What Is A Section 4958 Excess Benefit Transaction Section 4958 applies to all excess benefit transactions occurring on or after September 14 1995 However Section 4958 does not apply to excess benefit transactions that occurred under a

An excess benefit transaction means any transaction in which an economic benefit is provided by an applicable tax exempt organization directly or indirectly to or for the use of any disqualified Section 4958 of the Internal Revenue Code imposes an excise tax on excess benefit transactions between a disqualified person and an applicable tax exempt organization

What Is A Section 4958 Excess Benefit Transaction

What Is A Section 4958 Excess Benefit Transaction

https://learn.financestrategists.com/wp-content/uploads/The_Benefits_of_a_Defined_Benefit_Plan.png

What Is A Cash Offer The Advantages And Disadvantages

https://admin.agentfire.com/wp-content/uploads/2023/03/what-is-a-cash-offer.jpg

What Is A Digital Pound Really Useful For Digital Pound Foundation

https://digitalpoundfoundation.com/wp-content/uploads/2023/01/What-is-a-digital-Pound-really-useful-for.jpg

Section 4958 Taxes on Excess Benefit Transations 1 Section 4958 imposes an excise tax also referred to as intermediate sanctions on disqualified persons and Section 4958 imposes excise taxes on each excess benefit transaction as defined in section 4958 c and 53 4958 4 between an applicable tax exempt organization as defined in

cise taxes on excess benefit transactions In addition to excise taxes that may be imposed under section 4958 the Internal Revenue Service may also revoke the tax exempt status of an The term excess benefit transaction means any transaction in which an economic benefit is provided by an applicable tax exempt organization directly or indirectly to or for the use of any

More picture related to What Is A Section 4958 Excess Benefit Transaction

What Is A Wet Signature Wet Signing Vs Digital Signatures

https://www.ilovepdf.com/storage/blog/222-1683276540-What-is-a-wet-signature-.jpg

What Is A Zero Knowledge Proof ZKPs Explained 2024

https://blog.thirdweb.com/content/images/size/w2000/2023/04/What-is-a-zero-knowledge-proof--ZKP---Zero-knowledge-proofs-explained.png

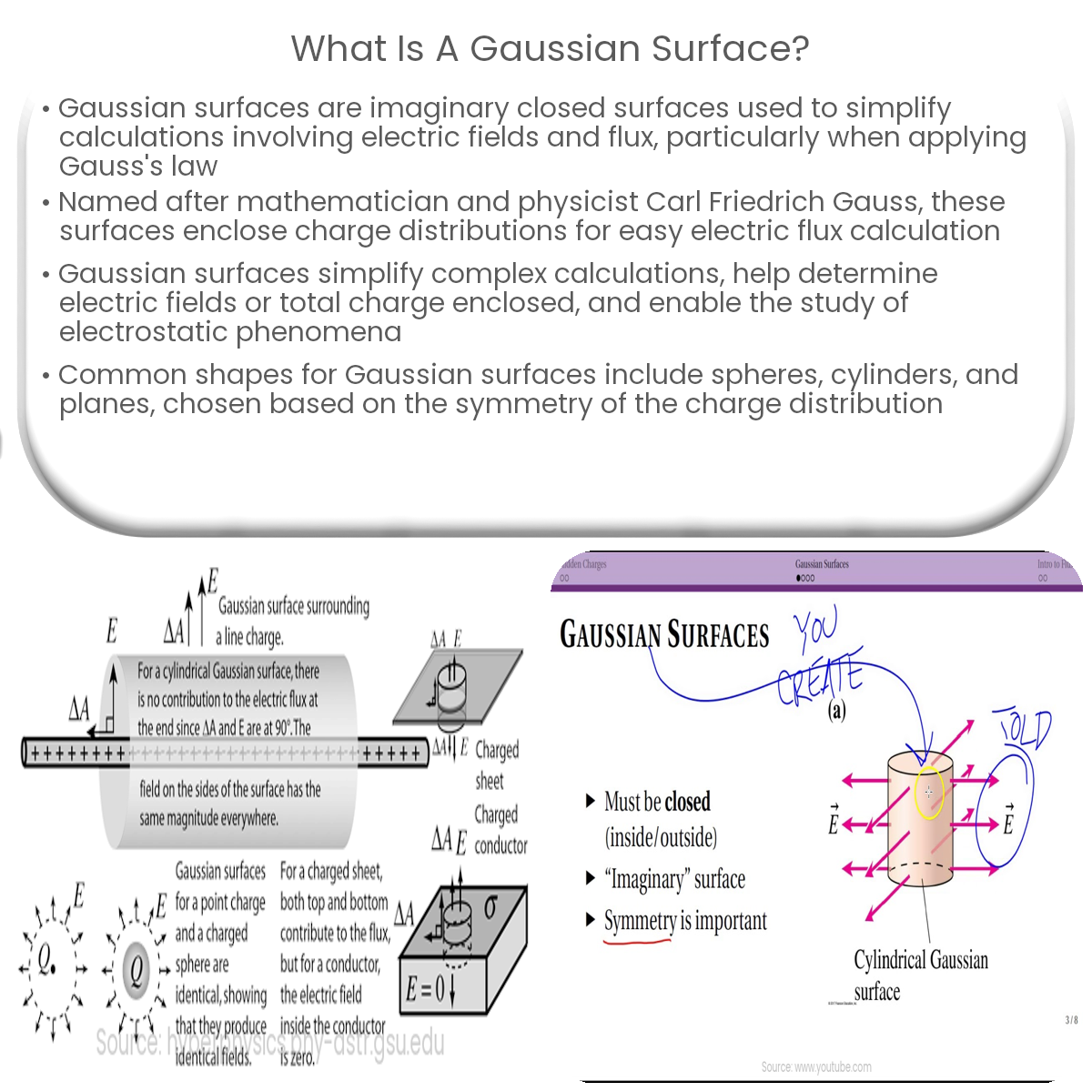

Qu Es Una Superficie Gaussiana

https://www.electricity-magnetism.org/wp-content/uploads/2023/06/what-is-a-gaussian-surface.png

Section 4958 imposes excise taxes on transactions that provide excess economic benefits to disqualified persons of public charities and social welfare organizations The proposed The term excess benefit transaction means any transaction in which an economic benefit is provided by an applicable tax exempt organization directly or indirectly to or for the use of any

53 4958 0 Table of contents This section lists the major captions contained in 53 4958 1 through 53 4958 8 a In general b Excess benefit defined c Taxes paid by disqualified Section 4958 imposes excise taxes on each excess benefit transaction as defined in section 4958 c and 53 4958 4 between an applicable tax exempt organization as defined in

What Is A Warehouse Management System Montawms en

https://montawms.com/en/wp-content/uploads/sites/7/2022/11/What-is-a-Warehouse-Management-System.webp

What Is A Meme Stock The Worst Investment Or 2024

https://thoughts.money/wp-content/uploads/2023/11/what-is-a-meme-stock.jpg

https://www.irs.gov/charities-non-profits/...

Section 4958 applies to all excess benefit transactions occurring on or after September 14 1995 However Section 4958 does not apply to excess benefit transactions that occurred under a

https://www.law.cornell.edu/cfr/text/26/53.4958-4

An excess benefit transaction means any transaction in which an economic benefit is provided by an applicable tax exempt organization directly or indirectly to or for the use of any disqualified

What Is A Foundation Plan

What Is A Warehouse Management System Montawms en

What Is A Fund

What Is A Flowchart Visily

What Is A Preferred Equity Investment LiveWell

What Is A Wire Transfer

What Is A Wire Transfer

Section 8 Company Compliance A Complete Guide Ebizfiling

What Is A Floating License Automation Software Systems

How To Delete Section Breaks In Google Docs PresentationSkills me

What Is A Section 4958 Excess Benefit Transaction - The term excess benefit transaction means any transaction in which an economic benefit is provided by an applicable tax exempt organization directly or indirectly to or for the use of any