What Is Non Taxable Social Security Income Learn how to report nontaxable social security and other pension payments on your tax return Find out which types of benefits are not taxable and where to get more information

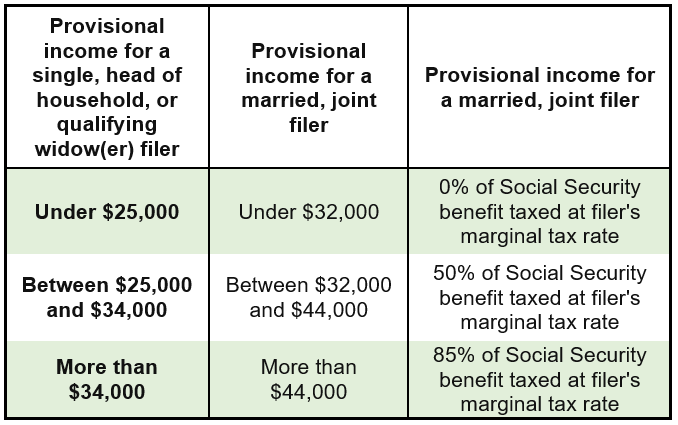

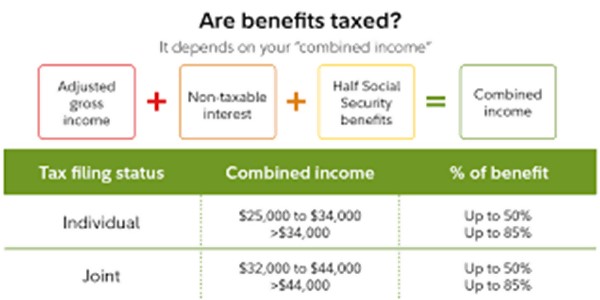

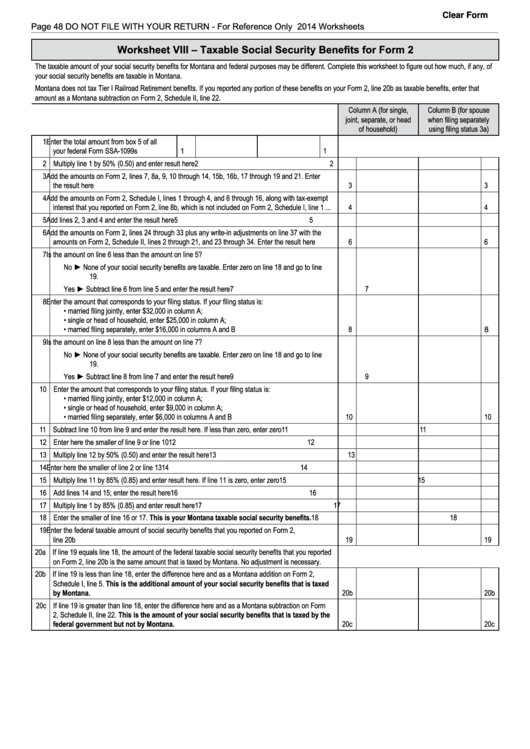

A portion of your social security benefits may be taxable based on your other income and filing status For additional information see Publication 525 Taxable and Non taxable Income Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and disability

What Is Non Taxable Social Security Income

What Is Non Taxable Social Security Income

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA12XNZm.img?w=1920&h=1080&m=4&q=75

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Taxable Social Security Calculator

https://www.covisum.com/hs-fs/hubfs/Imported_Blog_Media/WEB_Covisum_tax-chart-SST.png?width=613&name=WEB_Covisum_tax-chart-SST.png

Federal taxable income generally includes wages tips royalties commissions and for some up to 85 of Social Security benefits And that s not an exhaustive list However several types If your combined income is less than 32 000 none of your Social Security benefits are taxable If your combined income is between 32 000 and 44 000 up to 50 of your

Social Security benefits becoming non taxable after you turn 70 is a myth In truth a portion of your Social Security benefits remain taxable from the moment you start getting them until you die The money you get from Social Social Security benefits are not automatically included in gross income Their inclusion depends on the recipient s overall income level and filing status The IRS uses a

More picture related to What Is Non Taxable Social Security Income

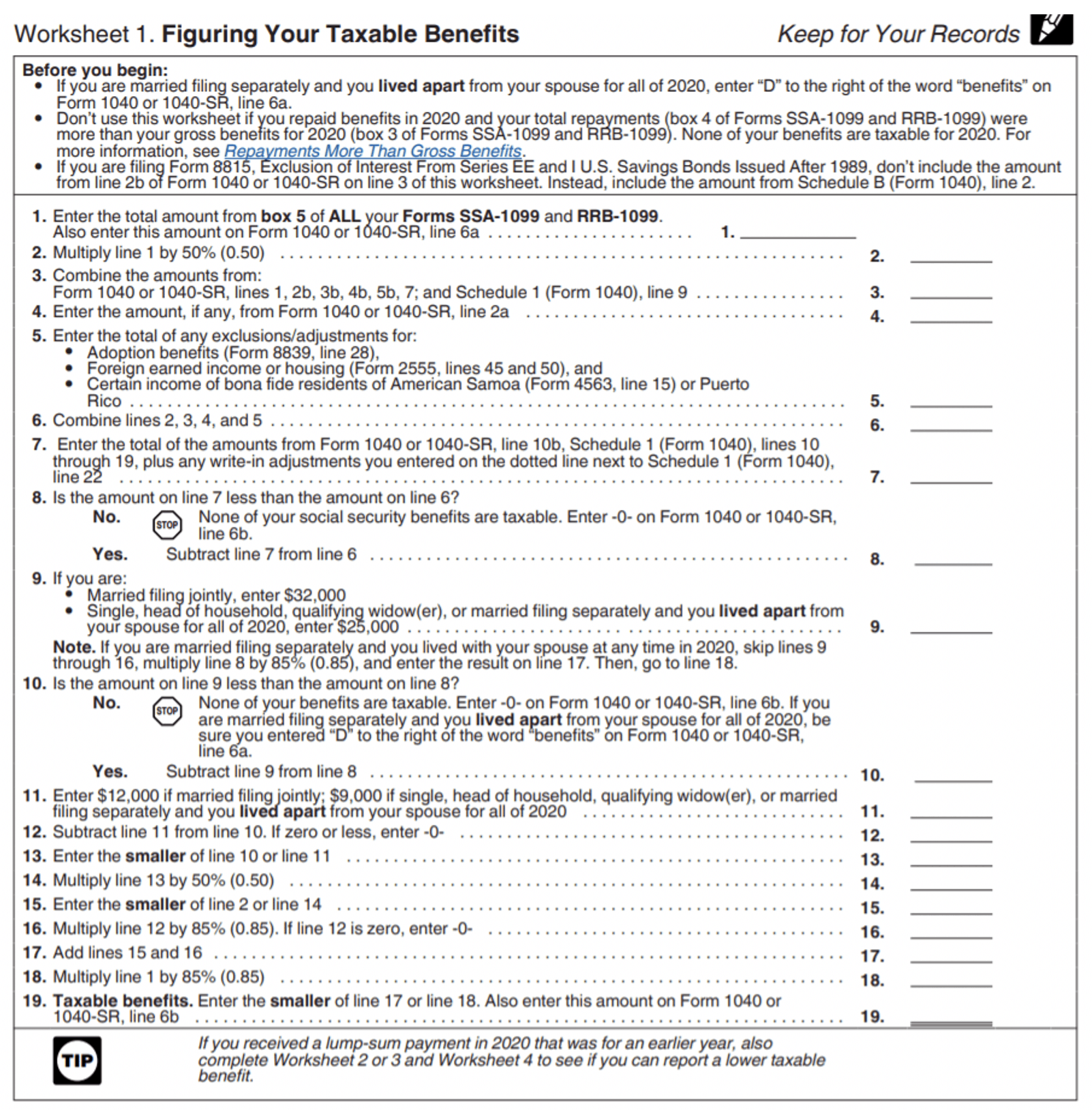

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Form1040.png

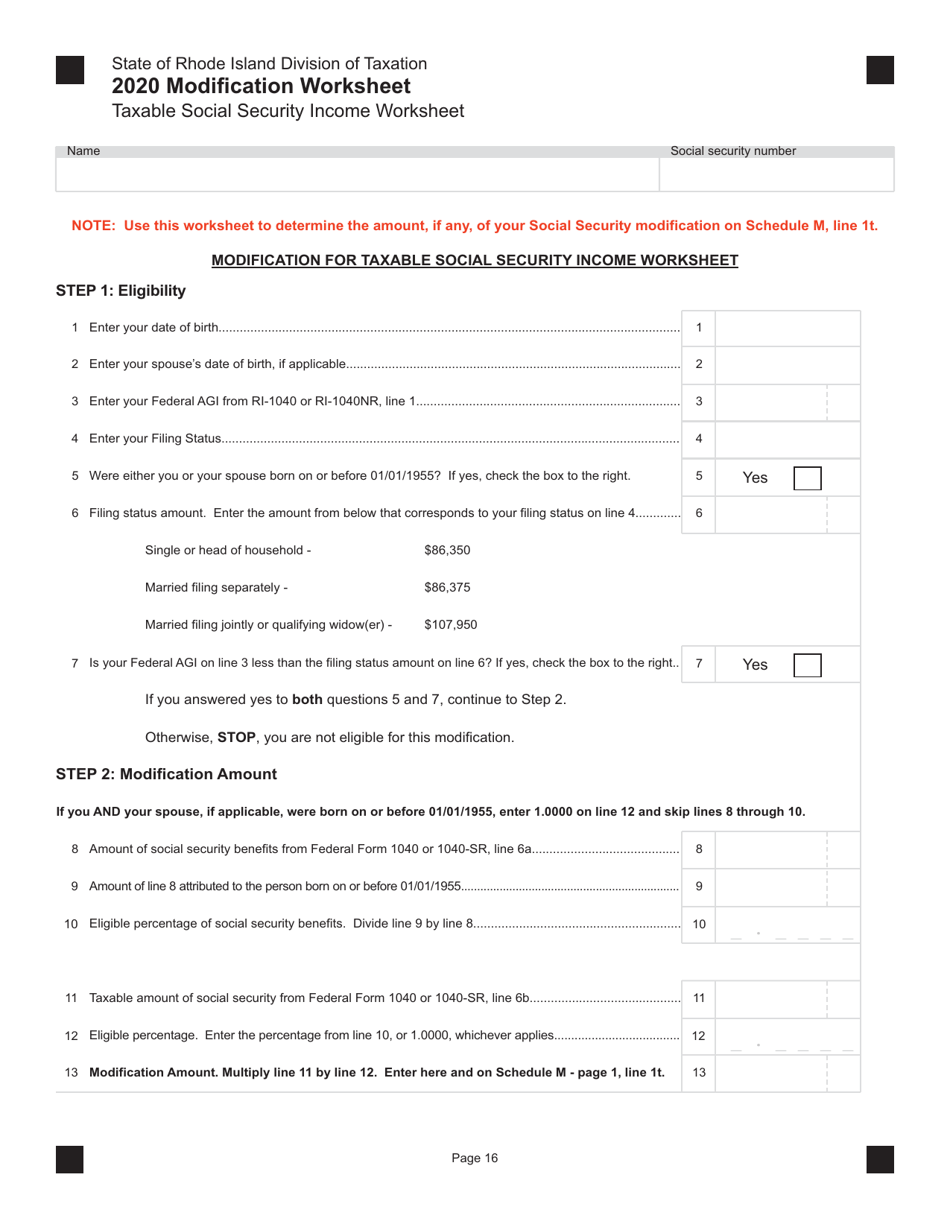

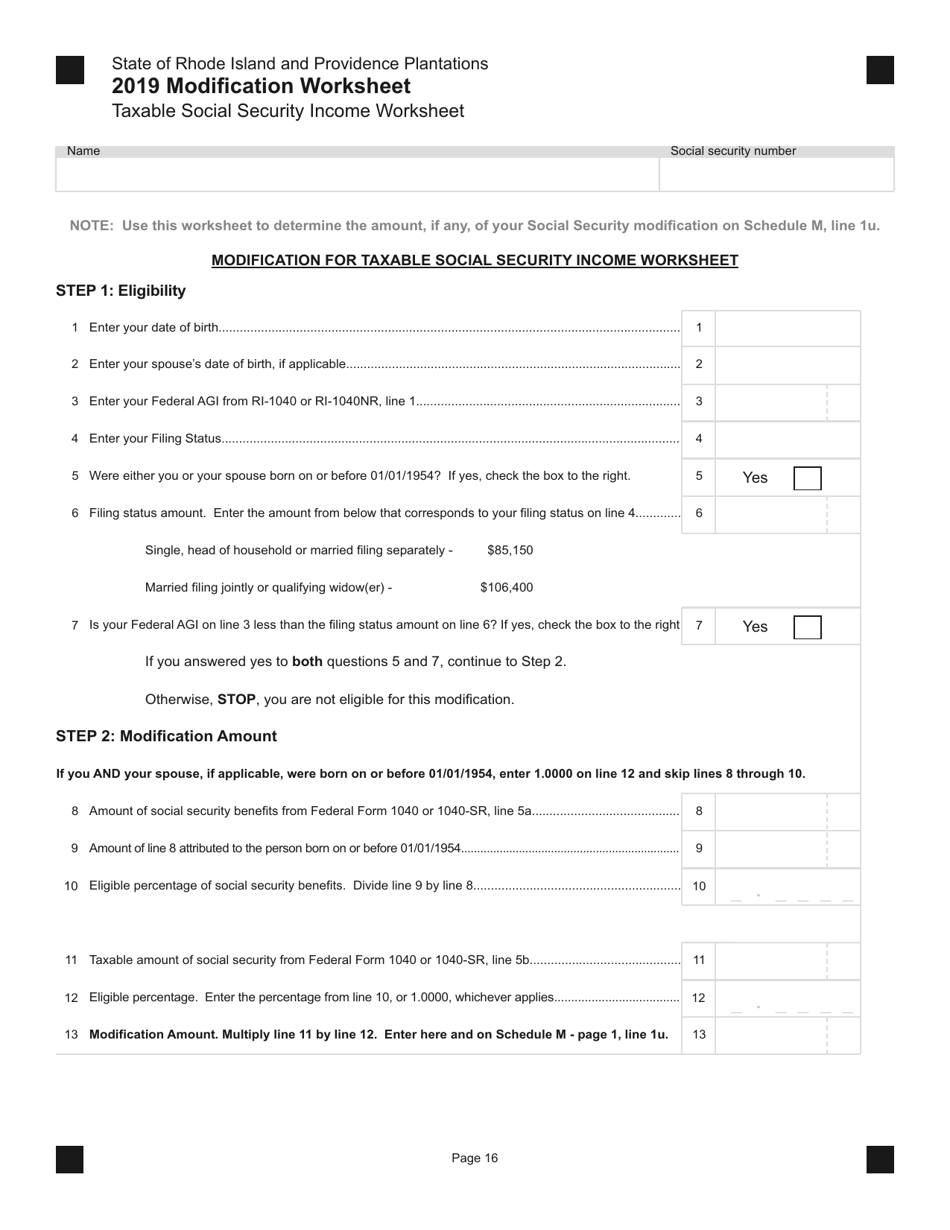

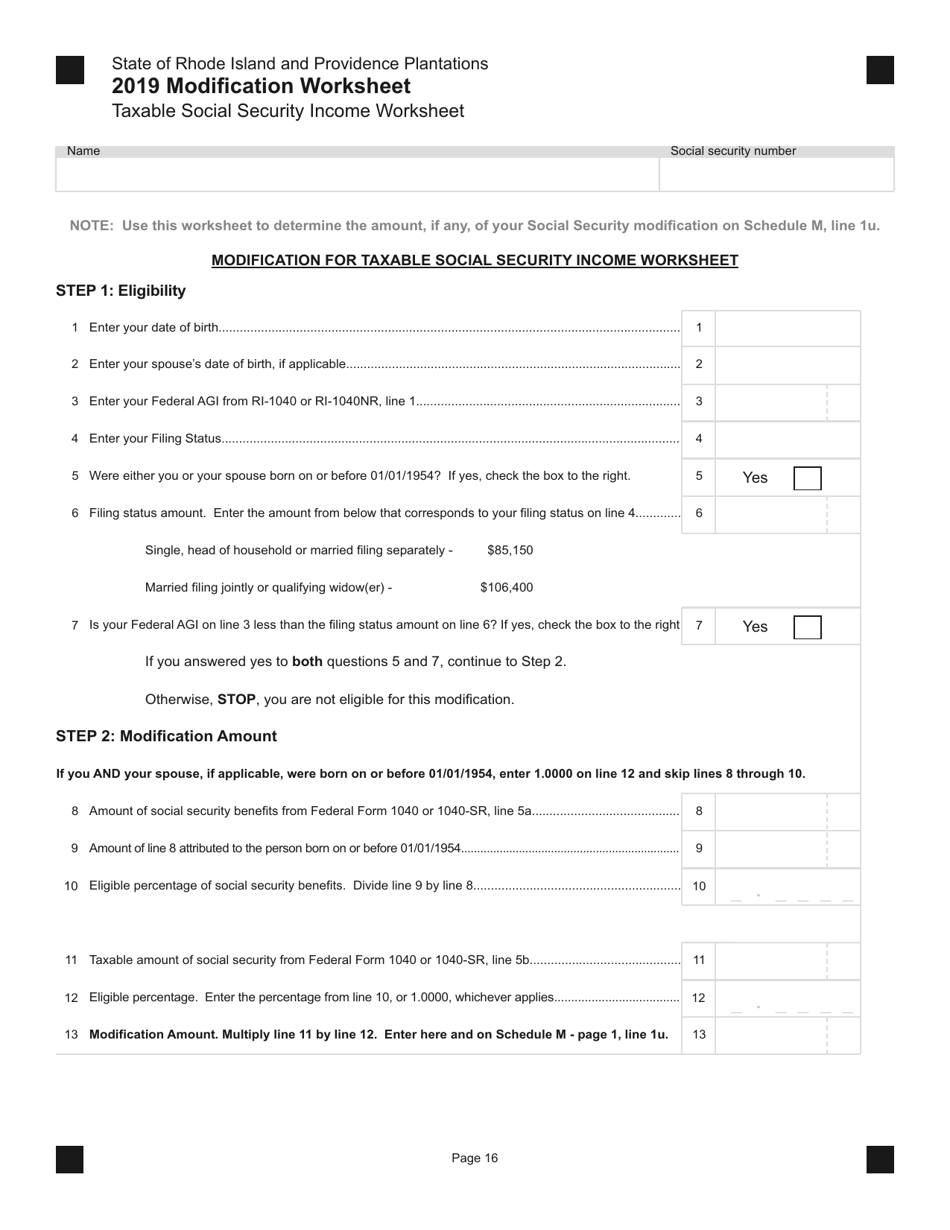

Is Social Security Taxable Worksheets

https://data.templateroller.com/pdf_docs_html/2134/21340/2134030/taxable-social-security-income-worksheet-rhode-island_print_big.png

Calculating Social Security Taxable Income TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

Social Security benefits are taxable only if your income exceeds a certain limit basically it all depends on your combined income If you stay under the threshold you pay Social Security is often non taxable or only partially taxable if your overall income is low The IRS provides Line 6a on Form 1040 to report total Social Security benefits and

Understanding how Social Security benefits are taxed is crucial for retirement planning This guide explains the complex tax rules including the provisional income calculation and how other Yes Social Security benefits can count as part of your taxable income under certain conditions If your overall income is above specific thresholds a portion of your Social

Irs Social Security Tax Calculator 2020 AidanNovalee

https://www.irstaxapp.com/wp-content/uploads/2020/03/social-security-benefits-calculator.png

Calculating Taxable Social Security Benefits Not As Easy As 0 50

https://www.moneytree.com/wp-content/uploads/2020/10/taxableSocialSecurity-1.png

https://apps.irs.gov › app › IPAR › resources › help › ntssb.html

Learn how to report nontaxable social security and other pension payments on your tax return Find out which types of benefits are not taxable and where to get more information

https://www.irs.gov › pub › irs-pdf

A portion of your social security benefits may be taxable based on your other income and filing status For additional information see Publication 525 Taxable and Non taxable Income

A Closer Look At Social Security Taxation Jim Saulnier CFP Jim

Irs Social Security Tax Calculator 2020 AidanNovalee

How Do I Calculate How Much Of My Social Security Is Taxable Retire

Taxes On Social Security Social Security Intelligence

Taxable Social Security Benefits Calculator 2024

Social Security Taxable Worksheet

Social Security Taxable Worksheet

Taxable Social Security Benefits Worksheet

How To Calculate Federal Income Tax On Social Security Benefits

[img_title-16]

What Is Non Taxable Social Security Income - If your Social Security benefits are your only source of income then they are usually not considered taxable income and thus not taxed by the IRS You will be sent Form SSA 1099