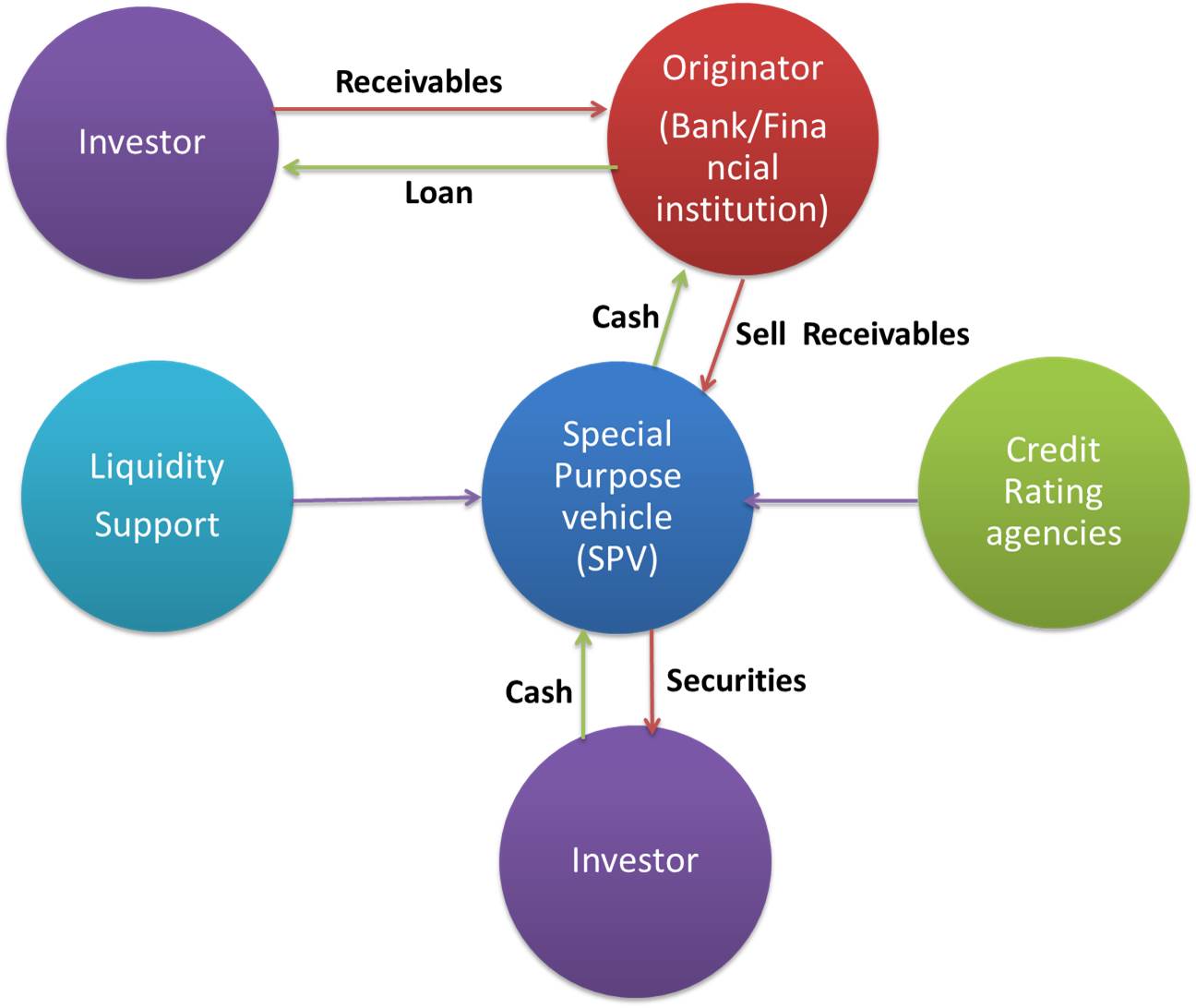

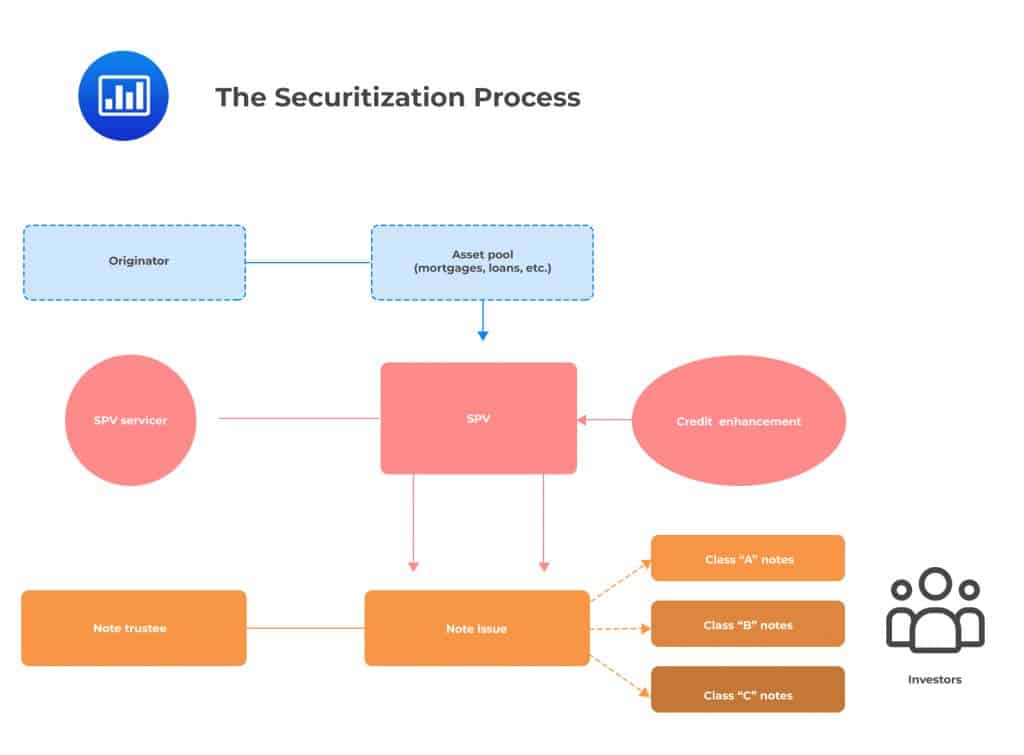

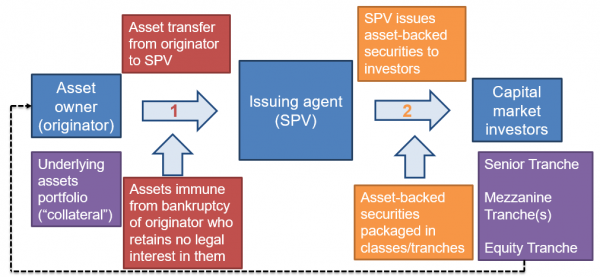

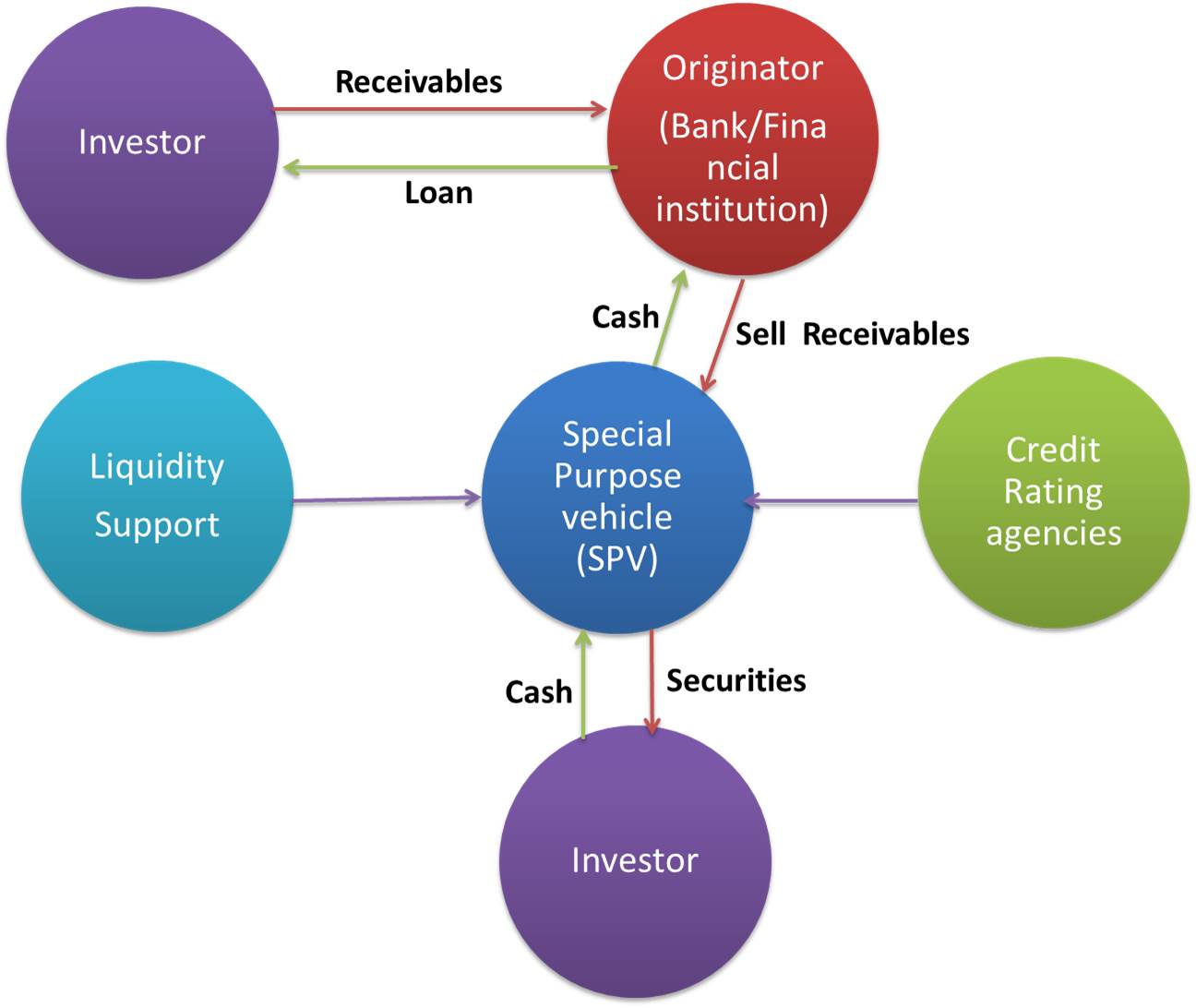

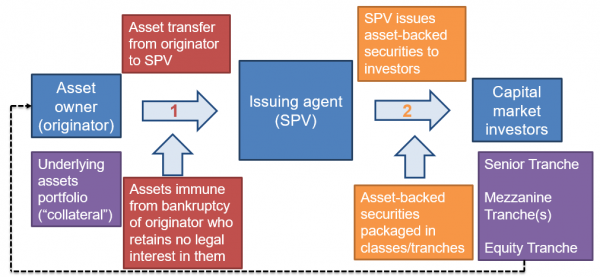

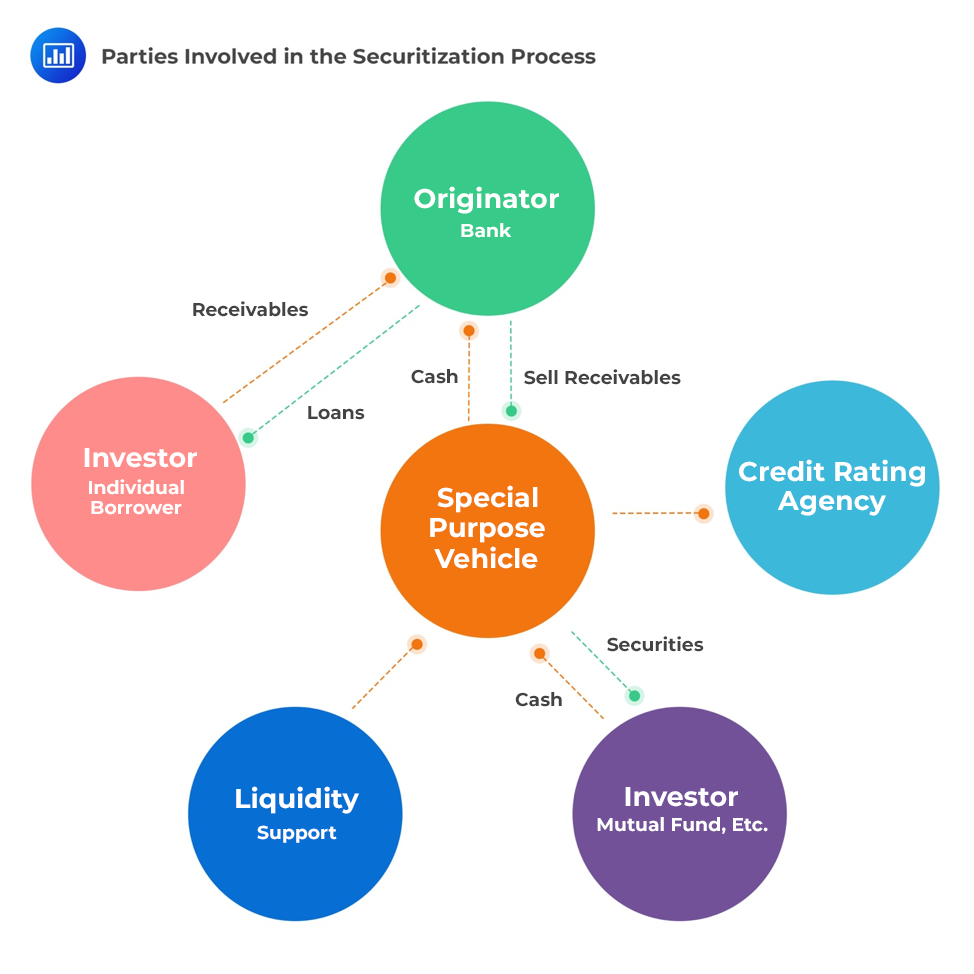

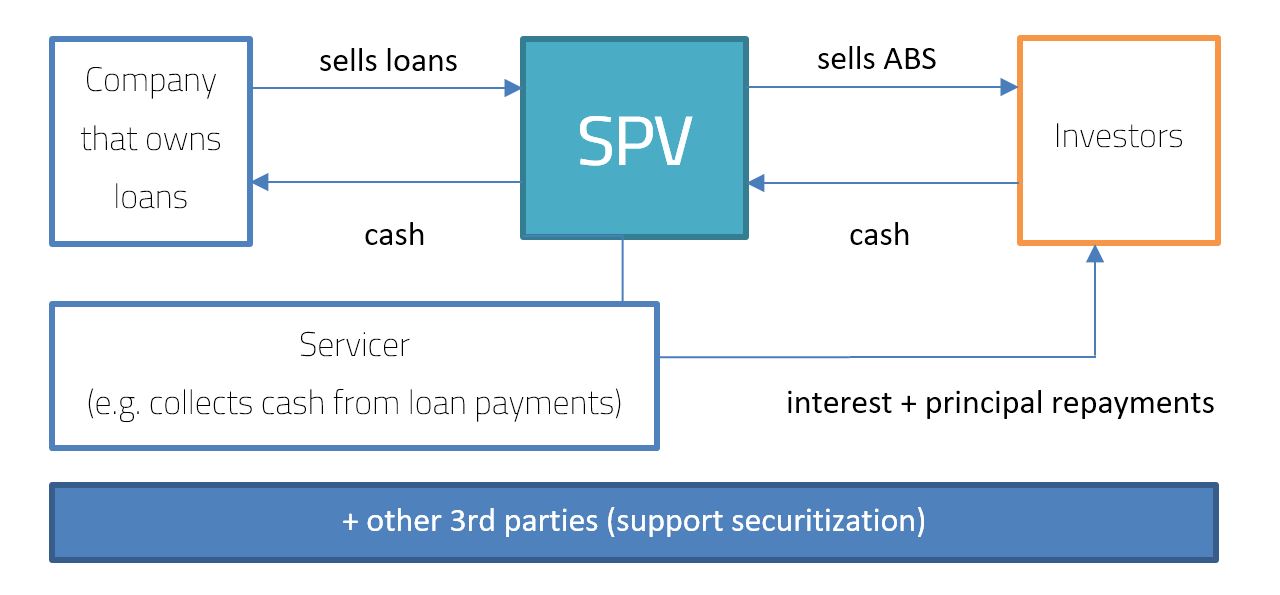

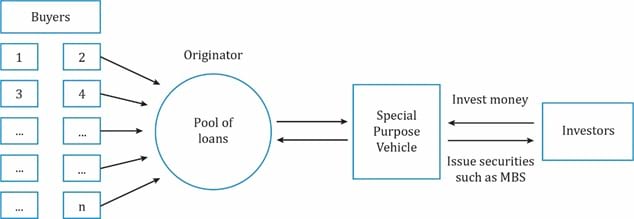

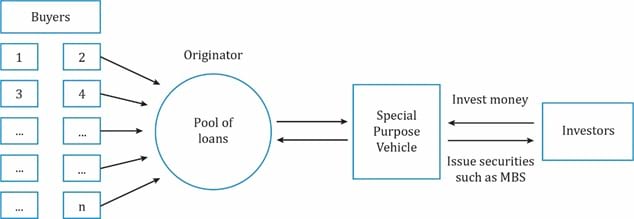

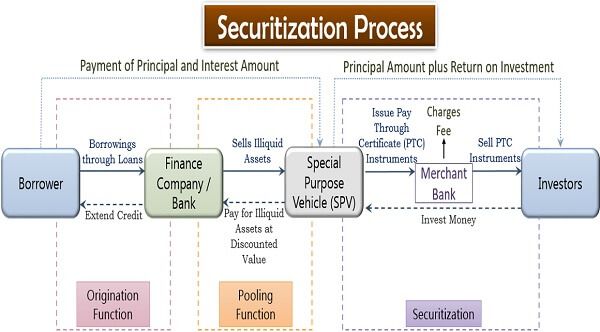

What Is A Securitization Transaction A securitization is a transaction in which a sponsor or originator obtains funding by causing a special purpose entity to issue securities backed by and paid from the proceeds of

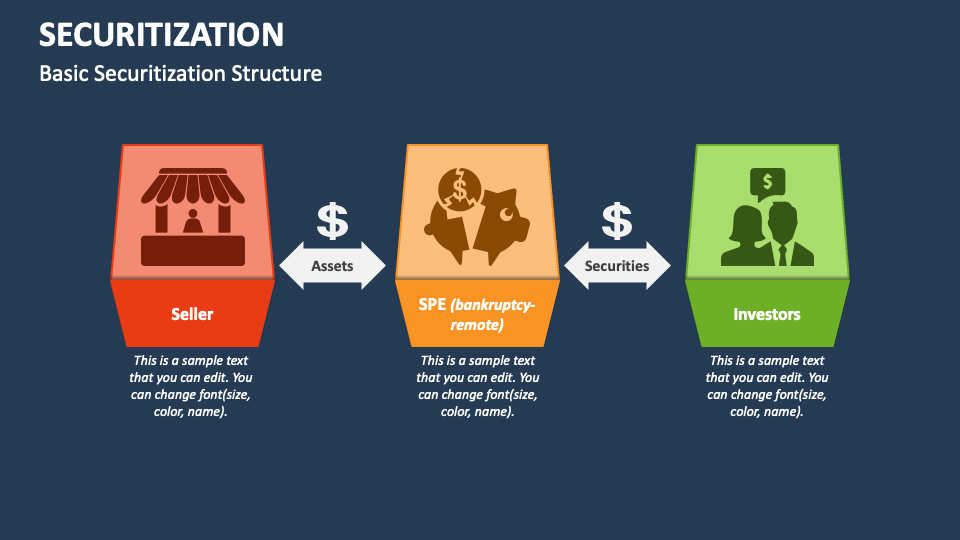

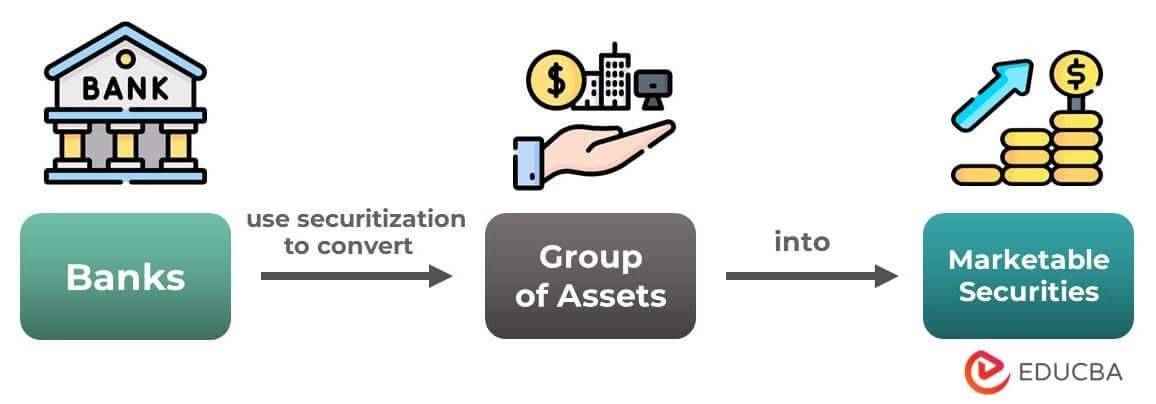

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages commercial mortgages auto loans or credit card debt obligations or other non debt assets which generate receivables and selling their related cash flows to third party investors as securities which may be described as bonds pass through securities or collateralized debt obligations CDOs Investors are repaid from the principal and interest cash flows collecte Securitization is the process of pooling and packaging Financial Assets usually relatively illiquid into liquid marketable securities Securitization is an array of conversion of nonmarketable assets into marketable securities

What Is A Securitization Transaction

What Is A Securitization Transaction

https://www.thestreet.com/.image/t_share/MjAwNTIwMjUzMjI5MjQ1NTQ4/securitization.png

What Is Securitization Difference Process Securitization Basic

https://www.educba.com/securitization/wp-content/uploads/2013/12/Securitzation.jpg

Securitization PowerPoint Presentation Slides PPT Template

https://www.collidu.com/media/catalog/product/img/5/5/557ec2a82d38b535a42199572e94014b7fec171f8e03adbbc66df790a544c415/securitization-slide1.png

Securitization is a risk management tool used to reduce the idiosyncratic risk associated with the default of individual assets Banks and other financial institutions use securitization to lower their risk exposure and reduce the size Securitization is the process of pooling and repackaging homogeneous illiquid financial assets on the originator s balance sheet into marketable securities that can be sold in the capital markets to the ultimate

The term securitize refers to the process of pooling financial assets together to create new securities that can be marketed and sold to investors Mortgages and Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest bearing securities The interest and principal payments from the

More picture related to What Is A Securitization Transaction

What Is Securitization In A Collection Lawsuit Defense YouTube

https://i.ytimg.com/vi/wh_1_WHmz3w/maxresdefault.jpg

The Securitization Process CFA FRM And Actuarial Exams Study Notes

https://analystprep.com/study-notes/wp-content/uploads/2019/09/img_2.jpg

An Introduction To Securitization What Is Securitization GoldenPi

https://d2zny4996dl67j.cloudfront.net/blogs/wp-content/uploads/2022/09/16112513/Banner-4.jpg

Securitisation is a financing technique by which homogeneous income generating assets which on their own may be difficult to trade are pooled and sold to a specially created third party Securitization is the process of taking groups of assets packaging them together and selling them as interest earning securities on the secondary market These securities are

A securitization is a transaction in which a sponsor or originator obtains funding by causing a special purpose entity to issue securities backed by and paid from the proceeds of What Is Securitization Securitization is a financial innovation in which a company pools together its financial assets usually illiquid assets forming a Special Investment Vehicle

Frm part 2 securitization process CFA FRM And Actuarial Exams Study

https://analystprep.com/study-notes/wp-content/uploads/2019/09/frm-part-2-securitization-process-600x277.png

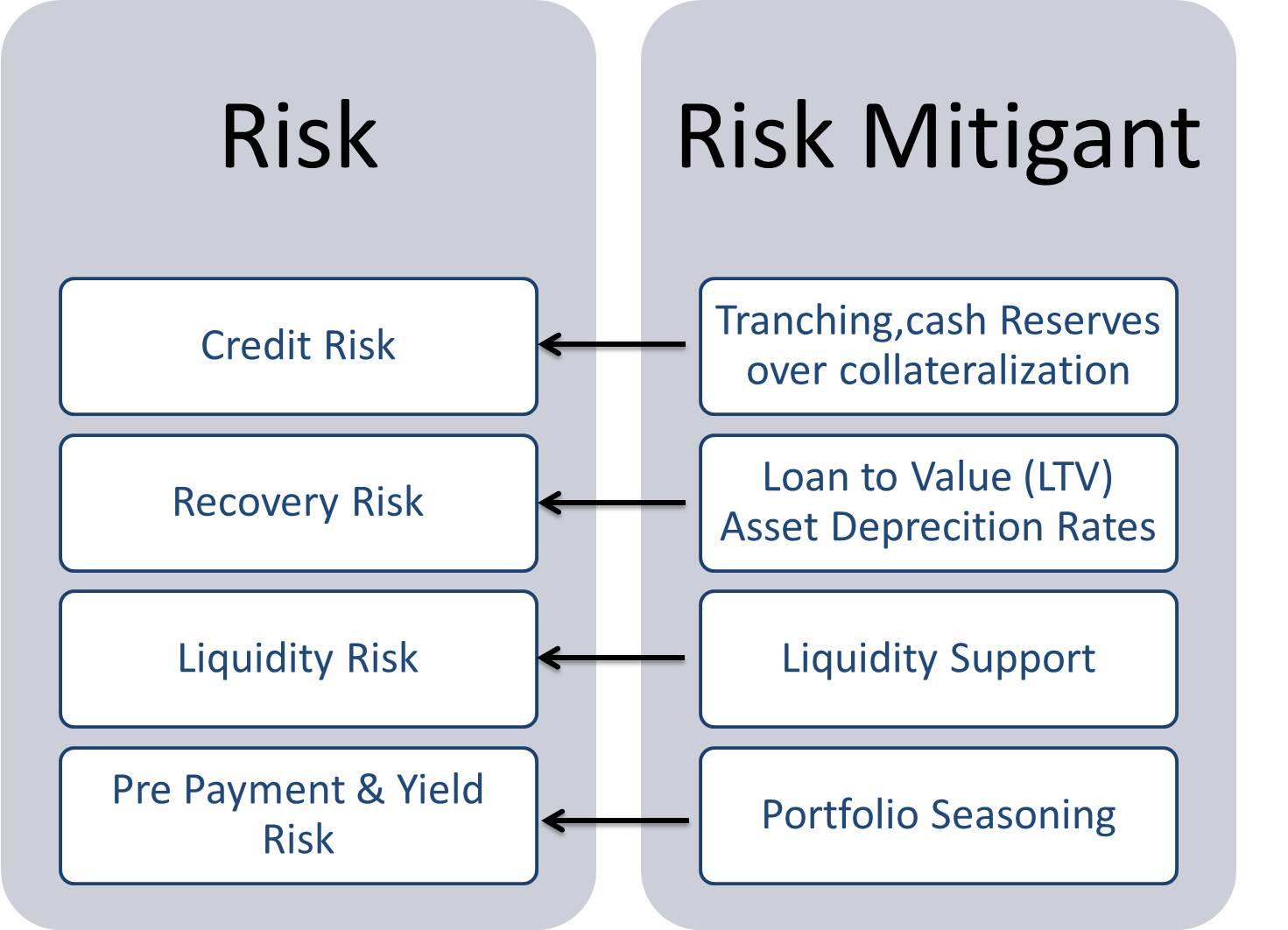

What Is Securitization Difference Process Securitization Basic

https://www.educba.com/securitization/wp-content/uploads/2013/12/Securitizationrisk.jpg

https://www.americanbar.org/groups/business_law/...

A securitization is a transaction in which a sponsor or originator obtains funding by causing a special purpose entity to issue securities backed by and paid from the proceeds of

https://en.wikipedia.org/wiki/Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages commercial mortgages auto loans or credit card debt obligations or other non debt assets which generate receivables and selling their related cash flows to third party investors as securities which may be described as bonds pass through securities or collateralized debt obligations CDOs Investors are repaid from the principal and interest cash flows collecte

Securitization Process Download Scientific Diagram

Frm part 2 securitization process CFA FRM And Actuarial Exams Study

Describe Securitization Fixed Income CFA Level 1 AnalystPrep

:max_bytes(150000):strip_icc()/asset-backed-security-4201381-1-bd07a6656c814548a785cc0eeb5ff1c4.jpg)

What Are The 5 Types Of Security Leia Aqui What Are The 5 C s In

CFA Level 1 Securitization Process

Process Of Securitization With Example

Process Of Securitization With Example

What Is Securitization Definition Process Types Advantages

Credit Card Processing A Definitive Guide M2P Fintech Blog

Securitization Process Definition Types Examples EduCBA

What Is A Securitization Transaction - The term securitize refers to the process of pooling financial assets together to create new securities that can be marketed and sold to investors Mortgages and