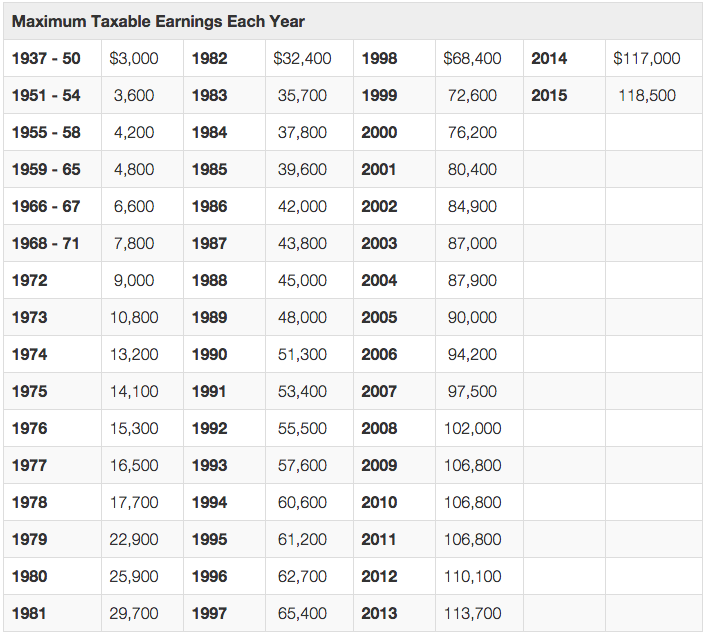

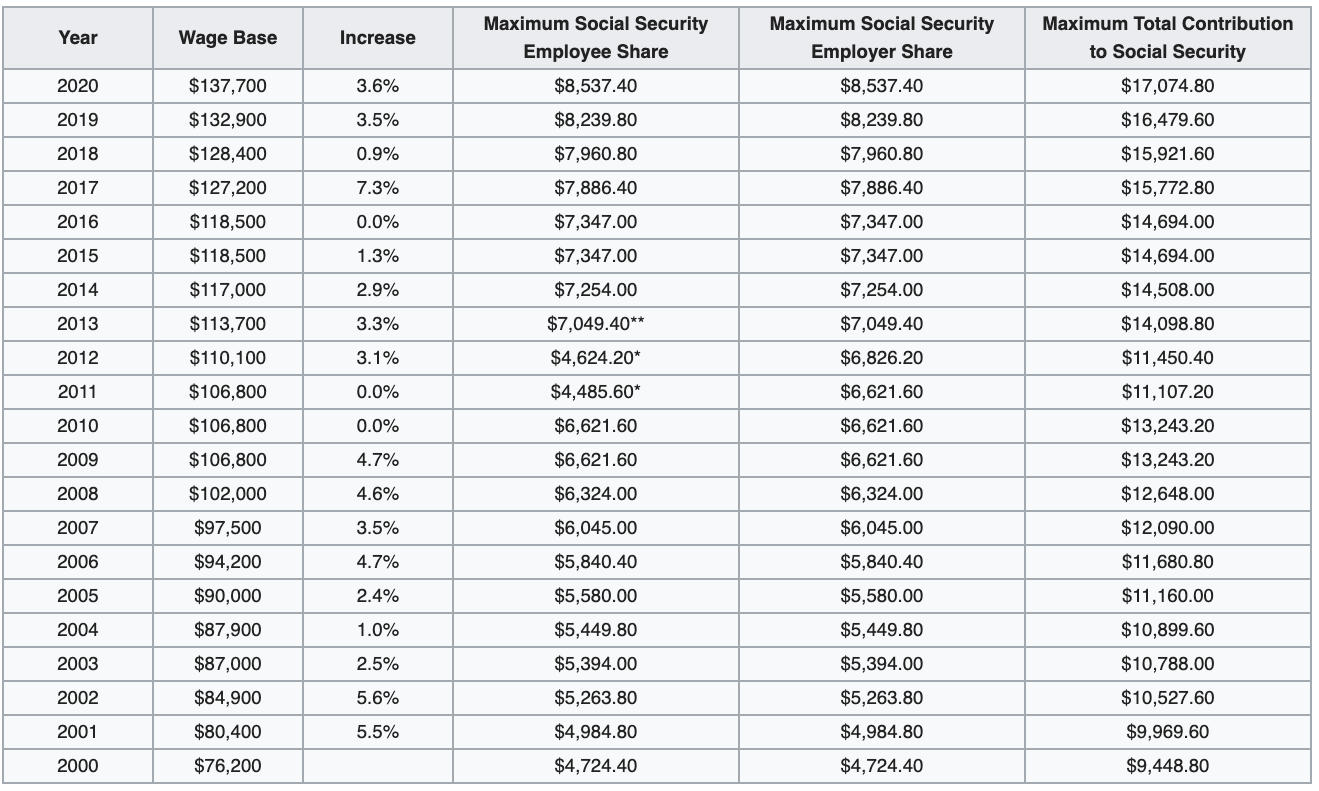

What Is Maximum Taxable Amount For Social Security For 2024 the Social Security tax limit is 168 600 Workers earning less than this limit pay a 6 2 tax on their earnings Individuals with multiple income sources will want to track their

42 rowsSee how we use earnings to compute a retirement benefit amount The initial benefit In 2025 the maximum amount of earnings on which you must pay Social Security tax is 176 100 We raise this amount yearly to keep pace with increases in average wages

What Is Maximum Taxable Amount For Social Security

What Is Maximum Taxable Amount For Social Security

https://www.financialsamurai.com/wp-content/uploads/2014/12/Maximum-taxable-earnings-each-year-social-security.png

Social Security Tax Limit 2025 Withholding Table Irena Lyndsie

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

Social Security Income Limit 2025 Increase Jacob Nasir

https://learn.financestrategists.com/wp-content/uploads/Social_Security_Benefit_Scale.png

58 rowsListed below are the maximum taxable earnings for Social Security In 2025 the wage base subject to Social Security taxes is 176 100 Any income earned above this limit in the calendar year will not be subject to Social Security taxes So the most an employee will have to pay in 2025 will be 10 918

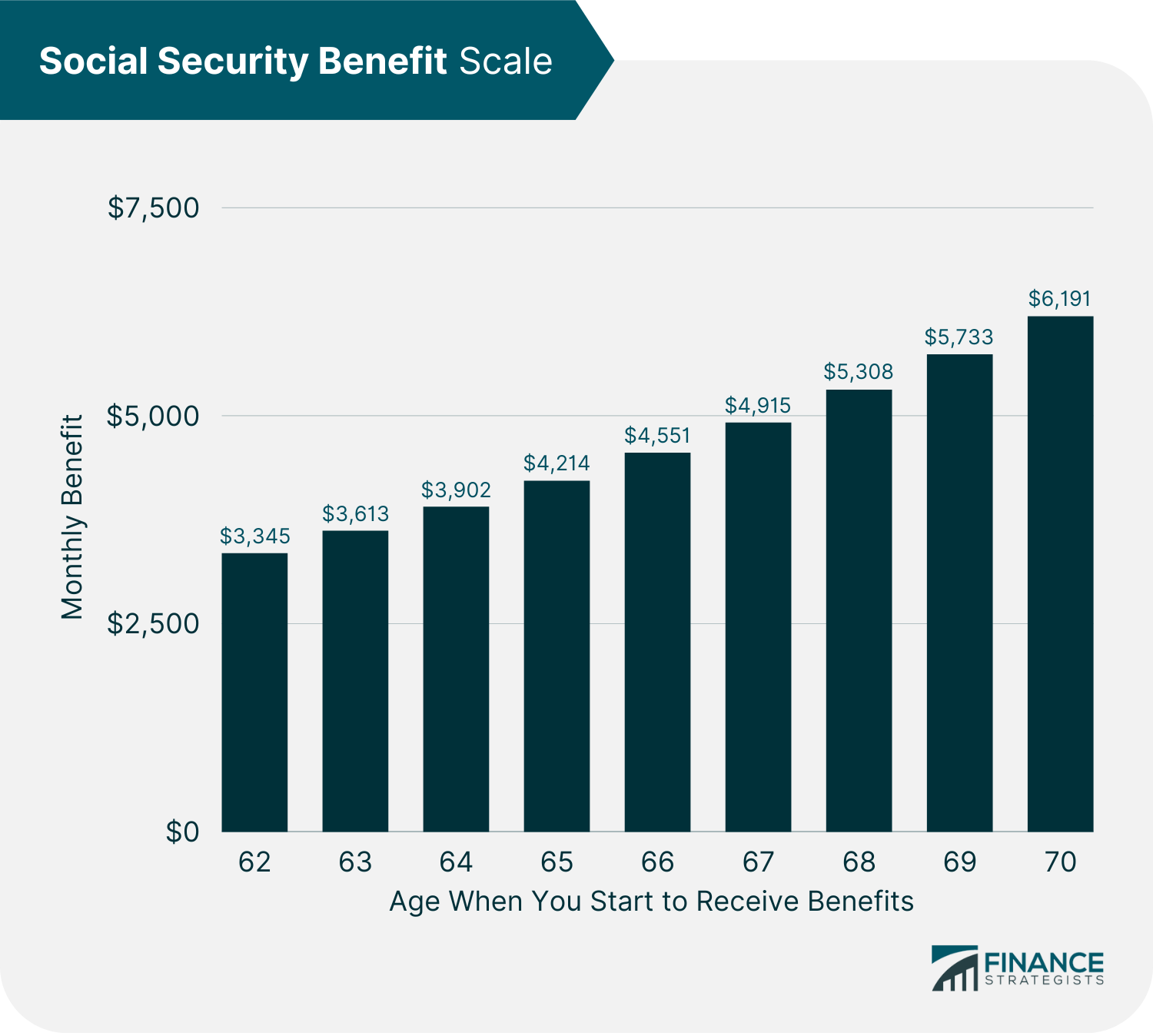

The maximum taxable income for Social Security for 2025 is 176 100 Under FICA the Federal Insurance Contributions Act 6 2 percent of your gross pay is withheld from The maximum monthly Social Security benefit that an individual can receive per month back in 2021 was 3 790 for someone who files at age 70 For someone at full retirement age the maximum amount is 3 011 and for

More picture related to What Is Maximum Taxable Amount For Social Security

Max Taxable Social Security Wages 2025 Olympics Amara Paige

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

Max Taxable Income For Social Security 2024 Sarah Cornelle

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2023/02/social-security-max-income.png?fit=1456

Max Amount Of Social Security Tax 2025 Enzo Quinn

https://www.financialsamurai.com/wp-content/uploads/2020/06/tax.png

The maximum amount of an employee s 2024 earnings and a self employed person s net income that is subject to the Social Security payroll tax is 168 600 This amount is also known as the Social Security annual wage limit wage Unlike the tax rate which has been at 6 2 for employees since 1990 the tax limit also known as the taxable maximum changes every year The 2024 max social security tax

For 2025 the Social Security tax limit is 176 100 Last year the tax limit was 168 600 So if you earned more than 168 600 this past year you didn t have to pay the Social Security For 2025 the Social Security tax limit is 176 100 This means that the maximum amount of Social Security tax an employee will pay through withholding from their paychecks in 2025 is

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://money.usnews.com › money › retirement › social...

For 2024 the Social Security tax limit is 168 600 Workers earning less than this limit pay a 6 2 tax on their earnings Individuals with multiple income sources will want to track their

https://www.ssa.gov › oact › cola › examplemax.html

42 rowsSee how we use earnings to compute a retirement benefit amount The initial benefit

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

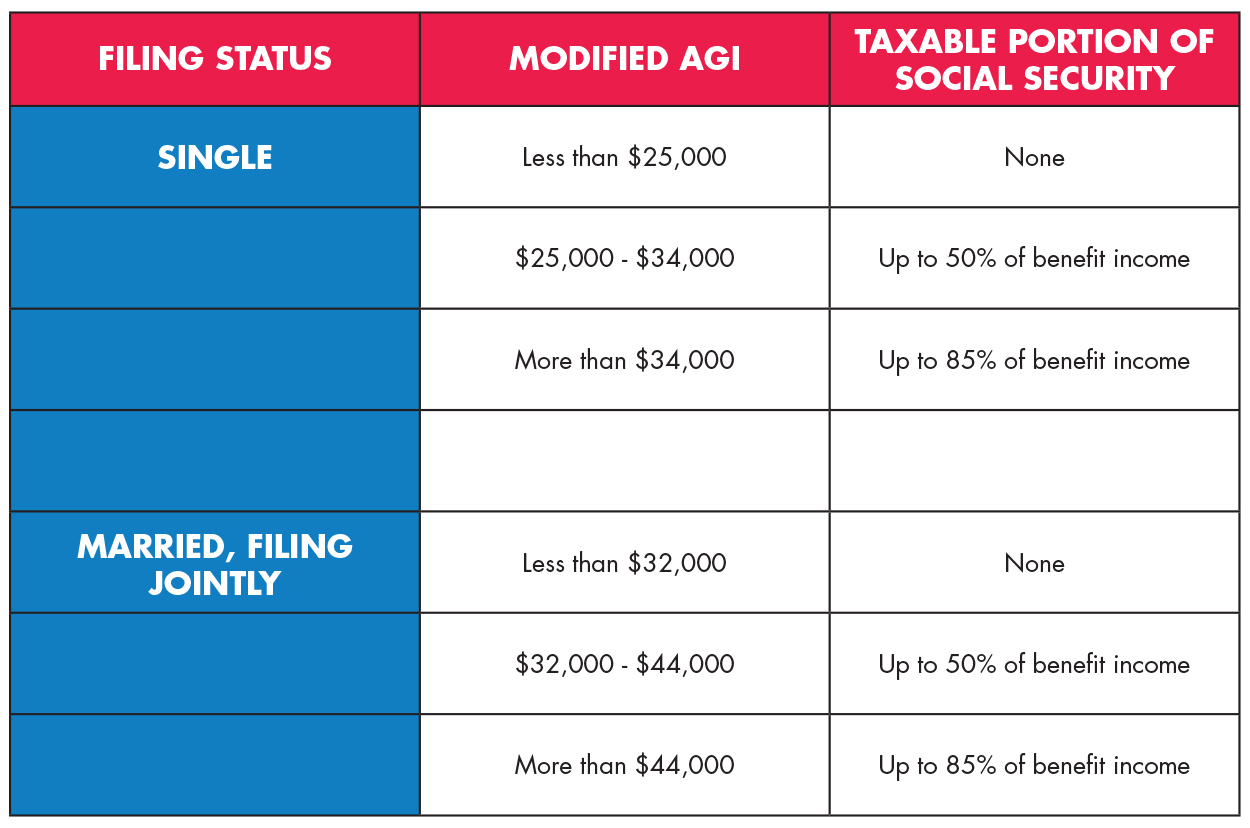

What Is Maximum Taxable Amount For Social Security - Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your