What Is Default Withholding The IRS requires a default withholding rate of 10 on RMDs from Individual Retirement Accounts IRAs unless the account holder opts out or specifies a different rate

Default Withholding Rates If a taxpayer receiving nonperiodic distributions fails to elect a withholding rate or to waive withholding the 10 percent rate will apply In the past the default withholding rate for periodic Under the final regulations the IRS can change the default rate of withholding applied to monthly pension or annuity payments simply by issuing new forms instructions or

What Is Default Withholding

What Is Default Withholding

https://higheducations.com/wp-content/uploads/2022/10/What-Does-Default-Mean.jpg

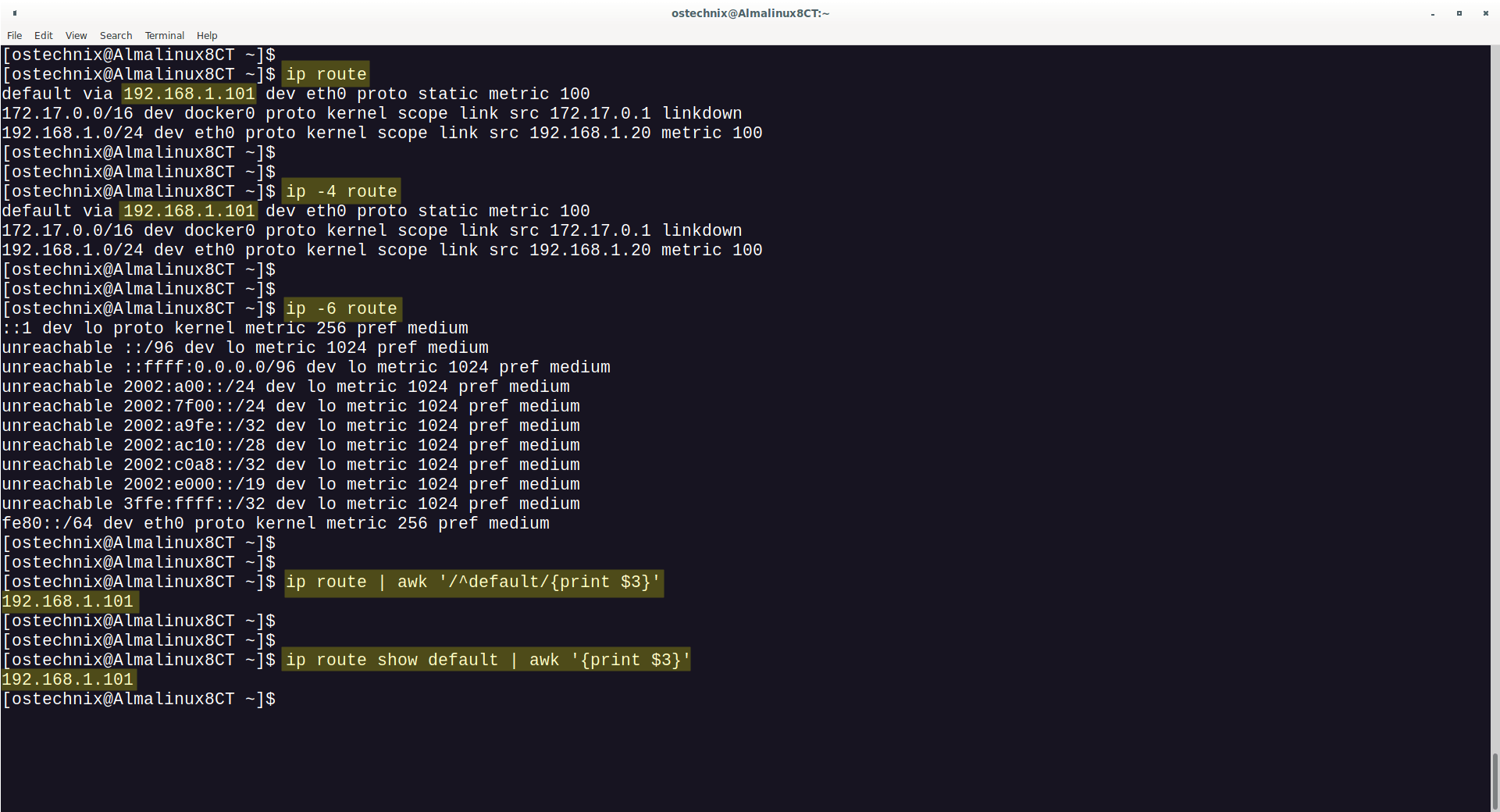

Find Default Gateway IP Address In Linux And Unix OSTechNix

https://ostechnix.com/wp-content/uploads/2022/09/Find-Default-Gateway-Using-ip-Command.png

Avoid Withholding Tax With ACAD Solutions Sdn Bhd

https://acad.com.my/web/image/7134/Withholding Tax Website Page SEO_09-11-2023.jpg

As in previous years default federal tax withholding is 20 for all rollover eligible payments whether periodic or non periodic withholding mandatory However annuitants who choose a Distributions from a retirement plan are subject to federal and state income tax withholding The tax rate depends on the type of plan Here s what to know

Because an RMD is ineligible for rollover you don t have the mandatory 20 withholding that would normally apply to distributions from qualified retirement plans so you Find tax withholding information for employees employers and foreign persons The withholding calculator can help you figure the right amount of withholdings

More picture related to What Is Default Withholding

Small Value Withholding Tax Payment Oct 07 2022 Johor Bahru JB

https://cdn1.npcdn.net/image/166512035923f738b6ef776af9417bd591ef038409.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

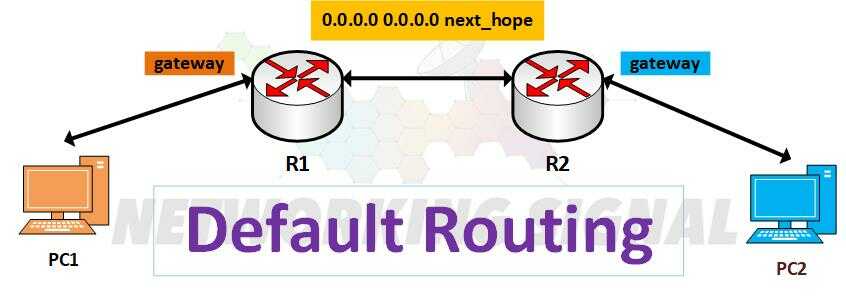

What Is Default Routing And How To Configure It Detail Explained

https://www.networkingsignal.com/wp-content/uploads/2022/11/what-is-default-routing-and-how-to-configure-it-detail-explained_optimized.jpg

Default Mode

https://accidentallyretired.com/wp-content/uploads/2022/10/Default-Mode-768x432.jpg

Default withholding is now Single with no adjustments changed from Married with three 3 allowances Note If you choose to not have income tax withheld you may indicate no If federal income tax is withheld state income tax of at least your state s minimum requirements must be withheld in addition to federal income tax withholding at the time of your distribution If

The Social Security Administration SSA announced it will increase the default overpayment withholding rate for Social Security beneficiaries to 100 percent of a person s The default withholding rate is 10 but you have the flexibility to adjust this You can choose to have more or less withheld or even opt for no withholding at all However it s

How To Set Default Sign in Option In Windows 11 Technoresult

https://technoresult.com/wp-content/uploads/2023/01/default-sign-in-option-feature-image.jpg

What Is The Default Mode Network

https://lh5.googleusercontent.com/eZtTIRxMFZpbJFsitPjV0NCpuglCogA39JXAD5m6kCFFUJkU4NXg0ztAAEtMMKpxx5GGnuTuHS65ZQqv24VWc9DGBsJIIs5LwQ277KJkhNQcFZVLPQhEzAUDKaDGIgCr_VCW6oH-6PfCAi3HH1vWhQ

https://accountinginsights.org › rmd-tax-withholding...

The IRS requires a default withholding rate of 10 on RMDs from Individual Retirement Accounts IRAs unless the account holder opts out or specifies a different rate

https://thelink.ascensus.com › articles › ...

Default Withholding Rates If a taxpayer receiving nonperiodic distributions fails to elect a withholding rate or to waive withholding the 10 percent rate will apply In the past the default withholding rate for periodic

BIR Imposes 1 Withholding Tax On Online Merchants

How To Set Default Sign in Option In Windows 11 Technoresult

Figuring Out Tax Withholding Mid Oregon View

Best Default Combination

What Does A Property Manager Do Do You Need One

Debt Limit 2023 Joe Biden Kevin McCarthy To Discuss Wednesday Fox43

Debt Limit 2023 Joe Biden Kevin McCarthy To Discuss Wednesday Fox43

Default Argument In C Default Argument With Examples In C What

What Is Reddit And Should Your Brand Be Using It Elton Heta News

Tax Update On Withholding Tax Nov 07 2022 Johor Bahru JB

What Is Default Withholding - As in previous years default federal tax withholding is 20 for all rollover eligible payments whether periodic or non periodic withholding mandatory However annuitants who choose a