What Is The Federal Tax Rate For Social Security Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between 25 000 and 34 000

The current tax rate for Social Security is 6 2 for the employer and 6 2 for the employee or 12 4 total The current rate for Medicare is 1 45 for the employer and 1 45 for the If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits

What Is The Federal Tax Rate For Social Security

What Is The Federal Tax Rate For Social Security

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

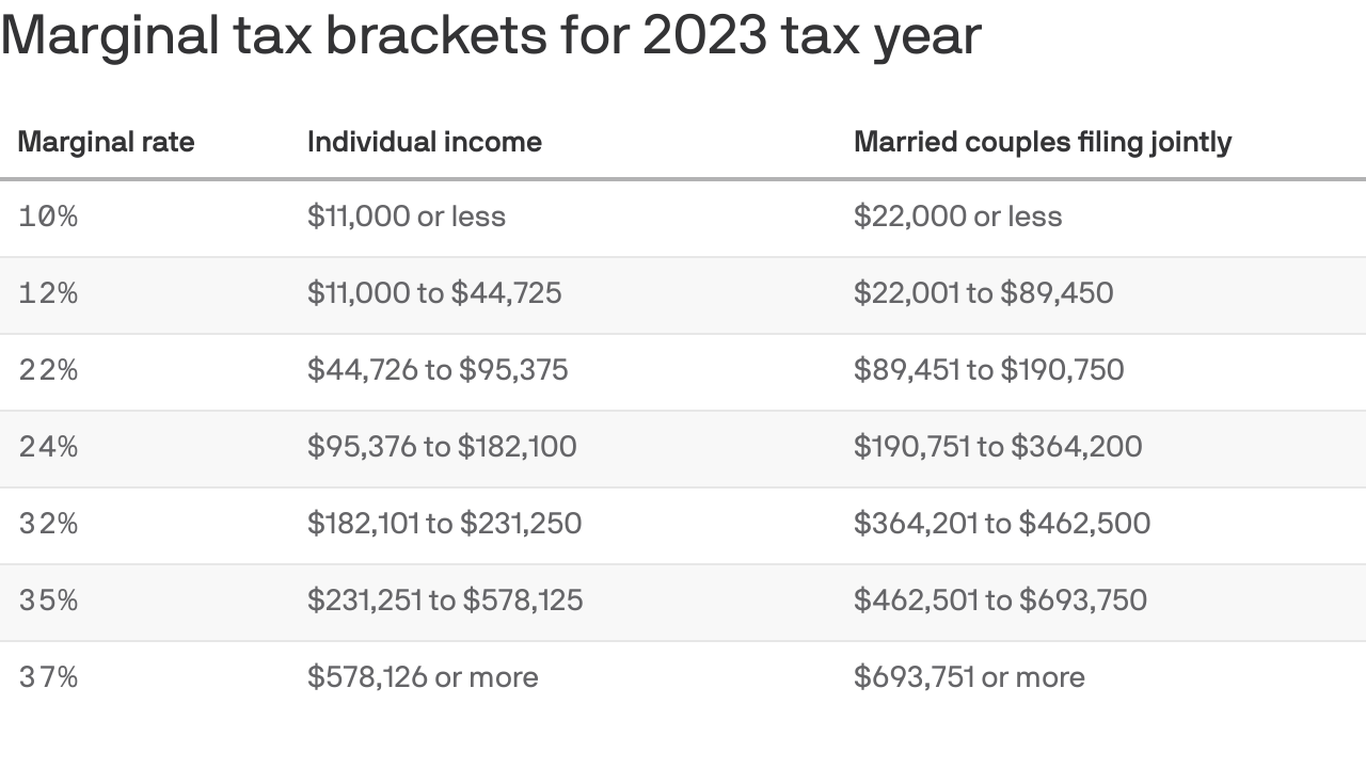

Here Are The Federal Income Tax Brackets For 2023

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

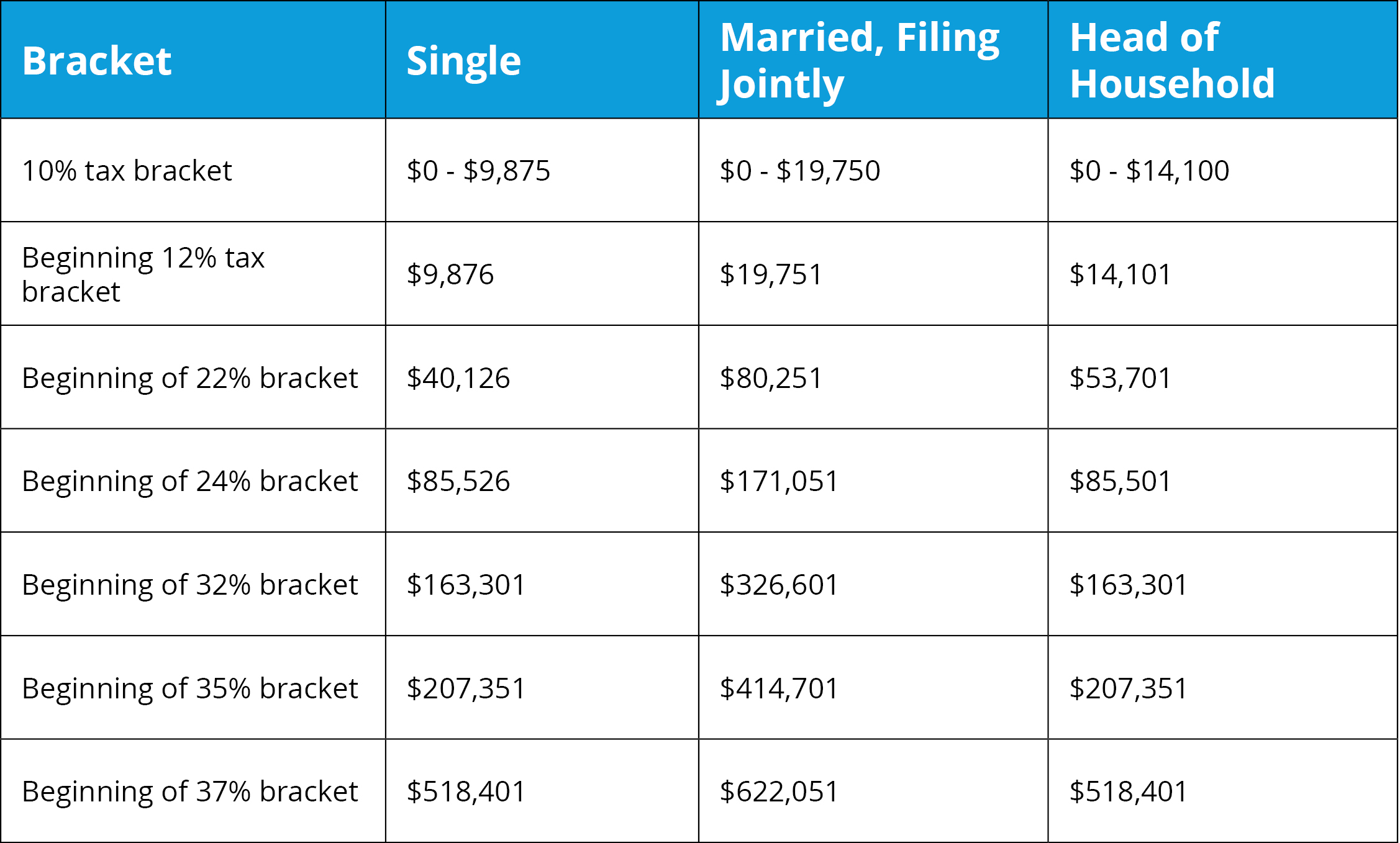

California Tax Brackets 2024 Barbey Sherri

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly

Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and 29 rowsTax rates are set by law see sections 1401 3101 and 3111 of the Internal Revenue Code and apply to earnings up to a maximum amount for OASDI The rates shown reflect the

More picture related to What Is The Federal Tax Rate For Social Security

Social Security Brackets 2024 Cammy Corinne

https://www.mercer.com/content/dam/mercer/assets/content-images/global/gl-2022-table-1-social-security-and-ssi-values.jpg

Tax Brackets 2024 Canada Ontario Kathy Maurita

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

Social Security Taxes A Comprehensive Guide Pearl Wealth Group

https://pearlwealthgroup.com/wp-content/uploads/2023/01/maxresdefault.webp

Social Security taxes in 2025 are 6 2 percent of gross wages up to 176 100 Thus the most an individual employee can pay this year is 10 918 Most workers pay their share through FICA Federal Insurance Contributions The employee tax rate for Social Security is 6 2 and the employer tax rate for Social Security is also 6 2 So the total Social Security tax rate percentage is 12 4

Social Security benefit taxes are based on what the Social Security Administration SSA refers to as your combined income That consists of your adjusted gross income plus any nontaxable interest you earned and certain other items and Below we ll detail how you can calculate your Social Security tax obligations as well as some strategies to potentially reduce your tax burden See how a tax relief professional

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)

Change One Word Page 805 Big Board Of Fun LoversLab

https://www.investopedia.com/thmb/DPa_w90U8Wx_lL-et-1ESMTYzwY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg

Oklahoma Tax Brackets 2025 Heath Gillian

https://images.axios.com/FeF3kXyZuSjEVWj-265DifJa2hw=/0x0:1280x720/1366x768/2022/10/19/1666195709283.png

https://www.usatoday.com › story › money › taxes › ...

Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between 25 000 and 34 000

https://www.irs.gov › taxtopics

The current tax rate for Social Security is 6 2 for the employer and 6 2 for the employee or 12 4 total The current rate for Medicare is 1 45 for the employer and 1 45 for the

2022 Income Tax Brackets Chart Printable Forms Free Online

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)

Change One Word Page 805 Big Board Of Fun LoversLab

Taxes On Social Security Social Security Intelligence

What Are The Tax Brackets For 2024 By Income And Income Drusie Aurilia

Listed Here Are The Federal Tax Brackets For 2023 Vs 2022 FinaPress

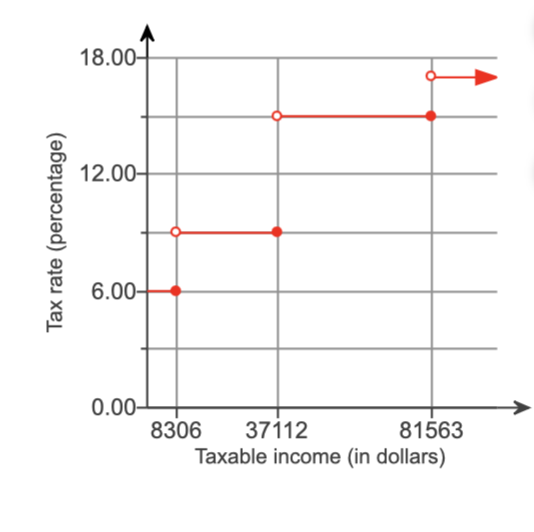

Solved The Federal Tax Rate For Heads Of Household Is Given Chegg

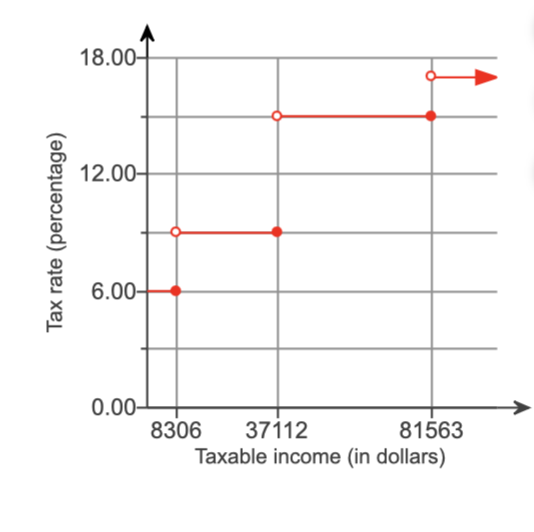

Solved The Federal Tax Rate For Heads Of Household Is Given Chegg

Why Does Social Security Get Taxed Retire Gen Z

U S Effective Corporate Tax Rate Is Right In Line With Its OECD Peers

Solved An Employee Earned 61 300 During The Year Working Chegg

What Is The Federal Tax Rate For Social Security - The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly