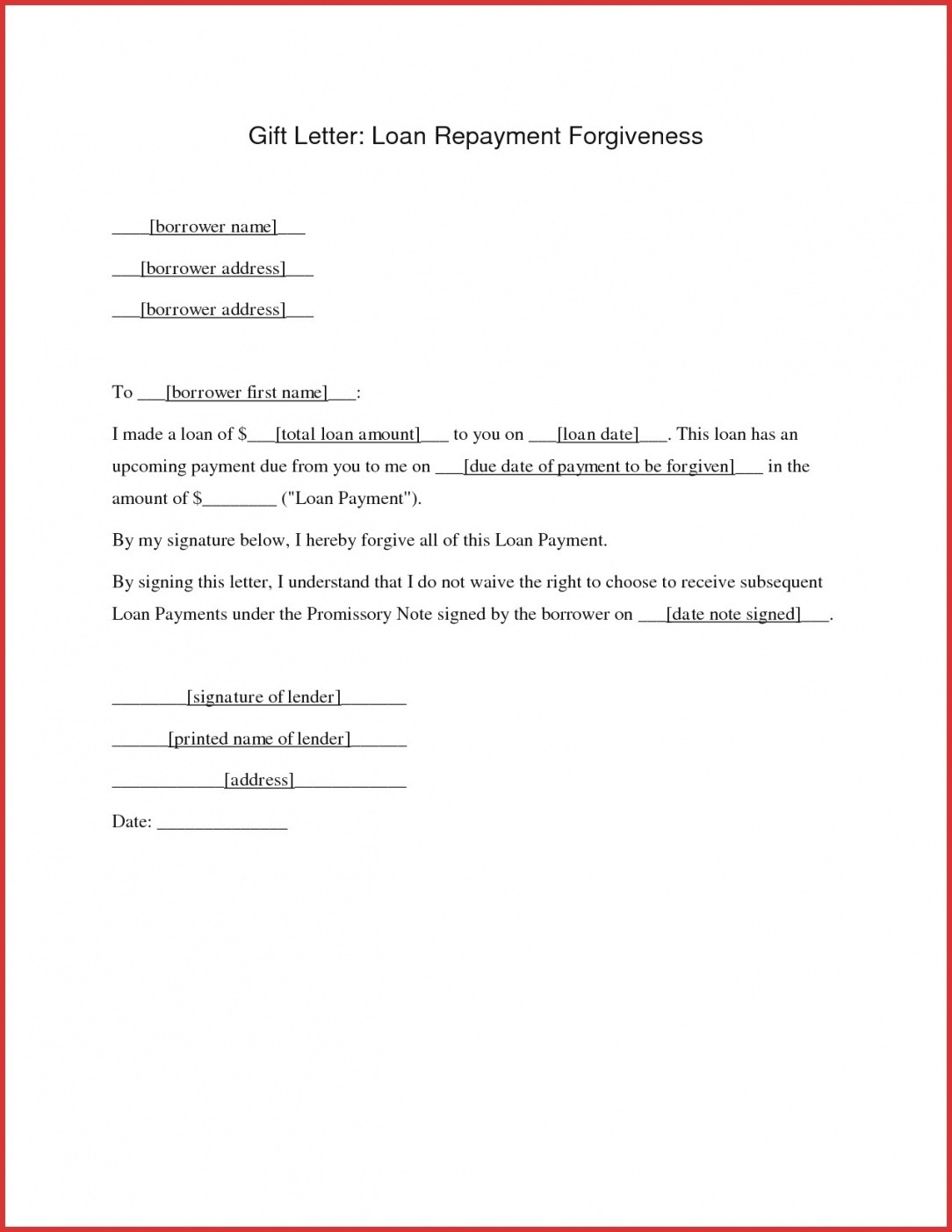

Loan Repayment Formula EmmalineShane

Costum Default Notice Letter Template PDF Tacitproject

Repayment Plan Chart Student Loan Borrowers Assistance

Repayment Plan Chart Student Loan Borrowers Assistance

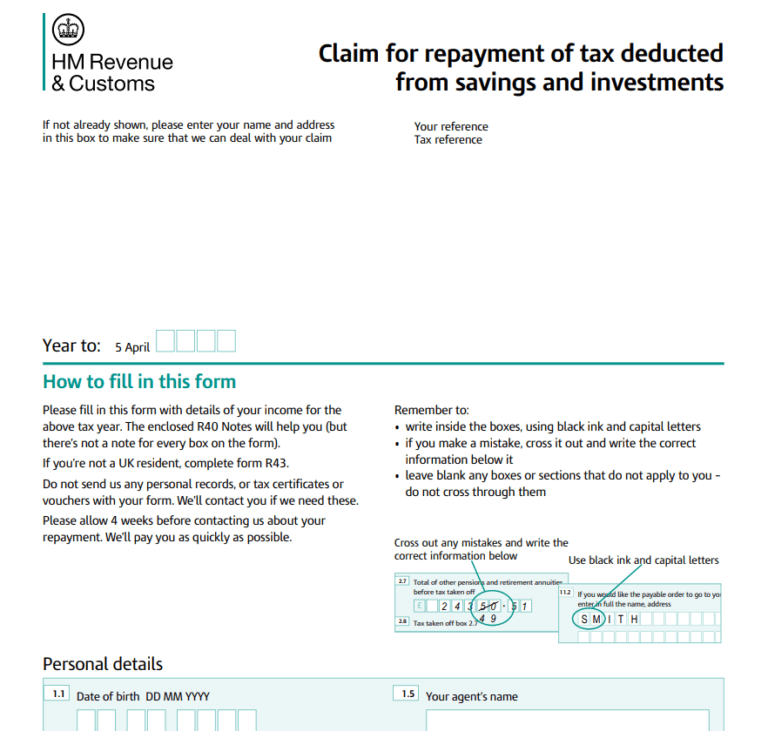

Hmrc Tax Return Self Assessment Form PrintableRebateForm

3 Pack Sight Care Supplement SightCare Vision Pills Vitamin For Eye

Warning Scam Letters Call HMRC On 0300 200 3819

What Is A Repayment Supplement From Hmrc - If the repayment is not authorised within that time limit the business will receive compensation in the form of a repayment supplement being five per cent of the repayment or 50 whichever is the greater paid