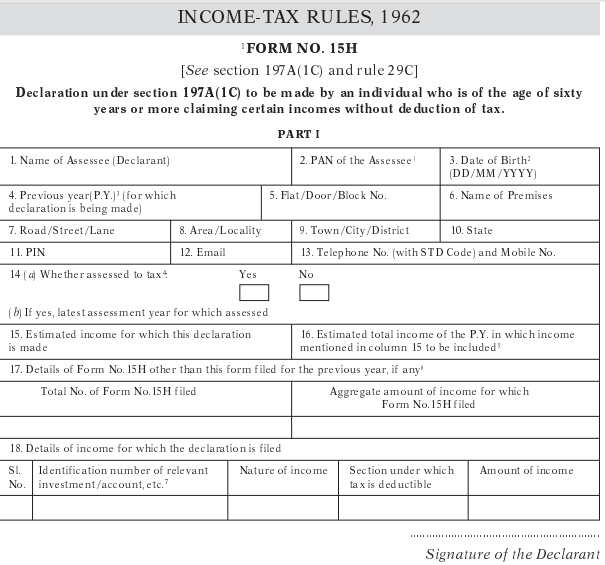

What Is Previous Year In Form 15h Form 15G or 15H is submitted to request income provider for not deducting tax or TDS for prescribed income These forms can be used only for payments in the nature of

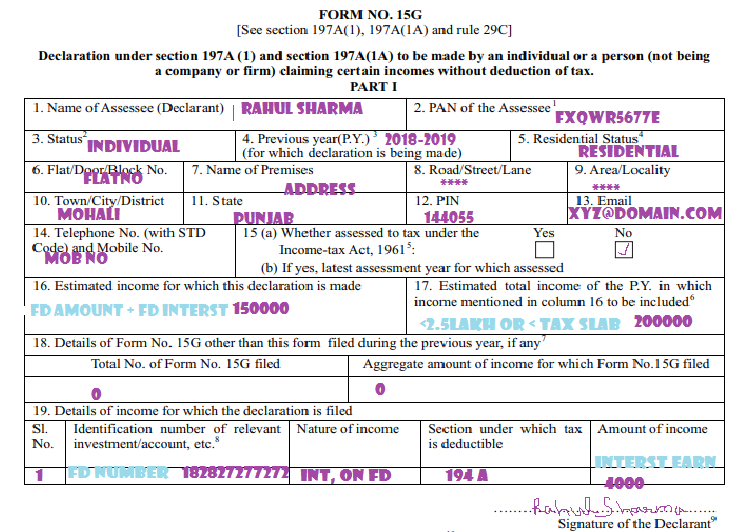

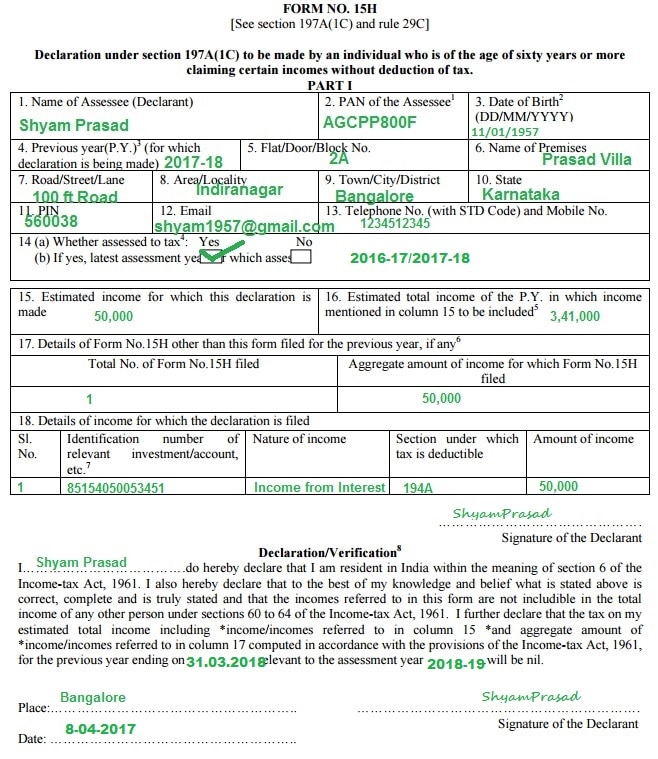

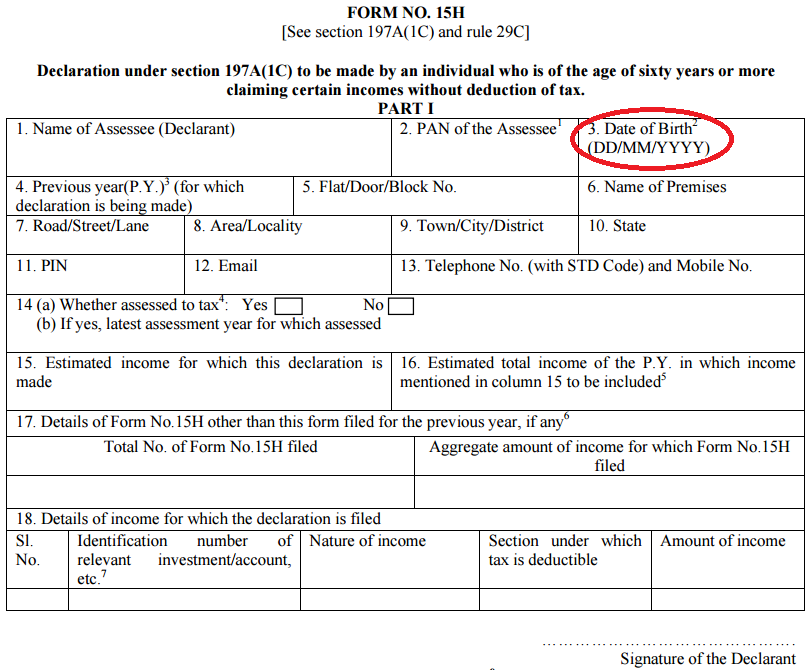

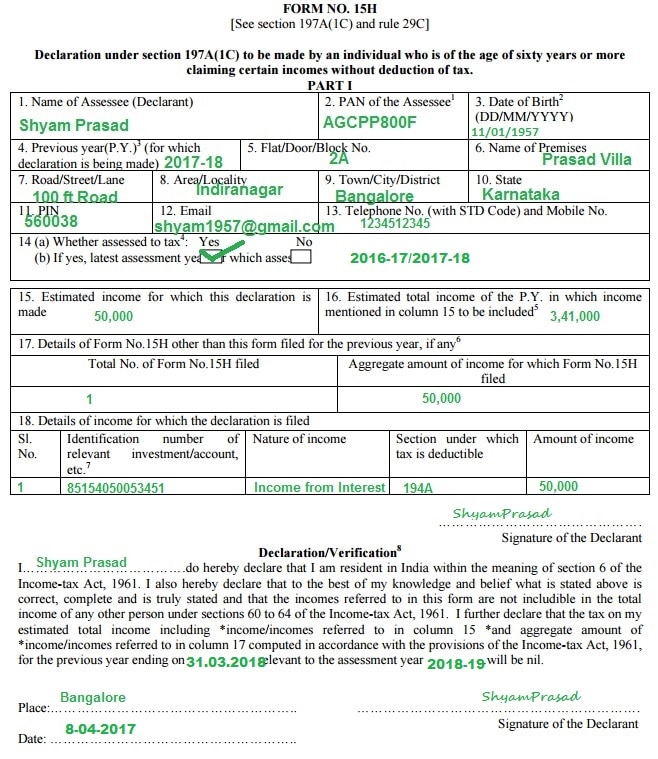

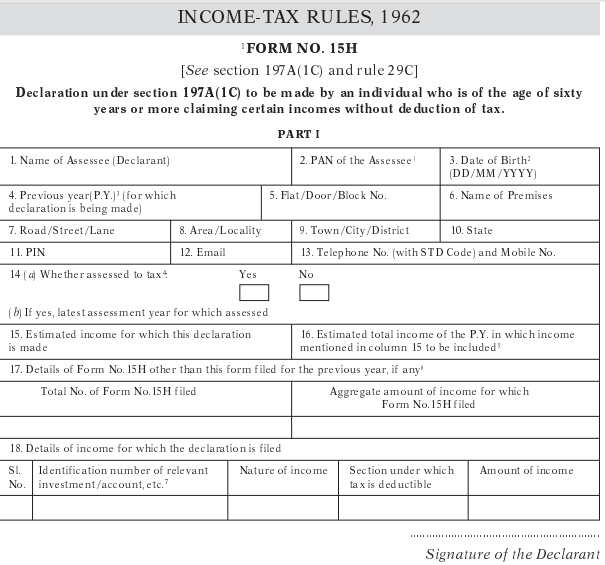

Previous Year Fill in the current financial year you are filling out the form Residential Status You can only fill out this form if you are an Indian resident Contact Details Fill in your current address email telephone and mobile Form 15H is a self declaration that may be submitted by senior citizen aged 60 years or above to reduce TDS tax deducted at source burden on interest earned from fixed deposits FD and recurring deposits RD

What Is Previous Year In Form 15h

What Is Previous Year In Form 15h

https://i.ytimg.com/vi/kLlNXTC-vOo/maxresdefault.jpg

Previous Year And Assessment Year In Form 15g YouTube

https://i.ytimg.com/vi/m6hotjcHIA8/maxresdefault.jpg

How To Fill Newly Launched Form 15G And Form 15H YouTube

https://i.ytimg.com/vi/sHZOEb0iV-s/maxresdefault.jpg

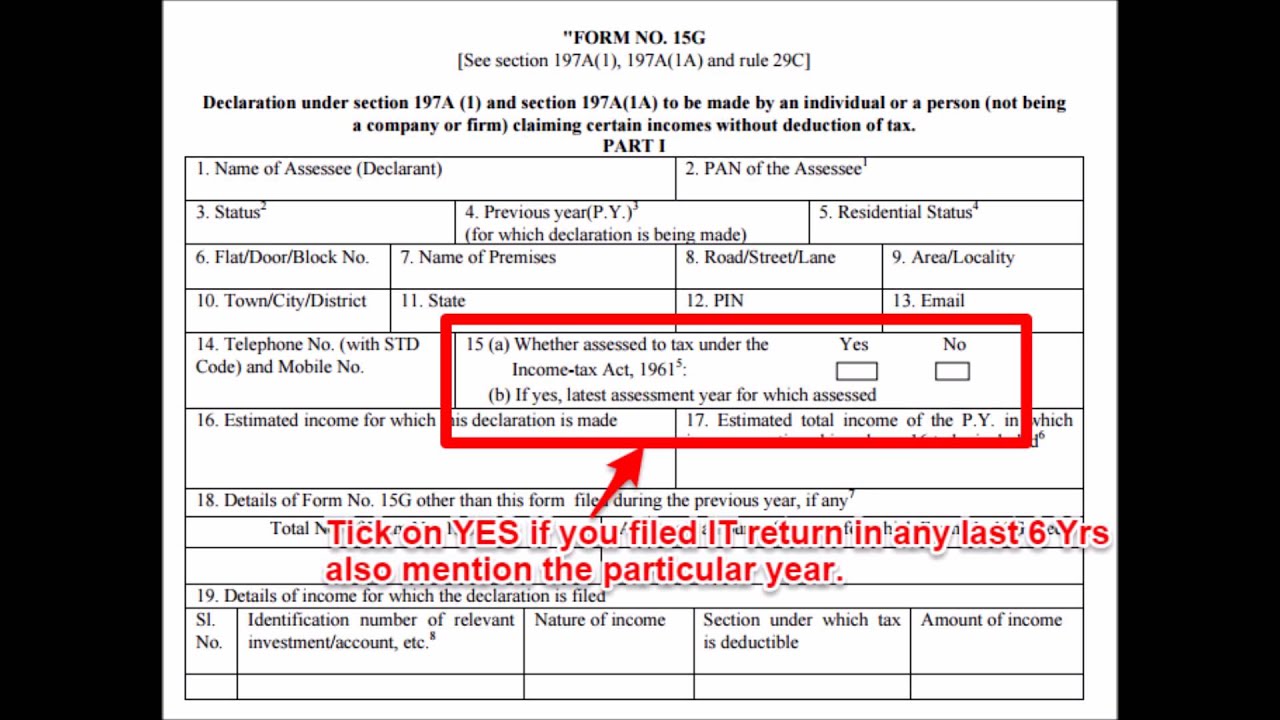

You can prove that the tax on your total income of the previous year in which the interest is to be received shall be nil even after including the cumulative interest the bank should not resort to tax deduction at source You For previous year Current year 2015 16 form 15g submission assessment year is 2016 17

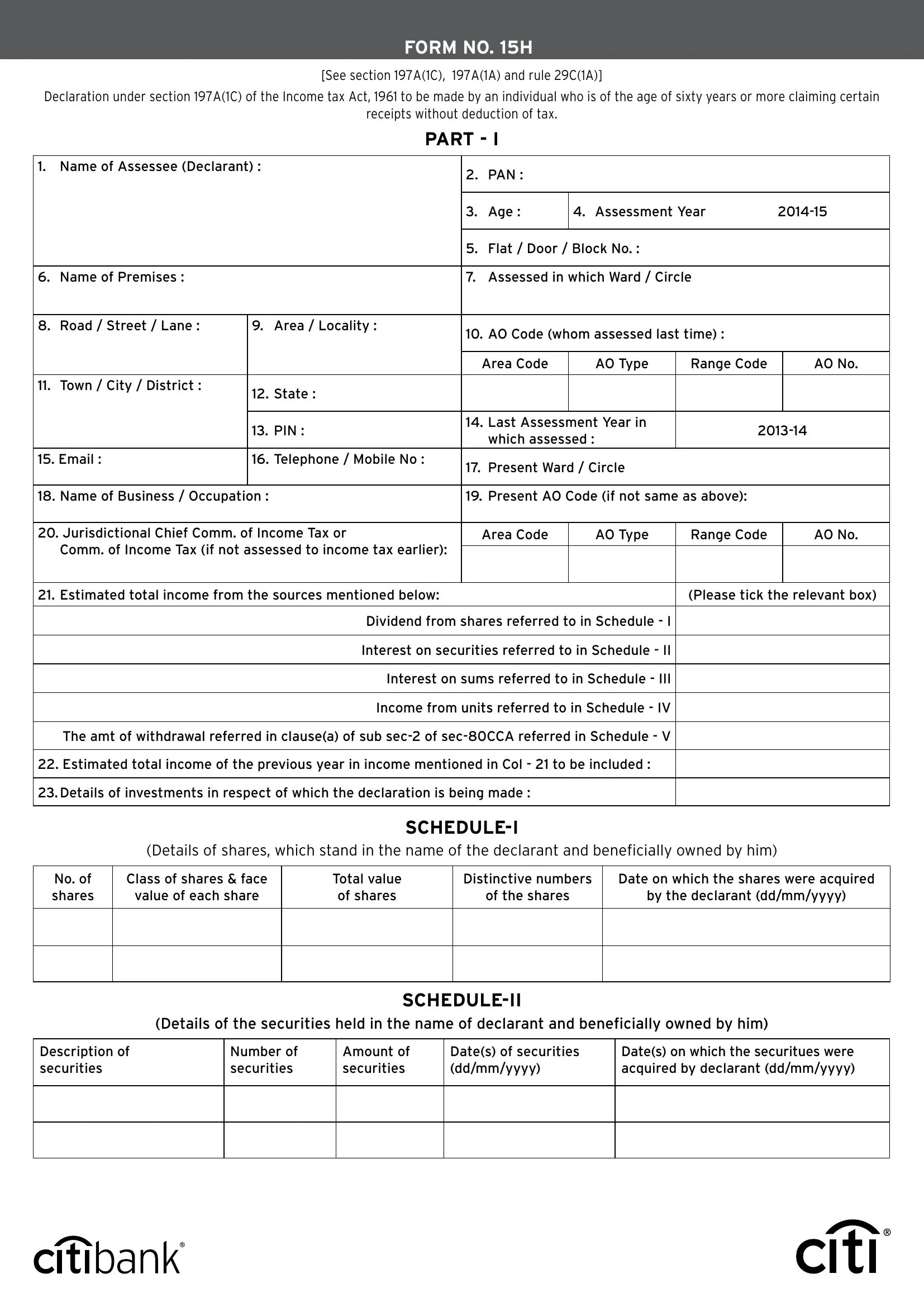

In the space marked as 2 write the ending date of the previous year as mentioned in column 4 of the Part 1 of Form 15H Remember a previous year always ends on 31st March You need to submit form 15H to banks if interest from one branch of a bank exceeds 10000 in a year This form should be submitted to all the deductors to whom you

More picture related to What Is Previous Year In Form 15h

Form 15H

https://www.yumpu.com/en/image/facebook/35228095.jpg

Voleverything Blog

https://www.hrcabin.com/wp-content/uploads/2021/05/Filled-pf-form-15h-part-1.png

Sbi Form 15g In Word Format Ptuprints

https://2.bp.blogspot.com/-G42wLx6N79U/XE2o34OByfI/AAAAAAAABFo/KSNAv7YYp40UhdaMVzhtD4BZqy-2iCEEwCLcBGAs/s1600/15%2BG%2Bform.png

Every Form 15H is valid for the financial year and the assessment year for which the assessee files it You need to submit it every year with an accurate estimation of income for Form 15H is required where the interest amount exceeds Rs 50 000 in a financial year It is also required if you have investments in debentures and bonds and the interest

A 15H form is a self declaration form that is submitted by resident individuals above the age of 60 having no taxable income The form must be submitted to financial Age Form 15H is designed for senior citizens only i e an individual should be over the age of 60 years in order to use this form Tax component An individual should have zero tax liability

Form 15g In Word Format Medlasopa

https://medlasopa237.weebly.com/uploads/1/2/5/7/125793332/295073689.jpg

What Is Form 15G 15H

https://www.apnaplan.com/wp-content/uploads/2015/12/How-to-fill-Form-15H.png

https://bemoneyaware.com

Form 15G or 15H is submitted to request income provider for not deducting tax or TDS for prescribed income These forms can be used only for payments in the nature of

https://babatax.com

Previous Year Fill in the current financial year you are filling out the form Residential Status You can only fill out this form if you are an Indian resident Contact Details Fill in your current address email telephone and mobile

What Is Form 15G 15H

Form 15g In Word Format Medlasopa

Form 15H Components And How To Fill The Form 15H

All About 15G Form Filling For PF Withdrawal With TDS Rules

Form 15H Fill Out Printable PDF Forms Online

Form 15h Fillable Format Printable Forms Free Online

Form 15h Fillable Format Printable Forms Free Online

What Is The Difference Between Form 15G And 15H

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

CBDT Extended 15G 15H Form Due Date To COVID 19 Crises SAG Infotech

What Is Previous Year In Form 15h - Form 15H is for senior citizens who are 60 years or older and Form 15G is for everybody else New Form 15H is also divided into two parts Part 1 This section is to be filled by the Senior