What Is The Maximum Amount Of Social Security Income The maximum benefit depends on the age you retire For example if you retire at full retirement age in 2025 your maximum benefit would be 4 018 However if you retire at age 62 in 2025

Who is eligible for the maximum benefit People whose earnings equaled or exceeded Social Security s maximum taxable income the amount of your earnings on which In 2024 the average Social Security benefit is 1 862 per month while the maximum for those retiring at full retirement age is 3 822 Achieving the maximum requires earning the taxable maximum

What Is The Maximum Amount Of Social Security Income

What Is The Maximum Amount Of Social Security Income

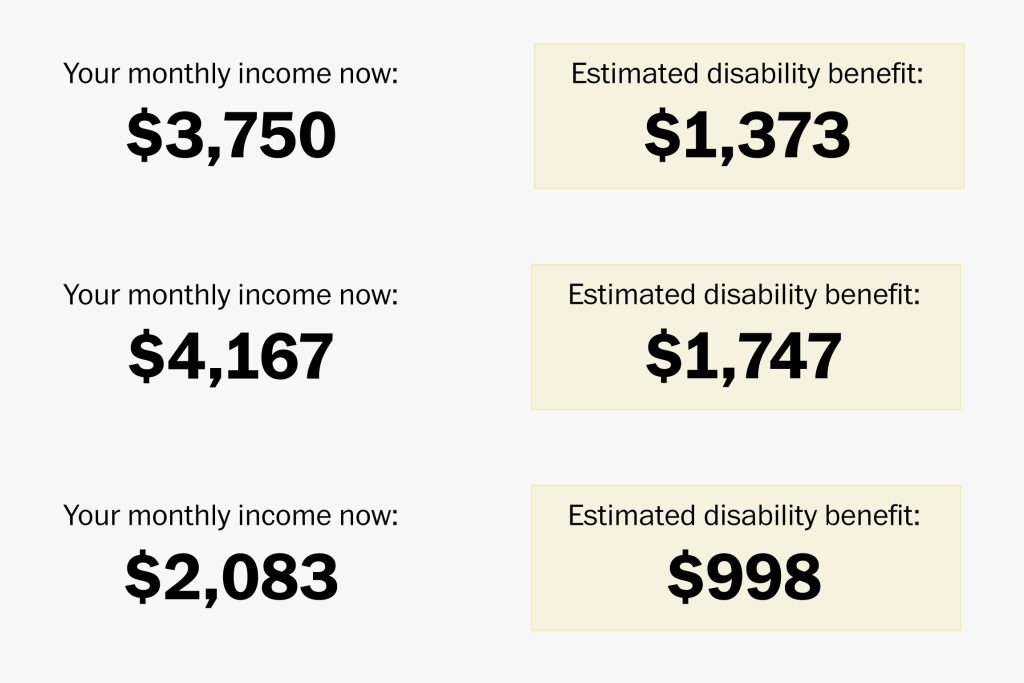

https://www.clausonlaw.com/blog/wp-content/uploads/2021/12/2300-disability-benefit-calculator-PROMO-1024x683.jpg

Social Security Rule Finished In 2024 Debbi Ethelda

https://learn.financestrategists.com/wp-content/uploads/Social_Security_Benefit_Scale.png

Income Limit For Maximum Social Security Tax 2020 Financial Samurai

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

12 rowsIf you are working there is a limit on the amount of your earnings that is taxable by The maximum Social Security benefit in 2024 is 3 822 per month at full retirement age It s 4 873 per month if retiring at 70 and 2 710 for retirement at 62

What Is The Maximum Social Security Benefit Available The highest Social Security retirement benefit for an individual starting benefits in 2024 is 4 873 per month according to the This means you must have earned the maximum taxable income amount your contribution and benefit base every year for 35 years The maximum taxable income amount

More picture related to What Is The Maximum Amount Of Social Security Income

[img_title-4]

[img-4]

[img_title-5]

[img-5]

[img_title-6]

[img-6]

In 2024 a person s taxable income cannot exceed 168 600 The maximum benefit varies each year due to the annual adjustment based on changes in the national wage level The current maximum monthly benefit is 3 822 for The 2024 max social security tax limit is 168 600 This features a notable increase of 5 2 from 2023 s 160 200 This means that the maximum taxable earning

If you file for Social Security retirement benefits before your full retirement age there is a limit on the amount of income you can earn This limit is almost always based on your annual earnings but in certain circumstances it could be your The maximum Social Security retirement benefit in 2025 will be 5 108 per month or the equivalent of 61 296 per year Here s who can expect to receive that much next year

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.ssa.gov › faqs › en › questions

The maximum benefit depends on the age you retire For example if you retire at full retirement age in 2025 your maximum benefit would be 4 018 However if you retire at age 62 in 2025

https://www.aarp.org › retirement › social-security › ...

Who is eligible for the maximum benefit People whose earnings equaled or exceeded Social Security s maximum taxable income the amount of your earnings on which

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Is The Maximum Amount Of Social Security Income - What Is The Maximum Social Security Benefit Available The highest Social Security retirement benefit for an individual starting benefits in 2024 is 4 873 per month according to the