What Is Current Income Tax System The individual income tax is the largest source of revenue in the federal income tax system Most of the income reported on individual income tax returns is wages and salaries

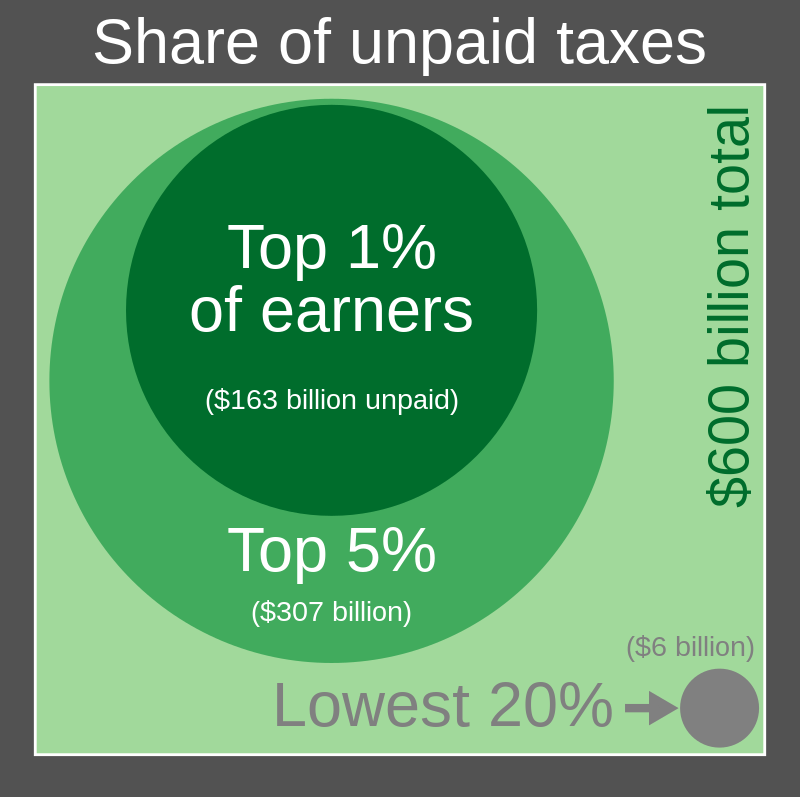

Income Tax Every person who earns income in the U S is supposed to pay income tax on both the federal and state level Besides Federal income tax Each state also has its own form of income tax that employers The Administration in its recent budget proposed tax reforms that would target higher income taxpayers Before we can begin to assess the value of specific proposals it

What Is Current Income Tax System

What Is Current Income Tax System

https://i.ytimg.com/vi/RSezYPI7KRo/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYFSBlKFwwDw==&rs=AOn4CLAfa9cJfQ-IggSOwFFdlm818E0YdQ

Tax Reliefs Available Under The Personal Income Tax Act Taxaide

https://taxaide.com.ng/wp-content/uploads/2022/09/methods-for-determining-personal-income-tax_0709135752.png

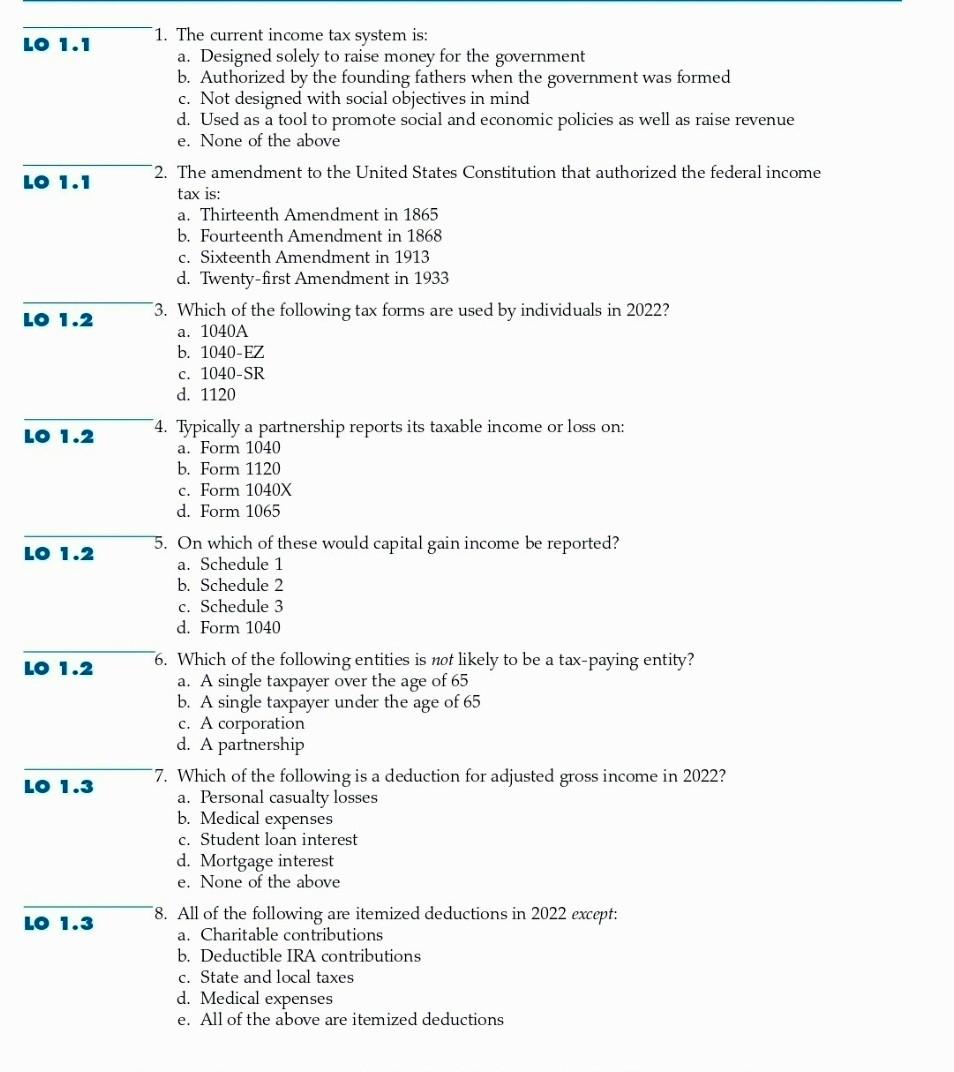

Solved 1 The Current Income Tax System Is A Designed Chegg

https://media.cheggcdn.com/study/7e0/7e0dc2c1-c899-4cd7-8220-4b952739dffe/image.jpg

The federal income tax is levied according to a progressive tax system where higher income earners are taxed at higher rates The tables below show the tax brackets and rates for 2024 and The old tax regime is the existing tax structure under which taxpayers can claim various deductions and exemptions under different sections of the Income Tax Act It has a higher tax rate but allows taxpayers to claim

Current Income Tax Rates and Brackets The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent table 1 The rates apply to taxable income adjusted gross income minus either the standard The income tax is a direct tax which follows a progressive slab rate where the rate of tax increases as the taxpayer s income rises The Income tax Act 1961 provides for two tax regimes the old regime which allows various deductions

More picture related to What Is Current Income Tax System

Taxation NOTES CHAPTER 4 TAXATION VARIOUS TYPES AND CURRENT

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/531abfbe028b997761a77bcd28eb91ec/thumb_1200_1697.png

What Is The Difference Between New And Old Income Tax System MahitiGuru

https://lh3.googleusercontent.com/-zxfHOnKjaMw/Y-DHDjczIjI/AAAAAAADxsc/5HS4L2jwzv0jlb-1TZlExPg2_54sikY-gCNcBGAsYHQ/s1600/n4685191961675675089405d2df2a56dba9765e051420d82a47262f02b088b9b0e844db62f4ccd598af9bae.jpg

The Benefits Of Selecting The New Tax Regime FY24

https://static.newsheads.in/media/thumbs/2023/04/21/475099656-income-tax-regime_1200x675.jpg

In both 2024 and 2025 the federal income tax rates for each of the seven brackets are the same 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent Income tax is a critical component of government revenue systems worldwide enabling governments to fund essential services while also reflecting principles of equity through its

What Is Income Tax Income tax in its simplest form is a legal obligation charged by governments on individuals and corporations financial incomes Predominantly it s applied The Indian taxation system follows a three tier structure with taxes imposed by the Central Government State Governments and local municipal bodies The system includes

What Is US Taxation

https://media.licdn.com/dms/image/D4D12AQG0ALbSZxA7yQ/article-cover_image-shrink_720_1280/0/1674326393377?e=2147483647&v=beta&t=bsIr8xGSRdww4rgSy0Cr1Uppv5_yi9rUAiOCqZ0XYy4

How To Fix Our Irrational Income Tax System IFS Zooms In The Economy

https://assets.pippa.io/shows/5ea004d9fbcc383829c71657/1706192354472-618336eb8e2e91bb89b85fdb89a85f3d.jpeg

https://sgp.fas.org › crs › misc

The individual income tax is the largest source of revenue in the federal income tax system Most of the income reported on individual income tax returns is wages and salaries

https://taxguru.in › income-tax › us-tax-sys…

Income Tax Every person who earns income in the U S is supposed to pay income tax on both the federal and state level Besides Federal income tax Each state also has its own form of income tax that employers

Old Tax Regime Vs New Tax Regime

What Is US Taxation

Progressive Income Tax System Which Taxes High Incomes More incomtax

Alternative Minimum Tax Exemption Calculate Form And How To Claim

Introduction To The Tax System INTRODUCTION TO THE INCOME TAX SYSTEM

New Income Tax System

New Income Tax System

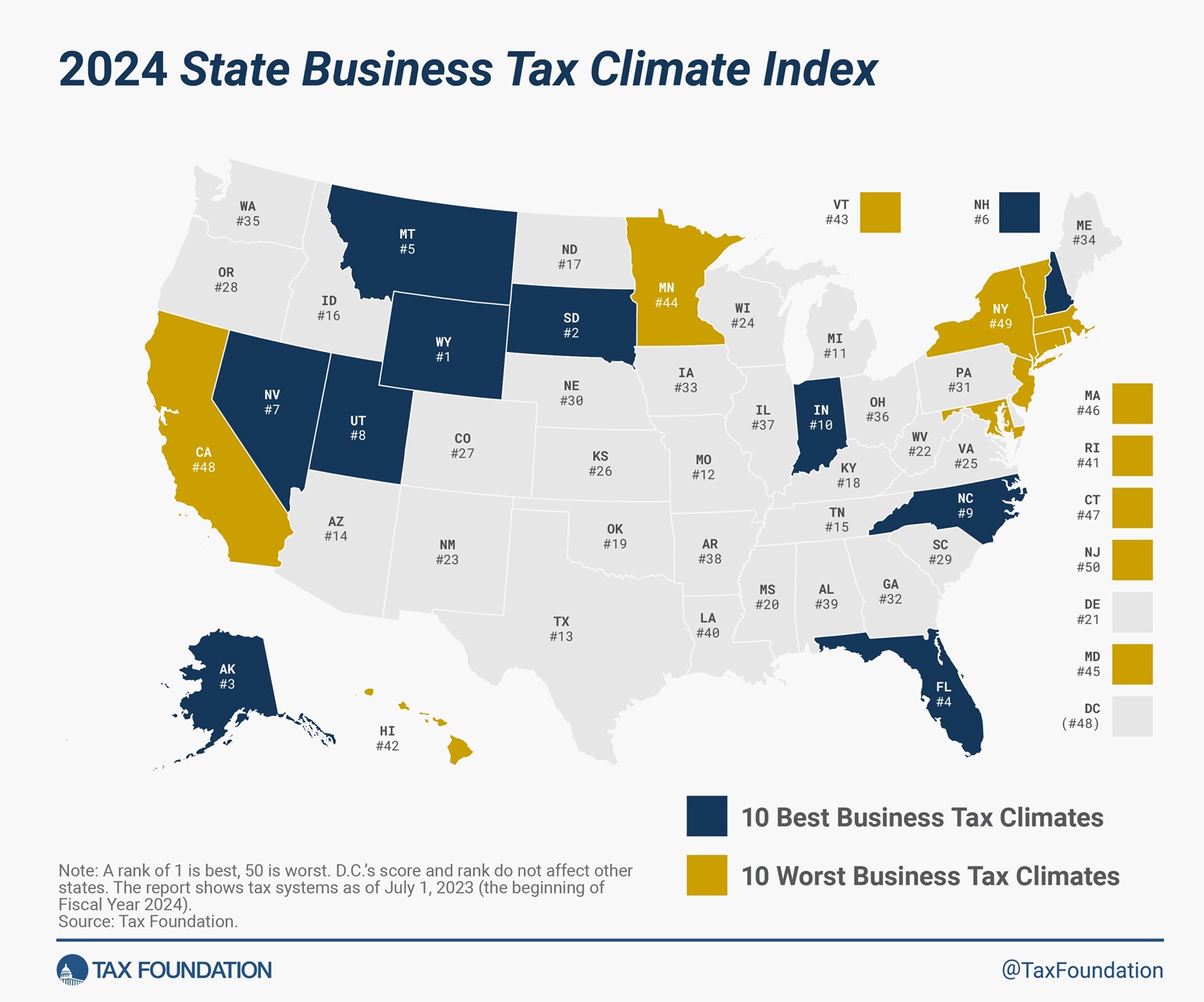

SBTCI 2023 Which States Are Best And Worst and Moving In The Right

2023 Guide For Understanding The Tax System For Individuals LEPROC

Paying Income Taxes Civics 101 A Podcast

What Is Current Income Tax System - Yes federal income tax rates are different from state income tax rates State income tax rates are typically much lower than federal tax rates A handful of states including